October 2019 Issues

Issue 1: 2019 Tax Season Cut-Off Dates for E-File Form 1040

Last date for transmitting returns on extension from Form 4868 – October 15, 2019

Last date for re-transmitting rejected late or returns on extension from Form 4868 – October 20, 2019

Issue 2: Error in Calculation on Schedule Tax Worksheet for Form 1040 and 1041 – Reminder – IRS will Use Letter 474-C Explaining the Math Error and Other Details

The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D (Form 1040) contained an error. The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D filers who had 28% rate gain (taxed at a maximum rate of 28%) reported on line 18 of Schedule D or unrecaptured § 1250 gain (taxed at a maximum rate of 25%) reported on line 19 of Schedule D. All returns filed after May 15 should reflect the new calculation; the IRS will update any returns filed after May 15 to reflect the correct tax using the new calculation. Because the IRS has already provided the corrected worksheet to its tax software partners, anyone filing a 2018 return, including those with extensions, after May 15, 2019, are not affected by the error. The correction results in a lower regular tax for most affected taxpayers, and a higher regular tax for a small number of the impacted taxpayers, depending on the taxpayer’s individual return.

Issue 3: Form I-9 Update on Form

The U.S. Citizenship and Immigration Services (USCIS) has advised employers to continue using the current version of Form I-9 (Employment Eligibility Verification) after its expiration date on Aug. 31, 2019, until further notice.

USCIS will provide updated information about the new version of the Form I-9 as it becomes available.

Employers must complete Form I-9 for all newly hired employees to verify their identity and authorization to work in the United States. I-9 Central – https://www.uscis.gov/i-9-central

Issue 4: Chief Counsel Advice 2019-33-011 Discusses Third Party Refund Procedures

In 1995 the Supreme Court case of Williams, (S Ct 1995) 75 AFTR 2d 95-1805 ) resulted in a modification to the IRC and the addition of §6325(b)(4) and § 7426(a)(4) with the implementation of the IRS Restructuring and Reform Act of 1998. It closed a gap in the tax law concerning erroneous collection of a tax liability if certain requirement were met.

The Court held that a woman could bring a refund suit in federal court because she paid her ex-husband’s tax liability under protest to remove a lien from her property and she had exhausted her administrative remedies. The Court reasoned that the IRS could not leave the woman, from whom the IRS had erroneously collected taxes, without a remedy.

Under § 6325(b)(4)(A), a third-party owner (or part owner) of a property subject to a federal tax lien that secures another person’s taxes (property secured by a lien) has the right to obtain a lien discharge upon either depositing cash with, or furnishing a bond to, the IRS. The IRS must refund the amount deposited or release the bond if the IRS determines that:

(1) the tax liability giving rise to the lien can be satisfied from a source other than the liened property, or

(2) the value of its interest in the liened property is less than the IRS’s prior determination of that value.

Any amount not used to satisfy the tax liability is refunded to the third-party owner of the property.

Under § 7426(a)(4) , a third-party owner of liened property has 120 days from the date the IRS issues a certificate of discharge under § 6325(b)(4) , to file a substitution of value action in district court, challenging the IRS’s valuation of its interest in the liened property. The judicial remedy available to third parties to challenge the value or attachment of a tax lien to their property is exclusive and no other action may be brought by a third-party claimant.

If the property owner does not challenge the IRS’s determination within the 120-day period, the IRS will, within 60 days of the expiration of the 120-day period, apply the amount deposited or collect on the bond to the extent necessary to satisfy the tax liability secured by the lien.

If the property owner successfully challenges the IRS’s determination of the value of the IRS’s lien interest, the court will enter judgment ordering a refund of the amount deposited or a release of the bond to the extent the deposit or bond exceeds the court’s determination of the lien’s value.

In Rev. Rul. 2005-50, the IRS clarified that because of the amendments to §6325 and § 7426 a person not liable for the underlying tax (third-party), may not file a refund action under the holding in Williams.

Chief Counsel’s Position

The advice states that §§ 6325(b)(4) and 7426(a)(4) , and not Williams (the case), apply when a third party pays another person’s tax liability. Thus, a third party cannot pay another person’s tax liability and then sue for a refund. The third party must use the deposit and bond remedy provided in § 6325(b)(4) to obtain a lien discharge and then file a substitution of value suit as provided in § 7426(a)(4) .

Issue 5: Penalty Relief Related to Reliance on Revenue Procedure 2018-38 and Notice 2019-47

This Notice provides penalty relief related to taxpayer reliance on Revenue Procedure 2018-38, which was set aside by an order issued on July 30, 2019, by the United States District Court for the District of Montana in the case of Bullock v. IRS (D. Mont. Jul. 30, 2019).

Revenue Procedure 2018-38, provided information reporting relief to organizations exempt from tax under § 501(a), other than organizations described in § 501(c)(3), that are required to file an annual Form 990, Return of Organization Exempt from Income Tax, or Form 990-EZ, Short Form Return of Organization Exempt from Income Tax. Relief was granted from the general requirement to report the names and addresses of their contributors on the Schedule B of their Forms 990 or 990-EZ filed for taxable years ending on or after December 31, 2018. The information reporting relief did not apply to political organizations described 2 in § 527. The instructions to Schedule B of Forms 990 and 990-EZ were modified to conform to Revenue Procedure 2018-38.

- 6652(c)(1)(A)(i) imposes a penalty for a failure to file a return required under §6033(a)(1) on the date and in the manner prescribed. § 6652(c)(1)(A)(ii) imposes a penalty for a failure to include any of the information required to be shown on a return filed under §6033(a)(1) or to show the correct information. The §6652(c) penalty is not imposed if it is shown that the failure was due to reasonable cause.

Generally, an organization exempt from tax under § 501(a) must file its Form 990 or 990-EZ by the 15th day of the 5th month after the organization’s accounting period ends. The court’s July 30, 2019 order in Bullock has raised questions from taxpayers regarding the filing requirements for the 2018 tax year because the order was issued after the due date for most 2018 Forms 990 or 990-EZ. Any exempt organization filing before July 30, 2019, other than organizations described in § 501(c)(3), that did not report the names and addresses of its contributors on the Schedule B of its Forms 990 or 990-EZ, would have filed consistent with Revenue Procedure 2018-38 and according to the instructions to Schedule B of Forms 990 and 990-EZ.

In consideration of these facts, and the reliance interests of taxpayers, and consistent with how the IRS has previously exercised the authority under § 6652(c)(5) to provide relief from penalties for failures due to reasonable cause, the IRS will not impose a penalty under § 6652(c) for organizations exempt from tax under § 501(a), other than those organizations described in § 501(c)(3), that do not report the names and addresses of their contributors on the Schedule B of their Forms 990 or 990-EZ filed for a taxable year ending on or after December 31, 2018, and on or prior to July 30, 2019.

Exempt organizations may still be liable for a penalty under § 6652(c) for a failure to report any information required under § 6033(a) that is unrelated to the donor information described in Revenue Procedure 2018-38.

Issue 6: New Procedures to Enable Certain Expatriated Individuals a Way to Come into Compliance with their U.S. tax and Filing Obligations

New procedures were announced that will enable certain individuals who relinquished their U.S. citizenship to come into compliance with their U.S. tax and filing obligations and receive relief for back taxes.

The Relief Procedures for Certain Former Citizens apply only to individuals who have not filed U.S. tax returns as U.S. citizens or residents, owe a limited amount of back taxes to the United States and have net assets of less than $2 million. Only taxpayers whose past compliance failures were non-willful can take advantage of these new procedures. Many in this group may have lived outside the United States most of their lives and may have not been aware that they had U.S. tax obligations.

Eligible individuals wishing to use these relief procedures are required to file outstanding U.S. tax returns, including all required schedules and information returns, for the five years preceding and their year of expatriation. Provided that the taxpayer’s tax liability does not exceed a total of $25,000 for the six years in question, the taxpayer is relieved from paying U.S. taxes. The purpose of these procedures is to provide relief for certain former citizens. Individuals who qualify for these procedures will not be assessed penalties and interest.

The IRS is offering these procedures without a specific termination date. The IRS will announce a closing date prior to ending the procedures. Individuals who relinquished their U.S. citizenship any time after March 18, 2010, are eligible so long as they satisfy the other criteria of the procedures.

These procedures are only available to individuals. Estates, trusts, corporations, partnerships and other entities may not use these procedures.

Relinquishing U.S. citizenship and the tax consequences that follow are serious matters that involve irrevocable decisions. Taxpayers who relinquish citizenship without complying with their U.S. tax obligations are subject to the significant tax consequences of the U.S. expatriation tax regime. Taxpayers interested in these procedures should read all the materials carefully, including the FAQs, and consider consulting legal counsel before making any decisions.

Issue 7: Revenue Procedure 2019-37

Revenue Procedure 2019-37 provides the procedure by which a taxpayer may obtain the automatic consent of the Commissioner of Internal Revenue under § 446 and § 1.446-1(e) to change a method of accounting to comply with § 451 and the proposed regulations under §§ 1.451-3 and 1.451-8. Revenue Procedure 2019-37, also provides procedures for certain qualifying taxpayers to make a method change to comply with the proposed regulations without filing a Form 3115, Application for Change in Accounting Method. This revenue procedure modifies Rev. Proc. 2018-31, 2018-22 I.R.B. 637.

Issue 8: 2019 Instructions for Form 8995 Qualified Business Income Deduction Simplified Computation

QBI includes items of income, gain, deduction, and loss from a trades or businesses that are effectively connected with the conduct of a trade or business in the U.S. This includes income from partnerships (other than PTPs), S corporations, sole proprietorships, certain estates and trusts that are included or allowed in figuring the taxable income for the year. To figure the total amount of QBI, the taxpayer must consider all items that are related to the trade or business. This includes, but not limited to, charitable contributions, unreimbursed partnership expenses, business interest expense, deductible part of self-employment tax, self-employment health insurance deduction, and contributions to qualified retirement plans.

QBI doesn’t include any of the following:

- Items that aren’t properly included in income.

- Income that is not effectively connected with the conduct of a trade or business within the U.S.

- Wage income (except “Statutory Employees” where Form W-2, box 13 is checked).

- Amounts received as reasonable compensation from a S corporation.

- Amounts received as guaranteed payments.

- Amounts received as payments received by a partner for services other than in a capacity as a partner.

- Items treated as capital gains or losses under any provision of the Code.

- Dividends and dividend equivalents.

- Interest income not properly allocable to a trade or business.

- Commodities transactions or foreign currency gains or losses.

- Income, loss, or deductions from notional principal contracts.

- Annuities (unless received in connection with the trade or business).

- Qualified REIT dividends.

- Qualified PTP income.

The QBI doesn’t include any losses or deductions disallowed under the basis, at-risk, passive loss, or § 461(l), excess business loss rules as losses limited or suspended under these rules aren’t included in determining the taxable income for the year. These losses are taken into account in the tax year they are included in determining the taxable income.

Issue 9: Self-employed Individuals Should be Aware of the Changes to OIC low-income Application Fees

Effective July 2, 2019, the Taxpayer First Act added an extra method the IRS must use in determining the low-income certification threshold necessary to waive the application fee for an Offer in Compromise (OIC). Taxpayers can apply to be considered for an OIC if they can’t pay their full tax liabilities, or if doing so would create a financial hardship. Offers currently require a $186 application fee to cover the cost of processing.

The IRS already waives the application fee for certified low-income taxpayers. However, the new method for determining eligibility for the waiver now uses the adjusted gross income (AGI) from the taxpayer’s most recent tax return. Taxpayers who do not qualify based on their AGI may still qualify as low-income if their household’s gross monthly income for 12 months falls at or below 250% of the poverty guidelines listed in Form 656 (PDF)

Issue 10: 2019 Illinois Tax Amnesty Program will be held 10/1/2019 through 11/15/2019

The Illinois Tax Delinquency Amnesty Act provides the opportunity for taxpayers to pay outstanding eligible tax liabilities and to have eligible penalties and interest forgiven on taxes paid in full during the amnesty period.

What tax liabilities and periods are eligible for the 2019 Illinois Tax Amnesty program?

Eligible liabilities are taxes due from periods ending after June 30, 2011, and prior to July 1, 2018. How do your clients participate? If they have an existing tax liability, make full payments of the eligible tax liability between October 1, 2019, and November 15, 2019. If the client fails to file a tax return or incorrectly reported the liability due on a previously filed return for these tax periods, now is the time to file returns, make corrections, and pay the tax. The client must file an original return for non-filed periods or file an amended return to make corrections.

What is the benefit of participating in the amnesty program?

If an eligible tax liability is paid in full between October 1, 2019, and November 15, 2019, eligible penalties and interest will be waived. What if the client owes only penalty and interest? If the client owes only penalty and interest, they do not qualify for the amnesty program.

https://www2.illinois.gov/rev/research/publications/bulletins/Documents/2020/FY2020-05.pdf

Issue 11: More on the Taxpayers First Act

Electronic signature will be allowed on two forms, Form 8821 and Form 2848. IRS has six months to issue rules for accepting signatures on these forms.

Issue 12: Fiscal Year 2019 Statutory Review of Disclosure of Collection Activities on Joint Returns, TIGTA Audit

- 6103(e)(8) requires the IRS to disclose efforts to collect delinquent taxes on joint tax liabilities when requested by taxpayers who are no longer married or no longer reside in the same household. § 6103(e)(7) allows authorized representatives of the joint filers to also receive the same collection information requested under § 6103(e)(8). If the IRS does not provide employees sufficient guidance for handling those requests, taxpayer rights could potentially be violated.

The objective of the review was to determine whether the IRS is complying with the provisions of § 6103(e)(8) as related to the disclosure of collection activities with respect to joint filers.

TIGTA’s review of computer system history files and employee interviews showed that employees were not always aware of the disclosure requirements for joint filer taxpayer contacts. TIGTA’s review of computer system history files found that the joint filer disclosure requirements were not followed in 22 (73%) of 30 Integrated Collection System history files and 17 (57%) of 30 Account Management Services history files.

In interviews that TIGTA conducted of a judgmental sample of 30 employees (15 revenue officers and 15 Automated Collection System function customer service representatives), revenue officers answered 31% of the questions incorrectly and customer service representatives answered 46% incorrectly. After the addition of § 6103(e)(8), the IRS updated Internal Revenue Manual sections to provide employees with guidance on responding to joint filer requests to comply with the law. However, the lack of a detailed list of what employees can disclose for joint filer requests in the various Internal Revenue Manuals and incomplete and inconsistent training between the various employees who provide collection information to taxpayers may be contributing to employees’ hesitation to disclose information.

TIGTA recommended that the IRS:

1) produce a detailed but simple-to-understand list of information that must be provided to IRS employees so that they understand the type of information that must be provided to joint filers seeking collection information (as well as the type of information that must not be provided to joint filers seeking collection information) and encourage employees who are still confused about their legal obligations to contact the Disclosure Help Desk, and

2) require §§ 6103(e)(7) and (e)(8) training for all employees with taxpayer contact regarding balance due or collection issues to remind them of the requirements to disclose tax return and collection activity on jointly filed returns when requested by the joint spouse.

IRS officials partially agreed with the recommendations and plan to take corrective actions. The IRS plans to update guidance with common joint filer scenarios and consider training for Collection function employees; however, TIGTA believes the updated guidance should include a simple list for quick reference and training should be provided to all employees with taxpayer contact regarding balance due or collection issues so they are aware of what information they are required to provide to taxpayers under I.R.C. §§ 6103(e)(7) and (e)(8).

Issue 13: Form IL-4562, Special Depreciation

Form IL-4562, Special Depreciation, should be filed by taxpayers who file an income or replacement tax return and report special depreciation on their federal Form 4562, Depreciation and Amortization, or Form 2106, Employee Business Expenses. The purpose of Form IL-4562 is to reverse the effects of the bonus depreciation (other than 100 percent bonus depreciation) allowed by §168(k).

Property acquired before September 28, 2017 and placed in service in 2018 is subject federally to 40% bonus depreciation. Because the IITA does not make a provision for property subject to the federal bonus depreciation rate of 40 %, an Illinois subtraction modification cannot be claimed for the property until the last year of regular depreciation. However, an Illinois special depreciation addition must be reported for 40 % bonus depreciation in the same year in which you claimed a federal special depreciation allowance for the property. The 100 % bonus depreciation allowed under Public Law 115-97, commonly referred to as the Tax Cuts and Jobs Act, is already allowed by Illinois, so no adjustments are required. Do not include 100 % bonus depreciation property on Form IL-4562. For more information refer to Form IL-4562, Special Depreciation.

Answers others found helpful

This amount is shown on the Illinois Schedule K-1-P, Partner’s or Shareholder’s Share of Income, Deductions, Credits, and Recapture, and should be included on the tax return on the line specified for additions or subtractions that flow through from a partnership or S corporation. Do not include the pass-through amount of depreciation on Form IL-4562, Special Depreciation, or the line on the return that is designated for Form IL-4562. The amounts on these lines should be for depreciation amounts earned directly by you.

Under the Illinois Income Tax Act, the computation of taxable “net income” begins with the taxpayer’s federal taxable income for business taxpayers and then makes various additions and subtraction modifications.

The client may not subtract anything that is not listed on Schedule M.

For example, they may not subtract:

- Unemployment compensation – Unemployment compensation included in your federal adjusted gross income, except railroad unemployment, is fully taxable to Illinois.

- Gambling losses – Illinois does not allow a deduction for gambling losses.

- Your federal itemized deductions from U.S. 1040 Schedule A, Itemized Deductions

- Any wages reported on your federal return – If you believe the wages reported on the Form W-2, Wage and Tax Statement, you received from your employer are incorrect, you must obtain a corrected Form W-2 or a statement from your employer, on company letterhead, stating that your Form W-2 was incorrect. We will not accept a letter from you or your tax preparer.

- Income received from Social Security benefits and retirement plans (including Illinois Teacher’s Retirement) – Eligible retirement income should be subtracted on IL-1040, Line 5.

- Out-of-state income – However, if you are filing as a resident or a part-year resident, you may be allowed to take a credit against Illinois Income Tax for income tax you paid to another state. See the instructions for Form IL-1040, Line 15, and Schedule CR, Credit for Tax Paid to Other States.

Issue: 14 : Billions of Dollars of Potentially Erroneous Carryforward Claims Are Still NOT Being Addressed

In a highly redacted report a “carryforward” credit or deduction refers to claiming the unused portion of a tax credit or deduction on a future year’s tax return. A credit reduces the tax liability amount, whereas a deduction reduces taxable income. About 2.5 million Tax Year (TY) 2015 tax returns contained claims for carryforward credits totaling $81.9 billion. In addition, 6.5 million TY 2015 tax returns claimed carryforward deductions of $55.9 billion.

Why TIGTA Did the Audit?

In two previous reviews, TIGTA recommended that the IRS develop a process to ensure the accuracy of carryforward claims. This audit was initiated to determine what corrective actions the IRS has taken in response to two previous TIGTA reviews dealing with General Business Credit carryforward claims. It was also initiated to assess the effectiveness of current IRS controls to detect and prevent questionable carryforward claims on individual and business income tax returns.

Actions have not been taken to **********. TIGTA’s review of TY 2015 electronically filed returns found that taxpayers continue to claim carryforward amounts. TIGTA identified 19,193 taxpayers claiming a carryforward credit or deduction with discrepancies totaling more than $5 billion that was used to offset tax. In addition, processes are not in place, *****************, a concern TIGTA first reported in Calendar Year 2013. A judgmental sample of 100 tax returns identified that 63 taxpayers did not include the required statement with their TY 2015 General Business Credit carryforward claims. The IRS could use the information ********** to identify potentially erroneous carryforward claims.

TIGTA made six recommendations, including that the IRS add criteria to its risk tool to identify high-risk carryforward Research Credit claims, and also to identify and examine returns with discrepancies of General Business Credit carryforward claims. Based on the results of this work, and if warranted, expand the criteria to identify other carryforward claims with discrepancies. TIGTA also recommended that the IRS prepare and submit an information technology request. Finally, TIGTA recommended that the IRS develop a strategy to evaluate possible revisions to tax forms to capture carryforward claim information. The IRS agreed with three recommendations and partially agreed with one recommendation. The IRS disagreed with the need to prepare and submit an information technology request. The IRS also disagreed with the need to change tax forms without evidence that such information would be beneficial to identifying noncompliance.

Issue 15: Notice 2019-46 – Domestic Partnerships and S Corporations Filing Under Proposed GILTI Regulations

This notice announces that the Department of the Treasury intend to issue regulations that will permit a domestic partnership or S corporation to apply the rules in proposed §1.951A-5 for taxable years ending before June 22, 2019. This notice also addresses the applicability of penalties in the case of a domestic partnership or S corporation that acted consistently with proposed §1.951A-5 on or before June 21, 2019, but files a tax return consistent with the final regulations under §1.951A-1(e). In order to apply the rules in proposed §1.951A-5 or for penalties not to apply, a domestic partnership or S corporation must satisfy certain notification and reporting requirements described in section 5 of this notice. The regulations described in this notice will be effective for taxable years ending before June 22, 2019. Prior to the issuance of the regulations described in this notice, domestic partnerships and S corporations may rely on this notice, provided they satisfy the requirements described herein. Please review notice if this is applicable to a client.

Issue 16: IRS Withdraws the “Altera Memo” Directive

MEMORANDUM FOR ALL LARGE BUSINESS AND INTERNATIONAL DIVISION EMPLOYEES

FROM: Douglas W. O’Donnell /s/ Douglas W. O’Donnell

Commissioner, Large Business and International Division

SUBJECT: Withdrawal of Directive LB&I-04-0118-005, Instructions for Examiners

on Transfer Pricing Issue Selection – Cost-Sharing Arrangement

Stock Based Compensation, dated January 12, 2018

Purpose: The purpose of this document (“Withdrawal”) is to formally withdraw Directive LB&I-04-0118-005 (Cost Sharing Arrangement (CSA) Stock Based Compensation (SBC) Directive), dated January 12, 2018, which provided instructions for examiners on transfer pricing issue selection related to SBC in CSAs.

Background: U.S. taxpayers that are cost sharing participants are required to include SBC as intangible development costs (IDCs), under Treas. Reg. §§ 1.482-7A(d)(2) and 1.482-7(d)(3), if such costs are directly identified with, or reasonably allocable to, the intangible development activity of the CSA.

In Altera Corp. v. Commissioner, 145 T.C. 91 (2015), the Tax Court invalidated Treas. Reg. § 1.482-7A(d)(2). The IRS appealed Altera and issued Directive LB&I-04-0118-005 on January 12, 2018, directing examiners to stop opening new examinations for issues related to SBC included in CSA IDCs until the outcome of the Altera appeal is known. On June 7, 2019, the United States Court of Appeals for the Ninth Circuit reversed the U.S. Tax Court’s opinion in Altera.

Withdrawal of Directive: Based on the Ninth Circuit’s decision in Altera, I am formally withdrawing Directive LB&I-04-0118-005. With the issuance of this Withdrawal, examiners should continue applying Treas. Reg. §§ 1.482-7A(d)(2) and 1.482-7(d)(3), including opening new examinations of CSA SBC issues when appropriate. These issues may be factually intensive, and transfer pricing teams should develop the facts to support their analyses and conclusions. Where appropriate, Issue Teams should

consider consulting the Practice Network and Counsel for support in developing the most reliable analyses of this issue. We will continue to monitor any further developments related to the Ninth Circuit’s decision.

Effective Date: July 31, 2019

Contact: For further information regarding this Withdrawal, please contact the Director of Treaty and Transfer Pricing Operations.

This Withdrawal is not an official pronouncement of law and cannot be used, cited, or relied upon as such. In addition, nothing in this directive should be construed as affecting the operation of any provision of the Code, regulations, or guidance thereunder.

Issue 17: Other News

Watch the Senate Bill on proposed simplification for S Corporations

- The S Corporation Modernization Act (S. 2156) would reform the tax code related to an additional tax on S corporations that have previously converted from C corporations if more than 25 % of the S corporation’s income is passive – such as rents, royalties, and interest). This bill would increase the threshold to 60 %.

- It also permits any S corporation bank to have IRA shareholders. Currently, IRA ownership of S corporation banks is limited to only those S corporation banks with stock held by an IRA.

- In addition, the bill would repeal the excess passive income rule as an S-election event.

IRS Targets with Planned S Corporation Audits

- Distributions

- Built-In Gains Tax

- Shareholder basis

Notes from Our Fall CPE Classes

- When the revised I-9 becomes final it will be posted at: https://www.uscis.gov/i-9-central. Until the new I-9 is available, continue to use the August 2019 Obsolete version.

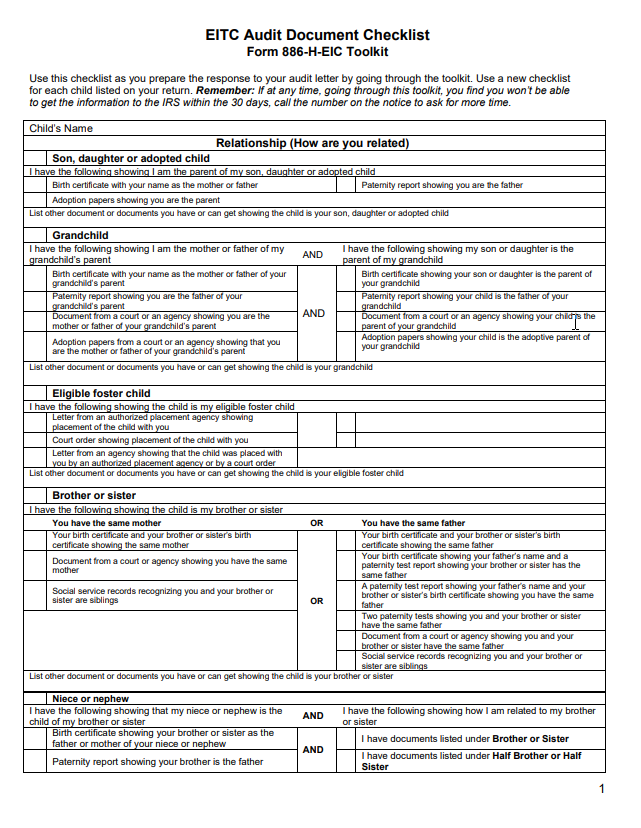

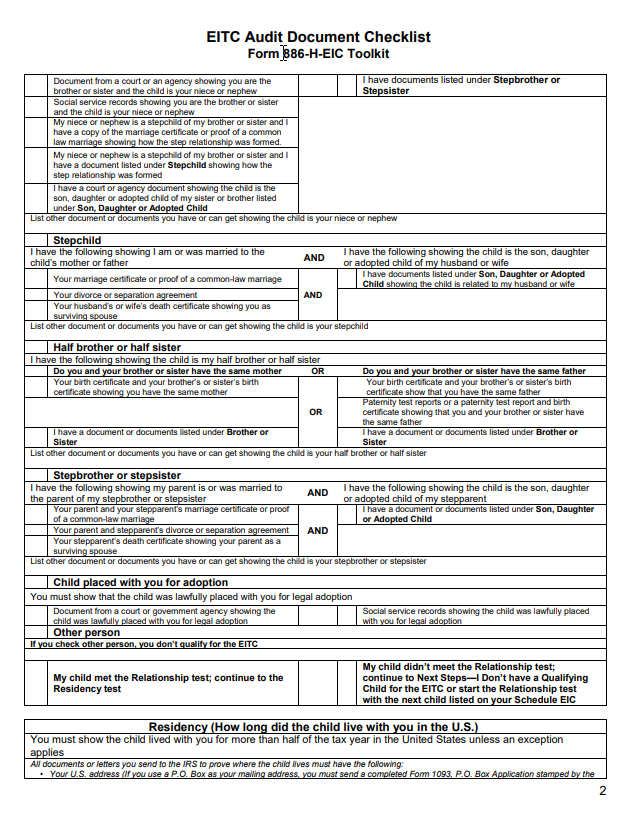

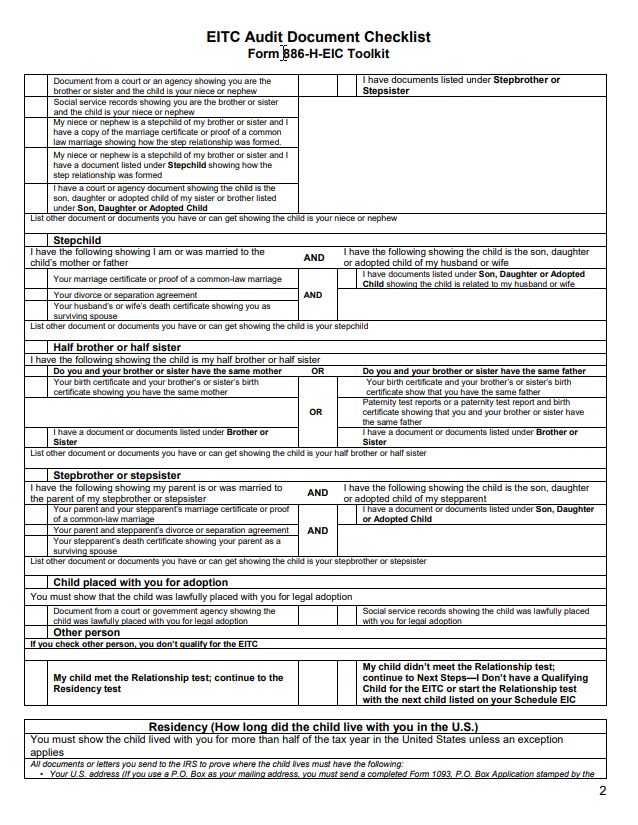

- IRS’s EITC Central has a new Form 886-H-EIC Tool and formatted checklists for your use as well as templates.

Here is where to go:

Click on the EITC Checklist and will bring up the following Form on the next page.

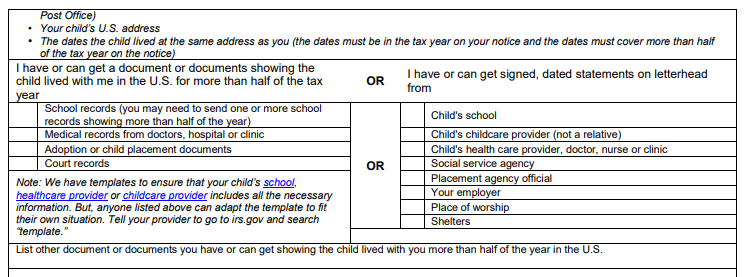

On page 3 of the form is a link to the Templates for the school, healthcare and childcare provider, see below.

If you click on the links they will provide the template.

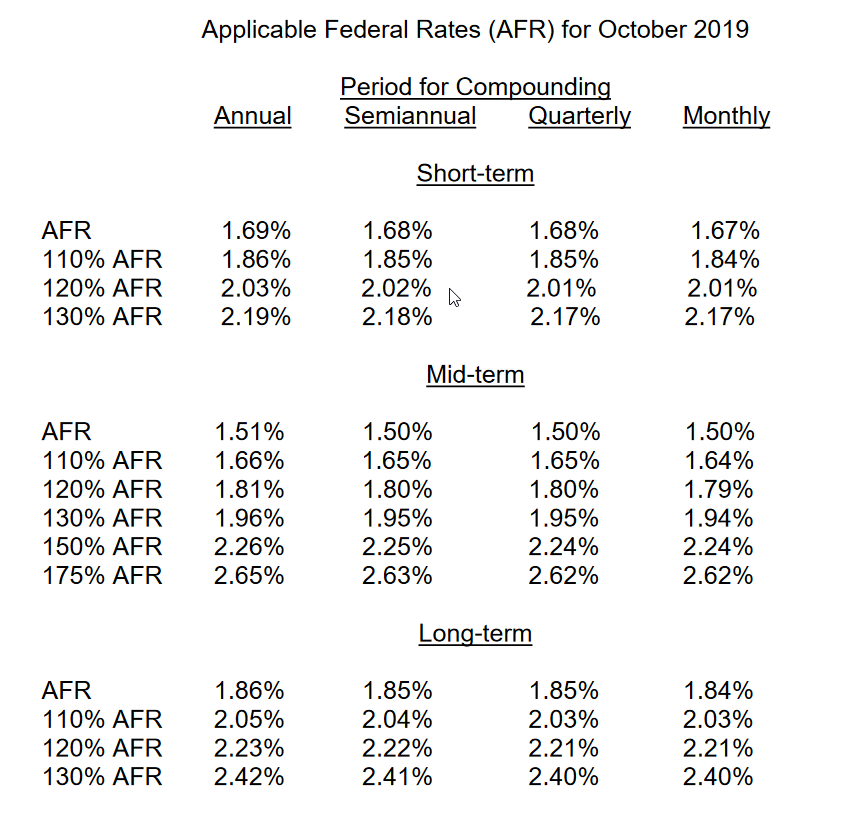

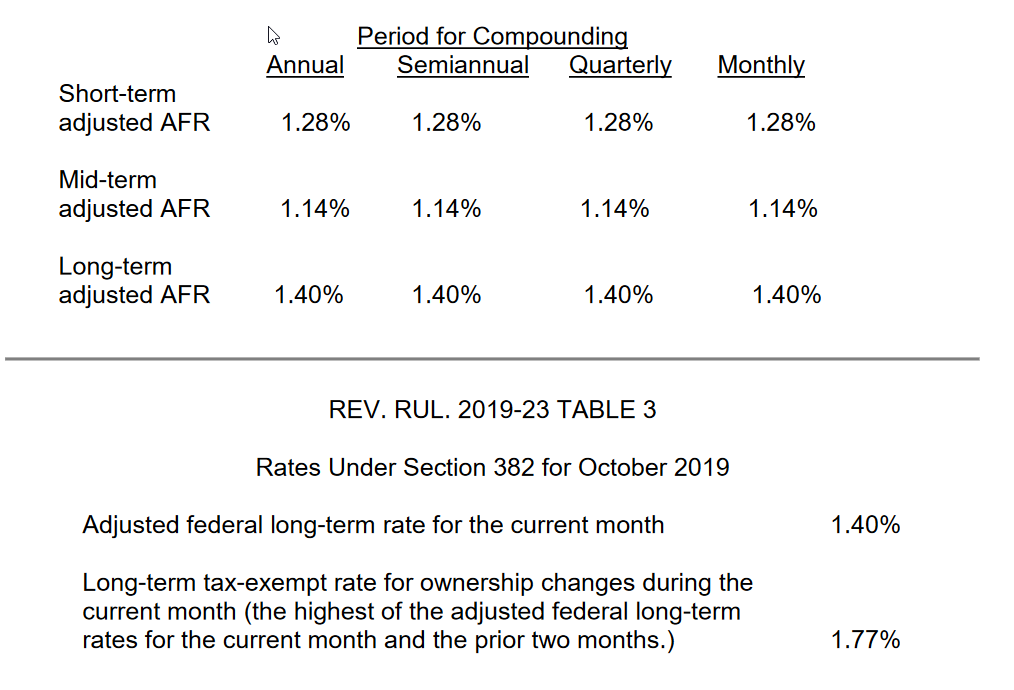

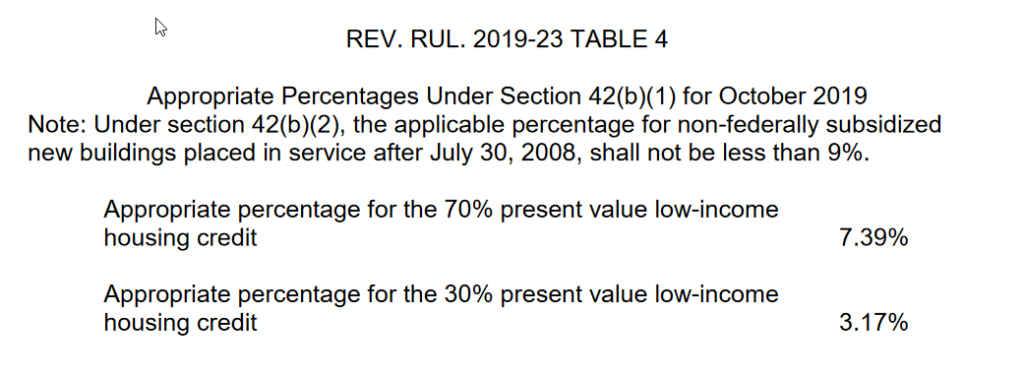

Issue: 19 Rev. Rul. 2019-23 – Applicable Federal Rates for October 2019

REV. RUL. 2019-23

TABLE 2 Adjusted AFR for October 2019

REV. RUL. 2019-23 TABLE 5

Rate Under § 7520 for October 2019

Applicable federal rate for determining the present value of an annuity, an interest for life or a term of years, or a remainder or reversionary interest 1.8%