In This Issue:

Several issues to review before we get deep into filing season are in the monthly tax newsletter. Changes in law, the standard mileage rates, transcripts and a review of Timely Mailing rules will serve you well as we soon become immersed with tax returns.

We have also highlighted Illinois’s new guidance on Nexus.

Each month we will try to highlight state guidance on an area of tax concern.

The 2020 Webinar Schedule is now available, check it out here.

- Repeal of Select ACA Taxes and Other Healthcare Issues

- IRS Issues 2020 Standard Mileage Rates – Notice 2020-05

- Source of Income from Certain Sales of Personal Property – Reg- 100956-19

- Requests for Transcripts Through e-Services

- Proposed Rules for Identifying and Recovering Misdirected Direct Deposit Refunds – Reg. 116163-19

- IRS helps workers, businesses with new Gig Economy Tax Center

- Client Letter Concerning the SECURE Act

- Highlight of the Taxpayer Advocates Report to Congress

- Guidance for the Qualified Business Income Deduction on a Substitute for Return (SFR) – SBSE-04-1219-0054

- Guidance to Charities that Receive Donations of Virtual Currency

- IRS P.O. Box Closings

- IRS Provides Relief to Financial institutions Affected by Tax Change Raising the Age for Required Minimum Distributions

- IRS and Treasury Issued Guidance for Students with Discharged Student Loans and Their Creditors – Criteria Must be Met

- Additional Resources for Marketplace Facilitators, Marketplace Sellers and Remote Sellers in Illinois

- Annual Enrollment Renewal Application Period for EA’s

- Timely Mailing as Timely Filing or Payment—The Postmark Date Rule

- Rul. 2020-3 – Applicable Federal Rates for February 2020

February 2020 Issues

Issue 1: Repeal of Select ACA Taxes and Other Healthcare Issues

When the President signed two Senate-passed appropriations bills on December 20, 2019 it funded the government through September 30, 2020.

In addition, it repealed or made changes or funding to:

- The Affordable Care Act “Cadillac” tax on employer-sponsored health plans repealed effective in 2020.

- The 2.3% tax on medical devices, repealed effective 2020.

- Health insurer fee repealed effective 2021.

- An extension of the 7.5% medical expense deduction, overrides the 10% amount phased in from the Tax Cuts and Jobs Act.

- The minimum age to purchase tobacco products nationwide was raised to age to 21.

- Funding for the Patient-Centered Outcomes Research Institute (PCORI) was approved for ten years.

Issue 2: IRS Issues 2020 Standard Mileage Rates – Notice 2020-05

The IRS issued the 2020 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. Beginning on January 1, 2020, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

- 57.5 cents per mile driven for business use, down one half of a cent from the rate for 2019.

- 17 cents per mile driven for medical or moving purposes, down three cents from the rate for 2019.

- 14 cents per mile driven in service of charitable organizations.

It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Taxpayers also cannot claim a deduction for moving expenses, except members of the Armed Forces on active duty moving under orders to a permanent change of station. Review Rev. Proc. 2019-46.

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

A taxpayer may not use the business standard mileage rate for a vehicle after using any depreciation method under the Modified Accelerated Cost Recovery System (MACRS) or after claiming a § 179 deduction for that vehicle. In addition, the business standard mileage rate cannot be used for more than five vehicles used simultaneously. Review 4.05 of Rev. Proc. 2019-46.

Issue 3: Source of Income from Certain Sales of Personal Property – Reg- 100956-19

Treasury and the IRS issued proposed regulations on Special Rules for Determining Source.

Gains, profits and income from the sale or exchange of inventory property that is produced in whole or in part within the United States and sold outside of the United States (or vice versa) is allocated and apportioned between U.S. and foreign sources solely on the basis of the production activities, § 863(b), as amended by the Tax Cuts and Jobs Act.

Under the tax reform rule, if income is produced entirely in the United States, it is U.S. source income. Income produced entirely in a foreign country is foreign source income. Inventory produced in both the United States and a foreign country is mixed-source income. Finally, these proposed regulations modify certain rules for determining whether foreign source income is effectively connected with the conduct of a trade or business within the United States.

Issue 4: Requests for Transcripts Through e-Services

IRS will be updating its databases from which Return Transcripts and Record of Account transcripts generate on January 4, 2020. Once these databases update, you will no longer be able to request Tax Year 2015 Return Transcripts and Record of Account Transcripts.

Issue 5: Proposed Rules for Identifying and Recovering Misdirected Direct Deposit Refunds – Reg. 116163-19

The proposed regulations provide guidance on §§6402(n)and 6402(n) of the Internal Revenue Code (Code), concerning the procedures for identification and recovery of a misdirected direct deposit refund. The regulations reflect changes to the law made by the Taxpayer First Act. The proposed regulations affect taxpayers who have made a claim for refund, requested the refund be issued as a direct deposit, but did not receive a refund in the account designated on the claim for refund.

In §301.6402-2(g)(1), a misdirected direct deposit refund is defined as any refund of an overpayment of tax that is disbursed as a direct deposit but is not deposited into the account designated on the claim for refund. This typically occurs when the IRS or a taxpayer mistakenly inputs or provides to the tax professional an incorrect account or routing number from the claim for refund. A misdirected direct deposit refund can also occur if a financial institution mistakenly credits the payment to an account other than the account designated in the IRS’s direct deposit instruction.

Not all instances where a taxpayer fails to receive a direct deposit in the account designated on the claim for refund are the result of a misdirected direct deposit refund. The requested tax refund may have instead been issued in the form of a paper check or may not have been issued at all if the IRS adjusted the requested refund amount during the processing of the tax return or offset the requested tax refund to pay certain debts.

- 301.6402-2(g)(2) of the proposed regulations designates the method of reporting a misdirected direct deposit refund.

- Taxpayers may submit Form 3911.

- May report a missing refund orally through an IRS customer service line

- Report a missing refund, after scheduling an appointment, through submission of the Form 3911 in person at a Taxpayer Assistance Center.

- If experiencing a hardship, the taxpayer may report a missing refund to TAS by telephone, facsimile, mail or in person.

If the IRS determines a direct deposit was issued, it will initiate a refund trace for any missing refund in accordance with the procedures set out in §301.6402-2(g)(3) of the proposed regulations.

- 301.6402-2(g)(4) of the proposed regulations establishes that when a misdirected direct deposit refund has been identified by the IRS, the IRS will issue a replacement refund in the full amount of the refund that was misdirected. The refund will generally be issued as soon as possible to make the taxpayer whole and limit credit interest.

Issue 6: IRS Helps Workers, Businesses with New Gig Economy Tax Center

The IRS launched a new Gig Economy Tax Center on IRS.gov to help people in this growing area meet their tax obligations through more streamlined information.

The gig economy is also known as the sharing, on-demand or access economy. It usually includes businesses that operate an app or website to connect people to provide services to customers. While there are many types of gig economy businesses, ridesharing and home rentals are two of the most popular.

Educating gig economy workers about their tax obligations is vital because many don’t receive form W-2s, 1099s or other information returns for their work in the gig economy. However, income from these sources is generally taxable, regardless of whether workers receive information returns. This is true even if the work is fulltime, part-time or if the person is paid in cash. Workers may also be required to make quarterly estimated income tax payments, pay their share of Federal Insurance Contribution (FICA), Medicare and Additional Medicare taxes if they are employees and pay self-employment taxes if they are not considered to be employees.

The Gig Economy Tax Center offers tips and resources on a variety of topics including:

- filing requirements

- making quarterly estimated income tax payments

- paying self-employment taxes

- paying FICA, Medicare and Additional Medicare

- deductible business expenses

- special rules for reporting vacation home rentals

Issue 7: Client Letter Concerning the SECURE Act

You can use the Client Letter that follows to inform your clients of key provisions under the Setting Every Community Up for Retirement Enhancement Act (SECURE Act) that affect individuals.

Dear Client:

Congress recently passed, and the President signed into law, the Setting Every Community Up for Retirement Enhancement Act (SECURE Act), landmark legislation that may affect how you plan for your retirement. Many of the provisions go into effect in 2020, which means now is the time to consider how these new rules may affect your tax and retirement-planning situation.

Here is a look at some of the more important elements of the SECURE Act that have an impact on individuals. The changes in the law might provide you and your family with tax-savings opportunities. However, not all of the changes are favorable, and there may be steps you could take to minimize their impact. Please give me a call if you would like to discuss these matters.

Repeal of the maximum age for traditional IRA contributions. Before 2020, traditional IRA contributions were not allowed once the individual attained age 70½. Starting in 2020, the new rules allow an individual of any age to make contributions to a traditional IRA, as long as the individual has compensation, which generally means earned income from wages or self-employment.

Required minimum distribution age raised from 70½ to 72. Before 2020, retirement plan participants and IRA owners were generally required to begin taking required minimum distributions, or RMDs, from their plan by April 1 of the year following the year they reached age 70½. The age 70½ requirement was first applied in the retirement plan context in the early 1960s and, until recently, had not been adjusted to account for increases in life expectancy.

For distributions required to be made after Dec. 31, 2019, for individuals who attain age 70½ after that date, the age at which individuals must begin taking distributions from their retirement plan or IRA is increased from 70½ to 72.

Partial elimination of stretch IRAs. For deaths of plan participants or IRA owners occurring before 2020, beneficiaries (both spousal and non-spousal) were generally allowed to stretch out the tax-deferral advantages of the plan or IRA by taking distributions over the beneficiary’s life or life expectancy (in the IRA context, this is sometimes referred to as a “stretch IRA”).

However, for deaths of plan participants or IRA owners beginning in 2020 (later for some participants in collectively bargained plans and governmental plans), distributions to most non-spouse beneficiaries are generally required to be distributed within ten years following the plan participant’s or IRA owner’s death (10-year rule). So, for those beneficiaries, the “stretching” strategy is no longer allowed.

Exceptions to the 10-year rule are allowed for distributions to (1) the surviving spouse of the plan participant or IRA owner; (2) a child of the plan participant or IRA owner who has not reached majority; (3) a chronically ill individual; and (4) any other individual who is not more than ten years younger than the plan participant or IRA owner. Those beneficiaries who qualify under this exception may generally still take their distributions over their life expectancy (as allowed under the rules in effect for deaths occurring before 2020).

Expansion of Section 529 education savings plans to cover registered apprenticeships and distributions to repay certain student loans. A Section 529 education savings plan (a 529 plan, also known as a qualified tuition program) is a tax-exempt program established and maintained by a state, or one or more eligible educational institutions (public or private). Any person can make nondeductible cash contributions to a 529 plan on behalf of a designated beneficiary. The earnings on the contributions accumulate tax-free. Distributions from a 529 plan are excludable up to the amount of the designated beneficiary’s qualified higher education expenses.

Before 2019, qualified higher education expenses didn’t include the expenses of registered apprenticeships or student loan repayments.

But for distributions made after Dec. 31, 2018 (the effective date is retroactive), tax-free distributions from 529 plans can be used to pay for fees, books, supplies, and equipment required for the designated beneficiary s participation in an apprenticeship program. In addition, tax-free distributions (up to $10,000) are allowed to pay the principal or interest on a qualified education loan of the designated beneficiary, or a sibling of the designated beneficiary.

Kiddie tax changes. In 2017, Congress passed the Tax Cuts and Jobs Act (TCJA, P.L. 115-97), which made changes to the so-called “kiddie tax,” which is a tax on the unearned income of certain children. Before enactment of the TCJA, the net unearned income of a child was taxed at the parents’ tax rates if the parents’ tax rates were higher than the tax rates of the child.

Under the TCJA, for tax years beginning after Dec. 31, 2017, the taxable income of a child attributable to net unearned income is taxed according to the brackets applicable to trusts and estates. Children to whom the kiddie tax rules apply and who have net unearned income also have a reduced exemption amount under the alternative minimum tax (AMT) rules.

There had been concern that the TCJA changes unfairly increased the tax on certain children, including those who were receiving government payments (i.e., unearned income) because they were survivors of deceased military personnel (“gold star children”), first responders, and emergency medical workers.

The new rules enacted on Dec. 20, 2019, repeal the kiddie tax measures that were added by the TCJA. So, starting in 2020 (with the option to start retroactively in 2018 and/or 2019), the unearned income of children is taxed under the pre-TCJA rules, and not at trust/estate rates. And starting retroactively in 2018, the new rules also eliminate the reduced AMT exemption amount for children to whom the kiddie tax rules apply and who have net unearned income.

Penalty-free retirement plan withdrawals for expenses related to the birth or adoption of a child. Generally, a distribution from a retirement plan must be included in income. And, unless an exception applies (for example, distributions in case of financial hardship), a distribution before the age of 59½ is subject to a 10% early withdrawal penalty on the amount includible in income.

Starting in 2020, plan distributions (up to $5,000) that are used to pay for expenses related to the birth or adoption of a child are penalty-free. That $5,000 amount applies on an individual basis, so for a married couple, each spouse may receive a penalty-free distribution up to $5,000 for a qualified birth or adoption.

Taxable non-tuition fellowship and stipend payments are treated as compensation for IRA purposes. Before 2020, stipends and non-tuition fellowship payments received by graduate and postdoctoral students were not treated as compensation for IRA contribution purposes, and so could not be used as the basis for making IRA contributions.

Starting in 2020, the new rules remove that obstacle by permitting taxable non-tuition fellowship and stipend payments to be treated as compensation for IRA contribution purposes. This change will enable students receiving those payments to begin saving for retirement without delay.

Tax-exempt difficulty-of-care payments are treated as compensation for determining retirement contribution limits. Many home healthcare workers do not have taxable income because their only compensation comes from “difficulty-of-care” payments that are exempt from taxation. Because those workers did not have taxable income, they were not able to save for retirement in a qualified retirement plan or IRA.

For contributions made to IRAs after Dec. 20, 2019 (and retroactively starting in 2016 for contributions made to certain qualified retirement plans), the new rules allow home healthcare workers to contribute to a retirement plan or IRA by providing that tax-exempt difficulty-of-care payments are treated as compensation for purposes of calculating the contribution limits to certain qualified plans and IRAs.

Issue 8: Highlight of the Taxpayer Advocates Report to Congress

Over the next few newsletters we will highlight specific issues pointed out by the National Taxpayer Advocate

The IRS Is Struggling to Accomplish Its Mission

According to its mission statement, the IRS aims to “provide America’s taxpayers top quality service by helping them understand and meet their tax responsibilities and enforce the law with integrity and fairness to all.” The report says the IRS is struggling to meet both of those goals.

The IRS has been found to be among the lowest performing federal agencies in providing a positive customer experience. The President’s Management Agenda emphasizes the importance of high-quality customer service and cites the American Customer Satisfaction Index (ACSI) and the Forrester U.S. Federal CX Index™ as key benchmarks. The ACSI report for 2018 ranked the Treasury Department tied for 10th out of 12 federal departments and says that “most [IRS] programs score . . . well below both the economy-wide national ACSI average and the federal government average.” The 2019 Forrester report ranked the IRS as 13th out of 15 federal agencies and characterized the IRS’s score as “very poor.”

During fiscal year (FY) 2019, the Advocate’s report says the IRS received approximately 100 million telephone calls, and customer service representatives answered only 29%. In recent years, the agency has scaled back in-person assistance, closing more than 10% of its Taxpayer Assistance Centers, generally requiring taxpayers to schedule appointments in advance, and reducing the number of taxpayers served by nearly half from FY 2015 to FY 2018.

The report says the IRS is also struggling to enforce the law with “fairness to all.” The IRS recently estimated it was unable to collect an annual average of about $381 billion in unpaid tax attributable to legal-source income for tax years 2011-2013. With approximately 122 million U.S. households in 2013, that suggests each U.S. household is effectively paying an average annual “surtax” of more than $3,000 to subsidize noncompliance by others.

The report says that “fairness to all” also requires that the IRS be accessible to taxpayers against whom it takes enforcement actions, such as wage garnishments, bank levies, or the filing of notices of federal tax lien. Levies often create economic hardships for individual taxpayers, and the law requires the IRS to release levies in those cases. Yet taxpayers often cannot reach the IRS to make it aware of their hardships. During FY 2019, the IRS’s Automated Collection System (ACS) more than doubled the number of levies it served (from about 200,000 in FY 2018 to about 428,000 in FY 2019), while the percentage of calls answered on the consolidated ACS telephone lines dropped from 49% to 31%. Wait times for taxpayers who got through increased from 24 minutes to 38 minutes.

The report urges the IRS to prioritize phone service for taxpayers against whom it takes collection action. “The IRS has an obligation to be accessible to these taxpayers, and it should not ramp up enforcement actions beyond the point where it has enough telephone assistors to handle the taxpayer calls those actions generate,” Roberts wrote.

The report attributes the IRS’s shortcomings mostly to budget constraints but also to a culture in which the agency focuses on its own priorities without adequately factoring in the needs of taxpayers.

The IRS Does Not Receive Enough Funding to Meet Taxpayer Needs

Since FY 2010, the IRS budget has been reduced by about 20% after adjusting for inflation, and the number of full-time equivalent employees has declined by about 22%. The report points out that answering 100 million telephone calls, conducting audits, and taking enforcement actions require adequate staffing, and the IRS cannot substantially improve its performance without additional resources.

The report urges Congress to increase IRS funding and to change the budget rules to account for the revenue additional IRS appropriations are likely to generate. In FY 2018, the IRS collected nearly $3.5 trillion on a budget of about $11.4 billion. “It is economically irrational to underfund the IRS,” the report says. “If a company’s accounts receivable department could generate an ROI [return on investment] of 300:1 and the chief executive officer (CEO) failed to provide enough funding for it to do so, the CEO would be fired. Yet in general, the federal budget rules exclusively take into account outlays and ignore the revenue those outlays generate.”

In particular, the report recommends that Congress increase funding for taxpayer service and IT modernization. “Mostly because of antiquated technology, a smaller workforce, and an increasing workload, [the IRS] cannot afford to provide the quality of service that taxpayers deserve,” the report says.

More on this SIGNIFICANT report in March

Issue 9: Guidance for the Qualified Business Income Deduction on a Substitute for Return (SFR) – SBSE-04-1219-0054 – IRS’s Small Business/Self-Employed (SB/SE) Division has said that it will not allow a qualified business income (QBI) deduction on IRS-prepared substitute returns.

This memorandum provides guidance for the qualified business income (QBI) deduction on a substitute for return (SFR) prepared under IRC section 6020(b). See IRM 4.12.1.8.2.1, IRC 6020(b). Please distribute this information throughout your organization.

Depending on the taxpayer’s taxable income, the QBI deduction is subject to multiple limitations including the type of trade or business, the amount of W-2 wages paid by the trade or business, and the unadjusted basis immediately after acquisition (UBIA) of qualified property held by the trade or business. Additionally, a qualified business loss or qualified publicly traded partnership loss carried forward from prior years must be considered. Therefore, while a taxpayer may be entitled to claim a QBI deduction on a filed return, the Service will not allow the QBI deduction on an SFR prepared under IRC section 6020(b).

If a taxpayer subsequently files a delinquent tax return that includes a QBI deduction, the Service will consider the deduction following the same policies for other items included on the filed return.

This guidance is effective immediately and will be incorporated into IRM 4.12.1, Non-filed Returns, and IRM 4.19.17, Campus Examination Non-Filer Program, within two years of issuance. –

- A qualified business income (QBI) deduction will not be allowed on a substitute for return (SFR) prepared under

- 6020(b).

- If a taxpayer subsequently files a signed delinquent tax return reporting a QBI deduction, the deduction will be considered following the guidance in IRM 4.12.1.9, Examination of a Secured Delinquent Return.

Issue 10: Guidance to Charities that Receive Donations of Virtual Currency

Virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, and a store of value other than a representation of the U.S. dollar or a foreign currency.

Q33. If I donate virtual currency to a charity, will I have to recognize income, gain, or loss?

A33. If you donate virtual currency to a charitable organization described in Internal Revenue Code § 170(c), you will not recognize income, gain, or loss from the donation.

Q34. How do I calculate my charitable contribution deduction when I donate virtual currency?

A34. Your charitable contribution deduction is generally equal to the fair market value of the virtual currency at the time of the donation if you have held the virtual currency for more than one year. If you have held the virtual currency for one year or less at the time of the donation, your deduction is the lesser of your basis in the virtual currency or the virtual currency’s fair market value at the time of the contribution.

Q35. When my charitable organization accepts virtual currency donations, what are my donor acknowledgment responsibilities? (12/2019)

A35. A charitable organization can assist a donor by providing the contemporaneous written acknowledgment that the donor must obtain if claiming a deduction of $250 or more for the virtual currency donation.

Q36. When my charitable organization accepts virtual currency donations, what are my IRS reporting requirements? (12/2019)

A36. A charitable organization that receives virtual currency should treat the donation as a noncash contribution. See Publication 526, Charitable Contributions, for more information. Tax-exempt charity responsibilities include the following:

- Charities report non-cash contributions on a Form 990-series annual return and its associated Schedule M, if applicable. Refer to the Form 990 and Schedule M instructions for more information.

- Charities must file Form 8282, Donee Information Return, if they sell, exchange or otherwise dispose of charitable deduction property (or any portion thereof) – such as the sale of virtual currency for real currency as described in FAQ #4 – within three years after the date they originally received the property and give the original donor a copy of the form. See the instructions on Form 8282 for more information. (12/2019)

Issue 11: IRS P.O. Box Closings

The IRS is closing several business payment P.O. Boxes (or Lockbox addresses) in the Cincinnati and Hartford areas beginning July 1, 2020. Payments mailed to these closed payment locations will be returned to the sender. No forwarding service will be available.

To help ensure timely receipt, check Where to File on irs.gov before mailing the client’s payment. If you receive an IRS payment letter, please send the payment to the address found in the letter.

IRS encourages taxpayers to use IRS Direct Pay. It’s fast, secure and easy to use to pay a tax bill or estimated tax payment directly from a checking or savings account. Users receive instant confirmation that their payment has been made.

Issue 12: IRS Provides Relief to Financial institutions Affected by Tax Change Raising the Age for Required Minimum Distributions

Notice 2020-6 clarifies that if an RMD statement is provided for 2020 to an IRA owner who will turn age 70½ in 2020, the IRS will not consider the statement to be incorrect, but only if the financial institution notifies the IRA owner no later than April 15, 2020, that no RMD is due for 2020.

The Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act) changed the age for which an RMD is first required from age 70½ to 72. Under prior law, financial institutions would have needed to notify IRA owners who attained age 70½ in 2020 about their 2020 RMDs by Jan. 31, 2020.

The IRS encourages all financial institutions, in communicating these RMD changes, to remind IRA owners who reached age 70½ in 2019, and have not yet taken their 2019 RMDs, that they are still required to take those distributions by April 1, 2020.

Issue 12: IRS and Treasury Issued Guidance for Students with Discharged Student Loans and Their Creditors – Criteria Must be Met

The IRS and Treasury issued Revenue Procedure 2020-11 that establishes a safe harbor extending relief to additional taxpayers who took out federal or private student loans to finance attendance at a nonprofit or for-profit school.

Relief is also extended to any creditor that would otherwise be required to file information returns and furnish payee statements for the discharge of any indebtedness within the scope of this revenue procedure.

The Treasury Department and the IRS have determined that it is appropriate to extend the relief provided in Rev. Proc. 2015-57, Rev. Proc. 2017-24 and Rev. Proc. 2018-39 to taxpayers who took out federal and private student loans to finance attendance at nonprofit or other for-profit schools not owned by Corinthian College, Inc. or American Career Institutes, Inc.

The Revenue Procedure provides relief when the federal loans are discharged by the Department of Education under the Closed School or Defense to Repayment discharge process, or where the private loans are discharged based on settlements of certain types of legal causes of action against nonprofit or other for-profit schools and certain private lenders.

Taxpayers within the scope of this revenue procedure will not recognize gross income as a result of the discharge, and the taxpayer should not report the amount of the discharged loan in gross income on his or her federal income tax return.

Additionally, the IRS will not assert that a creditor must file information returns and furnish payee statements for the discharge of any indebtedness within the scope of this revenue procedure. To avoid confusion, the IRS strongly recommends that these creditors not furnish students nor the IRS with a Form 1099-C.

Issue 13: Additional Resources for Marketplace Facilitators, Marketplace Sellers and Remote Sellers in Illinois

Public Acts (P.A.) 101-0009 and 101-0604 expand nexus in Illinois to include marketplace facilitators that meet certain thresholds effective January 1, 2020. As a result, marketplace facilitators that meet either threshold, as detailed below, are required to register to collect and remit Illinois Use Tax for sales made through their marketplace. Marketplace sellers selling through the marketplace are not responsible for collecting and remitting Illinois Use Tax on these sales.

Marketplace means a physical or electronic place, forum, platform, application, or other method by which a marketplace seller sells or offers to sell tangible personal property. Examples of marketplaces include, but are not limited to, auctions, internet marketplace platforms on which tangible personal property is offered for sale; antique malls, home shopping networks selling tangible personal property over television, cable or satellite networks; or consignment shops selling tangible personal property on behalf of numerous persons.

Marketplace facilitator means a person who, pursuant to an agreement with an unrelated third-party marketplace seller, directly or indirectly through one or more affiliates, facilitates a sale by an unrelated third-party marketplace seller by doing both of the following:

- Listing or advertising for sale by the marketplace seller in a marketplace, tangible personal property that is subject to Illinois Use Tax; and

- Either directly or indirectly, through agreements or arrangements with third parties, collecting payment from the customer and transmitting that payment to the marketplace seller regardless of whether the marketplace facilitator receives compensation or other consideration in exchange for its services.

Marketplace seller means a person that sells or offers to sell tangible personal property through a marketplace operated by an unrelated third-party marketplace facilitator. A marketplace seller only includes persons who incur an Illinois Use Tax liability on their sales to Illinois purchasers. Persons making sales to Illinois purchasers that are subject to Illinois Retailers’ Occupation Tax (sales tax) are not considered to be “marketplace sellers” and are not subject to the provisions of 86 Ill. Adm. Code 150.804.

Affiliate is a person that, with respect to another person:

- has a direct or indirect ownership of more than 5 percent in the other person; or

- is related to the other person because a third person, or a group of third persons who are affiliated with each other, holds a direct or indirect ownership interest of more than 5 percent in the related person.

Marketplace Facilitators

Effective January 1, 2020, a marketplace facilitator that meets either of the thresholds outlined below is considered a retailer maintaining a place of business in Illinois for each sale of tangible personal property made through its marketplace resulting in Illinois Use Tax. A marketplace facilitator must register to collect and remit Illinois Use Tax to the Illinois Department of Revenue (IDOR). A marketplace seller or remote seller that uses a marketplace facilitator will not include sales resulting in Illinois Use Tax made through the marketplace in its threshold determination.

These new requirements apply when Illinois Use Tax is the only tax required to be remitted to IDOR by marketplace facilitators for sales made through the marketplace.

Note about sales made through the marketplace resulting in Illinois Retailers’ Occupation Tax (sales tax) liability: Sales to Illinois purchasers made through the marketplace resulting in Illinois Retailers’ Occupation Tax (sales tax) liability are the responsibility of the marketplace seller. In this case, the marketplace seller is considered the retailer for sales resulting in Retailers’ Occupation Tax (sales tax) liability and the marketplace seller must register to remit Illinois Retailers’ Occupation Tax (sales tax) to IDOR.

Thresholds

A marketplace facilitator who meets either of the following thresholds is considered the retailer for each sale of tangible personal property made through its marketplace on behalf of marketplace sellers:

- The cumulative gross receipts from retail sales of tangible personal property to purchasers in Illinois made through the marketplace by both the marketplace facilitator and marketplace sellers are $100,000 or more; or

- The marketplace facilitator and marketplace sellers selling through the marketplace cumulatively enter into 200 or more separate transactions through the marketplace for the sale of tangible personal property to purchasers in Illinois.

The thresholds are determined by examining the gross receipts and number of separate transactions (see 86 Ill. Adm. Code 150.804(f) for more information) and must include or exclude the following types of sales:

- Sales for resale must be excluded (for additional information see 86 Ill. Adm. Code 130. 201),

- Sales of tangible personal property that are required to be registered with an Illinois agency, including motor vehicles, watercraft, aircraft, and trailers, when these sales are made from locations outside Illinois to Illinois purchasers must be excluded, and

- Sales made through the marketplace on behalf of a marketplace seller or by a marketplace facilitator that are subject to Retailers’ Occupation Tax (sales tax) must be excluded. For example, sales made through a marketplace on behalf of a marketplace seller that are filled from inventory located in an Illinois warehouse. Marketplace sellers making such sales through the marketplace are required to register with IDOR and remit Illinois Retailers’ Occupation Tax (sales tax) on such sales. A marketplace facilitator making its own retail sales of tangible personal property through the marketplace that are subject to Illinois Retailers’ Occupation Tax (sales tax) must be registered for Retailers’ Occupation Tax (sales tax) and remit Retailers’ Occupation Tax (sales tax) on such sales.

All sales of tangible personal property, except those listed above, even if they are exempt from tax, must be included for purposes of calculating the thresholds.

How to determine if you meet a threshold

A marketplace facilitator must examine its selling activities in Illinois for the period of January 1, 2019, through December 31, 2019. If, during this period, the marketplace facilitator meets either of the thresholds, the marketplace facilitator must register with IDOR to collect and remit Illinois Use Tax beginning January 1, 2020, for one year.

If the marketplace facilitator does not meet either threshold effective January 1, 2020, the marketplace facilitator must determine on a quarterly basis (ending on the last day of March, June, September, and December) whether it meets either of the thresholds for the preceding 12-month period. If the marketplace facilitator meets either of the thresholds for the preceding 12-month period, the marketplace facilitator must register with IDOR and begin collecting and remitting Illinois Use Tax for all sales made through its marketplace beginning on the first day of the following quarter.

If at the end of the one-year period, a marketplace facilitator determines it met either of the thresholds during the preceding 12-month period, it is considered a retailer maintaining a place of business in Illinois and is required to continue to collect and remit Illinois Use Tax and file returns for the subsequent year for all sales subject to Illinois Use Tax made over its marketplace.

If at the end of the one-year period, a marketplace facilitator who was required to collect and remit Illinois Use Tax, determines it did not meet either of the thresholds during the preceding 12-month period, then going forward, the marketplace facilitator shall determine on a quarterly basis (ending on the last day of March, June, September, and December) whether it meets either of the thresholds for the preceding 12-month period. If you determine that you are no longer required to collect and remit Illinois Use Tax, you must contact IDOR to update your registration. If your registration is not updated with IDOR you will be considered to be actively registered with IDOR and required to file a return. We encourage you to continue to collect and remit Illinois Use Tax as a courtesy to your Illinois purchasers.

Requirements for marketplace facilitators

A marketplace facilitator shall

- Enter into an agreement with each of its marketplace sellers to facilitate sales of tangible personal property by that marketplace seller. The agreement shall contain a certification by the marketplace facilitator that, the marketplace facilitator assumes the rights and duties of a retailer under the Illinois Use Tax Act with respect to collection and remittance of Illinois Use Tax on sales made by the marketplace seller through the marketplace.

- Collect and remit Illinois Use Tax for sales made through its marketplace based on information provided by marketplace sellers. When Retailers’ Occupation Tax (sales tax) is incurred on a sale made through the marketplace on behalf of a marketplace seller, a marketplace facilitator may collect Illinois Use Tax from the purchaser, along with any local tax (sales tax) reimbursements, and transmit it to the marketplace seller for remittance to IDOR as Retailers’ Occupation Tax (sales tax).

- Register with IDOR for sales made through the marketplace by marketplace sellers and file returns in accordance with procedures required by the Illinois Use Tax Act. We encourage a marketplace facilitator to report its own sales separately from the sales made through the marketplace on behalf of marketplace sellers.

See 86 Ill. Adm. Code 150.804(h) for additional requirements.

Marketplace Sellers/Remote Sellers

Under Wayfair (economic) nexus, a remote seller making sales to Illinois purchasers from locations outside Illinois is required to register with IDOR to collect and remit Illinois Use Tax on those sales if it falls within the definition of a “retailer maintaining a place of business in this State” in 35 ILCS 105/2 . There are two groups of remote sellers that must collect tax on sales to Illinois purchasers:

Remote sellers with a physical presence in Illinois. Remote sellers that have a physical presence in Illinois are required to register with IDOR to collect and remit Illinois Use Tax on sales to Illinois purchasers.

Remote sellers without a physical presence in Illinois (See 86 Ill. Adm. Code 150.80, Wayfair (economic) nexus, for more information). On and after October 1, 2018, remote sellers without a physical presence in Illinois are required to register to collect and remit Illinois Use Tax for sales of tangible personal property to Illinois purchaser if they meet either of the following thresholds:

- Cumulative gross receipts of $100,000 or more from sales to Illinois purchasers,or

- 200 or more separate transactions with Illinois purchasers.

Note: Marketplace sellers and remote sellers may already be collecting and remitting Illinois Use Tax under Wayfair (economic) nexus. Your collection obligations may change effective January 1, 2020.

Change effective January 1, 2020

With the new marketplace law under P.A. 101-0009 and P.A. 101-0604, a marketplace facilitator is required to collect and remit Illinois Use Tax on all sales subject to Illinois Use Tax made by all marketplace sellers through its marketplace. A marketplace seller will no longer be required to report these sales. However, if you also make sales outside the marketplace or if the marketplace facilitator is not required to collect Illinois Use Tax because it does not meet either of the marketplace thresholds, you are required to collect and remit Illinois Use Tax on those sales if you are a “retailer maintaining a place of business” in Illinois (i.e., you have nexus, including, but not limited to, Wayfair [economic] nexus). When determining if a marketplace seller or remote seller meets a Wayfair (economic) nexus threshold, it should not include the gross receipts nor the number of separate transactions for sales to Illinois purchasers made through a registered marketplace.

Requirements for marketplace sellers

A marketplace seller shall

Furnish to the marketplace facilitator information that is necessary for the marketplace facilitator to correctly collect and remit Illinois Use Tax on each sale. The information may include a certification that an item being sold is taxable, not taxable, exempt from taxation, or taxable at a specified rate.

- Determine if it is required to separately register and collect and remit Illinois Use Tax on sales to Illinois purchasers in addition to those made through a marketplace. If the marketplace seller is a “retailer maintaining a place of business in this State” under Section 2 of the Illinois Use Tax Act, it is required to separately register and remit Illinois Use Tax on such sales to Illinois purchasers. In determining if a marketplace seller has Wayfair (economic) nexus (see 86 Ill. Adm. Code 150.803), neither the gross receipts from nor the number of separate transactions for sales of tangible personal property to purchasers in Illinois that a marketplace seller makes through a registered marketplace facilitator and for which it has received a certification from the marketplace facilitator shall be included for purposes of determining whether it meets the Wayfair (economic) nexus thresholds.

- separately register and remit tax on all sales of tangible personal property, including those made over a registered marketplace, that result in Retailers’ Occupation Tax (sales tax). For sales made through the marketplace that result in Illinois Retailers’ Occupation Tax (sales tax), the marketplace seller is considered the retailer and must report and remit tax on such sales as provided in the Retailers’ Occupation Tax Act, as well as applicable local occupation taxes. The marketplace facilitator is not considered the retailer with respect to such sales and is not required to remit tax to IDOR on such sales. However, the marketplace facilitator may collect these taxes from the purchaser and transmit them to the marketplace seller for reporting and remittance to IDOR as Retailers’ Occupation Tax (sales tax).

See 86 Ill. Adm. Code 150.804(i) for additional requirements.

Hold Harmless Provisions

A marketplace seller shall be held harmless for liability for the collection and remittance of Illinois Use Tax when a marketplace facilitator fails to correctly collect and remit tax after having been provided with information by a marketplace seller to correctly collect and remit tax.

If a marketplace facilitator demonstrates to the satisfaction of IDOR that its failure to correctly collect and remit Illinois Use Tax on a sale resulted from its good faith reliance on incorrect or insufficient information provided by a marketplace seller, it shall be relieved of liability for the tax on that sale. In this case, a marketplace seller is liable for any resulting Illinois Use Tax due.

Issue 14: Annual Enrollment Renewal Application Period for EA’s

The 2020 Enrollment Renewal Application Period is open from November 1, 2019 through January 31, 2020. Per U.S. Treasury Department Circular No. 230 (Rev. 6-2014) (PDF), you are required to renew your EA status during this time frame if your SSN ends in 4, 5, or 6. Without renewal your current enrollment will expire on March 31, 2020. You may submit your enrollment renewal application and payment online using Pay.gov.

Form 8554 Renewal

To renew you must:

- Have an active preparer tax identification number (PTIN).

- Complete a minimum of 72 hours per enrollment cycle (every three years). Additionally, you must also obtain a minimum of 16 hours of CE (including 2 hours of ethics or professional conduct) each enrollment year. EXCEPTION: If this is your first renewal, you must complete 2 hours of CE for each month of your enrollment, including 2 hours of ethics, or professional conduct each year.

- Pay the $67 non-refundable renewal fee. This fee applies regardless of your enrollment status.

Use these tips to ensure your application is processed as quickly as possible:

- Do not submit your application prior to November 1, 2019.

- Fill in the CE table in Part 1 completely.

- Sign, and date your form in Part 3.

Please allow 90 days for processing before calling 855-472-5540 to check on the status of your application.

Issue 15: Timely Mailing as Timely Filing or Payment—The Postmark Date Rule

(a)General rule

(1) Date of delivery

If any return, claim, statement, or other document required to be filed, or any payment required to be made, within a prescribed period or on or before a prescribed date under authority of any provision of the internal revenue laws is, after such period or such date, delivered by United States mail to the agency, officer, or office with which such return, claim, statement, or other document is required to be filed, or to which such payment is required to be made, the date of the United States postmark stamped on the cover in which such return, claim, statement, or other document, or payment, is mailed shall be deemed to be the date of delivery or the date of payment, as the case may be.

(2) Mailing Requirements

This subsection shall apply only if—

(A)the postmark date falls within the prescribed period or on or before the prescribed date—

(i) for the filing (including any extension granted for such filing) of the return, claim, statement, or other document, or

(ii) for making the payment (including any extension granted for making such payment), and

(B) the return, claim, statement, or other document, or payment was, within the time prescribed in subparagraph (A), deposited in the mail in the United States in an envelope or other appropriate wrapper, postage prepaid, properly addressed to the agency, officer, or office with which the return, claim, statement, or other document is required to be filed, or to which such payment is required to be made.

(b)Postmarks

This section shall apply in the case of postmarks not made by the United States Postal Service only if and to the extent provided by regulations prescribed by the Secretary.

(c) Registered and Certified Mailing; Electronic Filing

(1) Registered mail

For purposes of this section, if any return, claim, statement, or other document, or payment, is sent by United States registered mail—

(A) such registration shall be prima facie evidence that the return, claim, statement, or other document was delivered to the agency, officer, or office to which addressed; and

(B) the date of registration shall be deemed the postmark date.

(2) Certified Mail; Electronic Filing

The Secretary is authorized to provide by regulations the extent to which the provisions of paragraph (1) with respect to prima facie evidence of delivery and the postmark date shall apply to certified mail and electronic filing.

(d) Exceptions

This section shall not apply with respect to—

(1)the filing of a document in, or the making of a payment to, any court other than the Tax Court,

(2) currency or other medium of payment unless actually received and accounted for, or

(3) returns, claims, statements, or other documents, or payments, which are required under any provision of the internal revenue laws or the regulations thereunder to be delivered by any method other than by mailing.

(e) Mailing of deposits

(1) Date of deposit

If any deposit required to be made (pursuant to regulations prescribed by the Secretary under section 6302(c)) on or before a prescribed date is, after such date, delivered by the United States mail to the bank, trust company, domestic building and loan association, or credit union authorized to receive such deposit, such deposit shall be deemed received by such bank, trust company, domestic building and loan association, or credit union on the date the deposit was mailed.

(2) Mailing requirements

Paragraph (1) shall apply only if the person required to make the deposit establishes that—

(A) the date of mailing falls on or before the second day before the prescribed date for making the deposit (including any extension of time granted for making such deposit), and

(B) the deposit was, on or before such second day, mailed in the United States in an envelope or other appropriate wrapper, postage prepaid, properly addressed to the bank, trust company, domestic building and loan association, or credit union authorized to receive such deposit.

In applying subsection (c) for purposes of this subsection, the term “payment” includes “deposit”, and the reference to the postmark date refers to the date of mailing.

(3) No application to certain deposits

Paragraph (1) shall not apply with respect to any deposit of $20,000 or more by any person who is required to deposit any tax more than once a month.

(f)Treatment of private delivery services

(1) In General

Any reference in this section to the United States mail shall be treated as including a reference to any designated delivery service, and any reference in this section to a postmark by the United States Postal Service shall be treated as including a reference to any date recorded or marked as described in paragraph (2)(C) by any designated delivery service.

(2) Designated Delivery Service

For purposes of this subsection, the term “designated delivery service” means any delivery service provided by a trade or business if such service is designated by the Secretary for purposes of this section. The Secretary may designate a delivery service under the preceding sentence only if the Secretary determines that such service—

(A) is available to the general public,

(B) is at least as timely and reliable on a regular basis as the United States mail,

(C) records electronically to its data base, kept in the regular course of its business, or marks on the cover in which any item referred to in this section is to be delivered, the date on which such item was given to such trade or business for delivery, and

(D) meets such other criteria as the Secretary may prescribe.

(3) Equivalents of registered and certified mail

The Secretary may provide a rule similar to the rule of paragraph (1) with respect to any service provided by a designated delivery service which is substantially equivalent to United States registered or certified mail.

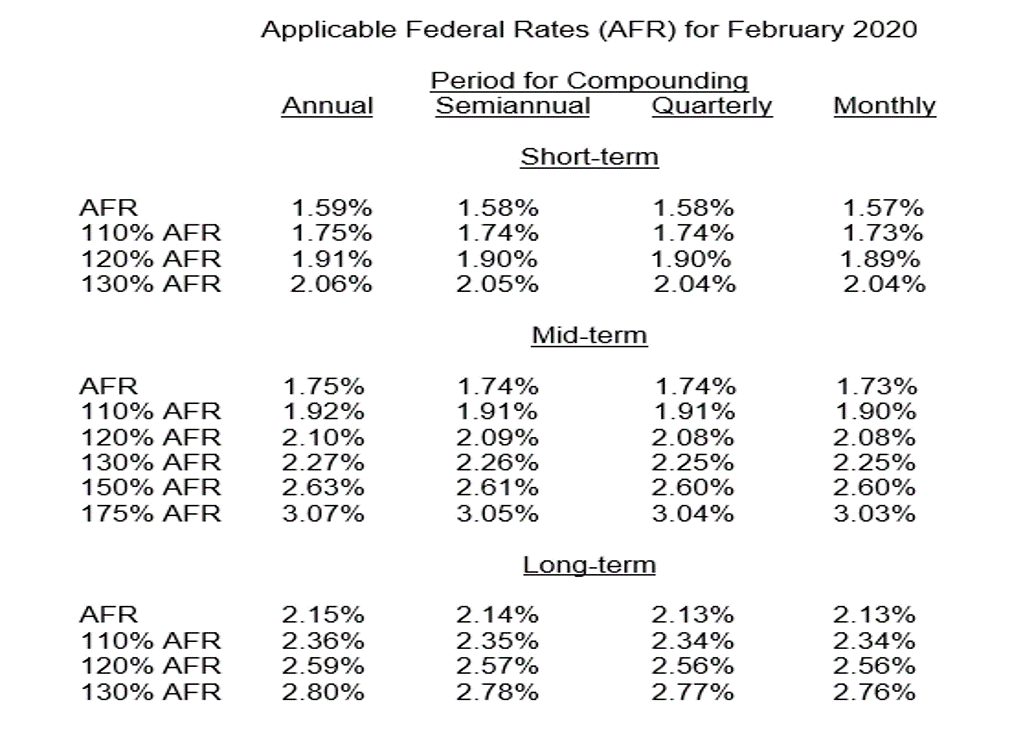

Issue 16: Rev. Rul. 2020-3 – Applicable Federal Rates for February 2020

REV. RUL. 2020-3 TABLE 1

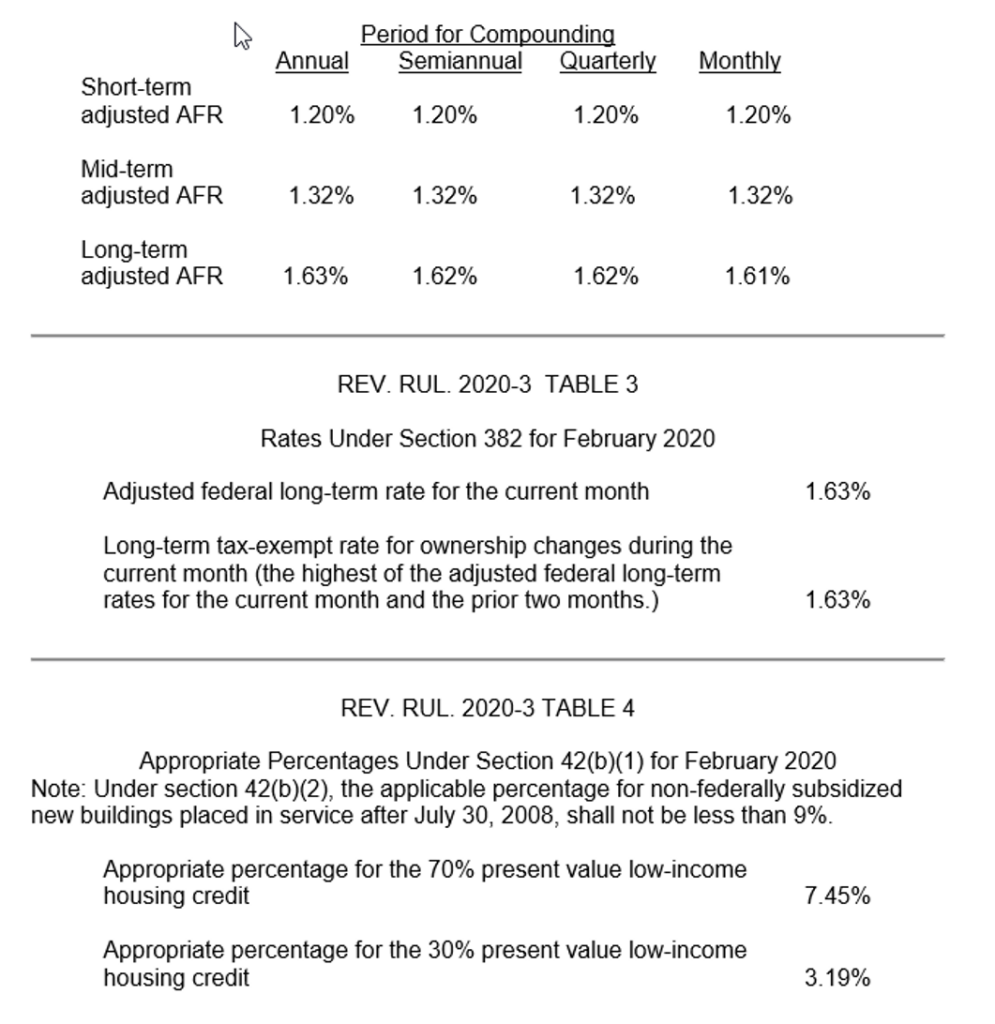

REV. RUL. 2020-3 TABLE 2

Adjusted AFR for February 2020

REV. RUL. 2020-3 TABLE 5

Rate Under Section 7520 for February 2020

Applicable federal rate for determining the present value of an annuity, an interest for life or a term of years, or a remainder or reversionary interest 2.2%