Happy New Year and Welcome to 2020!

We hope your holiday included joyful moments and a few days of rest, as we look toward the 2020 filing seasons and the challenges it may present. As with what has become a normal occurrence, Congress passed late legislation in the form of an extender bill, “Taxpayer Certainty and Disaster Tax Relief Act of 2019 and the SECURE Act. Both were signed into law by the President on December 20, averting a government shutdown.

Form W-4 – What You Need to Know – Webinar

Join us January 14, 2020 for a 2 Hour review of the new 2020 Form W-4. We will address typical questions your payroll clients may have. You will have a better understanding for the new concept as well as a tour of the IRS interactive assistant.

Getting Ready for 2020 Tax Season – Webinar

To prepare for the tax season, join us on January 15, 2020 for the Getting Ready for the 2020 tax season. We will review the new forms and changes as well as the extender legislation. For the 2019 tax year we have new forms for the Qualified Business Income Deduction as well as changes to the partnership K-1. Form 1040 has also been reduced to 3 schedules vs 6 for tax year 2019.

In this Issue:

Rental Safe Harbor Statement

News Release 2019-186, Return Requirements-Reminders for Professionals

Required Statement for Form 3800, General Business Credits

Final 2020 Form W-4 Now Available

Recent Legislation Requires Tax Exempt Organizations to e-File Forms

IRS Now Issuing Educational Compliance Letters

Mailing Forms, Payments and Correspondence to the IRS Changes Abound

Duplicate CAF Requests

New Downloadable Assistant Helps Small Businesses Withhold the Right Amount of Income Tax

Passport Advocacy Changes Caused by the IRS Commissioner’s Final Decision

Transition Relief Related to Health Care Coverage Reporting

Identity Theft Protection PIN Availability Expands

Deductible Livestock Costs for Adjusting 2019 Income Tax Returns

Notice 2019-66 Relief from Reporting Tax Basis on the 2019 Federal Tax Return

Drought-Affected Farmers and Ranchers have Extra Time to Sell Livestock

IRS Publication 1494 Issues Updating Levy Exemption Tables

Summary to Tax Extender Legislation – Taxpayer Certainty and Disaster Tax Relief Act of 2019

Rev. Rul. 2020-1 – Applicable Federal Rates for January 2020

Issue 1: Rental Safe Harbor Statement

Under IRS Notice 2019-07 and future Revenue Procedure 2019-38, the taxpayer hereby elects the following:

Under Section 3.02 of IRS Notice 2019-07, the taxpayer elects to treat all similar properties held for the production of rents (with the exception of those described in Section 3.05 of IRS Notice 2019-07) as a single rental real estate enterprise. In addition, taxpayer acknowledges that commercial and residential real estate may not be part of the same enterprise if applicable.

Under Section 3.06 of IRS Notice 2019-07, this statement is included to satisfy the procedural requirements for application of the safe harbor to treat the rental real estate enterprise as a trade or business under § 162 as defined in § 199A(d) and as laid out in Section 3.01 of IRS Notice 2019-07. The taxpayer hereby acknowledges that they have meet all requirements as laid out in detail under Section 3.03 (A)(B)(C) and further explained in Section 3.04 of IRS Notice 2019-07.

“Under penalties of perjury, I (we) declare that I (we) have examined the statement, and, to the best of my (our) knowledge and belief, the statement contains all the relevant facts relating to the revenue procedure, and such facts are true, correct, and complete.”

________________________________ _________________

Signature of Taxpayer Dated

The above is a safe harbor statement to be signed by the client. It acknowledges they have met the record keeping requirements and are in compliance with the notice.

Issue 2: News Release 2019-186, Return Requirements-Reminders for Professionals

- Update e-Services information.

- Renew PTINs.

- Update power of attorney/third-party authorization records.

- Review security safeguards.

- Review Practitioner Priority Service options.

Issue 3: IRS Now Issuing Educational Compliance Letters

Tax preparers who have submitted returns with questionable claims for the Earned Income Tax Credit, the Child Tax Credit Tax Credit/Additional Child Tax Credit, American Opportunity Tax Credit and Head of Household will soon receive Letter 5025. The intent of the letter is to raise awareness around questionable tax returns and assist preparers in meeting their due diligence requirements.

Why IRS is sending the letter.

A review of the 2018 returns shows you may not have met the due diligence requirements and may have prepared inaccurate returns for clients, claiming at least one of the following:

- Earned Income Tax Credit (EITC).

- Child Tax Credit (CTC) / Additional Child Tax Credit (ACTC) / Credit for Other Dependents (ODC).

- American Opportunity Tax Credit (AOTC).

- Head of Household (HOH) filing status.

The letter is to give information and raise awareness of the due diligence requirements that all paid preparers must follow. If you do not prepare accurate returns and comply with due diligence requirements under Internal Revenue Code §§ 6695(g) and 1.6695-2(b) of the Income Tax Regulations, you may be penalized. The penalty is $[530] per failure for tax returns filed in 2020.

The failure to exercise due diligence can also result in an audit, the suspension or termination of e-filing privileges, or a referral to the IRS Criminal Investigation Division. IRS may also audit clients which could prevent them from claiming the credits for a period of time in the future. IRS cannot supply information specific to the questionable returns, however, they found the following issues:

What you need to do meet all four due diligence requirements:

- Complete and send Form 8867, Paid Preparer’s Due Diligence Checklist, with every return prepared which claim any of the benefits listed above.

- Complete all worksheets, or equivalents, showing how the credits were computed as claimed on a return or amended return.

- Question the client if any information seems incorrect, inconsistent, or incomplete. Document your questions and the client’s responses.

- Keep all required records, including copies of any documents you relied on to determine eligibility for the benefits listed above and to compute the amount of the credits.

What happens next? This letter is for information only. You don’t need to respond. IRS will continue to check future returns you prepare that claim these benefits to ensure you’re meeting the due diligence requirements.

Issue 4: Required Statement for Form 3800, General Business Credits

The IRS reminds tax preparers of the required statement for Form 3800, General Business Credits. Line 4 in the Instructions for Form 3800 outlines the requirement to attach a statement for each credit claimed.

Line 4

Enter the amount of all carryforwards to 2018 of unused credits that are reported from line 2 of Part III with box C checked.

Required statement. For each credit, attach a statement with the following information.

- Show the tax year the credit originated, the amount of the credit as reported on the original return, and the amount allowed for that year. Also state whether the total carryforward amount was changed from the originally reported amount and identify the type of credit(s) involved. If the revised carryforward amount relates to unused additional research credits, attach an additional statement detailing the changes to the originally reported Form 6765 information for all originating credit years applicable.

- For each carryback year, show the year and the amount of the credit allowed after you applied the carryback.

- For each carryforward year, show the year and the amount of the credit carryforward allowed for that year. Note. Individuals claiming the research credit from a sole proprietorship or pass-through entity don’t include any carryforward of that credit on Part I, line 4, before figuring the limitation on Part III, line 1c. Include the carryforward when figuring the research credit limitation on line 1c of any Parts III with the applicable box A or B checked. Then include the allowable carryforward amount on Part I, line 4, and attach the statement required above. Adjustment for the payroll tax credit. A qualified small business that claimed the payroll tax credit on Form 6765 must reduce its research credit carryforward by the amount of the payroll tax credit.

Issue 5: Final 2020 Form W-4 Now Available

The 2020 Form W-4, Employee’s Withholding Certificate, is now available on IRS.gov. The new W-4 form better incorporates the changes ushered in by the Tax Cuts and Jobs Act allowing employees to more accurately estimate the amount of tax they ask their employers to withhold from their paychecks beginning in 2020. In addition, the goal of the new design is to balance simplicity, accuracy and privacy for employees while minimizing burden for employers and payroll processors.

A few of the visual changes that were made in the last draft shared include:

- It is now a full page.

- There are no withholding allowances (which is why the title of the form changed to “Employee’s Withholding Certificate”).

- Steps 1 through 5 to guide employees through the form.

- Instructions, worksheets, and tables follow the first page.

Changes since the last draft include minor edits to verbiage, but more notably, on page 2, under “Your Privacy,” more language was added to help the taxpayer understand exactly what checking the box in step 2(c) may do to withholdings.

The IRS encourages all tax professionals to become familiar with the new form now so that they can help taxpayers with proper withholding in 2020.

Issue 6: Recent Legislation Requires Tax Exempt Organizations to e-File Forms

The Taxpayer First Act, enacted July 1, requires tax exempt organizations to electronically file information returns and related forms. The new law affects tax exempt organizations in tax years beginning after July 1, 2019.

The following IRS forms are included in the mandate:

- Form 990, Return of Organization Exempt from Income Tax.

- Form 990-PF, Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private Foundation.

- Form 8872, Political Organization Report of Contributions and Expenditures.

- Form 1065, U.S. Return of Partnership Income (if filed by a Section 501(d) apostolic organization).

Those who previously filed paper forms will receive a letter from the IRS informing them of the change. Filing deadlines vary by form type. The IRS will postpone the required e-filing of Form 990-EZ for one year, while optional e-filing continues to be available. Although Forms 990-T and 4720 will come under the e-filing requirement next year, the IRS will continue to accept these forms on paper pending conversion to electronic format.

Form 8872

The IRS will no longer accept paper Forms 8872 reporting on periods after 2019. Forms 8872 reporting information for periods starting on or after Jan. 2020, will be due electronically by § 527 Organizations. These include political parties, political action committees and campaign committees of candidates for federal, state or local office. Among other requirements, most tax-exempt political organizations have a requirement to file semiannual, quarterly or monthly reports on Form 8872. To file electronically, the organization must have the username and password it received from the IRS after electronically filing its initial notice (Form 8871). To replace a username or password, please contact: IRS, Attn: Request for 8872 Password, Mail Stop 6273, Ogden UT 84201; Fax (855) 214-7520. Organizations can file electronically using the IRS website at IRS.gov/polorgs.

Form 990 and 990-PF e-filing

Under the legislation, most e-filings won’t be due before Dec. 15, 2020, from charities and other exempt organizations that generally file Form 990 or 990-PF by the 15th day of the fifth month after the tax year-end. In other words, Forms 990 and 990-PF with tax years ending July 31, 2020, and later MUST be filed electronically. Form 990 and 990-PF filings for tax years ending on or before June 30, 2020, may still be on paper. In the case of a short tax year or certain other circumstances detailed in the 990 or 990-PF Instructions, the IRS will continue to accept paper filing as its systems are yet unable to receive these forms electronically.

Form 990-EZ transition relief

For small exempt organizations, the legislation specifically allowed a postponement (“transitional relief”). For tax years ending on and before July 31, 2020, the IRS will accept either paper or electronic filing of Form 990-EZ, Short Form Return of Organization Exempt from Income Tax. For tax years ending Aug. 31, 2020, and later, Forms 990-EZ must be filed electronically. Generally, Form 990-EZ is for organizations with annual gross receipts less than $200,000 and total assets at tax year-end less than $500,000.

Paper Forms 990-T and 4720

In 2020, the IRS will continue to accept paper forms that are pending conversion into electronic format. These include Form 990-T, Exempt Organization Business Income Tax Return, and Form 4720, Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code. The IRS plans to have these returns ready for e-filing in 2021 (reporting on tax year 2020).

Issue 7: Duplicate CAF Requests

The IRS is working on initiatives to improve the Centralized Authorization File (CAF) process. They’ve noticed a significant increase in duplicate requests, specifically when the same exact request for access to a taxpayer’s account was sent in more than once. Sending in duplicate Forms 2848, Power of Attorney, and Form 8821, Tax Information Authorization, will result in processing delays, as both requests must be researched and reviewed.

Here’s what you need to do:

- Fax a request once. Faxing forms to the same or multiple numbers will delay processing.

- Double check forms for accuracy. Missing information delays requests.

Reducing the number of duplicates and increasing the accuracy of forms will help the IRS to process requests faster and help with other improvements that they are making.

Notification from the National Association of Tax Professionals (NATP) – No infringement intended.

Issue 8: Mailing Forms, Payments and Correspondence to the IRS Changes Abound

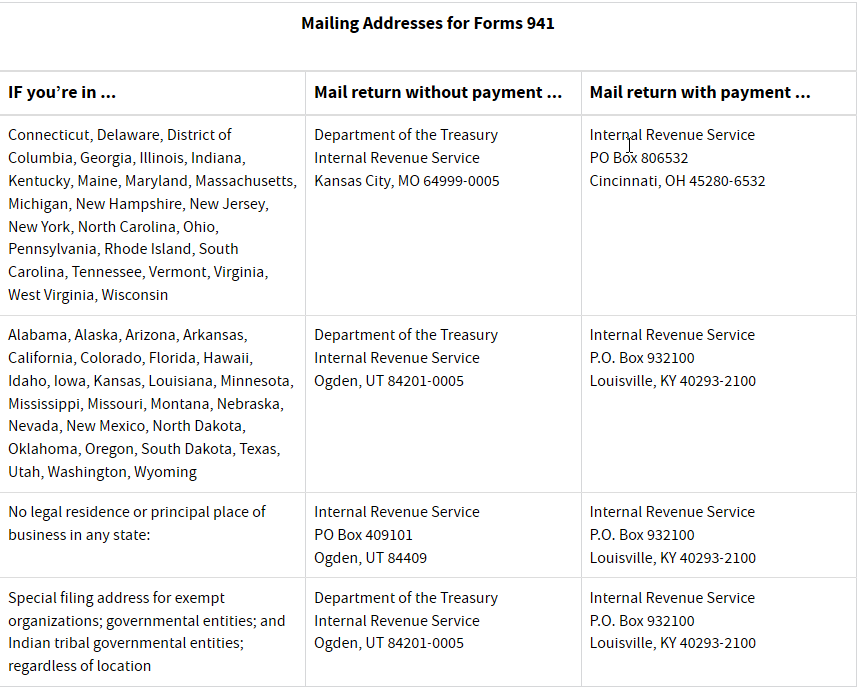

In preparation for the upcoming tax season, tax preparers should know where to file paper Form 941, Employer’s Quarterly Federal Tax Returns, for business clients and where to file paper tax returns for individual taxpayers. If using pre-printed envelopes to mail your client’s tax forms, payments and correspondence, ensure the correct address is used. This will help eliminate delays. Form 941 is not the only change in mailing Tax Return and Forms.

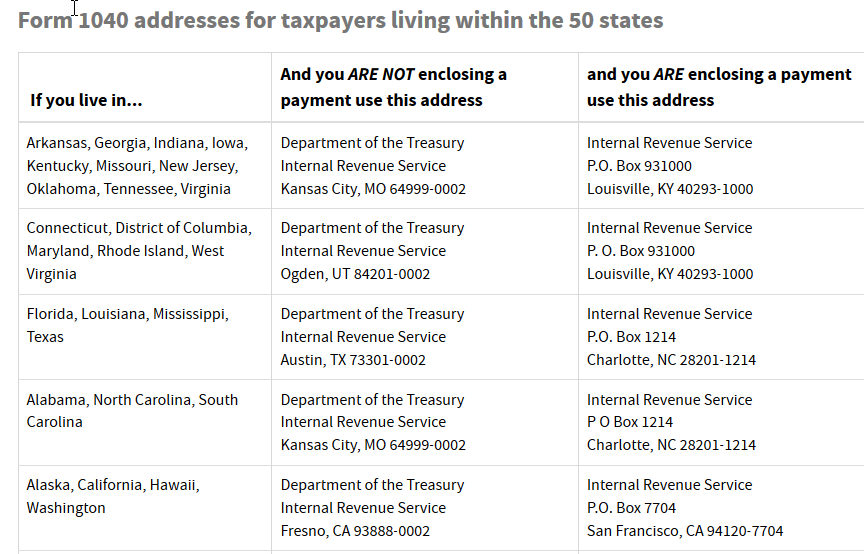

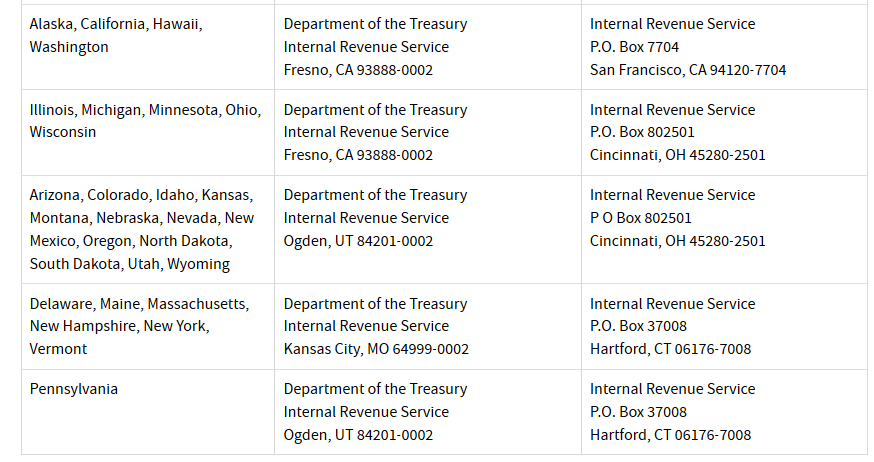

Form 1040 may have changes so check IRS.gov for updates. The table below is where you should send paper returns and payments calendar year 2020. These “Where to File” addresses are to be used ONLY by TAXPAYERS AND TAX PROFESSIONALS.

Exempt Organizations Address for 2020 Mailing have also Changed.

Requests for determination of status as an exempt organization (Forms 1023, 1024, 1024-A, 1028, and 8734) are filed at the following address:

Internal Revenue Service

P.O. Box 12192

TE/GE Stop 3, Team 105

Covington, KY 41012-0192

To file using a private delivery service, use the following address:

Internal Revenue Service

Mail Stop 31A: Team 105

7940 Kentucky Drive

Florence, KY 41042

Issue 9: IR-2019-209 – New Downloadable Assistant Helps Small Businesses Withhold the Right Amount of Income Tax

The Internal Revenue Service has launched a new online assistant designed to help employers, especially small businesses, easily determine the right amount of federal income tax to withhold from their workers’ pay.

Known as the Income Tax Withholding Assistant for Employers, this new spreadsheet-based tool is designed to help employers easily transition to the redesigned withholding system (no longer based on withholding allowances), which goes into effect on Jan. 1. It does this by helping them easily implement new income-tax withholding requests from employees who fill out the completely redesigned 2020 Form W-4, Employee’s Withholding Certificate.

At the same time, the tool can also help employers continue to properly withhold from employees who still have a withholding request on file using a past version of the W-4, which was based on withholding allowances.

Now available for download, without charge, on IRS.gov, the Income Tax Withholding Assistant for Employers is designed to help any employer who would otherwise figure withholding, manually, using a worksheet and either the percentage method or wage bracket tables found in Publication 15-T, Federal Income Tax Withholding Methods. Employers who already use an automated payroll system won’t need this new assistant because their system already does the math.

The Income Tax Withholding Assistant for Employers is available in Microsoft Excel. The employer can use the tool to create a profile for each employee that then automatically calculates their correct federal income tax withholding.

To use the Income Tax Withholding Assistant for Employers, the employer starts by indicating their pay period frequency (for example, weekly, bi-weekly, monthly, etc.), and then enters key information from an employee’s Form W-4. For the tool to work properly, the employer must indicate whether the employee submitted a 2020 Form W-4, which does not base withholding on the number of withholding allowances claimed, or a prior version of the W-4, which does.

The employer can then save a separate customized copy of the file for each employee containing that employee’s Form W-4 information. Then, each pay period, the employer simply opens the employee’s file and enters their gross wage or salary amount for that pay period. The tool will then automatically display the correct amount of federal income tax to withhold from that employee’s pay.

Issue 10: Passport Advocacy Changes Caused by the IRS Commissioner’s Final Decision

The National Taxpayer Advocate has long advocated to exclude certain taxpayers with TAS cases from certification of a seriously delinquent tax debt resulting in passport consequences (passport certification). As the IRS Commissioner considered this issue, he made a temporary decision to automatically protect all taxpayers working with TAS from certification. The IRS Commissioner has now made a final determination on this issue. Taxpayers working with TAS will no longer be automatically protected from certification. Instead, TAS will work with the IRS to identify and resolve the seriously delinquent tax debts of these taxpayers. Disagreements about how to address individual cases or whether to protect a specific taxpayer from certification who has already taken significant steps to resolve the debt will still be resolved with Taxpayer Assistance Orders (TAOs).

Issue 11: Transition Relief Related to Health Care Coverage Reporting

Notice 2019-63 extends the due dates for certain 2019 information reporting requirements for insurers, self-insuring employers, and certain other providers of minimum essential coverage under § 6055 and for applicable large employers under § 6056.

Specifically, this notice extends the due date from January 31, 2020 to March 2, 2020 for furnishing to individuals the 2019:

- Form 1095-B, Health Coverage

- Form 1095-C, Employer-Provided Health Insurance Offer and Coverage

This notice provides that the Service will not impose a penalty against reporting entities for failing to furnish a Form 1095-B to responsible individuals if certain conditions are met. It also extends transitional good-faith relief from §§ 6721 and 6722 penalties to the 2019 information reporting requirements under §§ 6055 and 6056.

Issue 12: Identity Theft Protection PIN Availability Expands

When the IRS begins the 2020 tax filing season, taxpayers in more locations will be eligible to opt into the online Identity Protection (IP) PIN program. The IP PIN is a 6-digit number that adds another layer of protection for taxpayers’ Social Security numbers and helps protect against tax-related identity theft.

Taxpayers will be eligible for this voluntary program if they filed a federal tax return last year from Arizona, California, Colorado, Connecticut, Delaware, the District of Columbia, Florida, Georgia, Illinois, Maryland, Michigan, Nevada, New Jersey, New Mexico, New York, North Carolina, Pennsylvania, Rhode Island, Texas and Washington.

The IRS has created a new publication – Publication 5367, Identity Protection PIN Opt-In Program for Taxpayers – to help taxpayers understand the required steps. Please inform clients who are eligible and interested in this program.

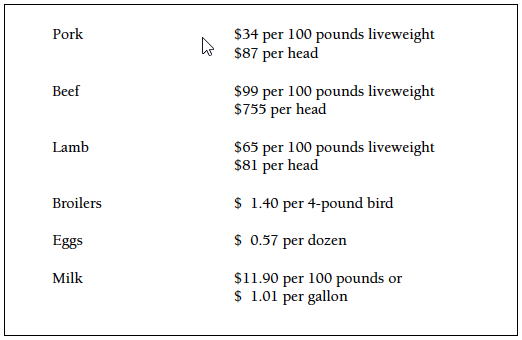

Issue: 13 : Deductible Livestock Costs for Adjusting 2019 Income Tax Returns

Estimated deductible costs for use in adjusting farm expenses to exclude the cost of producing home-consumed farm produce. The costs include all cash costs, depreciation and deductible production costs of home-raised feed. No charge is made for the farm operator’s labor. If hired labor or purchased grain and roughages are used to produce these products, or if high interest costs are incurred, the costs should be increased accordingly. In arriving at production costs, it was assumed that the young animals were raised and fed.

Issue 14: Notice 2019-66 Relief from Reporting Tax Basis on the 2019 Federal Tax Return

This notice provides the following:

- The requirement to report partners’ shares of partnership capital on the tax basis method will not be effective for 2019 (for partnership taxable years beginning in calendar 2019) but will be effective beginning in 2020 (for partnership taxable years that begin on or after January 1, 2020). For 2019, partnerships and other persons must report partner capital accounts consistent with the reporting requirements in the 2018 forms and instructions, including the requirement to report negative tax basis capital accounts on a partner-by-partner basis.

- Clarifies the 2019 requirement for partnerships and other persons to report a partner’s share of “net unrecognized § 704(c) gain or loss” by defining this term for purposes of the reporting requirement.

- Exempts publicly traded partnerships from the requirement to report their partners’ shares of net unrecognized § 704(c) gain or loss until further notice. Provides that the requirement added by the draft instructions for 2019 for partnerships to report to partners information about separate “§ 465 at-risk activities” will not be effective until 2020.

- Provides relief from certain reporting penalties imposed by the Internal Revenue Code.

Issue 15: Drought-Affected Farmers and Ranchers have Extra Time to Sell Livestock

Those who were forced to sell livestock due to drought may get extra time to replace the livestock. They may also have more time to defer tax on any gains from the forced sales.

Here are some facts to help farmers understand how the deferral works and if they are eligible.

- The one-year extension gives eligible farmers and ranchers until the end of the tax year after the first drought-free year to replace the sold livestock.

- The farmer or rancher must be in an applicable region. An applicable region is a county designated as eligible for federal assistance, as well as counties contiguous to that county.

- The farmer’s county, parish, city or district included in the applicable region must be listed as suffering exceptional, extreme or severe drought conditions by the National Drought Mitigation Center. All or part of 32 states, plus Guam, the U.S. Virgin Islands and the Commonwealths of Puerto Rico and the Northern Mariana Islands, are listed. The list of applicable regions is in Notice 2019-54.

- The relief applies to farmers who were affected by drought that happened between September 1, 2018, and August 31, 2019.

- This relief generally applies to capital gains on sales of livestock held for draft, dairy or breeding purposes.

- Sales of other livestock, such as those raised for slaughter or held for sporting purposes, or poultry are not eligible.

- To qualify, the sales must be solely due to drought, flooding or other severe weather causing the region to be designated as eligible for federal assistance.

- The farmers generally must replace the livestock within a four-year period, instead of the usual two-year period.

- Because the normal drought sale replacement period is four years, this extension immediately affects drought sales that occurred during 2015. However, because of previous drought-related extensions affecting some of these areas, the replacement periods for some drought sales before 2015 are also affected.

Issue 16: IRS Publication 1494 Issues Updating Levy Exemption Tables

Tables for Figuring Amount Exempt from Levy on Wages, Salary, and Other Income (Forms 668-W(ACS), 668-W(c)(DO) and 668-W(ICS)).

The amount of levy exemption is determined by the filing status, how often the employee is paid and the amount of wages. The tables have been updated to reflect 2020changes in law.

Issue 17: Extender Legislation Summary – Taxpayer Certainty and Disaster Tax Relief Act of 2019

- Extensions of 34 expired or expiring provisions—as well as disaster tax relief.

- Exclusion from gross income of discharge of qualified principal residence indebtedness.

- Treatment of mortgage insurance premiums as qualified residence interest.

- Reduction in medical expense deduction floor back to 7.5%.

- Deduction of qualified tuition and related expenses.

- Black lung disability trust fund excise tax.

- Indian employment credit.

- Railroad track maintenance credit.

- Mine rescue team training credit.

- Classification of certain race horses as 3-year property.

- 7-year recovery period for motorsports entertainment complexes.

- Accelerated depreciation for business property on Indian reservations.

- Expensing rules for certain productions.

- Empowerment zone tax incentives.

- American Samoa economic development credit.

- Biodiesel and renewable diesel.

- Second generation biofuel producer credit.

- Nonbusiness energy property.

- Qualified fuel cell motor vehicles.

- Alternative fuel refueling property credit.

- 2-wheeled plug-in electric vehicle credit.

- Credit for electricity produced from certain renewable resources.

- Production credit for Indian coal facilities.

- Energy efficient homes credit.

- Special allowance for second generation biofuel plant property.

- Energy efficient commercial buildings deduction.

- Special rule for sales or dispositions to implement FERC or State electric restructuring policy for qualified electric utilities.

- Extension and clarification of excise tax credits relating to alternative fuels. Sec. 134. Oil spill liability trust fund rate.

- New markets tax credit.

- Employer credit for paid family and medical leave.

- Work opportunity credit.

- Certain provisions related to beer, wine, and distilled spirits.

- Look-thru rule for related controlled foreign corporations.

- Credit for health insurance costs of eligible individuals.

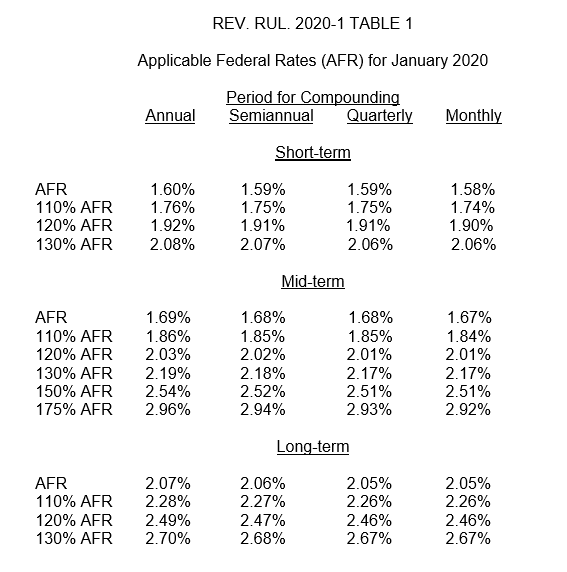

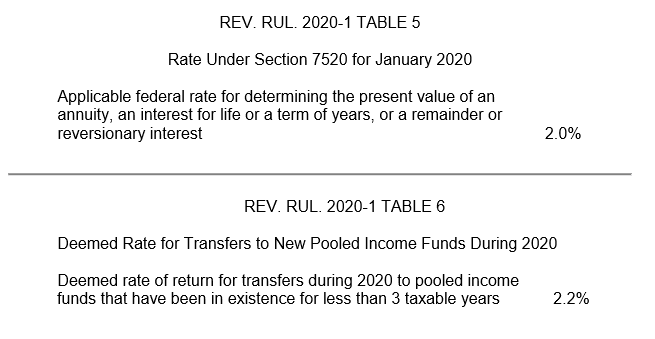

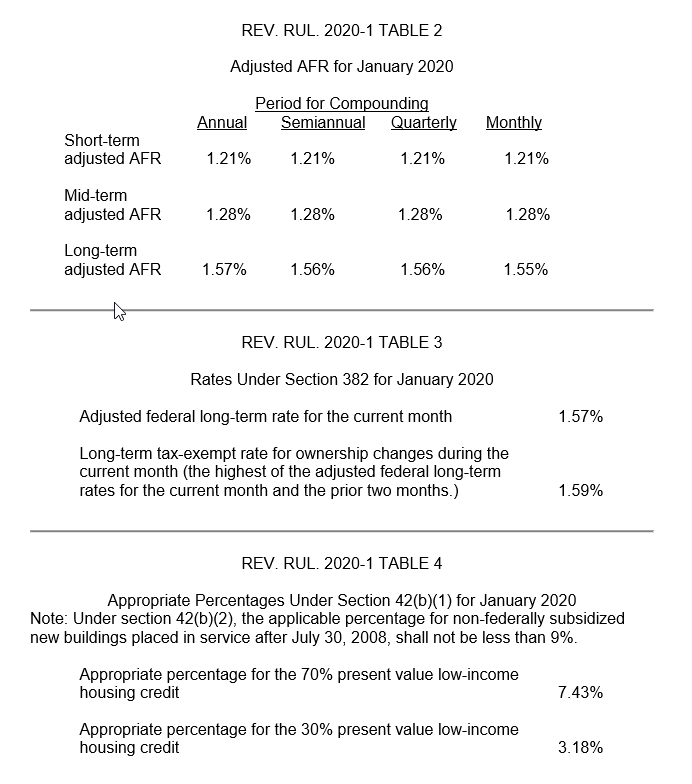

Issue: 19 Rev. Rul. 2020-1 – Applicable Federal Rates for January 2020