In This Issue:

- Chief Counsel Advice 202302011 – Loss for Crypto Due to Decline of Value

- Chief Counsel Advice 202302012 – Appraisal Needed for Donated Crypto

- Notice 2023-21, §6511- Limitations on Credit or Refund—Allowance of Credits and Refunds—Amount of Credit or Refund Filed Within 3 Years – Important

- Supreme Court: Non-willful FBAR Penalty Applies Per-Report, Not Per-Account

- IRS Charged Too Much to Issue, Renew PTINs

- Changes Coming Soon to SSA’s Business Services Online Portal

- IRS Issues Renewed Warning on Employee Retention Credit Claims

- IRS Begins Digitalization Efforts Starting with Forms 940 – IR 2023-41

- Werfel Begins Work as 50th IRS Commissioner

- Client Update: Retirees Who Turned 72 in 2022 Must Take RMD by April 1, 2023

- Scammers Offer to Help with Online Accounts

- Understand When IRS Personnel May Contact Your Client

- Form 1099-K Received in Error or with Incorrect Information

- IRS Issues Guidance, Seeks Comments on Nonfungible Tokens

- IRS SB/SE Examination Director Says Service Considering Eliminating Form 944

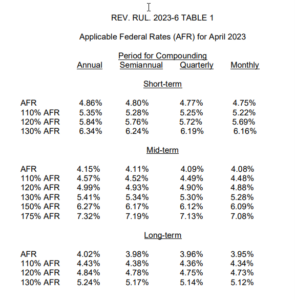

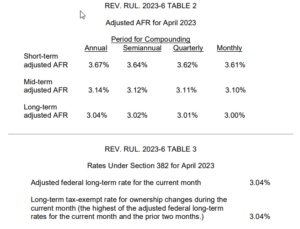

- Applicable Federal Rates for April 2023, Rev. Rul. 2023-6

Issue 1: Chief Counsel Advice 202302011 – Loss for Crypto Due to Decline of Value

Applicability of I.R.C. section 165 to cryptocurrency that has declined in value.

The Chief Counsel Advice responds to a request for non-taxpayer specific advice regarding the applicability of § 165 of the Internal Revenue Code (“Code”) to cryptocurrency that has substantially declined in value.

The document should not be used or cited as precedent.

Issue: § 165 of the Code provides for the deduction of losses sustained during the taxable year. If Taxpayer A owns cryptocurrency that has substantially declined in value, has Taxpayer A sustained a loss under § 165 of the Code due to worthlessness or abandonment of the cryptocurrency?

Conclusion: No. § 165 provides a deduction for losses that are evidenced by closed and completed transactions, fixed by identifiable events, and actually sustained during the taxable year. Taxpayer A has not abandoned or otherwise disposed of the cryptocurrency, and the cryptocurrency is not worthless because it still has value. Therefore, Taxpayer A has not sustained a loss under § 165 and the corresponding regulations. Further, even if Taxpayer A sustained a loss under § 165, the loss would be disallowed because § 67(g) suspends miscellaneous itemized deductions for taxable years 2018 through 2025.

In this case, Taxpayer A maintained ownership of Cryptocurrency B through the end of 2022, even though the value of each unit of the cryptocurrency as of the end of the year was less than one cent. Taxpayer A retained the ability to sell, exchange, or otherwise dispose of Cryptocurrency B during 2022. Furthermore, Taxpayer A continued to exert dominion and control over Cryptocurrency B and, regardless of intent, did not take any affirmative steps to abandon the property during 2022. Therefore, Taxpayer A did not sustain a loss pursuant to section 165(a) in 2022 due to abandonment.

Issue 2: Chief Counsel Advice 202302012 – Appraisal Needed for Donated Crypto

Qualified appraisal requirement for charitable contributions of cryptocurrency

The Chief Counsel Advice responds to a request for non-taxpayer specific advice regarding the applicability of § 170(f)(11)(C) of the Internal Revenue Code (“Code”) to charitable contributions of cryptocurrency.

The document should not be used or cited as precedent.

Issues 1. Is Taxpayer A required to obtain a qualified appraisal under § 170(f)(11)(C) for contributions of cryptocurrency for which Taxpayer A claims a charitable contribution deduction of more than $5,000?

Issue 2. If Taxpayer A is required to obtain a qualified appraisal under § 170(f)(11)(C) and fails to do so, does the reasonable cause exception provided in § 170(f)(11)(A)(ii)(II) apply if Taxpayer A determines the value of the cryptocurrency based on the value reported by a cryptocurrency exchange on which the cryptocurrency is traded?

Conclusions

- Yes. If Taxpayer A donates cryptocurrency for which a charitable contribution deduction of more than $5,000 is claimed, a qualified appraisal is required under § 170(f)(11)(C) to qualify for a deduction under § 170(a).

- No. If Taxpayer A determines the value of the donated cryptocurrency based on the value reported by a cryptocurrency exchange on which the cryptocurrency is traded rather than by obtaining a qualified appraisal, the reasonable cause exception provided in §170(f)(11)(A)(ii)(II) will not excuse noncompliance with the qualified appraisal requirement, and Taxpayer A will not be allowed the charitable contribution deduction under § 170(a).

Issue 3: Notice 2023-21, §6511- Limitations On Credit or Refund—Allowance of Credits and Refunds—Amount of Credit or Refund Filed Within 3 Years – Important

Recognizing that earlier COVID-related return due date postponements did not equate to extensions and thus did not lengthen lookback periods under § 6511(b)(2)(A), IRS offered relief so that both postponement periods will be disregarded in determining beginning of lookback period for that purpose.

Grant Of Relief

- Taxpayers Affected by COVID-19 Emergency. The Secretary has determined that any person with a federal tax return filing or payment obligation that was postponed by Notice 2020-23 to July 15, 2020, is affected by the COVID-19 emergency for purposes of the relief described in this § 3 (Affected Taxpayer). The Secretary has also determined that any person with a filing or payment obligation with respect to a federal income tax return in the Form 1040 series that was postponed by Notice 2021-21 to May 17, 2021, is an Affected Taxpayer.

- Relief for Determining the Lookback Period for Claims for Credit or Refund. For an Affected Taxpayer with a due date postponed by Notice 2020-23, the period beginning on April 15, 2020, and ending on July 15, 2020, will be disregarded in determining the beginning of the lookback period for the purpose of determining the amount of a credit or refund under § 6511(b)(2)(A) relating to the tax for which the return filing or payment due date was postponed.

In addition, for an Affected Taxpayer with a due date postponed by Notice 2021-21, the period beginning on April 15, 2021, and ending on May 17, 2021, will be disregarded in determining the beginning of the lookback period for the purpose of determining the amount of a credit or refund under § 6511(b)(2)(A) relating to the tax for which the return filing or payment due date was postponed.

- Example.

Taxpayer is a calendar-year filer with a 2019 Federal income tax return due date of April 15, 2020. Taxpayer’s employer withheld income taxes from Taxpayer’s wages throughout 2019 and remitted the withheld income taxes to the IRS. Per § 6513(b), these withheld income taxes are deemed paid on April 15, 2020. The due date for Taxpayer’s 2019 Federal income tax return was postponed by Notice 2020-23 to July 15, 2020.

Pursuant to the postponed due date, Taxpayer timely filed their return on June 22, 2020. Under § 6511(a), Taxpayer may timely file a claim for credit or refund until three years from the return filing date, or June 22, 2023.

But if Taxpayer files a claim for credit or refund on June 22, 2023, absent the relief granted in this notice, the amount of Taxpayer’s credit or refund would be limited to tax paid during the period beginning three years before the filing of the claim, or June 22, 2020.

As a result, a credit or refund of Taxpayer’s withheld income taxes would be barred because they were deemed paid on April 15, 2020, outside of the lookback period in §6511(b)(2)(A).

This notice provides relief by disregarding the period beginning on April 15, 2020, and ending on July 15, 2020, in determining the beginning of the lookback period. Accordingly, under the relief provided by this notice, if Taxpayer files a claim for credit or refund on or before June 22, 2023, the lookback period extends three years back from the date of the claim, disregarding the period beginning on April 15, 2020, and ending on July 15, 2020. As a result, the limit to the amount of the credit or refund would include Taxpayer’s withheld income taxes deemed paid on April 15, 2020.

The relief provided under § 7508A in this notice is automatic. Affected Taxpayers do not have to call the IRS, file any form, or send letters or other documents to receive this relief.

Issue 4: Supreme Court: Non-willful FBAR Penalty Applies Per-Report, Not Per-Account

Overturning the Fifth Circuit, the Supreme Court has held that $10,000 maximum penalty for the non-willful failure to file an FBAR accrues on a per-FBAR, not a per-account, basis. (Bittner, (S Ct 2/28/2023)

A U.S. person must report all foreign bank accounts if the aggregate value of those accounts exceeds $10,000 anytime during a calendar year. The accounts are reported on FinCEN Form 114, Report of Foreign Bank and Financial Accounts, also known as an FBAR.

A person who fails to report a reportable account on an FBAR may be subject to a penalty. The amount of the penalty depends on whether the violation was willful or non-willful. The maximum penalty for a non-willful violation of the reporting requirements is $10,000 (adjusted for inflation for violations after 2015).

The Ninth Circuit, along with other federal district courts, have held that the $10,000 non-willful failure to file an FBAR penalty applies per FBAR, not per financial account (e.g., bank accounts) required to be reported on the form.

The Fifth Circuit had held that the penalty applies per account not reported.

The Supreme Court, reversing the Fifth Circuit opinion, found that, “Best read, the [non-willful penalty rules] treat the failure to file a legally compliant report as one violation carrying a maximum penalty of $10,000, not a cascade of such penalties calculated on a per-account basis.”

Issue 5: IRS Charged Too Much to Issue, Renew PTINs

A federal district court has determined that the IRS charged tax practitioners too much to obtain or renew a PTIN. The court ordered the IRS to determine “an appropriate refund” by recalculating the PTIN fees it charged from 2011 through 2017. (Steele (DC Dist. Col, 2/21/2023)

The IRS requires tax return preparers to obtain a Preparer Tax Identification Number (PTIN) and to use it when filing returns or claims for refunds. The IRS imposes a user fee on individuals obtaining or renewing a PTIN (PTIN fees).

The IRS relied on the Independent Offices Appropriations Act (IOAA) as authority for imposing PTIN fees. The IOAA provides that agencies “may prescribe regulations establishing the charge for a service or thing of value provided by the agency.”

Soon after the IRS began charging PTIN fees, a group of tax practitioners sued the IRS in federal district court claiming that the agency lacked the authority under the IOAA to charge tax return preparers for issuing and renewing PTINs because it wasn’t providing a “service or thing of value” to tax return preparers. The district court agreed and enjoined the IRS from collecting more PTIN fees. It further ordered the IRS to provide “each class member with a full refund of all PTIN fees paid from September 1, 2010, to the present.”

However, on appeal the DC Circuit found that the PTIN system provided a service to return preparers by “protecting the confidentiality of their personal information.” This is because the PTIN replaced a preparer’s Social Security Number as their “identifying number” on returns they prepared.

Therefore, the appeals court reasoned, the IOAA authorized the imposition of a fee to recoup the costs of “generating PTINs and maintaining a database of PTINs.” However, the appeals court remanded the case to the district court to consider whether the PTIN fees the IRS charged were excessive.

PTIN fees were excessive. On remand, the district court found that the PTIN fees charged by the IRS were excessive. The district court noted that while the IOAA allows the IRS to charge a fee, the IRS must be able to explain how each cost included in the PTIN fee calculation was reasonably related the service it provided (i.e., an alternative identifying number that protects preparers from identity theft).

In this case, the IRS conceded that it unlawfully included certain expenses in its PTIN fee calculations. In addition to the conceded costs, the court found that the IRS also included the costs of certain PTIN-related activities that should not have been included in the fee calculation because these costs funded an independent public benefit, not just the PTIN users. The district court sent the case back to the IRS to “determine an appropriate refund.”

Issue 6: Changes Coming Soon to SSA’s Business Services Online Portal

Social Security Administration (SSA) announced that the Business Services Online (BSO) portal will be undergoing some changes, beginning March 25, 2023, for added security.

The change will update the BSO’s authentication functions for both new and existing users. The updated system will look similar to current authentication and registration practices.

The updated system will provide four different methods to access the BSO suite of services for employers, payroll providers, and third-party providers. These four methods are:

- mySSA account:Users may use an old user ID and services online mySSA account if it is from before September 21, 2021.

- BSO account:For those with an existing BSO account, login credentials may be matched. For those without a BSO account, one must be created that is associated with employer information. Note that to complete the BSO registration process, users must obtain an activation code through the mail which can take up to two weeks.

- me:Authentication may be provided through id.me application.

- gov:The login.gov application may also authenticate a BSO user. The application provides secure, private access to participating government agencies.

The SSA noted that it will roll out a webinar in April once the new authentication process goes live.

Issue 7: IRS Issues Renewed Warning on Employee Retention Credit Claims

The Internal Revenue Service issued a renewed warning urging people to carefully review the Employee Retention Credit (ERC) guidelines before trying to claim the credit as promoters continue pushing ineligible people to file.

The IRS and tax professionals continue to see third parties aggressively promoting these ERC schemes on radio and online. These promoters charge large upfront fees or a fee that is contingent on the amount of the refund. And the promoters may not inform taxpayers that wage deductions claimed on the business’ federal income tax return must be reduced by the amount of the credit.

The IRS has been warning about this scheme since last fall, but there continue to be attempts to claim the ERC during the 2023 tax filing season. Tax professionals note they continue to be pressured by people wanting to claim credits improperly. The IRS Office of Professional Responsibility is working on additional guidance for the tax professional community that will be available in the near future.

People and businesses can avoid this scheme, and by not filing improper claims in the first place. If the business filed an income tax return deducting qualified wages before it filed an employment tax return claiming the credit, the business should file an amended income tax return to correct any overstated wage deduction.

Businesses should be cautious of advertised schemes and direct solicitations promising tax savings that are too good to be true. Taxpayers are always responsible for the information reported on their tax returns. Improperly claiming the ERC could result in taxpayers being required to repay the credit along with penalties and interest.

What is the ERC?

The ERC is a refundable tax credit designed for businesses who continued paying employees while shut down due to the COVID-19 pandemic or who had significant declines in gross receipts from March 13, 2020, to Dec. 31, 2021. Eligible taxpayers can claim the ERC on an original or amended employment tax return for a period within those dates.

To be eligible for the ERC, employers must have:

- sustained a full or partial suspension of operations due to orders from an appropriate governmental authority limiting commerce, travel or group meetings due to COVID-19 during 2020 or the first three quarters of 2021,

- experienced a significant decline in gross receipts during 2020, or a decline in gross receipts during the first three quarters of 2021, or

- qualified as a recovery startup business for the third or fourth quarters of 2021.

As a reminder, only recovery startup businesses are eligible for the ERC in the fourth quarter of 2021. Additionally, for any quarter, eligible employers cannot claim the ERC on wages that were reported as payroll costs in obtaining PPP loan forgiveness or that were used to claim certain other tax credits.

To report tax-related illegal activities relating to ERC claims, submit by fax or mail a completed Form 14242, Report Suspected Abusive Tax Promotions or Preparers and any supporting materials to the IRS Lead Development Center in the Office of Promoter Investigations.

Mail: Internal Revenue Service

Lead Development Center Stop MS5040

24000 Avila Road

Laguna Niguel, California 92677-3405

Fax: 877-477-9135

Employers should also report instances of fraud and IRS-related phishing attempts to the IRS at [email protected] and Treasury Inspector General for Tax Administration C at 800-366-4484.

Issue 8: IRS Begins Digitalization Efforts Starting with Forms 940 – IR 2023-41

As part of ongoing transformation efforts, the Internal Revenue Service announced today the successful expansion of digital scanning.

In a major step in the new Digital Intake scanning initiative, the IRS has already scanned more than 120,000 paper Forms 940 since the start of 2023, this is a twenty-fold increase compared to all of 2022. This effort will expand soon to include the scanning of Forms 1040 as well as Forms 941. The scanning effort is part of a multi-form, multi-solution scanning initiative known as Digital Intake.

Digital scanning is part of a larger effort underway at the IRS to transform the agency and make improvements for taxpayers. As part of the Inflation Reduction Act, the IRS has taken steps to improve service, including hiring more than 5,000 new telephone assistors, adding staff to IRS Taxpayer Assistance Centers and holding special Saturday hours, expanding the Document Upload Tool and other features.

The IRS has been using various technologies to scan tax returns for more than 35 years but recently took a leap forward by leveraging cutting-edge technologies via a revolutionary procurement approach to test their effectiveness. The capabilities enable the IRS to digitalize more paper for downstream processing and storage, resulting in greater efficiencies and improved data management outcomes.

In addition to contracts with industry partners, the IRS is also working with Treasury’s Bureau of the Fiscal Service and Lockbox Financial Agents to expand the reach of this work.

Current scanning initiatives currently underway at the IRS cover:

- Digital Intake with Lockbox: Lockbox Financial Agents (FAs) are banks that specialize in payment processing but until now have not taken the extra steps to scan and process tax forms. Each year, millions of taxpayers send payments and associated tax forms to these Lockbox banks. The Lockbox project works to scan paper returns on-site, and e-file those returns.

- Digital Intake with Industry Partners: Like the work with the Lockbox Financial Agents, this process extracts machine-readable information from paper tax returns and then e-files those returns. These efforts with industry partners, via contracts issued by the IRS, allow the IRS to process forms that are also received directly by the IRS.

The vast majority of tax returns are now filed electronically. But millions of forms are still filed by paper, which means a time-consuming process of manually handling and transcribing of these tax returns. By providing a capability to scan and electronically process paper returns, the IRS will be able to shorten the processing time for taxpayers who file paper returns.

Issue 9: Werfel Begins Work as 50th IRS Commissioner

Werfel, who was confirmed by the Senate on March 9, was sworn into office by Deputy Commissioner for Services and Enforcement Doug O’Donnell, who served as acting commissioner since November.

As commissioner, Werfel returns to the federal government, where he first began work at the Office of Management and Budget (OMB) in the late 1990s. He spent more than 15 years in the federal government, eventually serving as Controller of OMB. He came over to the IRS to temporarily serve as Acting Commissioner in 2013. Next, Werfel served as a leader of Boston Consulting Group’s (BCG) Public Sector practice, first covering North America and then as a global leader.

Werfel’s term will run through Nov. 12, 2027.

Issue 10: Client Update: Retirees Who Turned 72 in 2022 Must Take RMD by April 1, 2023

Most retirees who turned 72 in 2022 must take the first required minimum distribution (RMD) from their retirement account by April 1, 2023. The minimum distribution requirement applies to Individual Retirement Arrangements (IRAs), 401(k)s, and similar workplace retirement plans.

Note. Taxpayers who have Roth IRAs don’t need to take RMDs from those accounts.

This April 1 deadline only applies to a taxpayer’s first RMD. All other RMDs must be made by December 31. This means that taxpayers who turned 72 in 2022 and are taking their first RMD in 2023, must take their second RMD on or before December 31, 2023.

Note. In this case, both distributions are taxable in 2023 and reported on the taxpayer’s 2023 return.

Taxpayers taking a 2022 RMD by April 1, 2023, should use the life expectancy tables in Appendix B of IRS Publication 590-B to determine the minimum distribution they must take. Pub. 590-B has worksheets, examples and other information that can help anyone figure their RMD.

Some taxpayers with workplace retirement plans can delay taking RMDs if they are still working for the employer that sponsored that plan. These taxpayers, if their plan allows, can wait until April 1 of the year after they retire to start taking RMDs.

This RMD exception doesn’t apply to 5% owners of the business sponsoring the retirement plan or to participants in SEP and SIMPLE IRA plans. Also, there may be special rules for individuals who contributed to a 403(b) plan before 1987. These individuals should check with their employer, plan administrator or provider for information on how to treat those accruals.

New rule in 2023. For those planning ahead, starting in 2023 retirees can wait until age 73 to begin taking RMDs.

Issue 11: Scammers Offer to Help with Online Accounts

In the third installment of its 2023 Dirty Dozen, IRS warned taxpayers to watch out for scammers who tried to sell or offer help setting up IRS Online Account that would put their tax and financial information at risk of identity theft.

The IRS Online Account provides valuable tax information for people. But this information in the wrong hands can provide important information to help an identity thief try to submit a fraudulent tax return in the person’s name in hopes of getting a big refund. People should watch out for these scam artists offering to help set up these accounts because these are identity theft attempts to run off with the taxpayer’s personal or financial information.

An Online Account at IRS.gov can help taxpayers view important details about their tax situation. But scammers are trying to convince people they need help setting up an account. In reality, no help is needed. This is just a scam to obtain valuable and sensitive tax information that scammers will use to try stealing a refund. People should be wary and avoid sharing sensitive personal data over the phone, email, or social media to avoid getting caught up in these scams.

Issue 12: Understand When IRS Personnel May Contact Your Client

Most IRS contacts with taxpayers are through regular mail delivered by the United States Postal Service. However, there are limited circumstances when the IRS will come to a home or business as part of a collection investigation, an audit or an ongoing criminal investigation.

IRS in-person visits

IRS employees that may make face-to-face visits outside an IRS office include revenue officers, revenue agents and IRS Criminal Investigation special agents. IRS employees are trained to respect taxpayer rights, and there are some important facts to keep in mind about the different types of visits.

Revenue officers are IRS civil enforcement employees who work to resolve compliance issues such as unfiled returns and/or taxes owed – all situations where the taxpayer typically would have received multiple IRS letters in advance.

These in-person visits may be unscheduled and can be to share information, inform taxpayers of their tax filing and payment obligations and work with taxpayers to resolve their tax issues and bring them into compliance.

They conduct interviews to gather financial information and provide taxpayers with the necessary steps to become and remain compliant with the tax laws.

Revenue agents usually conduct in-person field audits that are normally at the taxpayer’s home, place of business or accountant’s office where the organization’s financial books and records are located. Revenue agents will make contact via mail or phone prior to any visit.

Revenue officers and agents always carry two forms of official credentials with a serial number and their photo. Taxpayers have the right to see each of these credentials and can also request an additional method to verify their identification.

Remember, taxpayers should know they have a tax issue before these visits occur since multiple mailings occur.

IRS-CI special agents investigate potential criminal violations of the Internal Revenue Code and related financial crimes. IRS-CI’s investigative jurisdiction includes tax, money laundering and Bank Secrecy Act laws. IRS-CI special agents always present their law enforcement credentials when conducting investigations.

IRS-CI may visit a taxpayer’s home or business unannounced during an investigation. However, they will not demand any sort of payment.

Issue 13: Form 1099-K Received in Error or with Incorrect Information

With this year’s April 18 tax deadline just around the corner, the Internal Revenue Service is offering these tips to taxpayers who received an incorrect Form 1099-K or received one of these forms in error. The IRS also explains how to report these transactions on their tax return.

What is a 1099-K

Form 1099-K, Payment Card and Third-Party Network Transactions, is an IRS form that is used to report certain payment transactions. Taxpayers use information reported on this form, along with their other tax records, to determine their correct tax liability. All income must be reported, unless it’s excluded by law. This is true, whether or not they receive a Form 1099-K.

The 1099-K reports various business transactions, including income from:

- A business the taxpayer owns.

- Self-employment.

- Activities in the gig economy.

- The sale of personal items and assets.

They will typically receive this form annually by Jan. 31 for transactions occurring during the prior year. This means that 2022 transactions were reported on the form they received by Jan. 31, 2023.

Some taxpayers may have incorrectly received a Form 1099-K, such as for the sale of personal items. In other cases, the form may have been issued in error – such as for transactions between friends and family, or expense sharing.

If this happens, or if the information on the form is wrong, contact the issuer of the Form 1099-K immediately. The issuer’s name appears in the upper left corner on the form along with their phone number. Taxpayers should keep a copy of all correspondence with the issuer for their records.

If a corrected 1099-K cannot be obtained

If taxpayers cannot get a corrected Form 1099-K, report the information on Schedule 1 (Form 1040), Additional Income and Adjustments to Income, as follows:

- Part I – Line 8z – Other Income – Form 1099-K Received in Error.

- Part II – Line 24z – Other Adjustments – Form 1099-K Received in Error.

The net effect of these two adjustments on adjusted gross income would be $0.

Personal item sold at a loss.

Similarly, if a taxpayer receives a Form 1099-K for a personal item sold at a loss, report the information on Schedule 1 with offsetting transactions.

For example, a taxpayer who received a Form 1099-K for selling a couch online for $700 would report on Form 1040:

- Part I – Line 8z – Other Income – Form 1099-K Personal Item Sold at a Loss $700.

- Part II – Line 24z – Other Adjustments – Form 1099-K Personal Item Sold at a Loss $700.

The net effect of these two adjustments on adjusted gross income would be $0.

Personal item sold at a gain.

If a taxpayer sells an item owned for personal use, such as a car, refrigerator, furniture, stereo, jewelry or silverware, etc., at a profit, this is reported as a capital gain. Report the gain as any other capital gain on Form 8949, Sales and other Dispositions of Capital Assets, and Schedule D (Form 1040), Capital Gains and Losses.

A mix of personal items sold – some at a gain and others with a loss.

Taxpayers must report gains and losses separately. Gains for assets cannot be offset by losses from the sale of personal assets.

If a taxpayer sold an item owned for personal use at a gain, see Personal items sold at a gain for information on how to report.

For personal items sold at a loss, follow the instructions for Personal items sold at a loss.

Planning ahead for 2023

The American Rescue Plan of 2021 changed the reporting threshold requirement for payment apps, also known as third-party settlement organizations. The IRS announced that the new Form 1099-K reporting threshold will start in tax year 2023.

- The old threshold was $20,000 and 200 transactions per year. This applies to the tax year 2022 and prior years.

- The new threshold is more than $600. This applies to tax year 2023 and future years.

The threshold change means some people may receive a Form 1099-K who have not received one in the past. There are no changes to what counts as income or how tax is calculated.

The IRS will share more information soon about 1099 reporting for 2023 that will be in effect for the 2024 tax season. In the meantime, the IRS reminds taxpayers that money received as a gift or for reimbursement does not require a 1099-K. Taxpayers can minimize the chance of receiving one of these forms in error by asking friends or family members to correctly designate that type of payment as a non-business-related transaction.

Issue 14: IRS Issues Guidance, Seeks Comments on Nonfungible Tokens

The Treasury Department and the Internal Revenue Service announced that they are soliciting feedback for upcoming guidance regarding the tax treatment of a nonfungible token (NFT) as a collectible under the tax law. Today’s guidance also requests comments on the treatment of NFTs as collectibles and describes how the IRS intends to determine whether an NFT is a collectible until further guidance is issued.

A nonfungible token (NFT) is a unique digital identifier that is recorded using distributed ledger technology and may be used to certify authenticity and ownership of an associated right or asset. Distributed ledger technology, such as blockchain technology, uses independent digital systems to record, share and synchronize transactions, the details of which are recorded simultaneously on multiple nodes in a network. A token is an entry of data encoded on a distributed ledger. A distributed ledger can be used to identify ownership of both NFTs and fungible tokens, such as cryptocurrency, as described in Rev. Rul. 2019-24.

- 408(m)(2) of the tax code provides for a specific list of items that constitute collectibles for certain purposes. Acquisition of a collectible by an individual retirement account (IRA) or individually-directed account of a qualified plan is treated as a distribution from the account equal to the cost to the account of the collectible. Generally, collectibles also do not have as advantageous capital-gains tax treatment as other capital assets.

Until additional guidance is issued, the IRS intends to determine when an NFT is treated as a collectible by using a “look-through analysis.” Under the look-through analysis, an NFT is treated as a collectible if the NFT’s associated right or asset falls under the definition of collectible in the tax code. For example, a gem is a collectible under § 408(m); therefore, an NFT that certifies ownership of a gem is a collectible.

In Notice 2023-27 the Treasury Department and the IRS are requesting comments on any aspect of NFTs that might affect the treatment of an NFT as a collectible as well as certain comments specifically set out in the notice.

Issue 15: IRS SB/SE Examination Director Says Service Considering Eliminating Form 944

During a March 20 presentation by the IRS on employment tax at the American Payroll Association’s (APA) Capital Summit in Washington D.C., Daniel Lauer, IRS Director of the Small Business/Self-Employed Examination—Specialty, said that the Service is considering decommissioning the annual federal employment tax return used by small employers “as we speak.”

Annual employment tax return. Form 944 (Employer’s Annual Federal Tax Return) is used by employers with an annual employment tax liability of $1,000 or less. The IRS may notify an employer to file Form 944 instead of Form 941 or an employer may request to file this form because its liability is below the threshold.

Who may currently file Form 944. Household employers, agricultural employers, those businesses that were notified by the IRS not to file Form 941, and employers that were not notified to file Form 944, are not allowed to file this annual return. If an employer is qualified to file Form 944 but its employment tax liability ends up exceeding $1,000 at some point, the employer continues to file this form until the IRS notifies the employer otherwise.

Small employers may have to go back to quarterly reporting. Should the IRS retire Form 944, those employers that filed annually with a January 31 due date would need to file their employment tax returns on a quarterly basis, with the due dates on the last day of the month after the end of each quarter.

Issue 16: Applicable Federal Rates for April 2023, Rev. Rul. 2023-6

REV. RUL. 2023-6 TABLE 5

Rate Under Section 7520 for April 2023 Applicable federal rate for determining the present value of an annuity, an interest for life or a term of years, or a remainder or reversionary interest 5.00%