Guidance has slowed down considerably over the last few weeks. We are still expecting additional guidance on QBI and its effect on cooperatives, and IRS announced future proposed regulations to clarify certain aspects of the centralized partnership audit regime.

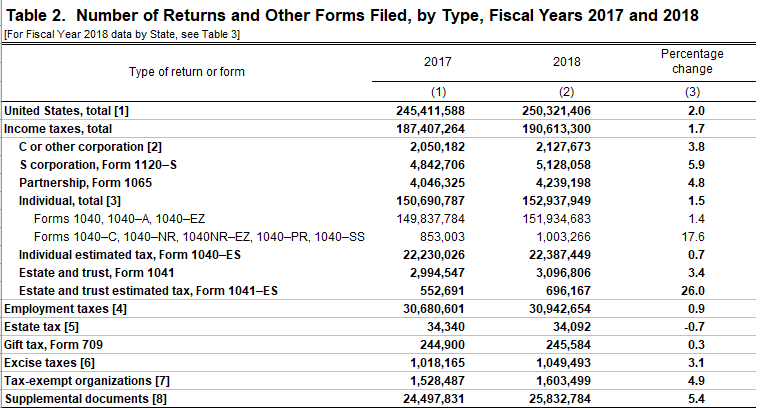

The IRS released the Data Book for 2018 showing range of tax data including audits, collection actions and taxpayer service. During fiscal year 2018, the IRS collected nearly $3.5 trillion, processed more than 250 million tax returns and other forms, and issued over 120 million individual income tax refunds totaling almost $395 billion.

The IRS received and processed more of every major type of form during FY 2018 than during the prior year, with the exception of estate tax returns; those filings were down slightly less than 1 % compared to the prior year. However, filings of pass-through entities were up in FY 2018; partnerships filed almost 5 % more forms with the IRS in FY 2018 than in the prior year, S-corporation filings were up almost 6 % in the same timeframe.

The IRS provided taxpayer assistance through more than half-billion visits to IRS.gov and helped more than 64.8 million taxpayers through different service channels, such as correspondence, toll-free telephone helplines or at Taxpayer Assistance Centers. There were also more than 309 million inquiries to the “Where’s My Refund?” application, up 11 % compared to the prior year.

Net revenue from delinquent collection activities rose to just over $40 billion, an increase of 1.6 % compared to the prior year. IRS levies were up 8.3 % compared to the prior year, but the agency filed about 8 % fewer liens than in fiscal year 2017.

Compared to the prior year, there were fewer audits during fiscal year 2018. The IRS audited more than 892,000 individual income tax returns during the fiscal year, down slightly from the prior year.

This Fall, we will be discussing the issues listed below at our seminars:

2019 Tax Legislation–Overview: Let us provide you with an overview of new law enacted in 2019 and IRS rulings and pronouncements. We will cover some key issues where guidance has been issued concerning prior enacted law, additional guidance on the SALT deduction, meals and entertainment and other updates as released.

Safe Harbor Election & Rentals: To Use or Not to Use, that is the Question? Notice 2019-07 – released concurrently with the Final Regs, provides notice of a proposed revenue procedure detailing a proposed safe harbor under which an RPE enterprise may be treated as a trade or business solely for purposes of IRC §199A. This is a key issue we are monitoring. Additional direction is expected on this issue and as this develops, this session will explain and provide examples that demonstrate the updated guidance. We will discuss related issues on deducting losses from Real Estate.

Centralized Partnership Audit Regime: This section will focus on the new series of forms issued concerning the Centralized Partnership Audit Regime. Form 8988 Election for Alternative to Payment of the Imputed Underpayment – IRC Section 6226, Form 8989, Request to Revoke the Election for Alternative to Payment of the Imputed Underpayment, Form 8980 Partnership Request for Modification of Imputed Underpayments Under IRC Section 6225(c) and more.

754 Election: Review the basics of a §754 Election to “step-up” the basis of the assets within a partnership when one of two events occur: distribution of partnership property or transfer of an interest by a partner. Basic class but will discuss how QBI is impacted.

Ethics and the Tax Client: During the past several years, news rules have been adopted or proposed that impact how we interact with our clients. This segment will provide a look at the latest IRS regulations and changes to professional standards. Security is all important and one segment of our discussion will center on the issue of protecting your client’s data. We will discuss how to ethically interact with the QBI deduction when you address the issue with your client. And finally, a review of the disciplinary proceedings you could face if your practice comes under scrutiny from the Office of Professional Responsibility.

IRS Procedures: We’ll present information on how to keep your EFIN current, navigating e-services and renewal of IP PTINs. Did you know IRS can “lock” you EFIN in the middle of filing season making you unable to e-file. It’s important to keep that information current, addresses, key officials, etc. E-services is the electronic way of doing business with the IRS. Get answers sooner, get transcripts when needed. What estimates have been paid? With a filed Power of Attorney, you can use e-services to get the above information and save a call to IRS and save time. Other online applications will also be reviewed as well as some common IRS procedures we all need to know.

Insolvency & Cancellation of Debt: A taxpayer is insolvent when the total liabilities exceed his or her total assets. The forgiven debt may be excluded as income under the “insolvency” exclusion. We will review the tax consequences for real estate property that is disposed of through foreclosure, short sale, deed in lieu of foreclosure, and abandonments. We will also delve into which business entity is more, or less, beneficial when it comes to cancellation of debt and insolvency. The segment will include examples and any law updates as the extension of the forgiveness of primary residents’ cancellation of debt (expired in 2017) is still being discuss as a potential retroactive law provision.

Penalty Abatement: We will demonstrate how to navigate a first-time Abatement Program, using Form 843, Rev Procedure 84-35 (Partnership Returns), Written & Oral Advice from the IRS, advice from a tax professional or attorney, ordinary business care, lost or destroyed records, code, regulations, Internal Revenue Manual, and case law to support your reasonable cause position.

Statute of Limitations: A review of the statute of limitations as they apply to federal tax law. If you do not understand your statute limits, a client’s refund could slip through your fingers. Or you could execute an Offer in Compromise for a year where the collection statute expires. With all the new changes a review of this area of the law will be a good refresher for all.

Marijuana & CBD Oil: The US Court of Appeals for the 9th Circuit in Hemp Industries Assn. et.al., vs. U.S. Drug Enforcement Admin., maintained the Drug Enforcement Administration’s (DEA) wide-ranging rule creating a separate classification for “Marijuana Extracts.” Though still illegal in the U.S., Marijuana legalization continues to pick up steam for legalization, due to many states who have adopted laws legalizing the use in various aspects from recreational to medicinal purposes. A review of where we stand taxwise concerning the Marijuana client will be provided.

Can’t attend in person? Join the live stream webinar to earn CPE and get the updates:

Fall Update Webinar: Cedar Rapids October 1

Year-End Webinar: Cedar Rapids December 10

June 2019 Issues

Issue 1: Maximum Values For 2019 For Use with Vehicle Cents-Per-Mile and Fleet-Average Valuation Rules

Notice 2019-34 provides four points of guidance:

- The maximum vehicle value for 2019, for purposes of the special valuation rules provided in Treas. Reg. § 1.61-21(d) and (e) that may be used to determine the value of personal use of an employer-provided vehicle.

- Information about how IRS and Treasury intends to publish this information in the future.

- Provides temporary relief from the consistency requirements in Treas. Reg. § 1.61-21(e)(5) for use with the vehicle cents-per-mile valuation rule.

- Allows flexibility with respect to the Treas. Reg. § 1.61-21(d)(5)(v)(B) rules relating to the period of use for the fleet-average valuation rule, which is an optional component of the automobile lease valuation rule under Treas. Reg. § 1.61-21(d).

If an employer provides an employee with a vehicle that is available to the employee for personal use, the value of the personal use generally must be included in the employee’s income.

A Quick Overview

The Vehicle Cents-Per-Mile Rule

If the use of the vehicle meets Treas. Reg. § 1.61-21(e)(1) requirements, generally the value of the personal use may be determined under the vehicle cents-per-mile valuation rule.

However, Treas. Reg. § 1.61-21(e)(1)(iii) currently provides that the value of the personal use may not be determined under the vehicle cents-per mile valuation rule for a calendar year if the fair market value of the vehicle on the first date the vehicle is made available to the employee exceeds a base value of $12,800, that amount is adjusted annually.

• The employer must adopt the vehicle cents-per-mile valuation rule by the first day on which the vehicle is used by an employee of the employer for personal use or

• The employer switches to the vehicle cents-per-mile valuation rule, the first day on which the commuting valuation rule is not used.

Once the vehicle cents-per-mile valuation rule has been adopted for a vehicle by an employer, the rule must be used by the employer for all subsequent years in which the vehicle qualifies for use of the rule.

The Fleet-Average Valuation Rule

For employer-provided automobiles available to employees for personal use for an entire year, generally the value of the personal use may be determined under the automobile lease valuation rule of Treas. Reg. § 1.61-21(d).

Under this valuation rule, the value of the personal use is the Annual Lease Value. Provided the requirements of Treas. Reg. § 1.61-21(d)(5)(v) are met, an employer with a fleet of 20 or more automobiles may use a fleet-average value for purposes of calculating the Annual Lease Values of the automobiles in the employer’s fleet.

The fleet-average value is the average of the fair market values of all the automobiles in the fleet. However, Treas. Reg. § 1.61-21(d)(5)(v)(D) provides that the value of an employee’s personal use of an automobile may not be determined under the fleet-average valuation rule for a calendar year if the fair market value of the automobile (determined pursuant to Treas. Reg. § 1.61-21(d)(5)(i) through (iv)) on the first date the automobile is made available to an employee exceeds the base value of $16,500, as adjusted annually.

Treas. Reg. § 1.61-21(d)(5)(v)(B) generally provides that the fleet-average valuation rule may be used by an employer as of January 1 of any calendar year following the calendar year in which the employer acquires a sufficient number of automobiles to total a fleet of 20 or more, each one satisfying the maximum value limitation of Treas. Reg. § 1.61-21(d)(5)(v)(D).

The Annual Lease Value calculated for automobiles in the fleet, based on the fleet-average value, shall remain in effect for the period that begins with the first January 1 the fleet-average valuation rule is applied by the employer to the automobiles in the fleet and ends on December 31 of the subsequent calendar year.

The Annual Lease Value for each subsequent two-year period is calculated by determining the fleet-average value of the automobiles in the fleet as of the first January 1 of that period. An employer may cease using the fleet average valuation rule as of any January 1.

Notice 2019-08 Provides Interim Guidance on New Procedures using § 280F(d)(7), as modified by The Tax Cuts and Jobs Act: Here is What Will Change – Increased Maximum Value

Notice 2019-08 states that the IRS and the Treasury Department anticipate that further guidance on these issues will be issued in the form of proposed regulations and expect that the regulations will be consistent with the rules set forth in Notice 2019-08.

The IRS and Treasury intend to amend Treas. Reg. § 1.61-21(d) and (e) to incorporate a higher base value of $50,000 as the maximum value for use of the vehicle cents-per-mile and fleet-average valuation rules effective for the 2018 calendar year and adjusted annually for inflation. In addition, the IRS and Treasury will not publish separate maximum values for trucks and vans for use with the vehicle cents-per-mile and fleet-average valuation rules.

For purposes of computing the allowance under a FAVR plan, the standard automobile cost for 2019 may not exceed $50,400. In addition, for an employer that did not qualify to use the fleet average valuation rule prior to January 1, 2019, because the maximum value limitation could not be met, Treasury and the IRS intend to revise Treas. Reg. §1.61-21(d) to provide that an employer may adopt the fleet-average valuation rule for 2018 or 2019, provided the requirements of § 1.61-21(d)(5)(v) are met for that year using the maximum vehicle values of $50,000 for 2018 or $50,400 in 2019.

Issue 2: Back-Up Withholding Rates

The current backup withholding tax rate is 24 % and the withholding rate that usually applies to bonuses and other supplemental wages to 22 %. Backup withholding applies in various situations, including when a taxpayer fails to supply their correct taxpayer identification number (TIN) to a payer. Backup withholding also applies, following notification by the IRS, where a taxpayer under-reported interest or dividend income on their federal income tax return. Publication 1281, Backup Withholding for Missing and Incorrect Name/TINS (PDF), now available on IRS.gov.

To stop backup withholding, the payee must correct any issues that caused it. They may need to give the correct TIN to the payer, resolve the under-reported income and pay the amount owed, or file a missing return.

Bonuses and Other Supplemental Wages

TCJA also lowered the tax withholding rates that normally apply to bonuses, back wages, payments for accumulated leave and other supplemental wages. In most cases, the new rate is 22 %, effective Jan. 1, 2018. For payments exceeding $1 million, the rate is 37%.

Issue 3: TD-9858. User Fees Relating to Enrolled Agents and Enrolled Retirement Plan Agents

TD-9858 contains final regulations that amend regulations relating to imposing user fees for enrolled agents and enrolled retirement plan agents. The final regulations remove the initial enrollment user fee for enrolled retirement plan agents because the IRS no longer offers initial enrollment as an enrolled retirement plan agent. The final regulations increase the amount of the renewal user fee for enrolled retirement plan agents from $30 to $67. In addition, the final regulations increase the amount of both the enrollment and renewal user fee for enrolled agents from $30 to $67. IRS has announced a future publication to explain changes.

Now is a good time to check your Enrolled Agent or Enrolled Retirement Plan Agent card for the current expiration date.

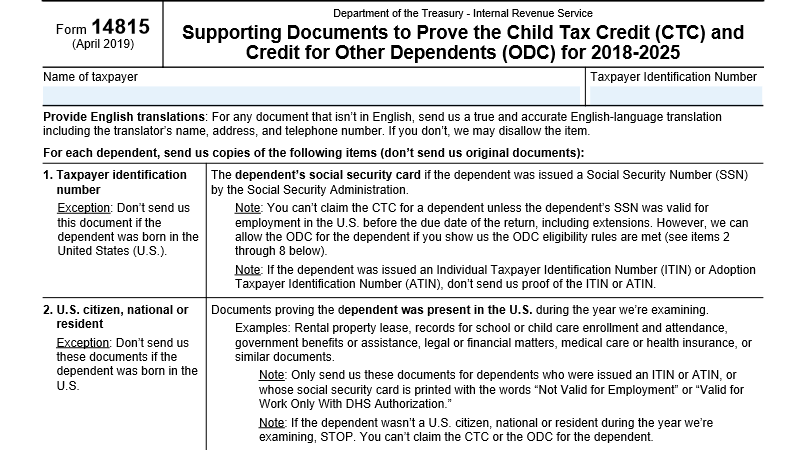

Issue 4: New Form 14815 Supporting Documents to Prove the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) for 2018-2025, issued April 2019

Issue 5: New Requirements Apply to any Business Seeking a Tax ID Number

Beginning May 13, only individuals with tax identification numbers – either a Social Security number (SSN) or an individual taxpayer identification number (ITIN) – may request an employer identification number. This new requirement, which was first announced by the IRS in March, will provide greater security to the EIN process by requiring an individual to be the responsible party and will also improve transparency.

An EIN is a nine-digit tax identification number assigned to sole proprietors, corporations, partnerships, estates, trusts, employee retirement plans and other entities for tax-filing and reporting purposes.

The change prohibits entities from using their own EINs to obtain additional EINs. The new requirement applies to both the paper Form SS-4, Application for Employer Identification Number, and online EIN applications.

Issue 6: Rev. Proc. 2019-20, Expansion of Areas for Issuing Determination Letters for Certain Retirement Plans

Revenue Procedure 2019-20, details two new issues for which retirement plan sponsors may now request determination letters:

- Statutory Hybrid Plans – plan sponsors may submit determination letter applications for statutory hybrid plans for the 12-month period beginning Sept. 1, 2019 and ending Aug. 31, 2020.

- Plan Mergers – plan sponsors may submit determination letter applications for certain merged plans on an ongoing basis.

Plan sponsors will continue to be able to submit a determination letter application for initial plan qualification and for qualification upon plan termination. Rev. Proc. 2019-20 also provides for a limited extension of the remedial amendment period under § 401(b) and Rev. Proc. 2016-37 under specified circumstances, and for special sanction structures that apply to certain plan document failures discovered by the IRS during the review of a plan submitted for a determination letter pursuant to Rev. Proc. 2019-20.

Issue 7: REG-105476-18 Withholding of Tax and Information Reporting with Respect to Interests in Partnerships Engaged in the Conduct of a U.S. Trade or Business

The proposed regulations affect certain foreign persons that recognize gain or loss from the sale or exchange of an interest in a partnership that is engaged in the conduct of a trade or business within the United States, and persons that acquire those interests. The proposed regulations also affect partnerships that, directly or indirectly, have foreign persons as partners. § 1446(f)(1) requires the transferee to deduct and withhold a tax equal to 10% of the amount realized on the disposition if a portion of the gain would be treated under § 864(c)(8) as effectively connected with the conduct of a trade or business within the United States.

An exception to the Sec. 1446(f)(1) is provided if the transferor furnishes an affidavit to the transferee stating, under penalties of perjury, the transferor’s U.S. taxpayer identification number (TIN) and that the transferor is not a foreign person.

Issue 8: The Kiddie Tax and Military Survivors’ Benefits

With the change in the Kiddie Tax rules some military families have discovered that they owe higher taxes for 2018 on distributions from their military survivors’ benefits than they had in previous years. This change in tax treatment is related to temporary changes to the “kiddie tax” in the TCJA. The kiddie tax was first enacted as part of the Tax Reform Act of 1986. Its purpose was to prevent wealthy parents from reducing their own tax liability by creating investment accounts and trusts in the names of their children, who were typically subject to lower tax rates. Whether the child could be claimed as a dependent really did not come into play as there were special filing requirements based on unearned income. The parents could elect to include on their return the unearned income of a child to avoid the kiddie tax if they met certain requirements. The election was made by filing Form 8814.

Military Survivor Benefits to Children Retired servicemembers may elect to provide their spouses and/or children with up to 55% of their pension following the member’s death. In 2001, Congress expanded eligibility for this benefit to dependents of servicemembers who die while in active service. The payment is made monthly as an annuity for the lifetime of a surviving spouse and up to age 18 or 22 for most surviving children.

Due to a dollar-for-dollar offset with another federal benefits for some surviving spouses called Dependency and Indemnity Compensation (DIC), it is often more financially beneficial for the family to elect children as the beneficiaries to this military annuity to avoid this offset provision.

As of September 30, 2017, DOD reported 2,699 dependent children receiving annuities due to a parent’s death in retirement and an additional 6,916 receiving an annuity due to a parent’s death during active service. The income is considered unearned and have place some children in the kiddie tax arena. It would take Congressional action to fix. Bill introduced to change – we will be monitoring.

Issue 9: Defining the Tax Gap

A standard definition of the tax gap is the shortfall between the amount of tax voluntarily and timely paid by taxpayers and the actual tax liability of taxpayers. It measures taxpayers’ failure to accurately report their full tax liabilities on tax returns (i.e., underreporting), pay taxes due from filed returns (i.e., underpayment), or file a required tax return altogether or on time (i.e., non-filing). Estimates of the tax gap provide a picture of the level of overall noncompliance by taxpayers for a particular tax year, and include shortfalls in individual income taxes, corporate income taxes, employment taxes, estate taxes, and excise taxes.

Total Size of the Tax Gap

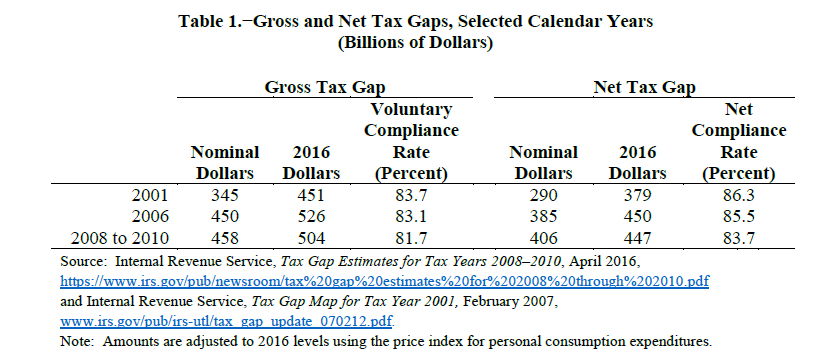

The Internal Revenue Service (“IRS”) periodically conducts studies to estimate the size of the tax gap and analyze its components. Table 1 indicates that in the most recent study, the estimated annual gross tax gap, per year on average for tax years 2008-10, was $458 billion and the annual net tax gap, which is the gross tax gap adjusted for late payments and collections due to enforcement activities, was $406 billion. Adjusted for inflation, the gross and net tax gaps are $504 billion and $447 billion in 2016 dollars, respectively.

With total average tax liabilities of $2.5 trillion per year between 2008 and 2010, the voluntary compliance rate is 81.7% and the net compliance rate is 83.7 %.

The largest source of the tax gap is the individual income tax, followed by employment taxes and the corporate income tax. These are also the three largest sources of Federal revenues, ranked in the same order by size.

Evidence shows that compliance is greatest for sources of income, such as wages and salaries, which are reported to the IRS by employers and other payers and for which taxes are withheld by third parties. Noncompliance is greatest for income and tax preferences, including self-employment income, for which third-party information is not separately reported to the IRS and is very difficult to obtain.

Audits

A taxpayer’s perceived probability of audit is an important component of the taxpayer’s decision to comply with a requirement to pay tax. To the extent that actual audit rates affect taxpayer perceptions, actual audit rates may be an important deterrent to noncompliance. In addition to the effect of perceived probability of audit, there is a specific deterrence effect of audits on the audited. Individuals generally appear to alter their perceived probability of audit upwards in the few years following an actual audit, increasing reported wages, self-employment income, and other types of income for three to four years following the audit.

Issue 10: Rule Changes for Taxable Year of Inclusion

The Tax Cuts and Jobs Act (TCJA) changed certain rules for accrual-method taxpayers. Previously, taxpayers who used the accrual-method generally needed to include income in the year in which all events had occurred that fixed the right to receive income and the amount could be determined with reasonable accuracy, the “all-events test”.

TCJA revised § 451 so that, in general, for accrual-method taxpayers that have applicable financial statements, the “all events test” is met for an item of gross income no later than the taxable year in which such income is taken into account as revenue in its AFS.

Issue 11: IRS Corrects Errors in 2018 Forms 1040 and 1041 Schedule D Worksheets

The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D (Form 1040) contained an error. The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D filers who had 28% rate gain (taxed at a maximum rate of 28%) reported on line 18 of Schedule D or unrecaptured § 1250 gain (taxed at a maximum rate of 25%) reported on line 19 of Schedule D. All returns filed after May 15 should reflect the new calculation; the IRS will update any returns filed after May 15 to reflect the correct tax using the new calculation. Because the IRS has already provided the corrected worksheet to its tax software partners, anyone filing a 2018 return, including those with extensions, after May 15, 2019, are not affected by the error. Those taxpayers reporting these types of transactions typically file more complex returns and frequently obtain tax-filing extensions from the IRS. For that reason, the IRS believes that many potentially affected taxpayers are yet to file. The correction results in a lower regular tax for most affected taxpayers, and a higher regular tax for a small number of the impacted taxpayers, depending on the taxpayer’s individual return.

Note that most taxpayers filing Schedule D do not have amounts on lines 18 and 19, check Yes on line 20, and do not use the Schedule D Tax Worksheet to figure their regular tax, and are unaffected. Affected taxpayers need not file an amended return with the IRS or call the IRS. The IRS is reviewing returns submitted prior to May 16; more information will be provided about this review later.

Issue 12: MeF 94x On-Line Signature PIN Registrations

The IRS is receiving 94x On-Line Signature PIN Registration applications on which the requestor is not the authorized signer for the business (e.g., owner, partner, corporate officer). The 94x On-Line Signature PIN (10 digits) may be used only by authorized signers to sign their employment tax returns. If the authorized signer for a business receives a 94x On-Line Signature PIN, he or she should not share, disclose, or allow anyone else to use it. PINs are confidential.

Tax professionals such as CPAs, accounting firms, tax preparers, bookkeepers, reporting agents, etc., do not have authority to use the 94x On-Line Signature PIN to sign a 94x return for the authorized signer. If a tax professional or other unauthorized signer submits a 94x Online Signature PIN Registration application, the application will not be accepted.

Other signature options available for MeF 94x employment tax returns include:

- Practitioner PIN – Form 8879-EMP, IRS e-file Signature Authorization. The authorized signer selects a 5-digit, electronic filing PIN and authorizes the Electronic Return Originator (ERO) to enter that PIN as the signature on the employment tax return. EROs must use Form 8879-EMP to electronically sign employment tax returns.

- Electronic Attachment of Manual Signature – Form 8453-EMP, Employment Tax Declaration for an IRS e-file Return. The authorized signer manually signs the form, and the ERO scans it, saves as a PDF file, and attaches it to the e-filed return. There is no PIN involved in this option.

- Reporting Agent PIN – A reporting agent is an accounting service, franchiser, bank, service bureau, or other entity that complies with Rev. Proc. 2012-32 and is authorized to complete and electronically file 94x returns for a taxpayer. Reporting Agents sign all the electronic returns they file.

Issue 13: IRS Data Book – Number of Returns Filed

Issue 14: Iowa Becomes the Most Recent State to Regulate Tax Professionals and Require CPE

Let Basics and Beyond be Your CPE Provider to Meet Future CPE requirements.

On May 16, 2019, HF 590, a bill to regulate tax return preparers was signed by Kim Reynolds. Iowa becomes the newest state to enact legislation to regulate tax return preparers requiring them to have continuing education that meets the following criteria:

Beginning January 1, 2020, and every year thereafter, tax professionals would be required complete:

A minimum of 15 hours of continuing education courses on subject matters determined by Iowa Department of Revenue.

- This would include two hours of continuing education on professional ethics.

- Each course would have to be taken from an Internal Revenue Service approved provider of continuing education.

- A new tax professional would not be required to complete continuing education prior to the first year of preparing returns.

- All would be required to retain records of continuing education completion and include their federal PTIN on any Iowa tax return or claim for refund they prepare.

A “Tax return preparer” is defined in the bill as any individual who, for a fee or other consideration, prepares ten or more Iowa tax returns or claims for refund or who assumes final responsibility for completed work on such tax returns or claims for refund on which preliminary work has been done by another individual. “Tax return preparer” does not include:

- Certified Public Accountants,

- Licensed public accountants,

- Licensed attorneys,

- Enrolled agents, or fiduciaries of trusts, estates, or individuals.

The above group are officially licensed and currently require continuing professional education.

Issue 15: Rev Proc 2019-25 – IRS Issues 2020 Inflation-adjusted Amounts for Health Savings Accounts

For calendar year 2020, the limitation on deductions under § 223(b)(2)(A) for an individual with self-only coverage under an HDHP is $3,550 (up from $3,500 for 2019).

For calendar year 2020, the limitation on deductions under § 223(b)(2)(B) for an individual with family coverage under an HDHP is $7,100 (up from $7,000 for 2019).

For calendar year 2020, an HDHP is defined under § 223(c)(2)(A) as a health plan with an annual deductible that is not less than $1,400 (up from $1,350 for 2019) for self-only coverage or $2,800 (up from $2,700 for 2019) for family coverage, and with respect to which the annual out-of-pocket expenses (deductibles, co-payments, and other amounts, not including premiums) do not exceed $6,900 (up from $6,750 for 2019) for self-only coverage or $13,800 (up from $13,500 for 2019) for family coverage.

Issue 16: Predicted SSA Wages Base for 2020

The Old-Age, Survivors, and Disability Insurance taxable wage base is projected to rise to at least $136,800 in 2020, up $3,900 from 2019, the Social Security Administration said April 22. The projection was made in the agency’s 2019 annual report to the SSA board of trustees. We will await official notice.

Issue 17: IRS has Provided Various Applicable Federal Rate Tables for June 2019.

Rev. Rul. 2019-14

|

Table 1 Applicable Federal Rates (AFR) for June 2019 |

||||

| Period for Compounding | ||||

| Annual | Semiannual | Quarterly | Monthly | |

| Short-Term | ||||

| AFR | 2.37% | 2.36% | 2.35% | 2.35% |

| 110% AFR | 2.62% | 2.60% | 2.59% | 2.59% |

| 120% AFR | 2.85% | 2.83% | 2.82% | 2.81% |

| 130% AFR | 3.09% | 3.07% | 3.06% | 3.05% |

| Mid-Term | ||||

| AFR | 2.38% | 2.37% | 2.36% | 2.36% |

| 110% AFR | 2.63% | 2.61% | 2.60% | 2.60% |

| 120% AFR | 2.86% | 2.84% | 2.83% | 2.82% |

| 130% AFR | 3.10% | 3.08% | 3.07% | 3.06% |

| 150% AFR | 3.59% | 3.56% | 3.54% | 3.53% |

| 175% AFR | 4.19% | 4.15% | 4.13% | 4.11% |

| Long-Term | ||||

| AFR | 2.76% | 2.74% | 2.73% | 2.72% |

| 110% AFR | 3.03% | 3.01% | 3.00% | 2.99% |

| 120% AFR | 3.32% | 3.29% | 3.28% | 3.27% |

| 130% AFR | 3.59% | 3.56% | 3.54% | 3.53% |

Table 2

Adjusted AFR for June 2019

Period for Compounding

Annual Semiannual Semiannual Monthly

| Short-term adjusted AFR | 1.80% | 1.79% | 1.79% | 1.78% |

| Mid-term adjusted AFR | 1.81% | 1.80% | 1.80% | 1.79% |

| Long-term adjusted AFR | 2.09% | 2.08% | 2.07% | 2.07% |

Table 3

Rates Under Section 382 for June 2019

| Adjusted federal long-term rate for the current month | 2.09% |

| Long-term tax-exempt rate for ownership changes during the current month (the highest of the adjusted federal long- term rates for the current month and the prior two months.) |

2.19% |

Table 4

Appropriate Percentages Under Sec. 42(b)(1) for June 2019

Under Sec. 42(b)(2), the applicable percentage for non-federally subsidized

new buildings placed in service after July 30, 2008, shall not be less than 9%.

Appropriate percentage for the 70% present value low-income housing credit 7.59%

Appropriate percentage for the 30% present value low-income housing credit 3.25%

June Kicks Off Webinar Season for 2019.

Check out entire our schedule at https://www.cpehours.com/webinar-schedule/

2019 Tax Seminar Dates are Now Available

https://www.cpehours.com/dates-locations/

Claudine Raschi, MS.

Program Director

Basics & Beyond

727-210-6600 ext. 103