In this Issue:

- New Digital Assets IRS Page

- Inflation Reduction Act: Continued Assessment of Transformation Efforts

- Businesses: Electronically file Form 8300 to report cash payments over $10,000

- Auto Dealers Must Register with the IRS to Receive Advance Payments of the Clean Vehicle Tax Credit

- IRS Launches New Effort Aimed at High-Income Non-Filers

- Deadline Approaches for Recovery Rebate Credit

- CTA Enforcement for NSBA Members Halted

- IRS Alert: Beware of Companies Misrepresenting Nutrition, Wellness and General Health Expenses as Medical Care for FSAs, HSAs, HRAs and MSAs

- Tax Time Guide: IRS enhances Where’s My Refund? Tool

- Payers May Get Notices CP2100 and 2100A About Information Returns with Errors

- What Taxpayers Should do if They Received a Form 1099-K in 2024

- Physical Presence Education Requirement Waiver Extended for Enrolled Actuaries

- Important Social Security Administration Changes

- IRS Reminder to U.S. Taxpayers Living, Working Abroad: File 2023 Tax Return by June 17; Those Impacted by Terrorist Attacks in Israel Have Until Oct. 7

- IRS Employee Retention Credit Compliance Effort tops $1 billion Threshold since Fall; Voluntary Disclosure Program Suspended after March 22, Special Withdrawal Program Remains Open as Audits, Investigations Intensify

- Applicable Federal Rates for April 2024, Rev. Rul. 2024-07

Don’t forget to register for the Unlimited Webinar Package: https://www.cpehours.com/webinar-schedule/

Issue 1: New Digital Assets IRS Page

https://www.irs.gov/businesses/small-businesses-self-employed/digital-assets

The redesigned webpage features:

- Current IRS information on digital assets, and how to answer the digital asset question on a tax return: when to check yes or no.

- Streamlined information for ease of understanding; and

- A user-friendly layout featuring links at the top of the page to help viewers quickly find key information.

The Internal Revenue Service today announced the addition of two private-sector experts to help the agency’s efforts in the cryptocurrency and other digital assets arena.

Sulolit “Raj” Mukherjee, JD, and Seth Wilks, CPA, have been hired as executive advisors.

The pair, who have extensive experience in the tax and crypto industries, will help lead IRS efforts building service, reporting, compliance, and enforcement programs focused on digital assets.

Mukherjee has been a tax executive for more than 10 years in tax compliance and tax information reporting for financial institutions and has extensive experience in the crypto industry. He joins the IRS from a private blockchain software technology company where he served as Global Head of Tax.

Wilks comes to the IRS having worked in the digital asset tax policy space for the past six years. Prior to this Wilks worked extensively with tax compliance and planning issues related to multinational corporations and manufacturing, with a focus on complex supply chains, transfer pricing and cross-border transactions.

With funding from the Inflation Reduction Act, the IRS is working on a variety of taxpayer service and technology improvements as well as expanding enforcement efforts in complex, high-wealth areas where there are compliance concerns. The IRS is also focused on compliance in emerging areas.

Expanded work on digital assets is one of the priority areas where the IRS will focus, including work through the John Doe summons effort and the release of proposed regulations of broker reporting in August 2023 (Review IR-2023-153 for more on reporting).

A digital asset is a digital representation of value that is recorded on a cryptographically secured, distributed ledger or any similar technology. Common digital assets include convertible virtual currency and cryptocurrency; stablecoins; and non-fungible tokens (NFTs).

Everyone who files Forms 1040, 1040-SR, 1040-NR, 1041, 1065, 1120, 1120 and 1120S must check one box answering either “Yes” or “No” to the digital asset question.

Taxability of Digital Assets – Taxpayers should report digital asset transactions, gig economy income, foreign source income and assets

The Internal Revenue Service reminds taxpayers they’re generally required to report all earned income on their tax return, including income earned from digital asset transactions, the gig economy and service industry as well as income from foreign sources.

Reporting requirements for these sources of income and others are outlined in the Instructions for Form 1040 and Form 1040-SR. The information is also available on IRS.gov.

Digital assets, including cryptocurrency

A digital asset is a digital representation of value that is recorded on a cryptographically secured, distributed ledger. Common digital assets include:

- Convertible virtual currency and cryptocurrency.

- Stablecoins.

- Non-fungible tokens (NFTs).

Everyone must answer the question

Everyone who files Forms 1040, 1040-SR, 1040-NR, 1041, 1065, 1120 and 1120S must check one box answering either “Yes” or “No” to the digital asset question. The question must be answered by all taxpayers, not just by those who engaged in a transaction involving digital assets in 2023.

Checking “Yes”: Normally, a taxpayer must check the “Yes” box if they:

- Received digital assets as payment for property or services provided.

- Transferred digital assets for free (without receiving any consideration) as a bona fide gift.

- Received digital assets resulting from a reward or award.

- Received new digital assets resulting from mining, staking and similar activities.

- Received digital assets resulting from a hard fork (a branching of a cryptocurrency’s blockchain that splits a single cryptocurrency into two).

- Disposed of digital assets in exchange for property or services.

- Disposed of a digital asset in exchange or trade for another digital asset.

- Sold a digital asset; or

- Otherwise disposed of any other financial interest in a digital asset.

In addition to checking the “Yes” box, taxpayers must report all income related to their digital asset transactions.

For example, an investor who held a digital asset as a capital asset and sold, exchanged or transferred it during 2023 must use Form 8949, Sales and other Dispositions of Capital Assets, to figure their capital gain or loss on the transaction and then report it on Schedule D (Form 1040), Capital Gains and Losses. A taxpayer who disposed of any digital asset by gift may be required to file Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return.

If an employee was paid with digital assets, they must report the value of the digital assets received as wages.

Similarly, if they worked as an independent contractor and were paid with digital assets, they must report that income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Schedule C is also used by anyone who sold, exchanged or transferred digital assets to customers in connection with a trade or business and who did not operate the business through an entity other than a sole proprietorship.

Checking “No”: Normally, a taxpayer who merely owned digital assets during 2022 can check the “No” box as long as they did not engage in any transactions involving digital assets during the year. They can also check the “No” box if their activities were limited to one or more of the following:

- Holding digital assets in a wallet or account.

- Transferring digital assets from one wallet or account they own or control to another wallet or account they own or control: or

- Purchasing digital assets using U.S. or other real currency, including through electronic platforms such as PayPal and Venmo.

Gig economy earnings

Typically, income earned from the gig economy is taxable and must be reported to the IRS on tax returns. Examples of gig work include providing on-demand labor, services, goods, or selling goods online. Transactions often occur through digital platforms such as an app or website.

Taxpayers are required to report all income earned from the gig economy on a tax return, even if the income is:

- From temporary, part-time, or side work.

- Paid through digital assets like cryptocurrency, as well as cash, goods, or property.

- Not reported on an information return form like a Form 1099-K, 1099-MISC, W-2 or other income statement.

Taxpayers can visit the gig economy tax center for more information on the gig economy.

Service industry tips

Individuals who work in service industries such as restaurants, hotels and salons often receive tips from customers for their services. Generally, tips like cash or non-cash payments are taxable and should be reported.

- All cash tips should be reported to the employer, who must include them on the employee’s Form W-2, Wage and Tax Statement. This includes direct cash tips from customer to employee, tips from one employee to another employee, electronically paid tips and other tip-sharing arrangements.

- Noncash tips include value received in any medium other than cash, such as: passes, tickets, or other goods or commodities a customer gives the employee. Noncash tips aren’t reported to the employer but must be reported on a tax return.

- Any tips the employee didn’t report to the employer must be reported separately on Form 4137, Social Security and Medicare Tax on Unreported Tip Income, to include as additional income with their tax return. The employee must also pay the employee share of Social Security and Medicare tax owed on those tips.

Service industry employees don’t have to report tip amounts of less than $20 per month per employer. For larger amounts, employees must report tips to the employer by the 10th of the month following the month the tips were received.

Issue 2: Inflation Reduction Act: Continued Assessment of Transformation Efforts – Evaluation of Fiscal Year 2023 Delivery of Initiatives – Excerpt from Report

This report presents the results of a review to assess the Internal Revenue Service’s (IRS) Strategic Operating Plan to determine whether it provides a clear framework on the IRS’s plans to transform itself to improve taxpayer service, modernize technology, and increase equity in tax administration. This review is part of TIGTA’s Fiscal Year 2024 Annual Program Plan and addresses the major management and performance challenge of Managing Inflation Reduction Act Transformation Efforts. This report was prepared to provide information only. Therefore, no recommendations were made in the report. While no recommendations were made in this report, IRS management did provide a response. Management’s response to the draft report is included as appendix III.

New IRS Organizational Structure

In addition to the standup of the TSO, on December 13, 2023, the IRS Commissioner announced a new leadership structure noting this was a step designed to reflect the IRS’s new transformation goals. The new structure will be put in place in early Calendar Year 2024, with the Commissioner noting that the new leadership structure will help the IRS work efficiently as an agency and ensure that progress keeps moving forward.

Another factor behind the change is it creates more specialization at the top of the IRS’s organizational chart. According to the IRS, the new structure will allow for more specialization on emerging priorities in the transformation work while strengthening the senior leadership team’s oversight capability and flexibility on pressing tax administration issues.

The Deputy Commissioner for Services and Enforcement and the Deputy Commissioner for Operations Support will be replaced by a single Deputy IRS Commissioner.

Reporting to the Deputy Commissioner will be four Chiefs:

- Chief, Taxpayer Service – responsible for many of the major taxpayer service functions currently handled by the Wage and Investment Division. This includes the filing season work and taxpayer-facing operations such as toll-free operations, tax return processing centers, TACs, tax forms, taxpayer correspondence, and publication development.

- Chief Taxpayer Compliance Officer – responsible for overseeing compliance operations in the Large Business and International Division, Small Business/Self-Employed Division, Tax Exempt and Government Entities Division, Criminal Investigation, Office of Professional Responsibility, Return Preparer Office, Whistleblower Office, and Enterprise Case Management.

- Chief Information Officer – responsible for the current IRS Information Technology (IT) organization.

- Chief Operating Officer – responsible for overseeing a variety of key offices including the Human Capital Office, the Office of the Chief Financial Officer, Procurement, Facilities Management and Security Services, Privacy Governmental Liaison and Disclosure, Research, Applied Analytics and Statistics, and the Risk Office. The Commissioner indicated that the new structure would help top leadership to work together to drive faster and more effective progress, ultimately benefiting the work to improve the IRS, not just for taxpayers and the tax professional community but also for IRS employees.

Issue 3: Businesses: Electronically file Form 8300 to report cash payments over $10,000

Businesses that file 10 or more information returns must e-file Form 8300, Report of Cash Payments Over $10,000, instead of filing a paper return. For those with fewer information returns, e-filing Form 8300 is optional.

To electronically file Form 8300, a business must set up an account with the Financial Crimes Enforcement Network’s BSA E-Filing System.

Waivers and exemptions

If electronic filing would cause undue hardship, a business can request a waiver by submitting Form 8508, Application for a Waiver from Electronic Filing of Information Returns. If the IRS grants a waiver from e-filing any information return, that waiver automatically applies to all Forms 8300 for the rest of the calendar year. A business may not request a waiver from filing electronically only Form 8300. If a waiver is given, the business must include the word “waiver” on the center top of each Form 8300 when submitting a paper filed return.

If using the e-file technology conflicts with a filer’s religious beliefs, they’re automatically exempt from electronic filing. The filer must include the words “religious exemption” on the top of each Form 8300 when submitting the paper return.

For more information, businesses can call the Bank Secrecy Act E-Filing Help Desk at 866-346-9478 or email them at [email protected]. For details about the BSA E-Filing System, businesses can submit a technical support request at Self Service Help Ticket. The help desk is available Monday through Friday from 8 a.m. to 6 p.m. ET.

Issue 4: Auto Dealers Must Register with the IRS to Receive Advance Payments of the Clean Vehicle Tax Credit

To submit time-of-sale reports and receive advance payments of the Clean Vehicle Tax Credit, auto dealers and sellers must register their business with IRS Energy Credits Online. Dealers and sellers must use this tool to submit all time-of-sale reports for vehicles placed in service in 2024 and future years.

How to register

To register or access a previously registered business, dealers and sellers can go to IRS Energy Credits Online. The step-by-step instructions guide them through the process to register, submit time-of-sale reports and enter advance payment information. It may take 15 days or longer for the registration to process.

Once registered, dealers and sellers must use this tool to enter time-of-sale reports and provide the buyer certain required information.

What happens after registration

When a dealer successfully submits a time-of-sale report, the vehicle is eligible for the credit. A submission is successful when the dealer receives a copy of the report and a confirmation of acceptance by IRS Energy Credits Online. Buyers should use a copy of the report when they file their annual federal tax return.

Find out more about the Clean Vehicle Credits at IRS.gov/cleanvehicle.

Issue 5: IRS Launches New Effort Aimed at High-Income Non-Filers

The IRS announced a new effort focused on high-income taxpayers who have failed to file federal income tax returns. Using Inflation Reduction Act funding, the IRS will issue compliance letters to more than 125,000 cases where tax returns have not been filed since 2017.

This week, the IRS will begin mailing compliance alerts for failure to file a tax return, formally known as the CP59 notice. About 20,000 to 40,000 letters will go out each week, beginning with filers in the highest-income categories.

The Government Accountability Office (GAO) found the IRS should take steps to improve its audits of high-income/high-wealth taxpayers. The GAO analyzed closed IRS audits of individual returns from 2012 through 2022 with at least $500,000 in total positive income and found that, as the income of the audited taxpayers increased, so did the average amount of additional tax recommend by the IRS. However, the IRS generally closed fewer audits of the highest-income taxpayers.

The GAO noted that in 2020 the Treasury Department directed the IRS to audit at least 8% of tax returns filed by individuals with income of $10 million or more. The GAO found the IRS still needs to centralize its management of high-income/high-wealth audit programs and assess its:

- Research efforts to understand the complexity of high-income returns.

- Audit selection models to ensure that compliant taxpayers are not being burdened.

Auditor training needs to address any staffing and skills gaps.

Issue 6: Deadline Approaches for Recovery Rebate Credit

The IRS reminds taxpayers who may be eligible for the COVID-era Recovery Rebate Credit in 2020 that time is running out to file a tax return and claim their money. Taxpayers owed a refund, have three years after the filing due date to file and claim any money entitled to them. For 2020 tax returns, this year’s deadline is May 17, three years after the original May 17, 2021, tax deadline.

Issue 7: CTA Enforcement for NSBA Members Halted

An Alabama federal judge found the Corporate Transparency Act (CTA) of 2021 to be unconstitutional and barred the government from enforcing any provisions in the act against the plaintiffs in the case, which include the 65,000 members of the National Small Business Association (NSBA). The Financial Crimes Enforcement Network (FinCEN) is complying with the court’s order and said it will not enforce the act’s beneficial ownership information (BOI) reporting requirements against the plaintiffs: the NSBA, members of the NSBA as of the March 1 decision date, Isaac Winkles and reporting companies for which he is the beneficial owner or applicant.

The CTA’s BOI reporting requirements remain unchanged for all businesses except for the plaintiffs in National Small Business United v. Yellen, 5:22-cv-01448 (N.D. Ala. 2024). It is unlikely the ruling is the last word on the issue as the U.S. Department of Treasury is expected to appeal the decision to the U.S. Court of Appeals for the 11th Circuit.

March 04, 2024

Updated March 11, 2024

On March 1, 2024, in the case of National Small Business United v. Yellen, No. 5:22-cv-01448 (N.D. Ala.), a federal district court in the Northern District of Alabama, Northeastern Division, entered a final declaratory judgment, concluding that the Corporate Transparency Act exceeds the Constitution’s limits on Congress’s power and enjoining the Department of the Treasury and FinCEN from enforcing the Corporate Transparency Act against the plaintiffs. The Justice Department, on behalf of the Department of the Treasury, filed a Notice of Appeal on March 11, 2024. While this litigation is ongoing, FinCEN will continue to implement the Corporate Transparency Act as required by Congress, while complying with the court’s order. Other than the particular individuals and entities subject to the court’s injunction, as specified below, reporting companies are still required to comply with the law and file beneficial ownership reports as provided in FinCEN’s regulations.

FinCEN is complying with the court’s order and will continue to comply with the court’s order for as long as it remains in effect. As a result, the government is not currently enforcing the Corporate Transparency Act against the plaintiffs in that action: Isaac Winkles, reporting companies for which Isaac Winkles is the beneficial owner or applicant, the National Small Business Association, and members of the National Small Business Association (as of March 1, 2024). Those individuals and entities are not required to report beneficial ownership information to FinCEN at this time.

Issue 8: IRS Alert: Beware of Companies Misrepresenting Nutrition, Wellness and General Health Expenses as Medical Care for FSAs, HSAs, HRAs and MSAs

WASHINGTON – Amid concerns about people being misled, the Internal Revenue Service today reminded taxpayers and heath spending plan administrators that personal expenses for general health and wellness are not considered medical expenses under the tax law.

This means personal expenses are not deductible or reimbursable under health flexible spending arrangements, health savings accounts, health reimbursement arrangements or medical savings accounts (FSAs, HSAs, HRAs and MSAs).

This reminder is important because some companies are misrepresenting the circumstances under which food and wellness expenses can be paid or reimbursed under FSAs and other health spending plans.

Some companies mistakenly claim that notes from doctors based merely on self-reported health information can convert non-medical food, wellness and exercise expenses into medical expenses, but this documentation actually does not. Such a note would not establish that an otherwise personal expense satisfies the requirement that it be related to a targeted diagnosis-specific activity or treatment; these types of personal expenses do not qualify as medical expenses.

For example: A diabetic, in his attempts to control his blood sugar, decides to eat foods that are lower in carbohydrates. He sees an advertisement from a company stating that he can use pre-tax dollars from his FSA to purchase healthy food if he contacts that company. He contacts the company, who tells him that for a fee, the company will provide him with a ‘doctor’s note’ that he can submit to his FSA to be reimbursed for the cost of food purchased in his attempt to eat healthier. However, when he submits the expense with the ‘doctor’s note’, the claim is denied because food is not a medical expense and plan administrators are wary of claims that could invalidate their plans.

FSAs and other health spending plans that pay for, or reimburse, non-medical expenses are not qualified plans. If the plan is not qualified, all payments made to taxpayers under the plan, even reimbursements for actual medical expenses, are includible in income.

The IRS encourages taxpayers with questions to review the frequently asked questions on medical expenses related to nutrition, wellness and general health to determine whether a food or wellness expense is a medical expense.

Issue 9: Tax Time Guide: IRS enhances Where’s My Refund? Tool

Tax pros: Remind your clients of the enhancements made to the Where’s My Refund? Tool this filing season, including:

- Messages with detailed refund status in plain language.

- Seamless access on mobile devices and with the IRS2Go app.

- Notifications indicating whether the IRS needs additional information.

During this busy part of filing season, millions of taxpayers are anticipating refunds. The Where’s My Refund? tool provides taxpayers with three key pieces of information: IRS confirmation of receipt, approval of the tax refund, issuing date of the approved tax refund. Where’s My Refund? remains the best way to check the status of a refund.

Issue 10: Payers May Get Notices CP2100 and 2100A About Information Returns with Errors

When banks, credit unions, businesses and other payers file information returns with data that does not match IRS records, the IRS sends a CP2100 or CP2100A notice. The notices tell payers that the information returns they submitted have a missing or incorrect Taxpayer Identification Number, name, or both.

Each notice has a list of payees with the issues the IRS found. Payers need to compare the accounts on the notice with their records and correct or update their records, if necessary. Payers may also need to correct their backup withholding on payments made to payees.

Tax Tip 2023-75 lists the most common information returns with errors, and links to more guidance on backup withholding.

Issue 11: What Taxpayers Should do if They Received a Form 1099-K in 2024

If a taxpayer sold goods or services in 2023 and received payments through certain payment apps or online marketplaces or accepted payment cards, they could have received a third party reporting document Form 1099-K, Payment Card and Third Party Network Transactions.

Following feedback from taxpayers, tax professionals and payment processors, and to reduce taxpayer confusion, the IRS announced Notice 2023-74, which delayed the new federal law $600 reporting threshold for tax year 2023 on Form 1099-K, Payment Card and Third Party Network Transactions.

The previous reporting thresholds remained in place for 2023, which are more than $20,000 in payments and over 200 transactions. Taxpayers could have still received forms below the threshold.

It’s important to know that regardless of if a taxpayer received a Form 1099-K or not, they must report their income. This includes payments they receive in cash, property, goods, digital assets or foreign sources or assets.

Form 1099-K should not report personal payments like gifts and reimbursements.

What to do When Filing Taxes

It’s important to understand why an individual received a Form 1099-K. Taxpayers can then use it with their other tax records when it’s time to file their return. The form provides the gross amount of payment card/third party network transactions and may include a combination of different kinds of total payments received.

It’s important to note, just because a payment is reported on a Form 1099-K does not mean it’s taxable.

Taxpayers should review the form or forms, determine if the amount is correct, and determine any deductible expenses associated with the payment they may be able to claim when they file their taxes.

Selling Personal Items at a Loss

If an individual sold items at a loss, which means they paid more for the items than for what they sold them, there is not a tax liability. They will be able to zero out the payment on their tax return by reporting both the payment and an offsetting adjustment on a Form 1040, Schedule 1. This will ensure when they do receive these forms, they do not have to pay taxes they do not owe.

Selling Personal Items at a Gain

If an individual sold items at a gain, which means they paid less than for what they sold it, they will have to report that gain as income, and it is taxable.

What to do with a Form 1099-K received in error

People may get a Form 1099-K when they shouldn’t have if it:

- Reports personal payments from family or friends like gifts or reimbursements.

- Does not belong to them.

- Duplicates a Form 1099-K or other information reporting form they already received.

If this happens:

- Contact the issuer immediately – see “Filer” on the top left corner of Form 1099-K to find out the name and contact information of the issuer.

- Ask for a corrected Form 1099-K that shows a zero amount.

- Keep a copy of the original form and all correspondence with the issuer for your records.

- Do not wait to file taxes. File even if a corrected Form 1099-K is unavailable.

What to do with an Incorrect Form 1099-K

If the payee Taxpayer Identification Number (TIN) or gross payment amount is incorrect taxpayers should request a corrected form from the issuer.

- See “Filer” on the top left corner of Form 1099-K to find the name and contact information of the issuer. If a taxpayer doesn’t recognize the issuer, they should contact the Payment Settlement Entity (PSE) identified on the bottom left corner of the form above their account number.

- Keep a copy of the corrected Form 1099-K with other tax records, along with any correspondence from the issuer or PSE.

- Don’t contact the IRS. The IRS cannot correct Form 1099-K from an issuer.

Don’t wait to file taxes. To file a tax return, take these steps:

- If the Payee Taxpayer Identification Number (TIN) is incorrect report payments from the Form 1099-K and any sources of income on the appropriate tax return you normally file.

- If the gross payment amount is incorrect report the amount from your incorrect Form 1099-K on Schedule 1 (Form 1040), Additional Income and Adjustments to Income.

Issue 12: Physical Presence Education Requirement Waiver Extended for Enrolled Actuaries

The Joint Board for the Enrollment of Actuaries is extending the temporary waiver of its physical presence requirement for continuing professional education (CPE) programs. The Joint Board issued proposed regulations to eliminate the physical presence requirement altogether. The extended waiver applies to all enrolled actuaries and will remain in effect until proposed regulations are finalized.

The Joint Board for the Enrollment of Actuaries is retroactively extending the temporary waiver of its physical presence requirement for continuing professional education (CPE) programs and is proposing regulations to eliminate this in-person requirement altogether.

Adopted as a pandemic-related safety measure, the original temporary waiver, announced on Aug. 10, 2020, applied to any formal CPE program conducted from Jan. 1, 2020, through Dec. 31, 2022. Without this waiver, an enrolled actuary earning credit hours for a formal program would need to do so while being in the same physical location with at least two other participants engaged in substantive pension service.

The Joint Board has issued proposed regulations eliminating the physical presence requirement altogether. Therefore, the Joint Board is extending the temporary waiver until the date the proposed regulations are finalized. Accordingly, the extended waiver applies to CPE credits earned for programs held during the period from Jan. 1, 2023, through the date that is 30 days after the publication of the Treasury decision finalizing these proposed regulations.

Like the original waiver, the extended waiver applies to all enrolled actuaries, whether they are in active or inactive status, and all other CPE requirements remain unchanged. Enrolled actuaries are still required to earn the same number of credit hours under formal programs that would otherwise be required. The other requirements for a formal program continue to apply, including all requirements for a qualifying program under the Joint Board regulations, attendance by at least three participants engaged in substantive pension service and an opportunity for participants to interact with the instructor during the program. In addition, the certificate of completion or instruction issued by a qualifying sponsor of the program must indicate that the program is a formal program.

Issue 13: Important Social Security Administration Changes

Social Security Announces Four Key Updates to Address Improper Payments

Social Security Commissioner Martin O’Malley announced he is taking four vital steps to immediately address overpayment issues customers and the agency have experienced. Commissioner O’Malley testified before the U.S. Senate Special Committee on Aging and the U.S. Senate Committee on Finance (excerpt):

“For 88 years, the hard-working employees of the Social Security Administration have strived to pay the right amount, to the right person, at the right time. And the agency has done this with a high degree of accuracy over a massive scale of beneficiaries. But despite our best efforts, we sometimes get it wrong and pay beneficiaries more than they are due, creating an overpayment.

When that happens, Congress requires that we make every effort to recover those overpaid benefits. But doing so without regard to the larger purpose of the program can result in grave injustices to individuals, as we see from the stories of people losing their homes or being put in dire financial straits when they suddenly see their benefits cut off to recover a decades-old overpayment, or disability beneficiaries attempting to work and finding their efforts rewarded with large overpayments. Innocent people can be badly hurt. And these injustices shock our shared sense of equity and good conscience as Americans.

We are continually improving how we serve the millions of people who depend on our programs, although we have room for improvement, as media reports last fall revealed. We have also embarked upon a deep dive into the extent of the overpayment problem at Social Security, the root causes of these administrative errors, and the steps we can take as an agency to address these individual injustices.

Our deeper understanding of the complexities of this problem has set us on the following course of action:

- Starting next Monday, March 25, we will be ceasing the heavy-handed practice of intercepting 100% of an overpaid beneficiary’s monthly Social Security benefit by default if they fail to respond to our demand for repayment. Moving forward, we will now use a much more reasonable default withholding rate of 10 % of monthly benefits — similar to the current rate in the Supplemental Security Income (SSI) program.

- We will be reframing our guidance and procedures so that the burden of proof shifts away from the claimant in determining whether there is any evidence that the claimant was at fault for causing the overpayment.

- For the vast majority of beneficiaries who request to work out a repayment plan, we recently changed our policy so that we will approve repayment plans of up to 60 months. To qualify, Social Security beneficiaries would only need to provide a verbal summary of their income, resources, and expenses, and recipients of the means-tested SSI program would not need to provide even this summary. This change extended this easier repayment option by an additional two years (from 36 to 60 months).

- And finally, we will be making it much easier for overpaid beneficiaries to request a waiver of repayment, in the event they believe themselves to have been without any fault and/or without the ability to repay.

Implementing these policy changes — with proper education and training across the people, policies, and systems of the agency — is an important but complex shift. And we are undertaking that shift with urgency, diligence, and speed.

Issue 14: IRS Reminder to U.S. Taxpayers Living, Working Abroad: File 2023 Tax Return by June 17; Those Impacted by Terrorist Attacks in Israel Have Until Oct. 7

The Internal Revenue Service reminds taxpayers living and working outside the U.S. to file their 2023 federal income tax return by Monday, June 17, 2024. This deadline applies to both U.S. citizens and resident aliens abroad, including those with dual citizenship.

This deadline does not apply to taxpayers who live or have a business in Israel, Gaza or the West Bank, and certain other taxpayers affected by the terrorist attacks in the State of Israel. They are granted relief until Oct. 7, 2024, to both file and pay most taxes due. For more information, check out Notice 2023-71.

Taxpayers unable to file their tax returns by the June deadline can request a further extension to file, but not pay, until Oct. 15.

Qualifying for the June 17 extension

If a taxpayer is a U.S. citizen or resident alien residing overseas or is in the military on duty outside the U.S., on the regular due date of their return, they are allowed an automatic 2-month extension to file their return without requesting an extension. If they use a calendar year, the regular due date of their return is April 15, and the automatic extended due date would be June 15. Because June 15 falls on a Saturday this year, the due date is delayed until the next business day, June 17.

A taxpayer qualifies for the June 17 extension to file and pay if they are a U.S. citizen or resident alien, and on the regular due date of their return:

- They are living outside the United States and Puerto Rico and their main place of business or post of duty is outside the United States and Puerto Rico, or

- They are in military or naval service on duty outside the United States and Puerto Rico.

Qualifying taxpayers should attach a statement to the return indicating which of these two situations applies.

File to Claim Benefits

Many taxpayers living outside the U.S. qualify for tax benefits, such as the Foreign Earned Income Exclusion and the Foreign Tax Credit, but they are available only if a U.S. return is filed.

In addition, the IRS encourages families to check out expanded tax benefits, such as the Child Tax Credit, Credit for Other Dependents and Credit for Child and Dependent Care Expenses and claim them if they qualify. Though taxpayers abroad often qualify, the calculation of these credits differs depending upon whether they lived in the U.S. for more than half of 2023.

Reporting Required for Foreign Accounts and Assets

Federal law requires U.S. citizens and resident aliens to report any worldwide income, including income from foreign trusts and foreign bank and securities accounts. In most cases, affected taxpayers need to complete and attach Schedule B, Interest and Ordinary Dividends, to their Form 1040 series tax return. Part III of Schedule B asks about the existence of foreign accounts such as bank and securities accounts and usually requires U.S. citizens to report the country in which each account is located.

In addition, certain taxpayers may also have to complete and attach to their return Form 8938, Statement of Specified Foreign Financial Assets. Generally, U.S. citizens, resident aliens and certain nonresident aliens must report specified foreign financial assets on this form if the aggregate value of those assets exceeds certain thresholds. For details, see the instructions for this form.

Reporting Foreign Financial Accounts to Treasury

Certain foreign financial accounts, such as bank accounts or brokerage accounts, must be reported by electronically filing Form 114, Report of Foreign Bank and Financial Accounts (FBAR), with the Treasury Department’s Financial Crimes Enforcement Network (FinCEN). The FBAR requirement applies to anyone with an interest in, or signature or other authority over foreign financial accounts whose aggregate value exceeded $10,000 at any time during 2023.

The IRS encourages taxpayers with foreign assets, even relatively small ones, to check if this filing requirement applies to them. The form is available only through the Bank Secrecy Act E-Filing System. The deadline for filing the annual FBAR is April 15, 2024. However, FinCEN grants those who missed the April deadline an automatic extension until Oct. 15, 2024. There’s no need to request this extension.

Report in U.S. Dollars

Any income received or deductible expenses paid in foreign currency must be reported on a U.S. tax return in U.S. dollars. Likewise, any tax payments must be made in U.S. dollars.

Both FINCEN Form 114 and IRS Form 8938 require the use of a Dec. 31 exchange rate for all transactions, regardless of the actual exchange rate on the date of the transaction. Generally, the IRS accepts any posted exchange rate that is used consistently.

Reporting for Expatriates

Taxpayers who relinquished their U.S. citizenship or ceased to be lawful permanent residents of the U.S. during 2023 must file a dual-status alien tax return and attach Form 8854, Initial and Annual Expatriation Statement. A copy of Form 8854 must also be filed with the IRS by the due date of the tax return (including extensions). See the instructions for this form and Notice 2009-85, Guidance for Expatriates Under Section 877A, for further details.

Extensions Beyond June 17

Taxpayers who cannot meet the June 17 due date can request an automatic extension to Oct. 15 by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. The IRS encourages anyone needing the additional time to make their request electronically. Several electronic options are available at IRS.gov/Extensions.

Businesses that need more time must file Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information and Other Returns.

Extensions for Military Personnel

Members of the military stationed abroad or in a combat zone during tax filing season may qualify for an additional extension of at least 180 days to file and pay taxes. More information, like who qualifies, can be found by reading Extension of Deadline – Combat Zone Service Q&As.

Spouses of individuals who served in a combat zone or contingency operation are generally entitled to the same deadline extensions with some exceptions.

Issue 15: IRS Employee Retention Credit Compliance Effort tops $1 billion Threshold since Fall; Voluntary Disclosure Program Suspended after March 22, Special Withdrawal Program Remains Open as Audits, Investigations Intensify

The Internal Revenue Service announced that the compliance efforts around erroneous Employee Retention Credit (ERC) claims have topped more than $1 billion so far since last fall as work continues on a number of efforts to counter questionable claims pushed by aggressive marketing, including an aggressive push on claims made for 2021.

“The IRS has made important progress in our compliance efforts protecting more than $1 billion in revenue in just six months, but we remain deeply concerned about widespread abuse involving these claims that have harmed small businesses,” said IRS Commissioner Danny Werfel. “We are encouraged by the results so far of our initiatives designed to help misled businesses, and the IRS will continue our broader compliance work given the aggressive marketing we’ve seen with this credit.”

Three IRS ERC initiatives have protected more than $1 billion just since the IRS instituted a processing moratorium on new claims beginning Sept. 14, 2023. An additional $3 billion in claims is being reviewed by IRS Criminal Investigation. Key figures from the three programs show:

- The special ERC Voluntary Disclosure Program (VDP), has yielded more than $225 million from over 500 taxpayers with another 800 submissions still being processed and more being filed at the last minute before the deadline.

- The ongoing claim withdrawal process for those with unprocessed ERC claims has led to 1,800 entities withdrawing $251 million.

- The IRS has determined that more than 12,000 entities filed over 22,000 claims that were improper and resulted in $572 million in assessments. The IRS is continuing this work, and more activity is planned in this – and other areas in the months ahead.

The amount protected by these IRS ERC initiatives will continue to grow as additional voluntary disclosures are processed, additional claims are withdrawn and additional compliance work is completed. The statistics above are through March 15.

These ERC initiatives are working to protect businesses from ERC promoters that shared misleading information or misrepresented eligibility rules and lured businesses to apply for the ERC when they did not qualify. The ERC program began as a critical effort to help businesses during the pandemic, but the program later became the target of aggressive marketing well after the pandemic ended. Some promoter groups may have called the credit by another name, such as a grant, business stimulus payment, government relief or other names besides ERC or Employee Retention Tax Credit (ERTC).

ERC VDP suspended after March 22; could potentially reopen at a future date.

The IRS also announced that it will suspend the VDP after March 22. The IRS may reopen the VDP at a future date depending on whether Congress extends the statute of limitations for ERC claims. The Treasury Department has proposed extending the statute of limitations to give the IRS additional time to address unscrupulous ERC claims.

Currently, the statute of limitations for claims processed for Tax Year 2020 will expire on April 15. Assessments on Tax Year 2020 claims will cease after this date. However, compliance activities regarding Tax Year 2021 ERC claims will continue since that statute does not expire until later.

If the VDP is reopened at a future date, the terms will be no better than the current program, which offers a special 20% discount.

The ERC Voluntary Disclosure Program, available through March 22, 2024, is for employers who need to repay ERCs they received through Dec. 21, 2023, either as a refund or as a credit on a tax return. This option lets a taxpayer repay the incorrect ERC, minus 20%, for any tax period they weren’t eligible for the ERC. Generally, businesses who enter this program do not have to amend other returns affected by the incorrect ERC and don’t have to repay interest they received from the IRS on an ERC refund.

The IRS anticipates more participants will enter the disclosure program into the final hours, so the more than $225 million in disclosed ERCs will increase.

Special withdrawal program remains open beyond March 22 for those with unprocessed ERC claims.

As the IRS continues its moratorium on processing ERC claims submitted after Sept. 14, 2023, businesses will continue to have an option to pull back on any unprocessed claims.

Businesses should quickly pursue the claim withdrawal process if they need to ask the IRS not to process an ERC claim for any tax period that hasn’t been paid yet. Taxpayers who received an ERC check but haven’t cashed or deposited it can also use this process to withdraw the claim and return the check. The IRS will treat the claim as though the taxpayer never filed it. No interest or penalties will apply.

The IRS currently has more than 1 million unprocessed ERC claims, so the claim withdrawal process remains an important option for businesses who may have submitted an improper claim.

ERC claim recapture will expand; audits, investigations intensify.

The IRS has already sent more than 12,000 letters to entities recapturing the ERC claim that was previously paid. This puts businesses in a position where they owe 100% of the ERC paid to them, plus penalties and interest dating back to the date the ERC was paid.

This initial round of letters covers Tax Year 2020. More letters are planned in coming months to address Tax Year 2021, which involved larger claims. Congress increased the maximum ERC from $5,000 per employee per year in 2020, to $7,000 per employee for each quarter of the year in 2021.

Among the other IRS compliance actions underway:

- Audits: The IRS has thousands of ERC claims currently under audit.

- Promoter investigations: The IRS is gathering information about suspected abusive tax promoters and preparers improperly promoting the ability to claim the ERC. The IRS’s Office of Promoter Investigations has received hundreds of referrals from internal and external sources. The IRS will continue civil and criminal enforcement efforts of these unscrupulous promoters and preparers.

- Criminal investigations: As of Feb. 29, 2024, IRS Criminal Investigation has initiated more than 386 criminal cases, with claims worth almost $3 billion. Twenty-five investigations have resulted in federal charges, with 12 convictions and six sentencings with an average sentence of 24 months.

Processing moratorium on new claims continues into the late spring.

On Sept. 14, 2023, amid concerns about aggressive ERC marketing, the IRS announced a moratorium on processing new claims. A specific resumption date has not been determined but, at this point, the IRS anticipates it will be sometime in the late spring.

This pause will help the IRS review the ERC inventory with strong, new measures of scrutiny in place. During the upcoming months, the IRS plans to complete the transcription of amended paper returns with the help of digitalization and deploy new risk analysis strategies to identify additional compliance work.

Deploying these new risk analysis strategies is necessary before the IRS will resume processing of claims submitted after the September 14 moratorium.

In the meantime, the IRS continues to process ERC claims submitted before the moratorium, but with more scrutiny and at a much slower rate than before the agency’s approach changed last year.

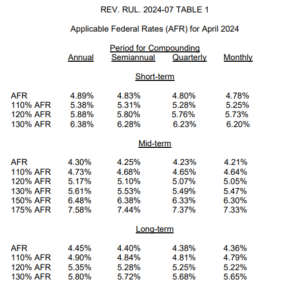

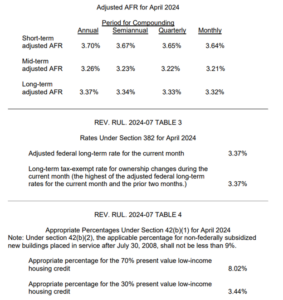

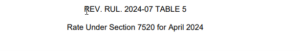

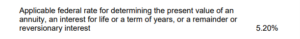

Issue 16: Applicable Federal Rates for April 2024, Rev. Rul. 2024-07