Section 199A and the 20% Deduction: What You Need to Know

In December of 2017, President Donald Trump signed into law the most sweeping tax reform that we’ve seen in decades. Passed by both the House and the Senate, the new tax law — known as the Tax Cuts and Jobs Act — included changes to a wide range of IRS rules and regulations, impacting corporations, small business owners, and individual taxpayers alike.

Amongst the significant changes made to the tax code was the introduction of section 199A, a regulation which deals with the deduction of qualified business income for sole proprietorships, partnerships, S corporations, trusts, or estates.

This new tax law has received considerable attention in the press. As a certified public accountant (CPA), enrolled agent (EA), or professional tax preparer, there’s a good chance that some of your clients will have questions for you about section 199A and the so-called “20% deduction.” It’s essential that you brush up on your knowledge of this and other changes to the tax code in preparation for the 2019 filing season, as your clients will be counting on you to maximize their potential deductions under the changes that have been introduced as part of the new tax law.

In this blog post, we’ll take a closer look at what exactly section 199A entails for a variety of tax filers. We’ll offer some necessary background information, explain the new tax law in detail, and provide answers to some questions that are commonly asked about section 199A and the 20% deduction. We’ll also offer some example scenarios to demonstrate how section 199A and the 20% deduction can be put to use in real life tax situations.

That said, it would be impossible to cover everything you need to know as an accounting or tax professional in a single blog post. For this reason, we highly recommend signing up for and attending a tax webinar related to the new tax law. Section 199A is just one important part of the comprehensive changes and updates that have been made to the tax code, and you’ll need to invest some of your annual CPE hours into tax reform webinars and seminars if you want to ensure that you’re fully up to speed in terms of tax reform.

Ready to learn more? Let’s get started!

What Is Section 199A?

Amongst the numerous alterations and updates that were made to the federal tax code as part of the new tax law introduced in December 2017, one important change is the addition of section 199A. This section of the tax code deals with a new 20% deduction of qualified business income for non-corporate taxpayers, including individuals, estates, non-grantor trusts, and pass-through entities such as S corporations, partnerships, LLCs, and sole proprietorships.

How Does Section 199A Work?

The general idea behind section 199A is to allow a 20% deduction for qualified business income in specific tax situations. Accordingly, the section 199A deduction for qualified business income (QBI) can be understood as being comprised of two parts.

First, any eligible taxpayer may be able to deduct up to 20% of their QBI from the operation of a domestic business. This business must exist as a sole proprietorship, partnership, LLC,

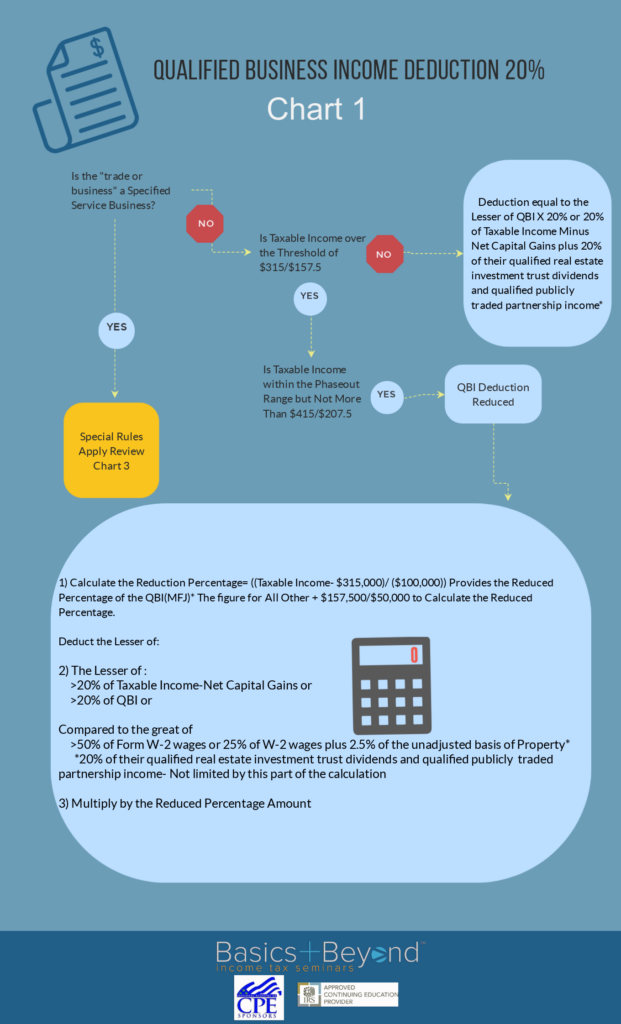

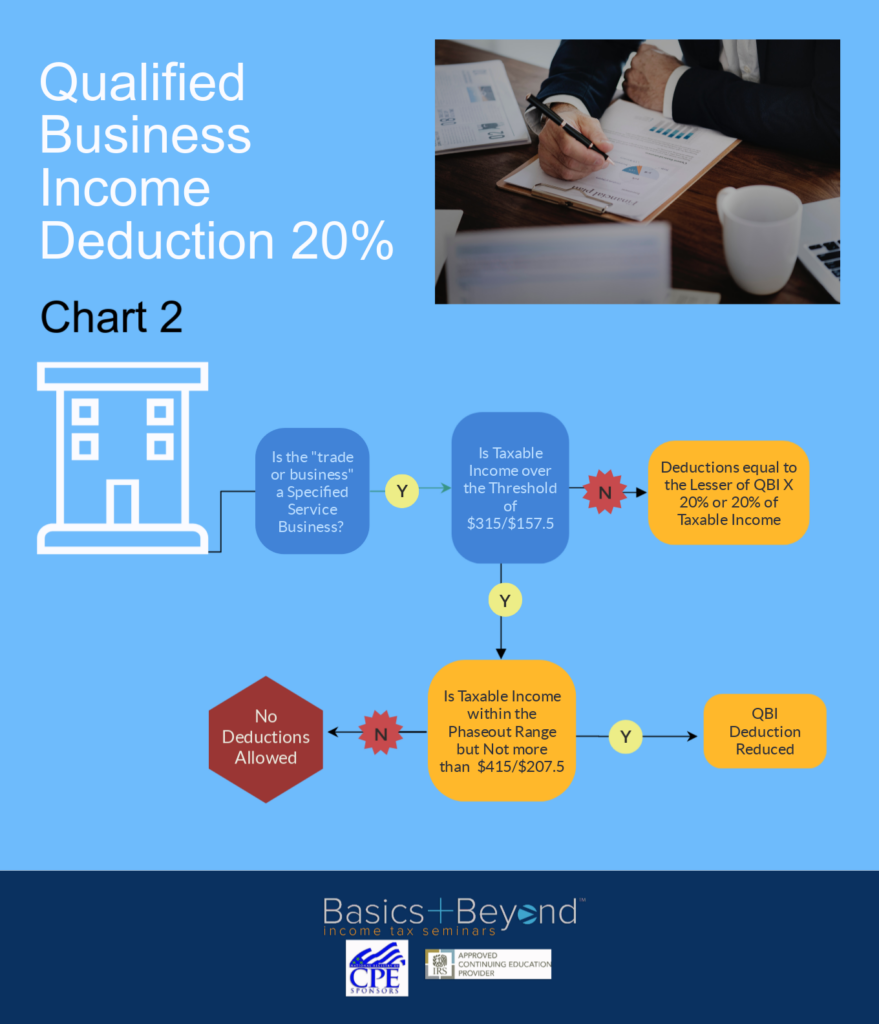

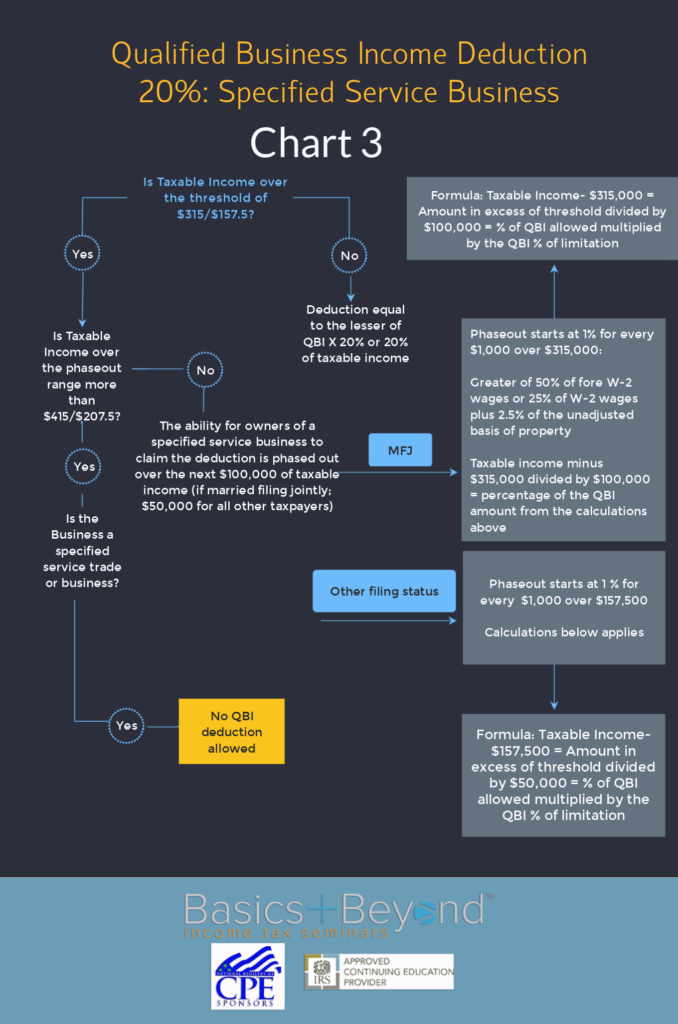

S corporation, trust, or estate. In other words, it’s not possible to use section 199A and the 20% deduction in the case of a C corporation. There are limitations placed on the deduction in accordance with a taxpayer’s total income as well. If a taxpayer who is married and filing a joint return with an income of more than $315,000 (or for single taxpayers filing with more than $157,500 of total income), the deduction is limited based upon:

- The type of business engaged in

- The total taxable income of the taxpayer

- Any and all W-2 wages paid out by the business

- The unadjusted basis immediately after acquisition (UBIA) of certain property owned by the business

It is also worth pointing out that in addition to C corporation income, any income earned via services provided as an employee is not eligible under section 199A for a 20% QBI deduction.

The other important aspect of section 199A relates to a deduction that’s connected with real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) earnings. If you are an eligible taxpayer, you may be able to deduct up to 20% of your combined REIT dividends and PTP income under section 199A. Unlike the deduction of qualified business income via a pass-through entity, there is no limitation here related to W-2 payments or the UBIA of certain types of business property.

What Counts as Qualified Business Income?

By now, you’ve probably noticed that section 199A only applies for so-called “qualified business income.” But what exactly is QBI? What counts as QBI, and what doesn’t?

Generally speaking, qualified business income is the net total of all of the combined income for a business, including gains, losses, deductions, and actual income. Any items falling under the “taxable income” heading is generally included.

However, there are some important exclusions that should be taken into consideration when calculating qualified business income. First of all, it’s important to keep in mind that only those income items which are connected to a domestic business or trade are eligible. In other words, the income in question must be related to a U.S. business in order to qualify for a section 199A deduction. Additionally, other income items — such as dividends, interest income, capital gains, and so on — are not eligible to be counted as qualified business income.

What Kinds of Items Don’t Count as Qualified Business Income?

For the sake of clarity, it’s helpful to list all of the types of income items which cannot be included as qualified business income. In brief, these are:

- Capital gains and losses (including both short-term and long-term capital gains)

- Dividends and interest

- Qualified real estate investment trust (REIT) dividends

- Qualified publicly traded partnership (PTP) income

- Interest income that cannot be allocated to a particular business or trade

- Gains in excess of losses from various commodities transactions which do not occur as part of the ordinary course of business

- Any foreign currency gains in excess of foreign currency losses

- Net income derived from notional principal contracts

- Any amounts coming from an annuity which are unrelated to the ordinary course of business

- Reasonable compensation paid to the taxpayer by the business for services rendered

- Guaranteed payments made to a partner for services rendered

- Payments as laid out in IRC §707(a) to a partner for services rendered

How Do We Compute the Qualified Business Income Deduction?

Assuming we now have a handle on what the QBI deduction is, what types of income can be included, and what sorts of income must be excluded, this raises the question: how exactly do we compute the qualified business income deduction according to the new tax law?

When computing QBI, you use the lesser of two separate values:

- 20% of the total QBI amount (meaning the net total QBI from all trades or businesses, including the share of QBI from trades or businesses conducted by relevant pass-through entities), plus 20% of aggregate real estate investment trust (REIT) dividends and qualified annual publicly traded partnership (PTP) income; OR

- 20% of all taxable income (including reductions from capital gains)

The lesser of these two values is used for computing QBI.

There are a few important things to note when it comes to determining QBI under the new tax law and section 199A. First, keep in mind that the QBI deduction is applied in computing taxable income. This is different from aggregate gross income. Additionally, remember that the 20% deduction under section 199A is available to individual taxpayers regardless of whether or not they opt to itemize their deductions. Further, it’s worth pointing out that if the net total qualified business income is less than zero, and/or if the qualified PTP and REIT income and dividends are less than zero, then each net category loss is applied separately to the follow year’s total QBI on the one hand and aggregate REIT dividends and qualified PTP income on the other.

Limitations to Section 199A and the 20% Deduction

As mentioned above, there are limitations related to section the 20% deduction depending upon a taxpayer’s total income and the W-2 wages paid out by a business.

If a single taxpayer earns less than $157,500 per year in taxable income (or $315,000 for a couple married and filing jointly), there is no wage, property, or trade of business limitation to consider. Section 199A and the 20% deduction will work as outlined above.

However, the limit on the deduction phases in when an individual taxpayer earns between $157,501 and $207,500 (or when a couple married and filing jointly earn between $315,001 and $415,000). Meanwhile, when taxable income exceeds $415,000 for couples married filing jointly (or $207,600 for all other filers), there are strict limits on the section 199A deduction. Specifically, under these income circumstances, the QBI deduction cannot exceed either 50% of the W-2 wages of the business or trade in question, or 25% of the business’ W-2 wages plus 2.5% of unadjusted basis immediately after acquisition (UBIA) of qualified property used in the business — whichever of these two amounts is higher.

For these purposes, W-2 wages are those wages which were paid with respect to employment during the calendar year, and which were associated with the trade or business in question. Not included in these wages is any amount which was not included in a return filed with the Social Security Administration on or before the 60th date after the due date for that return.

What about unadjusted basis immediately after acquisition (UBIA) or qualified property? This applies only to personal and real tangible property, meaning that property which falls under the allowances for depreciation laid out in IRC §167. This property must have been held for use in a qualified trade or business at the end of the tax year in question; must have been used at some point during the tax year as part of the production of qualified business income; and cannot be associated with a depreciation period that ended before the close of the tax year in question. The depreciation period begins when the item in question is first placed in service, and ends either 10 years later or the last day of the full year in the applicable recovery period (see IRC §168 for more information).

Examples of Section 199A and the 20% Deduction

Before we wrap up, let’s consider a couple examples where the 20% deduction might be used in order to see how certain limitations might apply.

First, consider a situation where the taxpayer in question is married, has a taxable income of $200,000, and a QBI of $150,000. To begin, we calculate the potential QBI deduction as $30,000 (20% of $150,000). Given that the taxpayer’s income of $200,000 falls below the $315,000 threshold for married taxpayers filing jointly, no limitation is placed on this taxpayer’s deduction under section 199A. So, the taxpayer can deduct the full $30,000.

Now, imagine that this taxpayer is married, has a taxable income of $200,000, and a QBI of $250,000. In this case, the 20% deduction would allow $50,000 to be deducted (20% of $250,000). However, as pointed out above, the 20% deduction under section 199A is the lesser of 20% of the total QBI plus 20% of aggregate REIT dividends and PTP income, or 20% of all taxable income. Since the taxpayer’s total taxable income is only $200,000 and 20% of this amount is $40,000, the maximum allowable deduction in this case under section 199A is $40,000.

New Tax Law Webinar

This is just one of a countless number of examples. Other factors such as W-2 wages, UBIA of qualifying property, and more complex taxable income scenarios can have a major impact on the calculation of the 20% deduction under section 199A.

Our goal here was to provide an overview of this change to the tax code. However, in order to fully understand this and other important aspects of the new tax law, we highly recommend signing up for a tax reform webinar. Here at Basics & Beyond™, we offer engaging, informative, and affordable tax webinars taught by knowledgeable experts in the field. As a NASBA-approved provider, you can rest assured that any CPE hours you obtain with Basics & Beyond are likely to qualify for your state’s educational requirements. Click here to sign up for a webinar today!