The Q & A from the Fall Virtual Seminars are below.

1099 -K Issues

What happens if you receive 1099k which includes business income and repayment for example pay for the whole bill and people and then send you a reimbursement. The 1099-k includes business income and personal deposits mixed.

You are going to have to reconcile on Sch C to get to the correct net taxable number. Declare the entire amount income then subtract out as an expense the reimbursement.

Why wouldn’t the guitar sale also go on Sch D?

I think it could. You may have net taxable income if sold as a profit “investment”. Or it could be a nondeductible loss of a personal asset. We described the many ways this could be reported, the important thing is that it is reported somewhere on the return.

Where would you report the sales tax that is recorded in the 1099-K that is remitted on the client’s behalf (like Amazon)?

If remitted by amazon and included on the 1099-K it would be deductible as a sales tax expense on the business schedule.

When should a taxpayer request a corrected 1099K? I anticipate clients saying oh this is wrong! Good luck. I think you need to correct using nominee reporting. In other words, add it on and then subtract off.

I agree.

Could you have a one and done 1099K and a reimburse payment Sch 1 on same return?

Yes, it is possible.

If your taxpayer sold personal items online through a local marketplace who is responsible for filing the 1099K and when is it due into the IRS? Can the preparer face preparer penalties for not informing them that they need to file this form?

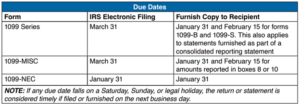

To cover myself, if I know that the client is not filing Form 1099-K and should, I would have a discussion with them concerning the issue. The 1099-K should be filed by the local marketplace who provides the form to them (the seller) based on the table below under 1099 series. If they fail to file, I would then send a letter (certified mail-return receipt requested) detailing the requirement and potential penalties to them if they do not file. At this time, I would make a decision as to whether I would retain them as a client. If you were to get into an audit situation, where he/she said or he/she never told them about this requirement – the letter would state that you did provide the information to them. You did your due diligence. The issue you want to avoid is that you knew they were not sending out the Forms 1099-K and did nothing to inform them of their responsibilities. It is a possibility they will shift the blame to you as you did not tell them otherwise.

How do you treat 1099K’s for restaurants in which tips and sales tax collected is included in the figure. Sales tax should not be reported as gross revenues but may trigger a mismatch with the IRS. Confused a bit to still to include sales tax on line 1a as gross sales for accrual taxpayer. Seems like it’s inflating the sales number just to match the 1099k.

When we discussed these rules, we based our discussion on the 1099 K reporting rules. The gross payment amount (Box 1a) on Form 1099-K reports the total payments you received. It doesn’t include adjustments for fees, credits, refunds, shipping, cash equivalents or discounts. These items are not income. You can deduct them from the gross amount.

Compare the gross payment amount to your records. These may include reports from payment apps or online marketplaces, payment card receipts or merchant statements.

Sales tax and tips would be part of the sale. We have to remember that some people include sales tax in their income and then take it as an expense. Others do not include sales tax in income and should not have a sales tax deduction. Tips are reported on Form W-2 and are not income to the business but are income to the employee. But we include tips on the W-2 and take a deduction for gross compensation. Tips should not be a separate deduction on the business return if reported tips on the W-2.

Going back to before lunch, I’m a little confused on offsets of gains and losses. I you are selling spare tickets on stub hub, sometimes you might have a gain, sometimes as loss. I assume we can offset gains and losses, even though we cannot deduct a net loss.

Yes, that is correct.

Corporation Issues

If you are a C Corporation and have not filed returns for the last 5-years, can you elect to be an S Corporation as of 8/31/23? Would that election be approved or due to past non-filing, do those returns need to be brought up to date?

You will need to catch up on the C Corporation filing. IRS will require the last 6 years. File a final return for the corporation for the short year January 1, 2023-August 31, 2023. Elect to be an S-Corp 09/01/23 and file a short year return. Do not need a new EIN. Must file 2553.

So, you are saying that if I file an S-Election without doing the last 6 years of the unfiled returns, the S Corporation Election would be denied.

It is possible.

S Corp with appreciated assets starting new S Corporation with same shareholders. Wants to transfer assets from old to new. Can they avoid the capital gains on the appreciated assets? Appears they should be treated as sold at FMV in the transfer.

Is the old S Corp being completely liquidated?

Is the Election to be a S Corp time limit the same if you are a LLC single member and have been filing Sch C?

You can be a single member LLC but must file the S election within the time frame specified. The election must be filed with the IRS no more than two months and 15 days after the beginning of your corporation’s tax year. There are provisions for a late election review the instruction in the Form 2553.

Is the 50% or more of shareholders to terminate an S Corp based on the number of owners or % of ownership?

Shareholders owning more than 50% of the outstanding stock of the corporation.

If a one member S-Corp buys a health plan on the exchange (do not qualify as a group) and it is paid/reimbursed by the company and properly reported on W-2 and the member is, then eligible for a credit on the return how is that handled? Does that credit amount then become income?

They were no longer eligible for the group plan as they have only one employee.

Is there ever a MAX for reasonable compensation? For example, if an S Corporation has net income of $40M, is paying $12M, $14M, $16M too much? This would be for an athlete with a loan out corp.

You seldom see the max challenges. The exception to that rule was “Menards” case. The issue to be concerned with is the services being performed for the corporation that justifies the amount of compensation. There is no magic number.

When S Corporation Shareholders A & B contribute money to S-Corp and S-Corp buys back shareholders C & D stock, do A & B shareholders get to increase the basis of their stock? If yes, will stock valuation in the minutes suffice to document stock basis or do new shares have to be issued?

No increase in basis to A & B shareholders for a corporate redemption of C & D shares of S corporation stock.

Qualified Disaster Issues

I have a question off topic, can you confirm no legislation was passed to treat Hurricane Ian as a “Qualified Disaster” so it would not be subject to casualty loss rules that are subject to 10% AGI & $100 reduction.

First Ian has two disaster declarations, no legislation was needed. DR-4673-FL and EM-3584-FL both for the Florida area. Not all countries in Florida were affected by the disaster declaration. Tax Year was 2022.

Use the code DR-4673-Fl on Form 4684

https://www.irs.gov/pub/irs-pdf/f4684.pdf

- Brevard (County)

- Charlotte (County)

- Collier (County)

- DeSoto (County)

- Flagler (County)

- Glades (County)

- Hardee (County)

- Hendry (County)

- Highlands (County)

- Hillsborough (County)

- Lake (County)

- Lee (County)

- Manatee (County)

- Monroe (County)

- Okeechobee (County)

- Orange (County)

- Osceola (County)

- Palm Beach (County)

- Pasco (County)

- Pinellas (County)

- Polk (County)

- Putnam (County)

- Sarasota (County)

- Seminole (County)

- Johns (County)

- Volusia (County)

Employee Retention Credit

My office has heard the IRS is going to consider signing Amendments for ERC credits to be agreeing with the ERC Filings. If clients had those done by a 3rd party and got their money, how do we “Prove” that we did diligence in verifying that their ERC app was good?

Your best way to prove is that you did an analysis of the rules and did the calculations as required by the law. To see whether your business is eligible for the ERC, start by determining whether:

(1) the business was fully or partially shut down due to a governmental order during any part of 2020, or

(2) the business’s gross receipts in any quarter of 2020 declined 50% or more relative to the same quarter of 2019.

If the answer to either question is YES, and the business had 100 or fewer employees, then any wages paid to any employee while the business was fully or partially shut down or during a quarter that it had a 50% decline in gross receipts may count towards the $10,000 per employee amount.

In addition to claiming tax credits for 2020, small businesses should consider their eligibility for the ERC in 2021. The ERC is now available for all four quarters of 2021, up to $7,000 per quarter. The level of qualifying business disruption has been reduced so that a 20% decline in gross receipts during a single quarter will make a business eligible for a maximum yearly benefit of $28,000 per employee.

For 2020, the Employee Retention Credit (ERC) is a tax credit against certain payroll taxes, including an employer’s share of social security taxes for wages paid between March 12, 2020, and December 31, 2020. The tax credit is 50% of the wages paid up to $10,000 per employee, capped at $5,000 per employee. If the amount of the tax credit for an employer is more than the amount of the employer’s share of social security tax owed, the excess is refunded – paid – directly to the employer.

https://home.treasury.gov/system/files/136/ERC-Flyer-4.13.21.pdf

Is it correct to assume that we shouldn’t have to amend Iowa tax returns when amending the federal tax returns for ERC credit claims since the credit was just a federal credit?

No – you must amend the State return to reflect reduction in wages.

Modifications for Wages to which the Employee Retention Credit Applies under Section 2301 of the CARES Act. (From Iowa Department of Revenue Website)

The CARES Act created a new Employee Retention Credit (ERC) available to eligible employers against employment taxes equal to fifty percent of qualifying wages of each employee. The Act further provides that no income tax expense deduction shall be allowed for the portion of wages for which the taxpayer received an ERC for the tax year.

The starting point for calculating Iowa net income is federal taxable income before the net operating loss for corporations, or federal adjusted gross income for individuals. Iowa law contains no specific adjustment for deductions disallowed at the federal level because the taxpayer claimed the federal ERC. Therefore, because no deduction is allowed for wages for which a taxpayer received the ERC at the federal level, no deduction is allowed for these amounts at the Iowa level, even though Iowa has no ERC or equivalent credit.

Based on this you would have to adjust the Iowa Return by the credit, so you would have to amend.

If they just received the ERC check, but haven’t cashed it and now believe it is fraudulent should they just send the check back?

The November newsletter has information on how to withdraw the ERC application. I would look to that for how to proceed. IRS intends to issue more guidance on this issue. I would review the criteria on how to qualify for ERC and if you are sure that the client does not meet the criteria review the newsletter process to withdraw.

Are you saying that to get the ERC in any instance requires that the employees were being paid to do nothing?

No. You need to review how to qualify.

Some promoters tell taxpayers that every employer qualifies for ERC. This is not true. Eligibility for the ERC depends on your specific facts and circumstances.

There are very specific eligibility requirements for claiming the ERC.

Eligible employers can claim the ERC on an original or amended employment tax return for qualified wages paid between March 13, 2020, and December 31, 2021. However, to be eligible, employers must have either:

- Sustained a full or partial suspension of operations due to an order from an appropriate governmental authority limiting commerce, travel or group meetings because of COVID-19 during 2020 or the first three quarters of 2021, or

- Experienced a significant decline in gross receipts during 2020 or a decline in gross receipts during the first three quarters of 2021, or

- Qualified as a recovery startup business for the third or fourth quarters of 2021.

A self-employed individual who has employees and who otherwise meets the requirements to be an eligible employer may be eligible for the ERC based on qualified wages they paid to employees. Self-employed individuals can’t include their own self-employment earnings or wages paid to related individuals when calculating the credit.

Employers in U.S. territories are eligible to claim ERC if they meet other eligibility requirements.

How about the interest received because of ERC? Which year to file amend to include the interest?

The interest is taxable in the year of receipt. Generally, we are talking about cash basis taxpayers. When interest is paid on a refund, it is taxable in the year received.

Which year must I amended if I receive an ERC credit?

The amount of your ERC reduces the amount that you are allowed to report as wage expense on your income tax return for the tax year in which the qualified wages were paid or incurred.

Generally, most taxpayers claim wage expense as a deduction on their income tax returns. However, for some taxpayers, wage expense is properly capitalized to the basis of a particular asset or as an inventory cost.

You should amend your income tax return to reduce the amount of your original wage expense if that adjustment has not yet been made by:

- reducing the prior wage deduction, or

- reducing the prior amount capitalized (and making any resulting adjustment, such as reducing a depreciation deduction).

Notice 2021-49

The CARES Act provides for any employer which received an ERC, such employer’s deduction against income for qualified wages must be reduced by the amount of the credit. The CARES Act further provides rules similar to those of I.R.C. § 280C(a) apply. Section 280C(a) requires any credit be “traced” to the specific wages generating such credit. Applying this rule, the employer’s wage deduction must be reduced in the year the qualified wages generating the ERC were paid. This generally requires filing an amended federal income tax return or administrative adjustment request (AAR), as applicable.

Amended tax returns and AARs must be filed within three years of the date the income tax return was due to be filed (including extensions).

By Amendments I mean the Income Tax amendments, not payroll tax. Then IRS is automatically amending the years where ERC was claimed and reducing the income??? Is that what you are saying?

There are a lot of rumors out there about ERC issues. We will tell you what we know is going on right now. This is a moving target, and we are awaiting more IRS information.

I have a Client claimed 2020 ERC in 2023 and this business has already closed in 2022.

When they receive their refund, they need to go back and amend 2020. They will need to pay any additional tax due to the reduction of the wages by the credit amount.

Do you know when we were first notified by the IRS that we needed to amend the tax return for the year the credit was related to?

Notice 2021- 49 is the announcement in 2021. That is not new. It has not changed recently.

How does a client pay back an ERC refund? Have a new client that used an online processor and received a fraudulent refund.

They will have to pay it back. The November newsletter has the most recent information in that IRS has detailed the “Withdrawal” option. We anticipate additional details on other options IRS will announce in the future. One of those is a payback option and should be announced shortly. Keep util the details are announced. I would save money.

Are you finding that there is any options for a 1065 or 1120S to pay the ERC tax at that level, instead of the K-1 to personal?

No. Have to amend the S Corporation and pay at the individual level. We are still awaiting future IRS guidance before the year end. At this point I am not sure this will be addressed, but I would check for future guidance.

If you have a client that received Employee Retention Credit through one of those organizations that charged a large fee to get this for them. They received their money, and I told them that they need to amend their returns for those years that they claimed the wage credit for.

What do I do if they won’t or don’t bring in their information to amend those returns? Do I claim the ERC as income in the year that they received it? They did give me that information.

Fire them and I would then send them a certified letter detailing the issue.

What if client amends prior tax return due to receipt of an ERC credit and then we find out the credit was fraudulently filed by one of those crack filers. This is so wrought with questions; it blows your mind. We amend and they owe money. Agree very sad. Our Firm went to great lengths to do these correctly. We charged based upon our time spent not a percentage of the refund.

Then they have to pay the ERC back and they owe the money. Then we have to amend it again. I can see this happening.

If you file an amended return and reduce the wages by ERC received, can you take the contingency fee paid to the ERC filer as an expense in the amended return.

This question is addressing the fee paid to the firm who convinced the client to file the claim and get the refund. We have no guidance on this issue, but the IRS is working on a process which should be available to us by years end. IRS has recently come out with how to “withdraw” a claim. This is detailed in the November newsletter. They should address these “fee” that were paid to the scammers and how that would be handled. Wait and see what guidance would be issued.

What do you think about a church that filed for the ERC, did not experience a decline in donations but was shut down for 8 months and continued to pay employees during that time, no layoffs, is it okay to claim?

Probably. You must do the calculations.

Do you amend say 2021 S corporation when filing the ERC claim even though have not received it yet or wait to amend 2021 S corporation until actually get the refund?

That’s a tough one as there is so many problems and forms that are not processed. If your review assures, they qualify I would amend the 2021 S Corp and then the individual returns.

If a third-party ERC Mill does my client’s amended 941X forms and gets them a refund check, but we know that if the ERC claim is audited it will be denied and have to be paid back, do we need to do the amended income tax returns to reduce the payroll taxes, or should we abstain?

Let’s put this in perspective. It is the client’s responsibly to amend the return. Would inform them in a letter sent certified mail of their responsibilities. If they fail to respond, the next letter would be to separate (fire) the client.

Do you amend say 2021 S corporation when file the ERC claim even though have not received it yet or wait to amend 2021 S corporation until actually get the refund?

That’s a tough one as there is so many problems and forms that are not processed. If your review assures, they qualify I would amend the 2021 S Corp and then the individual returns.

If a prior 1120 C return is amended, will the IRS charge a penalty or only tax and interest? If no penalties are charged, do we need to include a note on the return or code to show this is amended for ERC.

This is an issue that is evolving. IRS is reviewing how it will handle the cases of the amended returns. Everything is on the table regarding how this will be handled. We should know more by year end.

If I did not prepare the amended 941s for ERC, do I have any responsibility for the amended returns? As a note, the clients were eligible, but not sure of the accuracy as I did not review the data for the 941 amendments.

Well, I think you should find a way to help them determine whether the claim was valid. Kristy talked about a settlement program. Many of our clients might want to participate and repay to avoid problems in the future.

What if someone else filed amended 941s and your client wants you to amend the corporate income tax returns? How much risk do you have if the ERTC credit that was applied for and received was accurate? So, do you hold off on amending the corporate returns?

For now, I would hold off until we have clarification of IRS settlement program. The “withdrawal” option has been announced and is detailed in our newsletter. For now, let’s see what IRS is offering and then go from there.

Does it matter if the tax return is a cash basis or accrual basis business for amending due to late received ERC?

No

For ERC when I amend the 2020 / 2021 return I have the client pay the tax due. However, the IRS always sends a notice for underpayment of tax penalty and interest from the original due date (4/15/21 for 2020). Is there an easier way to avoid writing an abatement letter? I filed the amended 2020 and 2021 returns. It has been my experience that the IRS will charge interest -which is fair. The client received interest on their refunds so they should pay interest back.

First, wait to see if IRS charges a penalty, then request abatement. This is a moving target; we need to wait and see what IRS plans are for this program yet to be fully announced.

ERC billing & Circular 230: I’ve seen multiple 3rd parties preparing 941X with payment based on % of ERC refund. I thought that was a 230 violation. Are they operating illegally or is there a loophole that I am missing?

No loophole – these are just scammers hoping not to be caught. It is a violation of Circular 230.

Client filed ERC with a 3rd party. I do not agree. However, the client insists they qualify. They are going to need amended returns once the credits are received. They are good clients, so I’d really hate to disengage. Is it acceptable to prepare the amended returns?

I really would not file- if I did not think they qualified- I would suggest you review these new FAQ’s and arrange a call with the company who prepared the report and discuss with them and the client at the same time.

One of my clients used his payroll company Paychex to prepare and file his ERC and has received the money. Will the payroll company be compromised?

They will definitely be looked at.

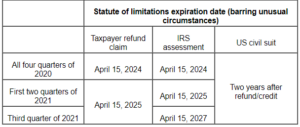

Does the 5-year statute count for both 941 and 1040/1065/1120?

No, see below the Form 941 Statutes

The IRS has three years to audit most ERC claims, but it has five years to audit payroll returns with ERCs filed for the last two quarters of 2021. There is no deadline to audit returns when fraud is involved.

Here is the audit deadline for the seven quarters during which this credit was available.

- Q2 2020 — April 15, 2024

- Q3 2020 — April 15, 2024

- Q4 2020 — April 15, 2024

- Q1 2021 — April 15, 2025

- Q2 2021 — April 15, 2025

- Q3 2021 — April 15, 2027

- Q4 2021 — April 15, 2027

Employers should be aware that the IRS could challenge previously paid employee retention credit refunds under the so-called erroneous refund provisions.

Notwithstanding any other statute of limitations, the government has two years from when it pays an employee retention credit refund to bring suit to recover the refund if it later determines the taxpayer was ineligible.

A special five-year statute of limitations applies to IRS assessments for the third quarter of 2021. This single-quarter anomaly arose from the manner in which the employee retention credit evolved over time.

As originally enacted under the CARES Act, the credit would have expired at the end of 2020. The Taxpayer Certainty and Disaster Tax Relief Act of 2020, however, significantly enhanced and extended the credit through the first half of 2021. The American Rescue Plan Act of 2021 modified the credit further and extended it through the end of 2021. It also extended the statute of limitations for IRS assessments to five years for employee retention credit claims for the second half of 2021.

The Infrastructure Investment and Jobs Act, however, retroactively repealed the credit as of the end of the third quarter of 2021. The five-year statute of limitations on assessment for the third quarter of 2021, much like the retroactive repeal of the credit for the fourth quarter of 2021, could reflect growing skepticism of the legitimacy of employee retention credits in the second half of 2021.

Civil action for recovery of erroneous refunds

Despite all the attention the employee retention credit has received, there has been very little discussion of IRC Section 7405(b), which allows the government to bring a civil action to recover any portion of a tax imposed by the Internal Revenue Code that was erroneously refunded. To prevail in an action under IRC Section 7405(b), the government must prove that (1) a refund was made to a taxpayer, (2) the refund was erroneously issued, and (3) the lawsuit to recover the erroneously issued refund was timely filed.2 Such actions are broadly used to recoup refunds that were “erroneously” issued. This error might, for example, be a clerical error, or alternatively, an error as to the taxpayer’s legal entitlement to the refund.3 Under IRC Sections 7405(d) and 6532(b), the statute of limitations for bringing such an action is generally two years from the making of the refund but extends to five years for fraud or misrepresentation of a material fact. (Similarly, a taxpayer can bring a refund suit under IRC Section 6532(a), beginning six months from the date of filing a refund claim and ending two years from the IRS’s disallowance of the claim.)

After the IRS covered the ERC scams, have they made any comment about any data on if they had noticed any conflicts in using wages for both PPP and ERC claims? I know internally we have discussed this as a potential landmine.

We will have to wait and see if the IRS addresses this in future guidance. As of this date we only have the guidance for a “withdrawal, more is coming.

We just fear the third parties will over-use the Wages. Possibly part of the IRS program coming??

Doesn’t the amended 1040 then restart the statute of limitations on the amended return for an additional period of time?

An amended return does not restart the statute.

To be sure I understand ERC and preparer responsibility. The preparer has to determine that the ERC prepared by someone else is correct before we amend the business return even though we are increasing taxable income.

That would be the first step, making sure they qualify. I would also ask to see the 941’s and any amendments so I could make an independent decision if the business qualifies. This would include any records used in the determination of the ERC. The issue here is to show you did your due diligence before putting yourself out there to do an amended return.

Have you heard of any accounting or legal firms claiming the ERC? In our area both were considered essential employees and therefore would not qualify, correct?

Your best way to prove is that you did an analysis of the rules and did the calculations as required by the law. To see whether your business is eligible for the ERC, start by determining whether:

(1) the business was fully or partially shut down due to a governmental order during any part of 2020, or

(2) the business’s gross receipts in any quarter of 2020 declined 50% or more relative to the same quarter of 2019.

If the answer to either question is YES, and the business had 100 or fewer employees, then any wages paid to any employee while the business was fully or partially shut down or during a quarter that it had a 50% decline in gross receipts may count towards the $10,000 per employee amount.

In addition to claiming tax credits for 2020, small businesses should consider their eligibility for the ERC in 2021. The ERC is now available for all four quarters of 2021, up to $7,000 per quarter. The level of qualifying business disruption has been reduced so that a 20% decline in gross receipts during a single quarter will make a business eligible for a maximum yearly benefit of $28,000 per employee.

For 2020, the Employee Retention Credit (ERC) is a tax credit against certain payroll taxes, including an employer’s share of social security taxes for wages paid between March 12, 2020, and December 31, 2020. The tax credit is 50% of the wages paid up to $10,000 per employee, capped at $5,000 per employee. If the amount of the tax credit for an employer is more than the amount of the employer’s share of social security tax owed, the excess is refunded – paid – directly to the employer.

Energy Credits

Please give information on insulation installed with the roof replacement.

insulation materials or systems and air sealing materials or systems (30% of costs). Insulation materials or systems and air sealing materials or systems: must meet the criteria established by the International Energy Conservation Code (IECC) standard in effect at the start of the year that is two years prior to the year the materials or systems are placed in service. For example, materials or systems placed in service in 2025 must meet the criteria established by the IECC standard in effect on January 1, 2023, to qualify for the Energy Efficient Home Improvement Credit in 2025.

A taxpayer may not include the labor costs for qualified energy efficient building envelope components including a qualifying insulation material or system, exterior window, skylight, or exterior door. Thus, for an energy efficient building envelope component for which a taxpayer pays a fixed price, the taxpayer must make a reasonable allocation between the qualifying cost of the property and the nonqualifying labor cost of the installation.

When calculating the Residential Clean Energy Property Credit, a taxpayer may include the labor costs properly allocable to the onsite preparation, assembly, or original installation of the qualified property and for piping or wiring to interconnect the qualifying property to the home.

Are roofing expenditures that were necessary for the installation of solar panels eligible for the Residential Clean Energy Property Credit?

A2. In general, traditional roofing materials and structural components do not qualify for the Residential Clean Energy Property Credit because they primarily serve a roofing or structural function. However, some solar roofing tiles and solar roofing shingles serve as solar electric collectors while also performing the function of traditional roofing, serving both the functions of solar electric generation and structural support and such items qualify for the credit.

Roofs are no longer part of the “New Energy Credit” unless solar in nature

Do you have an updated list of the qualifications for each of these energy properties such as the SEER on air conditioners or the window/door requirements.

This is what is currently available and will be updated as more information is available.

I have a client who is building a new home. He has a contractor performing the actual labor, but my client is paying for everything. Will my client qualify for the energy credits on the windows, doors, air conditioner, furnace etc.?

- Under the Energy Efficient Home Improvement Credit: a taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an addition to or renovation of an existing home, and not for a newly constructed home.

- Under the Residential Clean Energy Property Credit: a taxpayer can claim the credit for qualifying expenditures incurred for either an existing home or a newly constructed home.

The following residential clean energy expenditures are eligible for a Residential Clean Energy Property Credit of 30% of the cost:

- solar electric property expenditures (solar panels);

- solar water heating property expenditures (solar water heaters);

- fuel cell property expenditures;

- small wind energy property expenditures (wind turbines);

- geothermal heat pump property expenditures; and

- battery storage technology expenditures.

What energy efficiency requirements must be met to qualify for the Energy Efficient Home Improvement Credit? (added December 22, 2022)

A1. The following energy efficiency requirements must be met to qualify for the Energy Efficient Home Improvement Credit:

- Exterior doors: must meet applicable Energy Star requirements.

- Windows and skylights: must meet Energy Star most efficient certification requirements.

- Insulation materials or systems and air sealing materials or systems: must meet the criteria established by the International Energy Conservation Code (IECC) standard in effect at the start of the year that is two years prior to the year the materials or systems are placed in service. For example, materials or systems placed in service in 2025 must meet the criteria established by the IECC standard in effect on January 1, 2023, to qualify for the Energy Efficient Home Improvement Credit in 2025.

- Electric or natural gas heat pumps, electric or natural gas heat pump water heaters, central air conditioners, natural gas or propane or oil water heaters, natural gas or propane or oil furnaces or hot water boilers: must meet or exceed the highest efficiency tier (not including any advanced tier) established by the Consortium for Energy Efficiency (CEE) that is in effect as of the beginning of the year in which the property is placed in service. See also the CEE Directory of Efficient Equipment for a searchable database of qualifying equipment.

- Oil furnaces or hot water boilers can alternately qualify if they (1) meet or exceed 2021 Energy Star efficiency criteria and are rated by the manufacturer for use with fuel blends at least 20 percent of the volume of which consists of an eligible fuel; or (2) if placed in service after December 31, 2026, achieves an annual fuel efficiency rate of not less than 90 and is rated by the manufacturer for use with fuel blends at least 50 percent of which consists of an eligible fuel.

- Biomass stove or biomass boilers: must have a thermal efficiency rating of at least 75% (measured by the higher heating value of the fuel). – Not sure if anyone else needs to know, but I didn’t until I was schooled by a client…. a “biomass stove” means a wood or other burning fireplace.

- Panelboards, sub-panelboards, branch circuits, or feeders: must be installed according to the National Electric Code and have a load capacity of 200 amps or greater.

Q2. What energy efficiency requirements must be met to qualify for the Residential Clean Energy Property Credit? (added December 22, 2022)

A2. The following energy efficiency requirements must be met to qualify for the Residential Clean Energy Property Credit:

- Solar water heating property: must be certified for performance by the non-profit Solar Rating Certification Corporation or a comparable entity endorsed by the government of the State in which such property is installed.

- Geothermal heat pump property: must meet the requirements of the Energy Star program which are in effect at the time that the expenditure for such equipment is made.

- Battery storage technology property: must have a capacity of 3 kilowatt-hours or greater.

If we replaced our AC unit this year and we, did it in 2004 and took the full credit then, are we still allowed this new time frame of credit?

Yes, this is a new law.

A home is constructed, and you move in during January. You make an expenditure in September of that year. Would the expenditure count toward credit?

Depends, everything is new. The expenditures under the Residential Clan Energy Credit listed just above would be available for the credit. As for doors or windows, since it is a new home no.

Is the principal residence for purposes of claiming energy credit defined by what state the taxpayer files their income tax return? In other words, if a taxpayer is a snowbird (spending time 50% in each), is it the state we file state income tax return in?

If you own one home and live in it, it’s going to be classified as your primary residence. But if you live in more than one home, the IRS determines your primary residence by: Where you spend the most time. Let’s get real here there are 365 days in a year, and no one really measures 50% they come and go as they please.

If the vehicle is owned by S Corp, and sells to an owner, can the owner claim the credit?

No, the vehicle must be bought from a dealership not a personal sale.

If you have received insurance proceeds due to hail damage, do you reduce the costs that qualify for the energy credit? Hail damage to house, received insurance proceeds, had to install new windows, siding, roof, do you have to reduce the costs of the windows, etc. by the amount of insurance proceeds received to qualify for the energy credit?

I assume this was not in a qualified disaster area. Yet it was a disaster for the client. This is not easy as you should follow the casualty loss rules. Review Publication 547 to calculate the loss. If you receive insurance or other type of reimbursement, you must subtract the reimbursement when you figure your loss. To fully address this issue, we would need more information.

Was a disaster loss taken on the client’s tax return?

FMV of home before or after disaster calculated?

How would you allocate losses to each asset?

Provide more specifics to Claudine via email and I will call you.

Can the title of the vehicle be in the name of the partnership or S Corp and the partner or shareholder still take the clean energy vehicle credit? Tough question. Please get it titled in the correct name.

Looking at the draft of instruction to Form 8936 – Qualified Commercial Clean Vehicle Credit (Including Instructions for Schedule 1 (Form 8936-A), Qualified Commercial Clean Vehicle Credit Amount) – it states: Partnerships and S corporations must file this form to claim the credit. All other taxpayers are not required to complete or file this form if their only source for this credit is a partnership or S corporation. The amount will be shown on Schedule K. Then will be shown in the CREDITS box on the K-1.

Reg-1200080-22 states: Proposed § 1.30D–4(c)(2) would provide that in the case of a new clean vehicle placed in service by a partnership or S corporation, while the partnership or S corporation is the vehicle owner, the § 30D credit is allocated among the partners of the partnership under § 1.704–1(b)(4)(ii) or among the shareholders of the S corporation under §§ 1366(a) and 1377(a) of the Code and claimed on the tax returns of the partners or shareholder(s). Proposed § 1.30D–4(c)(3)(i) would provide that in the case of a new clean vehicle placed in service by a partnership or S corporation, the name and tax identification number of the partnership or S corporation that placed the new clean vehicle in service should be listed on the seller’s report pursuant to § 30D(d)(1)(H).

Do they need to own the vehicle the entire year? I have a client whose Tesla burned to the ground.

The guidance we currently have does not address how long the vehicle must be owned or if recapture applies. EV Tax Credit Recapture.

- 30D(f)(5) provides that the Treasury Department and IRS will issue regulations providing for recapturing the benefit of any Section 30D EV tax credit allowable with respect to any EV which ceases to be eligible for such credit. The proposed regulations do not cover recapture of the Section 30D EV tax credit. Although the Treasury Department and the IRS asked the public for comments on recapture, the proposed regulations do not include rules on recapture and do not include a statement as to when such rules would be issued.

Can you still take credit for installing a charging station in home without an electric vehicle?

Essentially, if you install a home EV charging station, the tax credit is 30% of the cost of hardware and installation, up to $1,000. Also, beginning this year (i.e., 2023), the EV charger tax credit for business and home installations applies to other EV charger equipment like bidirectional (i.e., two-way) chargers.

To claim the federal tax credit for the home EV charger, or other EV charging equipment, file Form 8911 with the IRS when you file your federal income tax return. You will need your receipts that show the purchase price of the EV charger and any fees for installation of the charger.

You will also need to know your tax liability for the year that you’re claiming the credit. That’s because the EV charger tax credit is subtracted from any federal tax that you might owe on that year’s return.

Also, the EV charger tax credit isn’t refundable, so you won’t receive cash back as a result of claiming the credit.

For a daycare, the energy credit is limited to the percentage of personal use of the house.

May a taxpayer claim a credit if the qualified property is also used for business purposes, such as in a dwelling unit in which the taxpayer also conducts a business? (added December 22, 2022)

A3. For both credits, if a taxpayer uses property solely for business purposes, the property will not qualify for the credit. A taxpayer who qualifies for the credits and whose use of the qualified property for business purposes is not more than 20 % may claim the full credit.

For a taxpayer who otherwise qualifies for the credits, but whose use of the qualified property for business purposes exceeds 20 %, the taxpayer must calculate the amount of credit by including only that portion of the expenditures for the property that are properly allocable to use for nonbusiness purposes.

Does this credit cover hybrids or fuel cells only?

https://www.fueleconomy.gov/feg/tax2023.shtml

Go to this website to get a list of vehicles that qualify for the credit.

It says First Qualified Buyer since August 2022. If the vehicle is older and had changed hands PRIOR to 2022 would the first buyer during the qualified period still get the credit or are they ousted because of multiple previous owners?

The vehicle cannot be more than 2 years old to qualify. The first owner would get the credit. The second owner may qualify for a used vehicle credit if the vehicle is no more than 2 years old. Once the vehicle is sold for the 3rd time, there is no credit available.

Had to replace our HVAC system this year: Trane XL20i, highly efficient heat pump, $18,000 – killer costs. I think we qualify for the $2,000 credit due to the heat pump.

Sounds like you would qualify! Heat pump = lessor of 30% of cost or $2,000.

Is the energy credit available if only the glass of a window is replaced? Replacement glass is energy efficient.

Paul, I have not seen anything on this, honestly. But if I look at this logically, glass alone should qualify. That’s the actual window – the rest is called a “window frame”! This assumes that logic applies to taxes, which is obviously debatable!

What about energy home credits for employee lodging owned by C Corporation?

If owned by a corporation, I am guessing this would come under business energy credits. Business energy credit has no provisions concerning windows in a business owned home.

Business owners have an opportunity to save on energy costs and contribute to a sustainable future through a range of enticing tax credits. First, by transitioning to low-cost solar power, businesses can benefit from a tax credit that covers 30% of the expenses incurred during the transition. This tax credit will begin to phase out in 2033, eventually being reduced to 0% by 2035.

Moreover, businesses can receive a tax credit of up to $5 per square foot for implementing energy-efficient improvements that lower utility expenses, offering both environmental and economic advantages. The credit amount per square foot increases if the business meets certain prevailing wage and apprenticeship targets. Examples include upgrading lighting systems, improving insulation, and installing high-efficiency HVAC systems. You can also opt for an energy audit by a professional or use a checklist to begin the process with your maintenance manager.

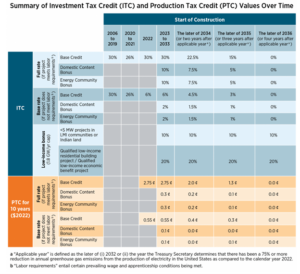

There are two tax credits available for businesses and other entities like nonprofits and local and tribal governments that purchase solar energy systems.:

- The investment tax credit (ITC) is a tax credit that reduces the federal income tax liability for a percentage of the cost of a solar system that is installed during the tax year.

- The production tax credit (PTC) is a per kilowatt-hour (kWh) tax credit for electricity generated by solar and other qualifying technologies for the first 10 years of a system’s operation. It reduces the federal income tax liability and is adjusted annually for inflation.

Project owners cannot claim both the ITC and the PTC for the same property, although they could claim different credits for co-located systems, like solar and storage, depending on what further guidance is issued by the IRS. Other types of renewable energy and storage technologies are also eligible for the ITC but are beyond the scope of this webpage.

Solar systems that are placed in service in 2022 or later and begin construction before 2033 are eligible for a 30% ITC or a 2.75 ¢/kWh PTC if they meet labor requirements issued by the Treasury Department or are under 1 megawatt (MW) in size.

- 1031 Like Kind Exchange

Larry mentioned using an expert on handling 1031 Exchanges for a Client??? Who is it we can refer our client to?

IPE 1031 in Des Moines

6150 Village View Dr #113, West Des Moines, IA 50266

(515) 279-1111

- 174 Research Credit

Why was there not more reaction regarding capitalization of the 174 expenses? I had a client that had R & D credit and now had to capitalize the expenses used for this. Cost the client over $880,000 in taxes and they are a small business! What are odds of § 174 required capitalization starting in 2022 being reversed? There is bi partisan however not sure it has a chance.

Are you talking about IRS guidance? There was a tremendous reaction, however Congress did nothing. We should promote research and development. Who performed their R&D study?

New § 174 guidance addresses disposition, retirement and abandonment of SRE property. Notice 2023-63 specifically addresses how taxpayers should treat unamortized specified research or experimental (SRE) expenditures when a corporation ceases to exist.

The Notice also explains how taxpayers should treat SRE expenditures when the property for which they were paid or incurred (SRE property) is transferred in certain transactions.

Taxpayers can rely on this guidance for tax years beginning after December 31, 2021.

Significant questions remain about how SRE expenditures should be treated in transactions not specifically addressed in the Notice, including divisive reorganizations under §§ 368(a)(1) and 355.

Significant questions also remain about how transactions including SRE expenditures are treated within a consolidated group and how provisions affecting the treatment of corporate attributes (e.g., IRC § 382) apply.

Many issues surround this, in my opinion the changes were made due to increased activity with R&D Credit mills and many businesses not really qualifying for the credit, but IRS does not have the manpower to audit, so they changed the rules. I do not think there is much chance of changing in the future.

Premium Tax Credit/Health Insurance

I have some small employers finding it is better to reimburse employees for marketplace health than to have employer group health plan. Have not done it yet, just considering as a cheaper option for both the employer and the employee to get their health insurance. Is the reimbursement taxable income to the employee or just a reimbursement?

Fully taxable.

Is the employer deducting as a fringe. How does he know what to pay? I would not do this; it is a can of worms. There is a problem with this due to the premium tax credit the taxpayer gets a credit for marketplace insurance, and we need to reconcile on Form 8962.

Getting an Employer Identification Number

I’ve been in business for over 30 yrs. and IRS won’t issue me a FEIN# to efile w-2’s? What can I do?

If you are an employer, you would have to file Form 941 and W-2’s and have a need of a FIEN. So, I assume you are asking why I can’t get a FEIN to file my clients Forms W-2s. The employer needs the EFIN in order to report wages and issue W-2’s. Tax preparers then generally use a third party to file the W-2’s and 941’s. Unless you are an employer or need a FEIN for other tax purposes you cannot get one. You may be issued a FEIN for bank purposes, but that generally will not allow you to file your client’s W-2’s unless you use a third party. The client uses their FEIN when filing W-2’s.

Look at the SSA Business services, using this system you would need your client permission to file the W-2/W-3 and you would need a separate account for each business which means keeping track of password and usernames.

https://www.ssa.gov/employer/

Farming Issues

What are farm inputs?

The resources that are used in farm production, such as chemicals, equipment, feed, seed, and energy.

Are Pre-paid for specific amount of NH3 to be put on the field after the first of the year. but they haven’t taken “delivery” because they were also going to have the co-op do the application.

The amount of prepaid expenses that can be deducted is generally limited to 50% of the total of all other deductible farm expenses including depreciation for the year. The 50% limit can be exceeded if one of the following exceptions are met:

- There is a change in business operations caused by unusual circumstances.

- You met the 50% test in the prior three years.

- The prepayment must have a business purpose and not be solely to avoid paying taxes, such as obtaining discounts or securing quantities.

The deduction of the prepaid expenses does not result in a material distortion of the taxpayer’s income for the year. The material distortion test should be met if the inputs are used within 12 months of their purchase. This is the rule. If they meet this rule, they should be ok”

So, if he took the deduction in 2021 for the pre-payment and passed away prior to the application of the Fertilizer this spring then the wife would get the step-up in basis.

Yes, you got it.

Advertising/Promotion

What would be the tax definition for promotion to add into advertising?

Advertising is an audio or visual that reaches your target audience and explains what your business does. You might advertise your business through:

- Newspapers, magazines, TV, and radio

- Flyers, brochures, and business cards

- Email marketing, social media, and your website

Many advertising strategies highlight an issue and offer a solution through the company’s products or services. For example, an advertisement for a lawn mowing service could show a person’s cat getting lost in their high grass.

Promotions, on the other hand, can be a little different than advertisements. Promotions include events, activities, sales, or anything that creates awareness for your business. Unlike an advertisement that shows off your business’s offerings, a promotion tries to get customers in the door by providing something. Let’s say you put coupons for your business in your local newspaper. These coupons promote your business by giving customers something of value.

A promotion expense is a cost companies incur to market their products or services to consumers. Promotion expenses range from giveaways, free samples, or other promotional gimmicks in order to help boost sales and revenue. Companies can write these costs off as a tax-deductible business expense.

Partnerships/LLC’s

If a 1065 corporation partner leaves, how will they file the tax return the following year? I assume you mean a partnership with 2 partners is that correct not a corporation???? Yes

If one partner has left the partnership has to be dissolved and a final return filed for that year. If the business is continuing with a sole owner Sch C, the sole owner does he want to be a corporation? If so, need a new EIN# and form the corporation. 26 CFR § 1.358-7 – Transfers by partners and partnerships to corporations.

Does an LLC become a Sub-S corporation if the CPA filed an 1120-S, without ever officially changing the form of the LLC to a Corporation? The intent of the LLC was not to be an S Corp, the CPA just filed the 1120-s instead of a 1065. I could not convince the CPA that he was wrong. The CPA did, but it was not the intent of the LLC. He did it for his convenience! Thus, it appears this cannot be corrected without having a negative effect on the LLC.

An LLC can elect to be treated as an S Corp if a Form 2553 is filed and then notify the state of the change. It can also be a partnership, but you need 2 people for a partnership or more – was it a one member LLC?

2 member LLC When the EIN is applied for the entity is elected – if the CPA made it an S Corporation, he would have id’d it as a corporation when getting the EIN, then the partners would have had to filed and sign a Form 2553. Apparently, the partners did not know what they were filing.

Corporate Transparency Act

Any input about LLC reporting to government.

They will have to file a report with FINCEN. We are developing a questionnaire, intake sheet, changes to the engagement letter and a letter to client about the requirements to report certain changes to FinCen. Look forward to seeing them at our year-end seminars.

Can you repeat the name of the small entity guide you discussed?

Small Entity Compliance Guide BOI Reporting Requirements. FinCen website, Small Entity Compliance Guide – BOI Reporting Requirements. The link to the FinCen Guide that AJ Referred to: https://www.fincen.gov/sites/default/files/shared/BOI_Small_Compliance_Guide_FINAL_Sept_508C.pdf

If an accountant does not draft the corporate transparency form, isn’t the chance the accountant will lose the client close to 100%?

If you do not tell the client about the CTA, you may well lose the client. There is a new wrinkle that has come about recently, there is an argument that the CTA gathering of information could be “practicing law” and outside the range of an accountant or a tax professional. That is currently being discussed across the nation. Each state bar association could make a decision on this issue, which means that each could handle this issue differently. This is a moving target. We will do our best to keep you updated in 2024.

Information from Larry

What was the tax resource website Larry referenced? Tax Advisor

Fringe Benefits and Commuting

If a company car is given to an employee, is this a form of compensation? Under IRS general rules, all use of a company car is considered personal use unless the employee documents the business use of the car. Personal use of a company vehicle generally results in taxable wages for the employee.

What Does “Personal Use of Company Vehicle” Mean?

Personal use of a company vehicle for non-work-related purposes is a taxable perk known as a de minimis fringe benefit. Examples of using a company vehicle for personal use includes:

- Your employees commute between home and work, if it is on a regular basis.

- Trips unrelated to your organization’s purpose, work, trade, etc.

- Use on a vacation or on the weekend.

- Use by someone other than an employee of your company.

Infrequent personal usage of an employer-provided vehicle is typically deducted from an employee’s salary.

How Do I Account for the Personal Use of a Company Vehicle?

The value of personal use of a company vehicle must be reported as income at least once a year. There are four methods for how you report use of a company vehicle:

General Valuation Method

The general valuation method is determined by the cost an individual would incur to lease the same vehicle under the same terms in the same geographic area.

Annual Lease Value Method

To use the lease value rule, multiply the annual lease value of the car (via the IRS Annual Lease Value table) by the percentage of personal mileage driven. This will give you the Fair Market Value (FMV) of the employee’s personal use of a company-provided vehicle.

As a note, the amount determined from the table includes the value of maintenance and insurance for the vehicle, but not the value of employer-provided fuel. Federal tax laws stipulate that employer-provided fuel must be valued separately.

Cents-Per-Mile Method

Using this method, the FMV is determined by multiplying the IRS standard business mileage rate by the number of personal miles driven.

Two conditions must be met for you to use this method:

The vehicle must be driven at least 10,000 miles annually.

The maximum FMV of a vehicle for use with this method is $56,100 in 2022 and $60,800 for 2023.

Commuting Value Method

With the commuting valuation rule, the value is calculated by multiplying the number of trips by either $1.50 (one way) or $3 (round trip). However, there are several conditions that must be met to use this method:

The vehicle is owned or leased by you and provided to your employee for use in conjunction with your business.

You require your employee to commute to and/or from work.

You have a written policy prohibiting your employees (and their family) from driving the vehicle for personal use other than commuting to and from work. Further, you enforce this policy.

Is a corporate officer earning at least $120,000 or more?

Earned at least $245,000 or more.

Owns 1% or more equity, capital or profits interest in the business.

An elected official.

How Do I Calculate Personal Use of a Company Vehicle?

Here are a few more helpful tips when you are determining which method to use to calculate the use of a personal vehicle according to company car tax rules:

If you use the cents-per-mile or annual lease valuation method, you must use it for all subsequent years you provide a vehicle to an employee.

The same special valuation method does not have to be used for all company-provided vehicles or for all employees comprising your team.

If you have one company-provided vehicle that is used by multiple employees, you must use the same valuation method for all employees using that vehicle.

How Do I Report Personal Use of Company Vehicle for Year-End Tax Planning?

Employee personal use of a company vehicle is reported on Form W-2 in boxes 1, 3, 5 and 14 and on Form 941 on line 2, 5a and 5c. You also need to watch if your state reports these wages in box 16.

Why is Calculating Personal Use of Company Vehicle Important?

The personal use of a company-owned automobile is considered part of an employee’s fully taxable wage income and proper documentation is vital. If you cannot determine business versus personal use, the value of the vehicle would be 100% taxable to the employee for both types of usage. It is important to get this reporting accurate, so your employee’s taxes (and yours) are correct come year-end planning time.

Can you please clarify what commuting is for construction workers?

Roofing company has a business owned pick-up truck driven by an employee. Yes, it has some tools being carried, but the employee also uses it as their personal vehicle, too. My position has been 1st & last trip of the day -> commuting.

See above information on Fringe Benefits and Commuting.

Hobby or a Business

I saw earlier that dog breeding was on the hobby list but is there an income amount at which it become a reportable business? I have a client that breeds dogs for police/military and brings in around 100k per year before expenses, it’s their main source of income Clearly not a hobby. This was an example of businesses that could be hobbies.

There is always an exception to the rule, and you are correct that sometimes this kind of business really is business. But in my experience generally, people will race cars, raise dogs, horses and do crafting as a hobby but want the deduction for losses again generally when there really is not a business, but personal pleasure comes into the equation. The TCJA took away miscellaneous itemized deduction subject to the 2%. That law will expire at the end of 2025. There comes a time after a series of losses that you must have that talk with you client about a “hobby.”

Meals and Entertainment

At one point, I thought the IRS did NOT accept food from a “vending machine” or a “gas station” as a deductible meal. Is that still the case? With some of these mega-gas stations, they are also offering food. So, is it just a “gas station” or is it a “restaurant”?

Food and beverages will be 100% deductible if purchased from a restaurant in 2021 and 2022. This applies to filing your taxes in 2023. But for purchases made in 2023 onwards, the rules revert back to how they were defined in the Tax Cuts and Jobs Act. This means purchases at restaurants are no longer 100% deductible.

What about office meals? What % is deductible?

50% generally. All food and beverages, regardless of whether characterized as meals or snacks and regardless of whether treated as de minimis fringes that are not taxable to the employee, are generally subject to the 50% deduction limitation by the business [Reg. 1.274-12(b)(1)].

What if meals are provided by sales reps to the customer’s office staff? What % is deductible?

I feel like they should be 100% deductible, however I believe 50% is the law.

Retirement

If a taxpayer is receiving RMD’s from an IRA, then passes away and an adult child inherits the IRA as a named beneficiary, can the child wait 10 years to close out the IRA, or is the child required to withdraw a minimum amount each year for 10 years, then the balance in the 10th year?

’We are assuming with this question one assumption – the adult child is a “non-eligible beneficiary” (i.e., most children and grandchildren, elimination of stretch IRA option and other individuals > than 10 years younger than the account owner are subject to the new 10-year distribution rule) and the death of the owner is after 12/31/2019. The answer is the adult child must continue RMDs in the calendar year after the death of the IRA owner.

The 10-year rules work as follows –

- Full liquidation by end of 10th year after year of death

- Decedent in RMD status –

- RMDs required.

- Single life table (using the most favorable factor in Table 1 for the owner or the non-eligible beneficiary)

- Non-recalculation method (i.e., the one minus rule applies). For example, the owner dies in 2023. The adult child’s single life factor is 40. The adult child will use 40 in 2023, 39 in 2024, 38 in 2025, so on and so forth….

- Notice 2022-53 – No penalty for failure to take RMDs in calendar year 2021 and 2022 for deaths of owners after 12/31/2019.

- Notice 2023-54 (7/14/2023) – No penalty for failure to take RMDs in calendar year 2023; IRS hopes to have RMD distribution rules finalized with calendar year 2024 RMD distributions.

Does the 529 to Roth figure adjust for Inflation over time or will that $35,000 figure remain locked in subject to future legislation?

The lifetime limit for rollovers is $35,000. There is no inflation adjustment contemplated in the SECURE Act 2.0 legislation.

From Larry’s Discussion: In 2024 clients can convert 529 Plans to Roth IRA. Is this a one-time conversion or can you convert each year?

It is a one-time conversion to the extend you are limited to $35,000 of IRC §529 rollover contribution to the ROTH IRA. However, you may have a time limit at the front (15-year life of the IRC §529) and a back loading restriction for contributions made in the last five years (plus earnings) are not available for the ROTH IRA rollover.

Is there a lifetime maximum that can be converted?

There is a maximum lifetime limit of $35,000; however, it will take time because of the $7,000 limit, the wages, salary, earnings requirement, and any other ROTH contribution make in a year the taxpayer is attempting to rollover an IRC §529 assets.

Clarification – Does a non-eligible designated beneficiary have to withdraw the inherited IRA during the 10-year period?

If the owner reached their “Required Beginning Date” (RBD) at the time of their death, then RMDs must continue (waived for 2021, 2022, and 2023). Distribute using Table I –

- Use younger of

- Beneficiary’s age or

- Owner’s age at birthday in year of death

- Determine beneficiary’s age at year end following year of owner’s death.

- Reduce beginning life expectancy by 1 for each subsequent year.

- Can take owner’s RMD for year of death.

If the owner did not reach the “Required Beginning Date” –

- Take entire balance by end of 5th year following year of death, or

- Distribute based on Table 1 –

- Use beneficiary’s age at year-end following year of owner’s death.

- Reduce beginning life expectancy by 1 for each subsequent year.

Or can they wait until year 10 to withdraw the entire amount?

No, they cannot wait until year 10 to withdraw the entire amount!

Inventory

So, if you do not do inventory and cogs is high, do I still put it on the cogs section or line item under other expense.

You can use either one. By using COGS, it gives you a better chance to make business decisions. If it is other expenses, they are all grouped together. Think of the front of Schedule C as overhead and the COGS for just what it is Total Cost of all items put into the product you are selling.

Post Office Date/Return Received/Mailbox Rules

Is it true the IRS only recognizes the US Postal Service as date of post office receiving item same as date IRS received items. When the IRS receives one of the approved delivery services such as Fed Exp it is deemed filed.

Prior to the enactment of § 7502(a) in 1954, forms needed to be physically delivered to the IRS to be considered timely filed. It is sometimes referred to as the “mailbox rule,” meaning that forms mailed on or before the last day for filing, but physically received by the IRS after the last day for filing, will be deemed timely filed.

Congress also enacted § 7502(f), which treats certain private delivery services as equivalent to the Postal Service if the following requirements are met:

- The delivery service is available to the general public;

- It’s at least as timely and reliable on a regular basis as the Postal Service; and

- It records electronically to its database (kept in the regular course of its business) or marks on the cover the date on which an item was given for delivery.

Rather than forcing taxpayers and tax practitioners to speculate which private delivery services would meet these ambiguous qualifications, the IRS published a list of designated private delivery services in Notice 2016-30, which considers the following as equivalent to the Postal Service:

FedEx

First Overnight

Priority Overnight

Standard Overnight

2 Day

International Next Flight Out

International Priority

International First

International Economy

UPS

Next Day Air Early AM

Next Day Air

Next Day Air Saver

2nd Day Air

2nd Day Air AM

Worldwide Express Plus

Worldwide Express

DHL

Express 9:00

Express 10:30

Express 12:00

Express Worldwide

Express Envelope

Import Express 10:30

Import Express 12:00

Import Express Worldwide

Taxpayers should still exercise caution when using a designated private delivery service, since only certain services are able to invoke the mailbox rule. For example, if a taxpayer used FedEx Ground, it would not be eligible.

But what if the filing is lost in transit or never received by the IRS? Unfortunately, the burden of proof for the mailing date falls on the taxpayer if there was no physical delivery. However, § 7502(c), known well by practitioners who prefer the Postal Service, holds that a form sent via Postal Service registered or certified mail will be prima facie evidence that the form was delivered to the IRS, and the date of filing will be the postmark date. The prima facie evidence rule applies to a designated private delivery service as well, as laid out in Reg.301.7502-1(e)(2)(ii).

Proof of filing is the exclusive means to establish prima facie evidence of physical delivery, regardless of whether a taxpayer uses the Postal Service or a designated private delivery service. Extrinsic evidence cannot be used as prima facie evidence to prove that the form was timely filed. As discussed in PLR 201442015, even affidavits from an accounting or law firm will not be considered prima facie evidence that such form was delivered to the IRS.

It does not matter if forms are mailed via Postal Service or a designated private delivery service, because both could qualify for benefits of the mailbox rule if the IRS physically received the form, and for prima facie evidence rules if the IRS never physically received the filing.

Statutory Employees

Can someone request to be a statutory employee if the company is not currently reporting it that way?

No, you have to fall into one of four categories and meet three conditions described under SS and Medicare. see irs.gov and keyword search Statutory Employees.