The Grain Glitch: 2018 Tax Reform

Last December, Congress passed the Tax Cuts and Jobs Act. Shortly thereafter, President Donald Trump signed the bill into law. At over 1,100 pages in length, this sweeping tax reform legislation was the most dramatic change to the tax code in decades. It included changes to a number of different aspects of both federal and state income taxes, including corporate tax rates, cost recovery provisions, foreign earnings, pass-through taxation, business deductions, small business taxes, tax brackets, the Affordable Care Act, the standard deduction and personal exemption, state and local tax deductions, the child tax credit, and much more. Amongst these changes was one provision in particular which went largely unnoticed at first. Within a few weeks, though, accounting and tax professionals around the country had pointed it out. Specifically, the tax reform bill included a particularly generous deduction for any business that sells its products directly to a cooperative. Before long, this provision had been dubbed the “grain glitch,” as the sale of agricultural commodities would be particularly impacted by this section of the new tax code. But what is the grain glitch exactly? How has it been addressed by law makers? And, most importantly, what will it mean for tax filing in 2019? We’ve put together this blog post to answer all of the questions you might have about the grain glitch. As with any section of the tax code, though, it’s important to remember that it’s only possible to cover so much information in a single article or blog. For this reason, we highly recommend signing up for one or more tax webinars in 2018 to ensure that you stay up to date with changes to the tax code. Particularly given the sweeping changes associated with the new tax reform bill, it’s important than ever to bring yourself up to speed on new federal tax provisions. Tax webinars are a great way to accomplish this while simultaneously fulfilling your annual CPE requirements.

That said, the information below will provide you with a solid overview of the issues surrounding the grain glitch, along with how Congress has attempted to fix it. Ready to get started? Keep reading to learn more.

What Is the Grain Glitch?

As part of the 2018 tax reform bill, Congress included a change to Section 199 of the tax code. The new IRC § 199A created a 20 percent tax deduction on any income derived from pass-through businesses, with the idea of mimicking the existing benefits offered to farmer-owner cooperatives (and their farmer customer) in the previous version of Section 199. Instead, though, the change had the unintended consequence of incentivizing the sale of products to cooperatives over non-cooperatives.

How does this work exactly? Simply put, the tax code would have allowed pass-through business owners who were also members of cooperatives to deduct 20 percent of all of their qualified cooperative dividends that were derived from sales to horticultural or agricultural cooperatives. However, this deduction would be on gross income, as opposed to the 20 percent deduction on pass-through net income associated with Section 199A.

This so-called “grain glitch” would then incentivize farmers to sell their agricultural commodities to cooperatives (rather than selling to private companies) in order to reap the benefits of the 20% tax deduction on gross income.

This was particularly concerning to those in the grain sector, as the amount of grain commodities marketed by cooperatives in various grain producing states differs significantly from one state to another. For example, roughly 90 percent of grain production is handled by cooperatives in Minnesota, compared to just 8 percent in Indiana. Given the competition between grain merchants, the tax code change could have resulted in serious supply chain issues.

Beyond the immediate concerns associated with agricultural commodities, there were also concerns raised regarding the potential creation of a new tax loophole that businesses nationwide might attempt to exploit. For example, businesses outside of the agricultural sector might have opted to create their own cooperatives, using those cooperatives as tax shields to avoid paying normal income tax rates.

How Does the Grain Glitch Work?

Let’s take a closer look at what it is exactly in Section 199A that would have allowed for this kind of tax loophole. The basic idea between Section 199A was to allow households receiving income through pass-through businesses (such as S corporations, sole proprietorships, and partnerships) to take a new deduction on that same income. The issue, though, is how the pass-through income deduction is termed in the tax code. Essentially, Section 199A first allows a household to deduct 20 percent of what is termed “qualified business income.” This QBI amount is calculated according to various limitations laid out in the provision. Later in the same section of the tax code, though, the provision also gives permission to certain households to deduct 20 percent of “qualified cooperative dividends.” These qualified cooperative dividends were to be calculated on a gross basis (rather than a net basis, as was the case with qualified business income), and according to a much smaller number of limitations and restrictions.

The biggest difference between these two allowances is the distinction between gross versus net income. If a farm business qualifying for pass-through income sells $500,000 in produce and incurs $350,000 in expenses, it would be allowed a 20% deduction on the net profit of $150,000. But if that same business we to sell to a cooperative and receive its income as cooperative dividends rather than regular income, it could deduct 20% of its gross sales. The difference is staggering: a $30,000 deduction as opposed to a $100,000 deduction. Additionally, some of the limitations in place for qualified business income wouldn’t apply to qualified cooperative dividends under the new Section 199A. For example, a household could only claim the QBI deduction on 20% of its taxable income, whereas the qualified cooperative dividends deduction can be claimed on up to 100% of taxable ordinary income.

Are Farmers Tax Exempt Under the Grain Glitch?

It’s easy to see why some tax advisors, lawmakers, and other authorities reacted so strongly to the grain glitch early on in 2018. If put to use under a particular set of circumstances, the grain glitch could have essentially removed the entire tax burden for farmers, making certain farmers tax exempt.

Let’s construct a hypothetical scenario to illustrate how this might work. Consider a large-scale farmer who produces $1 million worth of corn and soy each year. This farmer’s expenses total $900,000 per year. As a result, his annual income totals $100,000. Under the previous tax code, the farmer would have to pay taxes on this $100,000. Under the first part of Section 199A, the farmer could deduct up to 20% of this amount if it were pass-through income. Still, though, the farmer would certainly owe federal income taxes, even after taking a standard deduction, personal exemptions, and any tax credits they may be able to claim. With the grain glitch, though, the situation would change considerably. Imagine that the farmer sold all of their commodities to a cooperative, which then paid them in dividends. This would mean that they would have received $1 million in dividend income. Of this gross amount, 20% would be deductible under Section 199A. That’s a $200,000 deduction in total. However, the farmer only has $100,000 in total income after expenses. As a result, they would effectively eliminate their entire tax bill and pay nothing in federal income tax.

Could Non-Farm Businesses Exploit the Grain Glitch?

It was already concerning enough that agricultural businesses could suddenly cease to pay anything in federal income taxes. However, there were other potential consequences associated with the grain glitch as well. Essentially, a non-farm business could exploit this tax loophole in order to avoid paying taxes themselves. This could involve a group of highly profitable non-agricultural businesses reorganizing themselves as a cooperative. They could then pay themselves entirely (or largely) in cooperative dividends, and thus be able to deduct 20% of their total gross income from their total taxable income each year.

At the same time, though, a household could employ a different strategy to avoid paying income taxes. Imagine that a household purchases a share in a large, unprofitable farm that sells to cooperatives. The household would then be eligible to deduct their ownership portion of 20% of the amount of the farm’s total gross qualified cooperative dividend income. To put this in clearer terms, imagine that a household owns 10% of a farm with $10 million in annual sales to cooperatives. They could then deduct 20% of $1 million per year, effectively shielding themselves from $200,000 in federal tax liability.

The Grain Glitch Fix

As you can imagine, lawmakers were under a considerable amount of pressure to fix this significant loophole in the new federal tax code. On March 23, 2018, President Donald Trump signed into law the Consolidated Appropriations Act of 2018. This omnibus spending bill covers the federal budget for the rest of 2018, to the tune of $1.3 trillion in spending. As part of this 2,232 page piece of legislation, a fix to the grain glitch was included. However, this fix is rather complicated. It clocks in at a full 17 pages in length, and also goes into effect retroactively as of January 1, 2018. This means that there’s no way for anyone to take advantage of the grain glitch.

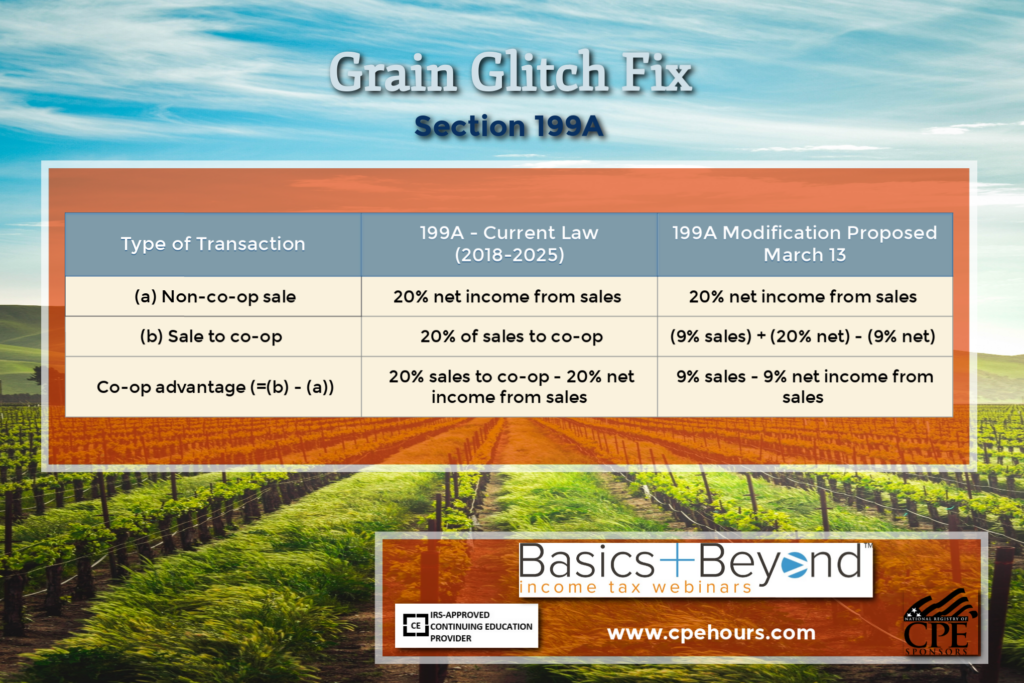

According to the fix, the tax benefit afforded to farmers who sell commodities to non-cooperatives is the same. In other words, they can access the same 20 percent qualified business income deduction that’s included under Section 199A of the tax code. However, this refers to the 20 percent deduction of net income, not the 20 percent gross income deduction previously allowed for dividends paid out from cooperatives. Additionally, this amount is income restricted to $157,500 for single taxpayers are $315,000 for taxpayers who are married and filing jointly. Things get much more complicated when it comes to sales to cooperatives. In some cases, it may still be more advantageous to sell to a cooperative than to a non-cooperative. In other cases, the new changes to the tax code under the Consolidated Appropriations Act of 2018 might actually make it more advantageous from a tax perspective to sell to a private business (rather than to a cooperative).

To start, a farm business would calculate the standard 20 percent QBI of whatever they’re selling — as though they had sold it to a non-cooperative. Then, they must subtract the smaller of either 50 percent of W-2 wages paid out in order to earn the income from the cooperative, or 9 percent of the net income attributable to cooperative sales. This means that a farm business with no W-2 payments would deduct nothing from this amount. Finally, the farm business can add back in something akin to the old Domestic Production Activities Deduction to their total deduction, which is passed through to them by the cooperative that’s purchasing their commodities. This amount could be 0, or it could range up to about 9 percent.

The specifics depend upon the cooperative in question, and how much of their qualified production activities income (QPAI) can be allocated to the farmers they purchase from under Section 199A(g)(2)(A) of the new tax code.

Grain Glitch Update: 2018 Tax Webinar

As you can see, the fix to the grain glitch does indeed address the issue surrounding a special deduction on gross rather than net income for dividends paid out as a result of sales to a cooperative. However, the fix is far from simple. We’ve only scratched the surface of the specifics here, and it’s important to fully understand how QPAI works in conjunction with Section 199A(g)(2)(A) in order to determine whether or not it’s advantageous for a potential client to sell to a cooperative rather than to a private buyer.

Here at Basics & Beyond™, we’re offering a number of tax webinars in 2018, one of which specifically addresses the grain glitch and its subsequent fix. We’ll bring you up to speed on everything you need to know about the grain glitch, including what it means for your clients. Our webinar offerings are engaging, affordable, informative, and convenient. To learn more about our 2018 tax webinar schedule, click here.