Tax Newsletter: 2021 Tax Season planning

New in 2021: Those who Did Not receive an EIP may be able to claim the Recovery Rebate Credit

Clients may be able to claim the Recovery Rebate Credit if they met the eligibility criteria in 2020 and:

- They didn’t receive an Economic Impact Payment this year, or

- Their Economic Impact Payment was less than $1,200 ($2,400 if married filing jointly for 2019 or 2018) plus $500 for each qualifying child.

Notice 1444 details the receipt of the Economic Impact Payment and is needed to calculate any Recovery Rebate Credit (Line 30) on the Form 1040 The client may be eligible an additional Recovery Rebate depending on the amount received and family dynamics.

Clients with an Individual Tax Identification Number should ensure it hasn’t expired before you can file their 2020 federal tax return. If it has expired, IRS recommends they submit a Form W-7, Application for IRS Individual Taxpayer Identification Number, now to renew their ITIN. Clients who fail to renew an ITIN before filing a tax return next year could face a delayed refund and may be ineligible for certain tax credits.

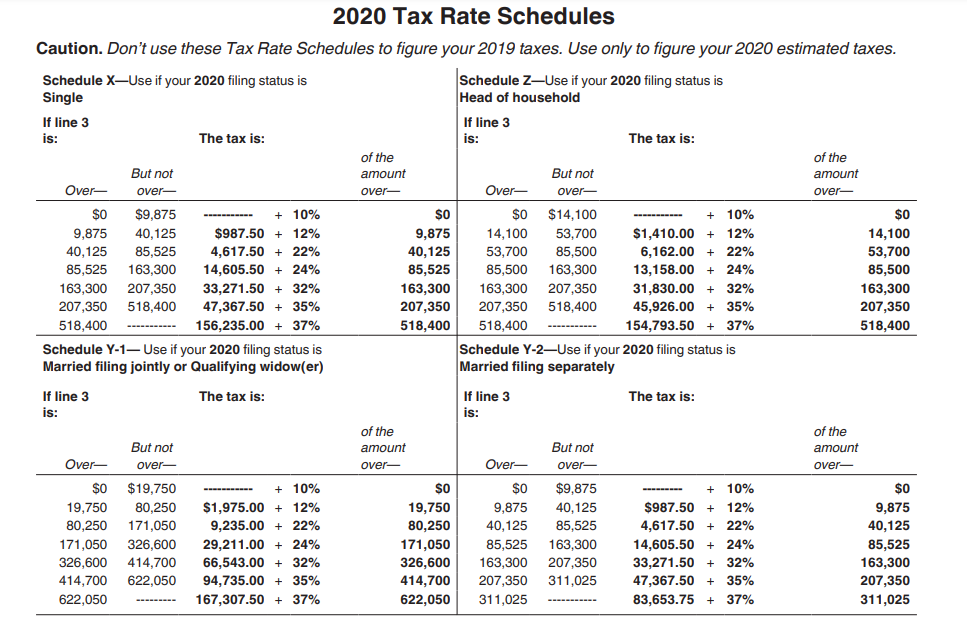

Taxpayers who received non-wage income like self-employment income, investment income, taxable Social Security benefits and in some instances, pension and annuity income, may have to make estimated tax payments. A gentle reminder may be in order but urge them to pay state estimates in December if possible. This could benefit their itemized deductions if needed.

Federal estimates can also be paid in December if it would benefit the client.

Document for Gathering Information from Clients Concerning the Economic Stimulus Payment

—————————————————————————————————————————————————————————–

Did You Receive an Economic Stimulus Payment?

Earlier in 2020 Congress passed the CARES Act in response to COVID-19. The Act authorized an Economic Stimulus Payment.

Generally, if you are a U.S. citizen or U.S. resident alien and met certain income guidelines, you may have received an Economic Impact Payment of $1,200 ($2,400 for a joint return) if you (and your spouse if filing a joint return). A child under age 17 and claimed as a dependent on the return generated an additional $500 per child.

You should have received Notice 1444 showing the amount of the check, direct deposit or debit card received. Many may have displaced the letter, so we are asking you to provide us with the amount received below. Thank you – this enables us to prepare a correct and complete return.

_______________ I received and have attached a copy of the Notice 1444.

_______________ I do not have a copy of the Notice 1444, but I did receive a stimulus check in the amount of $ _________________________.

_______________ I did not receive a stimulus check.

If IRS provides a website to check on the amount of the Economic Stimulus Payment, may our firm access that application to verify the payment received? Please circle the appropriate response.

Yes

No

Signature

_______________________________

Date

———————————————————————————————————————————————————————–

Received Interest on a Federal Tax Refund?

Clients who received a federal tax refund in 2020 may have been paid interest. The IRS sent interest payments to individual taxpayers who timely filed their 2019 federal income tax returns and received refunds. Most interest payments were received separately from tax refunds. Interest payments are taxable and must be reported on 2020 federal income tax returns. In January 2021, the IRS will send a Form 1099-INT, Interest Income, to anyone who received interest totaling at least $10.

EITC/ACTC-Related Refunds Should be Available by First Week of March

By law, the IRS cannot issue refunds for people claiming the Earned Income Tax Credit or Additional Child Tax Credit before mid-February. The law requires the IRS to hold the entire refund − even the portion not associated with EITC or ACTC. The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by the first week of March, if they chose direct deposit and there are no other issues with their tax return. Clients should “Where’s My Refund?” for their personalized refund date.

Direct Deposit

The best and fastest way for clients to get their tax refund is to have it direct deposited into their financial account.

New Above-the-line Charitable Contribution Deduction

Everyone is entitled to a charitable deduction this year. The TCJA doubled the standard deduction while repealing or limiting many itemized deductions, leaving millions fewer taxpayers claiming actual itemized deductions. Typically, there is no tax benefit for giving to charity unless you itemize deductions. However, the CARES Act created an above-the-line deduction of up to $300 for cash contributions from taxpayers who do not itemize. If your client would like to take advantage of this provision, make sure to donate before the end of the year.

Long-Term Care Insurance and Services

Premiums an individual pays on a qualified long-term care insurance policy are deductible as a medical expense. The maximum amount of a deduction is determined by an individual’s age. The following table sets forth the deductible limits for 2020 and 2021:

| Age | Deduction Limitation 2020 | Projected Deduction Limitation 2021 |

| 40 or under | $430 | $450 |

| Over 40 but not over 50 | $810 | $850 |

| Over 50 but not over 60 | $1,630 | $1,690 |

| Over 60 but not over 70 | $4,350 | $4,520 |

| Over 70 | $5,430 | $5,650 |

These limitations are per person, not per return. Thus, a married couple, both spouses over 70 years old, has a combined maximum deduction of $10,860 ($11,300 projected for 2021), subject to the applicable AGI limit.

Contribution to an IRA

Previously, individuals were not able to contribute to their traditional IRAs in or after the year in which they turn 70½. The SECURE Act eliminates this age cap. In 2021, clients can contribute up to $6,000 to a traditional or Roth individual retirement account. Add in an extra $1,000 if they are 50 and over. These limits are also unchanged from 2020.

401(k) Plans

Next year, workers can defer up to $19,500 into a 401(k) plan at work, plus $6,500 if they are age 50 and over. Those levels are unchanged from 2020.

No Required Minimum Distributions

There is no required minimum distribution this year (2020), due to the Covid-19 virus. The client might be in a lower tax bracket this year. It might be a good idea to accelerate some income and thereby use up what might be an opened-up lower bracket. Note: The waiver does not apply to defined benefit plans.

Required Minimum Distributions (RMDs) from retirement accounts will now begin at age 72 instead of 70½. Effective for individuals who reach age 70½ during year 2020 or later.

Inherited IRA Changes (SECURE Act)

Most non-spouse inherited IRAs must fully withdrawal the account by the end of the 10th year after the year of death (instead of over the beneficiary’s lifetime) This essentially eliminates the stretch IRA for most beneficiaries.

For IRA inheritances occurring after January 1, 2020, beneficiaries must withdraw the entire balance within 10 years of the death of the account owner. The 10-year rule does not apply to surviving spouses, beneficiaries who are less than 10 years younger than the account owner, chronically ill individuals, disabled individuals, or minor children (does not apply to grandchildren) of the account owner.

Kiddie Tax

The SECURE Act reinstated the kiddie tax previously suspended by the Tax Cuts and Jobs Act (TCJA). For tax years beginning after December 31, 2019, the unearned income of a child is no longer taxed at the same rates as estates and trusts. Instead, the unearned income of a child will be taxed at the parents’ tax rates if those rates are higher than the child’s tax rate. Taxpayers can elect to apply this provision retroactively to tax years that begin in 2018 or 2019 by filing an amended return.

Net Operating Losses

A client with an NOL from 2018, 2019 or 2020 taxable years can carry that loss back to each of the five preceding years unless they elect to waive the carryback.

HSA

Consider contributing to an HSA if the client is covered by a high-deductible health plan in 2020. Taxpayers with self-only coverage can deduct up to $3,550 ($7,100 with family coverage) for 2020. An additional $1,000 contribution is permitted if the eligible taxpayer is at least age 55.

Retirement Planning

Consider converting nondeductible individual retirement account (IRA) contributions up to $6,000, or $7,000 if the client is age 50 or older, to a Roth IRA. The conversion would be tax-free for many taxpayers because the original IRA contribution was nondeductible, and any growth will not be subject to tax on distribution.

Self-employed taxpayers can establish and contribute to certain qualified retirement plans such as a Simplified Employee Pension (SEP). A SEP, for example, allows employers to contribute to traditional IRAs setup for employees and provides a deduction up to 25 % of net earnings from self-employment (up to $57,000 for 2020).

Estate Planning

Considering last-minute lifetime gifting to family as well as other estate planning revisions to take advantage of the current lifetime exemption from estate tax ($11.58 million per taxpayer).

Unemployment Compensation

These benefit payments have received greater attention in 2020 due to the pandemic. All unemployment compensation, including the additional $600 payment, is taxable on your federal return. This compensation may also be taxable in some states. The client may or may not have had federal and state withholding withheld.

2020 Standard Deduction

Single/Married Filing Separately $12,400

Married Filing Jointly/Surviving Spouse $24,800

Head of Household $18,650

Dependent Filers

The standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of $1,100 or the sum of $350 and the individual’s earned income up to $12,400.

Additional Standard Deduction

If a client is age 65 or older and/or blind on the last day of the tax year, he or she is entitled to take an additional standard deduction. This additional deduction amount equals $1,300 and increases to $1,650 for unmarried taxpayers.

Alternative Minimum Tax

Alternative Minimum Tax (AMT) is calculated using a different set of tax rules than those used for regular tax, and some traditional deductions are not permitted. Certain income and expenses are also recognized under different rules for AMT. If the AMT calculation of tax is higher than regular tax, the taxpayer must pay the additional AMT tax, which is levied at two rates:

26 % and 28 %

In 2020, the 28 % AMT rate applies to incomes of $197,900 or higher for all taxpayers ($98,950 and above for married couples filing separate returns).

2020 AMT Exemption Amount

Married Filing Jointly/Surviving Spouse $113,400

Single/Head of Household $72,900

Married Filing Separately $56,700

Long Term Capital Gains and Qualified Dividend Tax Brackets and Rates

| Filing Status | 0% Rate | 15% Rate | 20% rate |

| Single | $0 – $40,000 | $40,001 – $441,450 | $441,450+ |

| Married Filing Jointly | $0 – $80,000 | $80,001 – $496,600 | $496,600+ |

| Married Filing Separately | $0 – $40,000 | $40,001 – $248,300 | $248,300+ |

| Head of Household | $0 – $53,600 | $53,601 – $469,050 | $469,050+ |

| Estates & Non-Grantor Trusts | $0 – $2,650 | $2,650 – $13,150 | $13,150+ |

Tax Rates for Estates and Trusts for 2020

| If taxable income is:

|

over | but not over | The tax is: | of the amount over

|

| $0 | $2,600 | 10% | $0 | |

| $2,600 | $9,450 | $260.00 + 24% | $2,600 | |

| $9,450 | $12,950 | $1,904.00 + 35% | $9,450 | |

| $12,950 | $ 3,129.00 + 37% | $12,950 |

Birth or Adoption Distribution

Workers may withdraw up to $5,000 penalty-free from a retirement account for the birth or adoption of a child.

Does the Client Know Their Annual Medicare Premium Cost?

The Social Security Administration uses a modified adjusted gross income (MAGI), which for its purposes means adjusted gross income plus tax-exempt income, to determine how much beneficiaries pay in Medicare premiums for the year. 2020 premiums are based on 2018 MAGI.

In addition to routine premiums, higher-earning beneficiaries ($87,000+ MAGI for individuals and $174,000+ MAGI married couples) are required to pay an income-related monthly adjustment amount (IRMAA) surcharge.

Evaluate income to inform client that their 2021 Medicare cast could rise if their 2019 MAGI increases.

Estate, Trust, Gift Tax Rates, Rules and Limits

- Federal estate tax (maximum rate): 40 percent (each state has its own set of estate/inheritance tax laws)

- 2020 exemption amount: $11.58 million per individual, $23.16 million for a married couple

- Annual gift tax exclusion: $15,000 or $30,000 if gift-splitting with spouse

- Portability: Surviving spouse may use the deceased spouse’s remaining estate tax exemption (to elect portability of the unused estate tax exemption, surviving spouse must file a federal estate tax return and make this election)

- Step-up in basis: Inherited assets receive a step-up in basis to market value as of date of death

Watch State Tax CARES Act Coupling

The CARES Act adds another layer of complexity to state legislative tracking. States generally conform to the federal tax code on either a static or rolling basis. For example, some states automatically incorporate changes to federal tax law, only decoupling from specific provisions, while others use a fixed Internal Revenue Code conformity date. Some provisions of the CARES Act apply retroactively for federal tax purposes but may not apply at the state level. Also, the significant expansion of teleworking due to COVID-19 could potentially trigger nexus and additional filing obligations for taxpayers.

CARES Act – New Tax Credits

Please note RKL 2020 Year End Tax Planning Guide was used for the following Cares Act Information – No infringement is intended.

Two pieces of coronavirus relief legislation, the Families First Coronavirus Response Act (FFCRA) and the CARES Act, launched a number of new payroll tax credits designed to support employers and their workforce during the pandemic.

Employer Retention Tax Credit

Under the Employer Retention Tax Credit (ERTC), businesses that closed or suspended operations due to coronavirus or businesses that experienced a significant decline in gross receipts may be eligible for a one-year credit against the qualified wages if continues to pay its employees between March 13, 2020 and December 31, 2020.

Employers can claim a credit worth 50% of qualified wages paid to each employee, up to $10,000, for that quarter through December 31, 2020.

Qualified wage calculations only include employees not providing services if the average number of full-time employees in 2019 was over 100. However, if under 100, then all employee wages are qualified.

Wages are limited to those paid during the business shut down or slow down. For any size company, qualified wages include group health plan costs. In all cases, the amount of qualified wages for each employee for all quarters may not exceed $10,000 (generating a max credit of $5,000 per employee). Employers who receive forgiveness on a Payroll Protection Program loan are not eligible to take the ERTC credit.

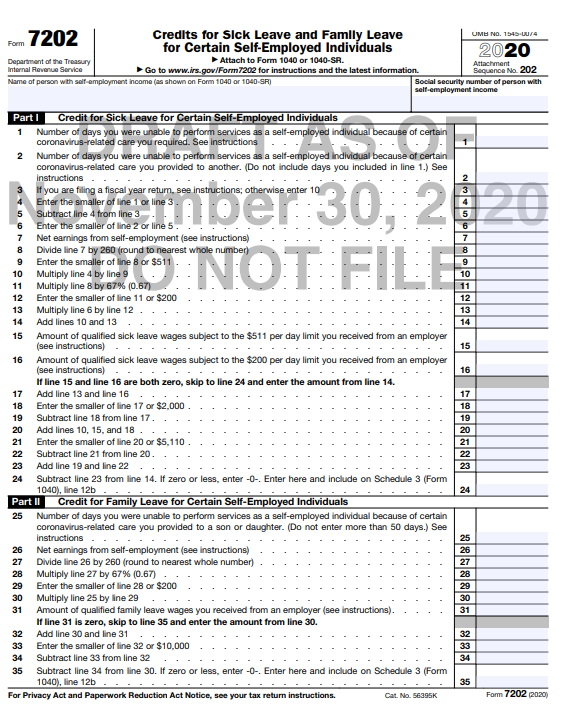

To claim ERTC: Reduce the 941 payment by all credits available, complete a

Form 7200 or reconcile the credits for a refund on Form 941.

Employer Payroll Tax Deferral

In order to provide businesses and self-employed individuals with additional cash flow in 2020, the CARES Act allows employers to defer payment of the employer share of the Social Security tax (6.2%) due in 2020.

50% of the deferred payroll taxes are due on December 31, 2021, and the remaining 50% are due on December 31, 2022. Taxpayers of any size may take advantage of this provision.

This deferral provision is also available to businesses that received a Paycheck Protection Program (PPP) loan, but time limits may apply depending on the date of forgiveness of the PPP loan.

To defer payroll tax: Report any employer Social Security amount deferrals for the quarter on the applicable Form 941. Remit 50% of the deferral by December 31, 2021 and the remaining 50% by December 31, 2022.

Emergency Paid Family and Sick Leave

The emergency leave provisions under FFCRA took effect on April 1, 2020 and run through December 31, 2020. FFCRA applies to public sector employers and private employers with fewer than 500 employees, with certain exemptions for healthcare, emergency responders and small businesses with 50 or fewer employees.

An employee qualifies for emergency sick leave if the employee is unable to work (or unable to telework) due to a need for leave because the employee:

- Is subject to a federal, state, or local quarantine or isolation order related to COVID-19.

- Has been advised by a healthcare provider to self-quarantine related to COVID-19.

- Is experiencing COVID-19 symptoms and is seeking a medical diagnosis.

- Is caring for an individual subject to an order described in (1) or self-quarantine as described in (2).

- Is caring for a child whose school or place of care is closed (or childcare provider is unavailable) for reasons related to COVID-19.

- Is experiencing any other substantially similar condition specified by the Secretary of Health and Human Services, in consultation with the Secretaries of Labor and Treasury Under the FFCRA, the first 10 days of the expanded FMLA are unpaid. Employees may supplement this 10-day waiting period with the Emergency Paid Sick Leave (also provided under the FFCRA) or other company paid leave benefits.

| Employment Status | Leave Needed for Reason | Days Covered | Payment Calculation | Cap on Wages Eligible for Tax Credits thru December 31, 2020 | Refundable Tax Credit Offsets |

| Employee | 1,2 and 3 | Days 1-10 | 100% of Regular Pay Rate

FT = 2 weeks or 80 hours PT = typical # hours worked in 2-week, period.

|

$511/day or $5,110 in total

|

Covered employers qualify for

dollar-for-dollar reimbursement through tax credits for all qualifying wages paid under the FFCRA.

|

| Employee | 4 or 6 | Days 1-10 | 2/3 of Regular Pay Rate

FT = 2 weeks or 80 hours PT = typical # hours worked in 2-week period |

$200/day or $2,000

in total |

Qualifying wages are those paid

to an employee who takes leave under the Act for a qualifying reason, up to the appropriate per diem and aggregate payment caps. |

| Employee | 5 | Days 1-10 | 2/3 of Regular Pay Rate

FT = 2 weeks or 80 hours PT = typical # hours worked in 2-week period |

$200/day or $2,000

in total |

Qualifying wages are those paid

to an employee who takes leave under the Act for a qualifying reason, up to the appropriate per diem and aggregate payment caps. |

| Employee

becomes eligible after 30 days of employment |

5 | Weeks 3-12

(50 days) |

2/3 of Regular Pay Rate

FT = 2 weeks or 80 hours PT = typical # hours worked in 2-week period |

$200/day or $12,000

in total |

Applicable tax credits include the

employer portion of the Social Security and Medicare tax for all payments as well as amounts paid or incurred to maintain health insurance coverage. |

To claim EPSL credits: Reduce the 941 payment by all credits available, complete Form 7200 or reconcile the credits for a refund on Form 941. This form can be filed at any time before the end of the month following the quarter in which the qualified wages were paid (for example, for second quarter wages the filing deadline is July 31). The form may also be filed multiple times throughout the quarter.

Special W-2 Reporting is Required

Notice 2020-54 provides guidance on the special preparation of Forms W-2. For complete information please refer to the notice.

Organizations that paid employees any wages required by FFCRA must correctly map the earning code for qualified sick and/or family leave wages onto Form W-2.

Sick Leave Wages for Employee:

In labeling this amount, use the following or similar language: “sick leave wages subject to the $511 per day limit.” This applies to employees unable to work due to:

- A federal, state or local quarantine or isolation order related to COVID-19.

- COVID-19 self-quarantine at the direction of a healthcare provider.

- COVID-19 symptoms and pending medical diagnosis.

Sick Leave Wages for Employee Caring for Others: In labeling this amount, use the following or similar language:

- “sick leave wages subject to the $200 per day limit.”

This applies to employees unable to work because they are caring for an individual subject to a self-quarantine or isolation at the direction of a healthcare provider or government.

Emergency Family Leave Wages: In labeling this amount, use the following or similar language:

- “emergency family leave wages.”

This applies to employees caring for a child whose school or place of care is closed or unavailable due to COVID-19.

For the above issues: Place the applicable descriptions/codes listed above in Box 14 on Form W-2.

Finally:

Attach a separate statement page to Form W-2. Here is sample wording:

Included in Box 14, if applicable, are amounts paid to you as qualified sick leave wages or qualified family leave wages under the Families First Coronavirus Response Act.

Specifically, up to three types of paid qualified sick leave wages or qualified family leave wages are reported in Box 14:

- Sick leave wages subject to the $511 per day limit because of care you required.

- Sick leave wages subject to the $200 per day limit because of care you provided to another; and

- Emergency family leave wages.

Individuals with self-employment income AND wages paid by an employer:

- Report the qualified sick leave or qualified family leave wages on Form 7202,

Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals.

- Include this form with your income tax return and reduce (but not below zero) any qualified sick leave or qualified family leave equivalent credits by the amount of these qualified leave wages.

Form 7202, Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals

Draft Instructions are available.

If the employee receives a paper Form W-2, the statement page must be included as a paper attachment and provided to the employee at the same time as the paper Form W-2.

If the employee receives an electronic Form W-2, the statement page must be provided electronically and provided to the employee at the same time as the paper Form W-2.

This ends the RKL 2020 Year-End Tax Planning Material

199A Opportunities

- Adjust wages to optimal levels: Wages can be a major limiting factor for QBI deduction. If you find that the business has been limited over the past two years, or the business is coming close to the limitation, there are a few ways to optimize wages in order to avoid it.

- Aggregation: After two years of QBI, we are now able to better identify when aggregation is advantageous in the current year as well as future years (because aggregation is binding in future years). Remember, there are a few criteria the business must meet in order to be eligible to aggregate.

- Common control of businesses

- No specified service businesses

- Provide products and services normally offered together

- Share facilities or significant centralized business elements

- Operate in coordination or reliance on one another

If the business qualifies, here are some triggers that indicate you may want to consider aggregation:

- The wage and unadjusted basis in assets are limiting your qualified business deduction.

- The business income fluctuates and can create a loss at one entity and income at another entity.

- Most employees and/or capital assets are held at one company that works closely with a commonly controlled company.

Rental Real Estate Safe Harbor:

Rental real estate can be a grey area for QBI, but the IRS provides a safe harbor. If you satisfy the safe harbor requirements, the income qualifies for the QBI deduction. He client will need to track separate books and records and maintain records of all services performed and total hours of services performed.

- 1231 Gains/Losses

- 1231 gains do not qualify for QBI, but 1231 losses are considered QBI. The one exception that is beneficial to taxpayers (for QBI purposes) is that §1231 gains within five years of a §1231 loss is considered ordinary income, not capital, so the gain should be included in QBI.

Foreign Financial Account and Reporting Requirements

Form 114, Reports of Foreign Bank and Financial Accounts (FBAR)

Taxpayers who own or have signature authority over foreign accounts with balances that total in excess of $10,000 must electronically file an FBAR. The IRS defines “authority” as the ability to initiate account withdrawals, and its

definition of “financial account” includes, but is not limited to:

- Traditional bank accounts and other accounts held with a financial institution

- Brokerage or commodities accounts

- Insurance and annuity policies with a cash value

- Mutual funds

The $10,000 figure is the aggregate of all accounts, and each account is measured at its maximum balance during the year. Whether or not a foreign account produces taxable income has no bearing on the FBAR filing requirement.

FBARs are due April 15 following the calendar year reported. Taxpayers are automatically granted a six-month extension until October 15 (no extension request needed).

Form 8938, Statement of Specified Foreign Financial Assets

Under the Foreign Account Tax Compliance Act (FATCA), taxpayers who hold certain levels of foreign assets during or at the end of a tax year must report these holdings on Form 8938. Foreign financial accounts (reported via FBAR) and foreign assets held directly

(i.e. foreign stock, securities, or debt) are included in FATCA’s definition of specified foreign financial assets. Filing Form 8938 does not relieve taxpayers of filing responsibility for FBAR (Form 114).

FACTA Reporting Thresholds

| Client Type | Amount on the Last Day of the Year Exceeding: | OR | Amount at any time

during the year exceeding: |

| Unmarried, living in U.S. | $50,000 | OR | $75,000 |

| Married Filing Separately, living in U.S. | $50,000 | OR | $75,000 |

| Married Filing Jointly, living in U.S. | $100,000 | OR | $150,000 |

| Unmarried, living abroad | $200,000 | OR | $300,000 |

| Married Filing Separately, living abroad | $200,000 | OR | $300,000 |

| Married Filing Jointly, living abroad | $400,000 | OR |

$600,000 |

Form 8938 is attached to a taxpayer’s annual return and must be filed by the due date, including extensions, for that return. For individuals and calendar-year C Corporations, this would be April 15 with a six-month extension available upon request.

Student Loan Interest Deduction

Borrowers can deduct education loan interest up to $2,500 per tax

year, subject to annual income limitations of $85,000 (single) and $170,000 (married filing jointly).

NOTE: The CARES Act suspended federal loan payments and halted interest accumulation through September 30, 2020. These provisions were extended through December 31, 2020, via a presidential memorandum signed on August 8, 2020.

Educator Expense Deduction

Teachers who buy supplies for their classrooms at their personal expense can deduct up to $250 of purchases.

Meals and Entertainment

| Event | 2020 Expenses |

| Office holiday party or picnic | 100% deductible |

| Client business meals | 50% deductible if business is conducted, taxpayer is present and not lavish or extravagant |

| Entertainment-related meals | 50% deductible if the meals are purchased separately from the entertainment or the cost of the meals is stated separately from the cost of the entertainment on one or more bills, invoices or receipts |

| Transportation to/from restaurant for client business meal | 100% deductible |

| Sporting event tickets | · No deduction for face value of ticket

· No deduction for skybox expenses to the extent of non-luxury seat ticket face value in such box No deduction for charitable sports events · No deduction for the right to purchase tickets to an educational institution’s athletic events · No deduction for transportation to/from and parking at sporting events · 50% deductible in the case of food and beverages provided during an entertainment activity; only when the food/beverages are purchased separately from the entertainment or the cost of the food/beverage is stated separate from the total cost of the entertainment on one or more bills/ invoices/receipts |

| Club memberships | No deduction for club dues No deduction for expenses incurred at a club organized for business, pleasure, recreation or other social purposes if related to an active trade or business |

| Meals provided for the convenience of the employer | 50% deductible (nondeductible after 2025) |

| Meals provided to employees occasionally and overtime employee meals | 50% deductible (nondeductible after 2025) |

| Water, coffee and snacks at the office | 50% deductible (nondeductible after 2025) |

| Meals in office during meetings of employees, stockholders, agents or directors | 50% deductible |

| Meals during business travel | 50% deductible |

| Meals at seminar or conference or at a business league event | 50% deductible |

| Meals included in charitable sports package | 50% deductible |

| Meals included as taxable compensation to employee or independent contractor | 100% deductible |

| Meals expenses sold to a client or customer (or reimbursed) | 100% deductible |

| Food offered to the public for free (e.g., at a seminar) | 100% deductible |

Moving Expenses

Available only to members of the Armed Forces (or their spouses or dependents) who are active duty and required to move by military order related to a permanent change of station.

Alimony and Child Support

For divorce or separation instruments executed after December 31, 2018, alimony payments will no longer be included in taxable income.

Additionally, the payments are not deductible by the payor. This treatment of alimony payments also applies to divorce or separation decrees that are modified after December 31, 2018, if the modification specifically states that the new treatment of alimony payments now applies.

For individuals who must pay alimony, this change may be costly. Child support payments remain non-deductible by the payor.

Self-employed deductions: There are a few deductions that only apply to individuals who are self-employed. Particularly, these include a deduction for health insurance premiums, a deduction for 50 percent of self-employment tax paid and contributions to retirement plans.

Electronic Signature Options Will Simplify Third-Party Authorizations

The Taxpayer First Act (TFA) of 2019 requires the IRS to provide digital signature options for Form 2848, Power of Attorney, and Form 8821, Tax Information Authorization.

Currently, submitting and processing these authorization forms is a paper operation. Tax professionals typically complete the forms and taxpayers sign them with a pen. The forms are mailed or faxed to the IRS. The faxed forms are printed or distributed electronically to the staff in the Centralized Authorization File (CAF) Unit. These teams review the forms for accuracy and fraud before adding the information to the CAF database.

Even before COVID-19, the IRS was working on CAF improvements and making the TFA requirements a reality. Here’s an important look at what’s ahead:

- In January, IRS plans to launch a new IRS.gov secure submission platform and a new page, “Submit Forms 2848 and 8821 Online,” that will allow tax professionals to upload third-party authorization forms electronically.

- Tax professionals will enter their Secure Access username and password or complete a Secure Access registration to authenticate their identities.

- Taxpayers and tax professionals can sign the forms electronically or with ink, and then upload the image of the form to the IRS.

This gives tax professionals and taxpayers a safe option to electronically sign and upload these critical documents without an in-person meeting. Especially in these uncertain times, keeping taxpayers and tax professionals safe is a top IRS priority.

Just as tax professionals are required to do for every electronically filed tax return, they’ll need to verify the taxpayer’s identity if there’s an electronic signature and the client is unknown to them.

This new IRS.gov third-party authorization submission process will not be the only electronic option for Forms 2848 and 8821.

Next summer, IRS plans to launch a platform called the Tax Pro Account. At launch, the Tax Pro Account will serve as the point of entry for tax professionals to electronically initiate and sign an online third-party authorization form.

That third-party authorization form will electronically transfer into the client’s IRS online account. Clients can access their personal IRS account and electronically sign the document. The document goes directly to the CAF, posting immediately. There’s no wait time, no backlog. The Tax Pro Account is an electronic operation from beginning to end.

When IRS has completed these projects next year, tax professionals will have four submission options: upload on IRS.gov, initiate electronically via Tax Pro Account, mail to IRS and fax to IRS. Because of the risk of fraud, we cannot accept electronic signatures on mailed or faxed authorization forms.

The IRS is committed to working with its stakeholders to improve this process for taxpayers and tax professionals.

President-Elect Joe Biden’s Tax Proposals

Long -Term Care Insurance

Tax credits that help working families pay for the cost of caring for an aging loved one, modeled off of legislation supported by AARP. Biden will also increase the generosity of tax benefits for older Americans who choose to buy long-term care insurance. No additional information at this time.

Repeal the TCJA components for high-income filers

- Reverts the top individual income tax rate for taxable incomes above $400,000 from 37% under current law to the pre-Tax Cuts and Jobs Act level of 39.6%.

Impose 12.4% Social Security payroll tax for wages above $400k

Temporarily increase the generosity of the Child Tax Credit and Dependent Credit. Expands the Child and Dependent Care Tax Credit (CDCTC) from a maximum of $3,000 in qualified expenses to $8,000 ($16,000 for multiple dependents) and increases the maximum reimbursement rate from 35% to 50%.

For 2021 and as long as economic conditions require, increases the Child Tax Credit (CTC) from a maximum value of $2,000 to $3,000 for children 17 or younger, while providing a $600 bonus credit for children under 6. The CTC would also be made fully refundable, removing the $2,500 reimbursement threshold and 15% phase-in rate.

Expands the Earned Income Tax Credit (EITC) for childless workers aged 65+

Tax long-term capital gains and qualified dividends at the ordinary income tax rate of 39.6% on income above $1 million and eliminates step-up in basis for capital gains taxation.

Renewable-energy-related tax credits to individuals.

Reestablishes the First-Time Homebuyers’ Tax Credit, which was originally created during the Great Recession to help the housing market. Biden’s homebuyers’ credit would provide up to $15,000 for first-time homebuyers.

Expands the estate and gift tax by restoring the rate and exemption to 2009 levels.

The provision for “step-up-in-basis” would repeal the present law “step-up in basis” rule that increases the tax basis for inherited assets to their full fair market value upon death. This would significantly increase the burden with respect to transferred assets than would the decreased exemption. The repeal could prove very costly over time to heirs of appreciated property at all income levels, not just the wealthiest. A like-kind exchange or contributions to partnerships or real estate investment trusts (REITs) would be a popular tax planning tool.

The Biden tax plan would afford some tax relief for the burden of student debt, in addition to adding more generous forgiveness and payment-deferral rules for present student loan programs. The tax feature of the Biden student loan assistance would forgive the balance of a borrower’s outstanding student loan debt after 20 years without imposing any tax liability.

Equalizing the tax benefits of traditional retirement accounts (such as 401(k)s and individual retirement accounts) by providing a refundable tax credit in place of traditional deductibility. (The proposal would eliminate the tax deduction for contributions to IRAs, 401(k)s, 403(b)s, and other pretax accounts, and to replace it with a new credit that would be (regardless of a taxpayer’s income) equal to a specified percentage of the amount contributed to the pre-tax account.)

Creating a refundable renter’s tax credit capped at $5 billion per year, aimed at holding rent and utility payments at 30 % of monthly income.

Expanding the Affordable Care Act’s premium tax credit.

Biden’s Plan for Business Tax Changes

Phases out the qualified business income deduction (§199A) for filers with taxable income above $400,000.

Increases the corporate income tax rate from 21% percent to 28%.

Creates a minimum tax on corporations with book profits of $100 million or higher. The minimum tax is structured as an alternative minimum tax—corporations will pay the greater of their regular corporate income tax or the 15% minimum tax while still allowing for net operating loss (NOL) and foreign tax credits.

Doubles the tax rate on Global Intangible Low Tax Income (GILTI) earned by foreign subsidiaries of US firms from 10.5% to 21%. In addition to doubling the tax rate assessed on GILTI, Biden proposes to assess GILTI on a country-by-country basis and eliminate GILTI’s exemption for deemed returns under 10% of qualified business asset investment (QBAI).

Establishes a Manufacturing Communities Tax Credit to reduce the tax liability of businesses that experience workforce layoffs or a major government institution closure

Expands the New Markets Tax Credit and makes it permanent.

Offers tax credits to small business for adopting workplace retirement savings plans.

Expands several renewable-energy-related tax credits, including tax credits for carbon capture, use, and storage as well as credits for residential energy efficiency, and a restoration of the Energy Investment Tax Credit (ITC) and the Electric Vehicle Tax Credit. The Biden plan would also end tax subsidies for fossil fuels.

Imposing a new 10%t surtax on corporations that “offshore manufacturing and service jobs to foreign nations in order to sell goods or provide services back to the American market.” This surtax would raise the effective corporate tax rate on this activity up to 30.8%.

Establishing an advanceable 10% “Made in America” tax credit for activities that restore production, revitalize existing closed or closing facilities, retool facilities to advance manufacturing employment, or expand manufacturing payroll.

Eliminating certain real estate industry tax provisions – no additional information on this proposal.

Increasing the generosity of the Low-Income Housing Tax Credit

![]() Basics & Beyond Resources

Basics & Beyond Resources

- Blog Page

- Resource List

- Webinar & Seminar Schedules

- Get Registered!

- Note: Paid attendees can request a link to the replay of any previously recorded webinar presentations by emailing us at [email protected]