Yearly State Tax Update: 2018 CPE Requirements in Iowa

It doesn’t matter whether you’re a tax preparer, Enrolled Agent (EA), Certified Public Accountant (CPA), tax attorney, or other tax professional. Regardless of which of these categories you fall into, nearly every state in the country has requirements related to obtaining and maintaining your license to provide tax services to the public. In order to meet these requirements, one thing you’re expected to do is obtain a minimum number of Continuing Professional Education (CPE) hours over the course of any given year. Different states have different timelines for these CPE hours (with some states being annual, others biennial, and still others triennial) — but at the end of the day, the reality is the same. You have to complete your CPE hours in order to renew your license.

Of course, it makes sense that these rules exist. Just think about how often tax law changes. From one year to the next, there can be significant alterations made to the existing tax code. And, of course, 2018 saw the introduction of one of the most sweeping tax reform bills in legislative history. Attending a tax CPE webinar is a great way to ensure that you fulfill your CPE requirements while also getting up to speed on changes to the tax code.

Like most states nationwide, Iowa CPE requirements involve obtaining a certain number of CPE hours per year. And as we approach the end of the year, it’s a good time for tax professionals in Iowa to get up to speed on changes to the state tax code.

With that in mind, we’ve put together this Iowa state tax update blog post to inform you about both Iowa’s CPE requirements as well as general changes to the Iowa tax code. We’ll also point you in the right direction for further and more detailed learning about Iowa’s state tax updates.

Keep reading to learn more.

Iowa CPE Requirements

In most states, there’s a hard and fast deadline by which you’re required to submit your CPE hours each year. Some states require you to do this each year, while others allow you to make this submission on a biennial or triennial basis.

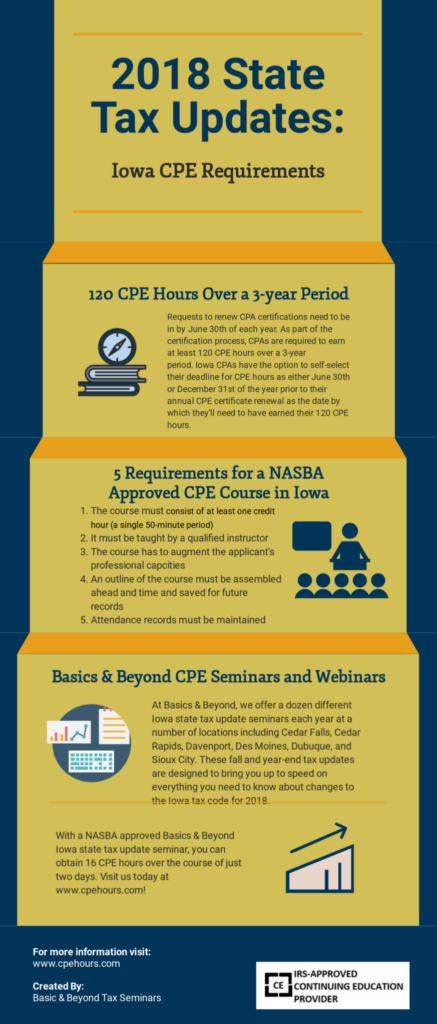

In Iowa, though, things are a bit more complicated. On the one hand, you do have to submit a request to renew their CPA certification no later than June 30th of each year. As part of this certification process, CPAs are required to earn at least 120 CPE hours over a 3-year period. However, Iowa CPAs have the option to self-select their deadline for CPE hours as either June 30th or December 31st of the year prior to their annual CPE certificate renewal as the date by which they’ll need to have earned their 120 CPE hours.

There’s no minimum requirement on a year to year basis. In other words, it’s possible to earn 20 CPE hours one year, 40 CPE hours in year two, and the remaining 60 CPE hours in your third year. Or you could split things up evenly, aiming for 40 CPE hours per year in each of the three years in your triennial CPE period. At the end of the day, all that matters is that you’ve obtained the minimum Iowa CPE requirement of 120 CPE hours over the course of three years.

It’s common practice for many states to have specific requirements for what sorts of courses you’re expected to take as part of your CPE requirements. For example, some states require that you obtain a minimum number of hours in various topics like attest, auditing, ethics, and so on. In Iowa, CPAs are required to obtain at least 4 hours of ethics and 8 hours of financial statement presentation (if this topic is relevant to the job duties you perform) as part of their total 120-hour minimum requirement.

Some states require that you submit detailed proof that you’ve obtained the correct number of CPE hours as part of your license renewal process. In Iowa, though, this isn’t the case. Rather than asking every professional who submits their renewal application to provide proof that they’ve completed at least 120 CPE hours in the past three years, the Iowa Accountancy Examining Board (IAEB) simply asks that you confirm that you’ve completed the required hours leading up to your CPA certificate renewal. However, it’s important to keep in mind that the Iowa Accountancy Examining Board conducts audits on a random basis of Certified Professional Accountants throughout the state of Iowa. If you’re the subject of an IAEB audit, you’ll be asked to provide proof that you’re completed all 120 of your CPE hours within the past three years leading up to your most recent license renewal. This means that even though you’re not required to submit proof of completion as part of the license renewal process, it’s still important to keep detailed records on hand in the event that you’re audited and need to offer evidence of completion to the IAEB.

There are five requirements that a course must meet if it’s going to count for CPE credit in Iowa:

- The course must consist of at least one credit hour (a single 50-minute period)

- It must be taught by a qualified instructor

- The course has to augment the applicant’s professional capacities

- An outline of the course must be assembled ahead and time and saved for future records

- Attendance records must be maintained

The time involved in completing and preparing for a certification exam can be used to count towards up to 50% of your total Iowa CPE requirements. You may claim up to five times the total length of time involved in sitting for the exam, as this amount is considered to account for the preparation time involved in terms of studying. Various professional meetings can be counted as well; however, meetings where food is provided may only count for 25% of total requirements and can only count for a maximum of 2 hours per meeting. Meetings of your own accounting firm cannot count toward CPE credits. Working as an instructor can only account for up to 50% of your total requirement, and two hours of preparation time can be claimed for each hour spent instructing. Authorship cannot exceed 25% of the requirement.

In Iowa, partial credit for CPE course attendance is allowed in half hour increments following the first hour of instruction. If you’re attending a college course, each semester hour counts as 15 CPE hours. If the course is taught in quarters rather than semesters, one quarter hour is the equivalent of 10 CPE credits. If the course is not taught for credit (and thus has no accompanying credit hour number), each content hour is equal to one CPE hour.

When signing up for a CPE seminar or webinar in order to fulfill the requirements for Iowa, it’s essential to ensure that the course is offered by an organization which is approved by the National Association of State Boards of Accountancy, or NASBA. Iowa honors CPE hours from NASBA approved providers. Basics & Beyond™ is NASBA approved, and we offer a wide selection of seminars and tax webinars designed to meet the needs of CPAs and tax professionals in Iowa.

Iowa 2018 State Tax Updates

As mentioned above, one of the major reasons behind requiring CPAs and tax professionals to obtain annual Continuing Professional Education hours is to ensure that these professionals stay up to date on changes to the tax code. Aside from the major 2018 tax reform that’s about to take effect, there are also annual state tax updates in Iowa that are important for Iowa tax professionals to understand. Staying up to speed on these state level updates is essential for providing the best possible services to your clients.

At Basics & Beyond, we offer a dozen different Iowa state tax update seminars each year at a number of locations including Cedar Falls, Cedar Rapids, Davenport, Des Moines, Dubuque, and Sioux City. These fall and year-end tax updates are designed to bring you up to speed on everything you need to know about changes to the Iowa tax code for 2018.

With a Basics & Beyond Iowa state tax update seminar, you can obtain 16 CPE hours over the course of just two days. Thanks to the fact that Basics & Beyond is NASBA certified, you can expect to receive a full 16 CPE credits for attending two days of seminars, including two hours of ethics which can count toward your triennial ethics requirement.

Below, we’ll offer an overview of some of the most important changes to the Iowa state tax code in 2018. However, it’s important to understand that there’s much more to these updates than we can account for in a short blog post. That’s why it’s essential to sign up for a full seminar dedicated to tax reform and tax updates in the state of Iowa. With that said, though, let’s look at some of the biggest changes to Iowa’s tax code for 2018.

2018 Iowa Tax Reform: Individual Income Tax

On May 30, 2018, Iowa Governor Kim Reynolds signed a major tax reform bill into law. The stated goal of this tax reform was to bring Iowa’s complex (and sometimes outdated) laws up to speed, while also simplifying them as much as possible.

Amongst these changes, one of the most impactful for many taxpayers is an alteration to individual income tax. Before Iowa’s 2018 tax reform, the individual state income tax rate was divided into nine brackets, with the topmost marginal tax rate being 8.98 percent. Following the tax reform legislation, this was converted into a four bracket tax system with a top marginal rate of 6.5 percent. This change is to occur over the course of several years, with the top marginal rate stepping down from 8.98 percent to 8.53 percent in 2019.

Another important change that will affect individual taxpayers involves the Section 179 expensing limit for small businesses. This amount will be increased from $25,000 before reform to $100,000 post reform (beginning in 2019). In combination with this change, the Iowa state government will adopt the new federal pass-through deduction rules — but at a lower amount. This amount will start at 25 percent of the total federal value in 2019, increasing gradually to 75 percent of the federal value by 2022.

Additionally, Iowa will decouple from the $10,000 State and Local Tax (SALT) deduction limit imposed by federal tax reform. It will also temporarily decouple from the federal level repeal of so-called like-kind exchanges.

2018 Iowa Tax Update: Corporate Income Tax

The top corporate tax rate in Iowa before tax reform was the highest in the United States at 12 percent. Following the new state tax reform law, this amount will decrease to a top corporate tax rate of just 9.8 percent. This change is occuring in combination with a repeal of the corporate alternative minimum tax.

Additionally, the Iowa tax reform will modify a number of business tax credits. These include more stringent restrictions on the Research Activities Tax Credit, a repeal of the Geothermal Heat Pump Tax Credit and Geothermal Tax Credit, and the Innovation Fund.

Stay Up to Date on 2018 Iowa Tax Reform and CPE Requirements

At the end of the day, it’s essential to ensure that you’re completely up to date on changes to the Iowa state tax code. 2018 saw the introduction of sweeping tax reform both at the national level and in the state of Iowa. With this in mind, it’s a good idea to attend a tax seminar dedicated to tax reform changes in Iowa. Basics & Beyond offers affordable, engaging, professional tax seminars and webinars tailored to meet the needs of Iowa accounting professionals. Click here to register now!