Tax Newsletter: Advanced Child Tax Credit

Reminder: Early Registration Discount for the Virtual Tax Seminars ends August 14th. Save $139

Virtual Tax Seminar Information is available here: Fall & Year-End Tax Seminars

In This Issue

- Tax Pro Account, for Online Power of Attorney Authorization, Available July 18

- Information on Notices Received After Paper Filing Form 990-EZ or Form 8868

- Advanced Child Tax Credit – Offset Issues

- Bills Introduced

- The IRS Dirty Dozen

- Penalties

- IRS Adds Ford, Hyundai, and Porsche Models to Plug-in Vehicle Credit List

- R. 4184 — 117th Congress (2021-2022) – Regulation of Tax Return Preparers

- How Clients with 2018-2020 Farming Losses Make/Revoke Certain Elections – Rev. Proc. 2021-14

- IRS Hiring

- Chief Counsel Addresses Concerns Regarding IRS-Issued FAQs

- Accounting Method Change Adjustment Affects Business Interest Deduction Calculation

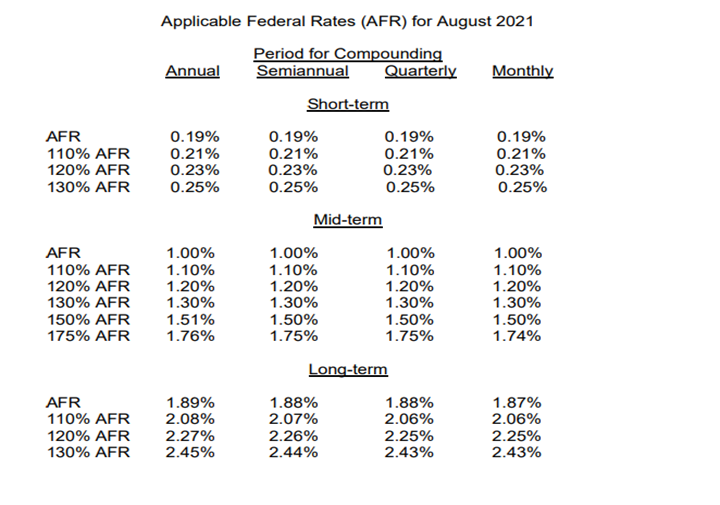

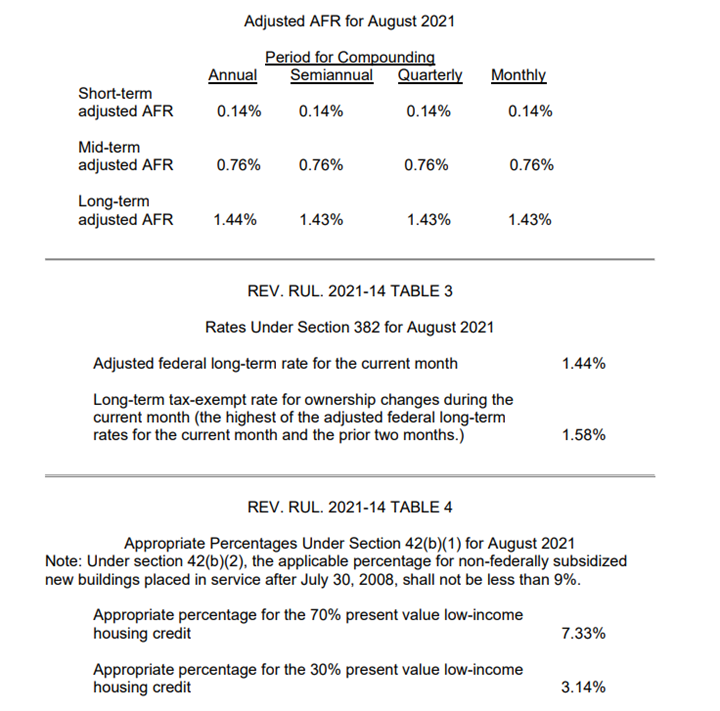

- Applicable Federal Rates for August 2021, Rev. Rul. 2021-14

Issue 1: Tax Pro Account, for Online Power of Attorney Authorization, Available July 18

Internal Revenue Manual 21.2.1.63

Tax Pro Account is an online system that allows tax professionals to securely request power of attorney (POA) authorization and/or tax information authorization (TIA) to represent an individual taxpayer in front of the IRS, in lieu of filing a paper Form 2848, Power of Attorney and Declaration of Representative, or Form 8821, Tax Information Authorization.

Tax Pro Account lets the tax professional submit an authorization request to an individual taxpayer’s IRS online account.

- Submit request in 15 minutes or less

- Taxpayer electronically signs

- Real-time processing

Use the Secure Access account to log in.

Who Can Use the Service?

To use Tax Pro Account, the tax professional must have:

- For Tax Information Authorization:

- A Centralized Authorization File (CAF) number in good standing assigned to them as an individual.

- A CAF address in the 50 United States or the District of Columbia.

- For Power of Attorney:

- A Centralized Authorization File (CAF) number in good standing assigned to them as an individual.

- A CAF address in the 50 United States or the District of Columbia.

- Authority to practice before the IRS as an attorney, certified public accountant, enrolled agent, enrolled actuary, or enrolled retirement plan agent.

- License to practice in the 50 United States or the District of Columbia as an attorney or certified public accountant.

Before Starting

Make sure this service is right for the request.

- Individual taxpayer must have:

- Address in the 50 United States or the District of Columbia.

- Ability to access IRS online account.

- Tax matters can be authorized from year 2000 and forward, plus 3 future years (calendar year only, not fiscal year):

- Form 1040 Income Tax.

- Split Spousal Assessment or Form 8857 Innocent Spouse Relief.

- Shared Responsibility Payment.

- Shared Responsibility Payment – Split Spousal Assessment.

- Civil Penalty (limited to periods of March, June, September, and December).

- Submitting with Tax Pro Account will revoke any prior authorization(s) on file with the IRS for the same tax matters, tax periods and authorization types. If the tax professional may wish to keep other authorizations intact, they must submit a Form 2848 or 8821 by fax, mail or online.

- To request authorization for multiple representatives:

- Each representative must log in with their account.

- Only 2 representatives may receive copies of a taxpayer’s IRS notices and communications.

- The taxpayer must authorize all representatives on the same day.

- If you request authorizations for overlapping tax periods and tax matters, the subsequent overlapping requests will not process if the taxpayer approves them on the same day.

Issue 2: Information on Notices Received After Paper Filing Form 990-EZ or Form 8868

The IRS is experiencing delays in processing paper returns, including Form 990‑EZ, Short Form Return of Organization Exempt from Income Tax, and Form 8868, Application for Extension of Time to File an Exempt Organization Return.

The IRS encourages organizations to file these forms electronically. If filing Form 990-EZ on paper, the client may receive a prematurely issued CP259A notice of non-filing. If filing Form 8868 on paper, there may be a delay in receiving CP211A notice confirming approval of the extension request.

Issue 3: Advanced Child Tax Credit – Offset Issues

Advance Child Tax Credit payments will not be reduced (that is, offset) for overdue taxes from previous years or other federal or state debts that the client owes.

However, if the client receives a refund when they file the 2021 tax return, any remaining Child Tax Credit amounts included in the refund may be subject to offset for tax debts or other federal or state debts owed.

Advance Child Tax Credit payments are not exempt from garnishment by non-federal creditors under federal law. Therefore, to the extent permitted by the laws of the individual’s state and local government, the advance Child Tax Credit payments may be subject to garnishment by the state, local government, and private creditors, including pursuant to a court order involving a non-federal party (which can include fines related to a crime, administrative court fees, restitution, and other court-ordered debts).

Advance Child Tax Credit payments will not be reduced (that is, offset) for overdue taxes from previous years or other federal or state debts that the spouse owes.

However, if the client files a joint 2021 tax return with their spouse and receive a refund, any remaining Child Tax Credit amounts included in the refund may be subject to offset for tax debts or other federal or state debts the spouse owes. The injured spouse can file Form 8379 with their 2021 tax return.

Monthly Child Tax Credit Payments Begin – IR 2021-151

Treasury and the IRS announced that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

This first batch of advance monthly payments worth roughly $15 billion reached about 35 million families today across the country. About 86% were sent by direct deposit.

The payments will continue each month. The IRS urged people who normally are not required to file a tax return to explore the tools available on IRS.gov. These tools can help determine eligibility for the advance Child Tax Credit or help people file a simplified tax return to sign up for these payments as well as Economic Impact Payments, and other credits they may be eligible to receive.

Under the American Rescue Plan, each payment is up to $300 per month for each child under age 6 and up to $250 per month for each child ages 6 through 17. Normally, anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll. Besides the July 15 payment, payment dates scheduled are: Aug. 13, Sept. 15, Oct. 15, Nov. 15 and Dec. 15.

Here are further details on these payments:

- Payments went to eligible families who filed 2019 or 2020-income tax returns.

- Tax returns processed by June 28 are reflected in these payments. This includes people who do not typically file a return, but during 2020 successfully registered for Economic Impact Payments using the IRS Non-Filers tool or in 2021 successfully used the Non-filer Sign-up Tool for Advance CTC, also on IRS.gov.

- Payments are automatic. Aside from filing a tax return, including a simplified return from the Non-Filer Sign-Up tool, families do not have to do anything if they are eligible to receive monthly payments.

Issue 4: Bills Introduced

H.R.3735 – E-Filing Standards Improvement Act. To provide electronic filing receipts to taxpayers who file tax returns via electronic filing process, and for other purposes.

S.1627 – Estate Tax Rate Reduction Act. To reduce the rate of tax on estates, gifts, and generation-skipping transfers.

S.1770 – Retirement Security and Savings Act of 2021. To reform retirement provisions, and for other purposes.

S.1887 – Multi-State Worker Tax Fairness Act of 2021. To limit the extent to which States may tax the compensation earned by nonresident telecommuters and other multi-State workers.

S.1889 – Compassionate Retirement Act of 2021. To establish an exception to the penalty on early distributions from qualified plans for individuals diagnosed with certain terminal illnesses.

S.1892 – Bicycle Commuter Act of 2021. To modify employer-provided fringe benefits for bicycle commuting.

S.1961 – IRA Act of 2021. To increase IRA contribution limits for individuals without an employer retirement plan.

H.R.3449 – HIRE Act of 2021. To make certain adjustments to the work opportunity credit to modernize the credit and make it more effective as a hiring incentive, and for other purposes.

H.R.3505 – To allow a refundable tax credit against income tax for certain healthcare professionals.

H.R.3564 – CHILD Care Act of 2021. To repeal the temporary rule allowing full deduction of business meals and to provide an appropriation for making payments under the Child Care and Development Block Grant Act of 1990.

H.R.3623 – IGNITE American Innovation Act. To provide for advance refunds of certain net operating losses and research expenditures, and for other purposes.

H.R.3644 – Expanding Access to Retirement Savings for Caregivers Act. To reduce the age for making catch-up contributions to retirement accounts to take into account time out of the workforce to provide dependent care services.

H.R.3796 – ELITE Vehicles Act. To terminate the credit for new qualified plug-in electric drive motor vehicles.

S.2014 – Refund Equality Act of 2021. To permit legally married same-sex couples to amend their filing status for tax returns outside the statute of limitations.

Issue 5: The IRS Dirty Dozen

The IRS began its “Dirty Dozen” list for 2021 with a warning to tax professionals, taxpayers and financial institutions to be on the lookout for these 12 nefarious schemes and scams. This year’s “Dirty Dozen” fall into four categories:

- Pandemic-related scams, like Economic Impact Payment theft.

- Personal information cons, including phishing, ransomware, and phone “vishing.”

- Ruses focusing on unsuspecting victims like fake charities and senior/immigrant fraud and

- Schemes that persuade taxpayers into unscrupulous actions such as Offer in Compromise mills and syndicated conservation easements.

Economic Stimulus Payments (EIP)

A continuing threat to individuals is from identity thieves who try to steal Economic Impact Payments (EIPs), also known as stimulus payments. Most eligible people will get their payments automatically from the IRS. Clients should watch out for these tell-tale signs of a scam:

- Any text messages, random incoming phone calls or emails inquiring about bank account information or requesting recipients to click a link or verify data should be considered suspicious and deleted without opening.

- Be alert to mailbox theft. Frequently check mail and report suspected mail losses to Postal Inspectors.

- Do not fall for stimulus check scams. The IRS will not initiate contact by phone, email, text, or social media asking for Social Security numbers or other personal or financial information related to Economic Impact Payments.

Clients should remember that the IRS website, IRS.gov, is the agency’s official website for information on payments, refunds, and other tax information.

Unemployment Fraud Leading to Inaccurate Taxpayer 1099-Gs

Because of the COVID-19 pandemic, many taxpayers lost their jobs and received unemployment compensation from their state. However, scammers also took advantage of the pandemic by filing fraudulent claims for unemployment compensation using stolen personal information of individuals who had not filed claims. Payments made on these fraudulent claims went to the identity thieves.

The IRS reminds taxpayers to be on the lookout for receiving a Form 1099-G reporting unemployment compensation that they did not receive. For people in this situation, the IRS urges them to contact their appropriate state agency for a corrected form. If a corrected form cannot be obtained so that a client can file a timely tax return, taxpayers should complete their return claiming only the unemployment compensation and other income they actually received.

Tax-related Phishing Scams Persist

The IRS warns taxpayers, businesses, and tax professionals to be alert for a continuing surge of fake emails, text messages, websites, and social media attempts to steal personal information. These attacks tend to increase during tax season and remain a major cause of identity theft throughout the year.

Phishing scams target individuals with communications appearing to come from legitimate sources to collect victims’ personal and financial data and potentially infect their devices by convincing the target to download malicious programs. Cybercriminals usually send these phishing communications by email but may also use text messages or social media posts or messaging.

These phishing schemes can be tricky and cleverly disguised to look like they are from the IRS or from others in the tax community. Remind clients to continually watch out for emails and other scams posing as the IRS, like those promising a big refund, missing stimulus payment or even issuing a threat. People should not open attachments or click on links in those emails or text messages.

Phishing Scams Targeting Tax Professionals

The IRS warns tax professionals about phishing scams involving verification of Electronic Filing Identification Numbers (EFIN) and Centralized Authorization File (CAF) numbers. The agency has seen an increase in these kinds of scams, along with offers to buy and sell EFINs and CAFs.

Phishing – New Client Scams Target Tax Pros

The “New Client” scam continues to be a prevalent form of phishing for tax pros. Here’s an example in the form of an email:

“I just moved here from Michigan. I have an urgent tax issue and I was hoping you could help,” the email begins. “I hope you are taking on new clients.”

The email says one attachment is an IRS notice and the other attachment is the prospective client’s prior-year tax return. This scam has many variations so tax professionals should be wary and avoid opening attachments or clicking links when they do not know the e-mail sender.

Impersonator Phone calls/Vishing

Individuals should be wary of unexpected phone calls asking for personal financial information. The IRS has seen an increase in voice-related phishing, or ‘vishing,’ particularly from scams related to federal tax liens. For those receiving phone calls out of the blue, security experts recommend asking questions of the caller but not providing any personal information. If in doubt, hang up immediately.

During 2020, almost 400 vishing scams were reported, a 14% increase from the prior year. Of those vishing scams, 25% were scammers who tried to use fake tax lien information. The number of tax-lien related scams increased from 58 in 2019 to 104 in 2020, an increase of 79%. The IRS urges taxpayers to refrain from engaging potential scammers on the phone or online.

While both the IRS and the Federal Trade Commission have seen a decline in the number of reports of scammers claiming to be from the IRS telephoning potential victims, the agency urges taxpayers to be wary. (The IRS has seen a 43% decrease in the number of reports of calls from callers claiming to be from the IRS: 20,500 in 2020 compared to 36,000 in 2019. The FTC saw a 67% decline from 7,694 reports in 2019 to 2,571 in 2020.)

While the numbers may be on the decline, the IRS urges taxpayers to remain vigilant and to remember the following things about the IRS:

- The IRS generally first contacts people by mail – not by phone – about unpaid taxes.

- The IRS may attempt to reach individuals by telephone but will not insist on payment using an iTunes card, gift card, prepaid debit card, money order or wire transfer.

- The IRS will never request personal or financial information by e-mail, text, or social media.

Recipients of these calls should hang up before giving out any information.

Social Media Scams Continue

Taxpayers should be aware of social media scams, which frequently use events like COVID-19 to try to trick people. Social media enables unscrupulous individuals to lurk on accounts and extract personal information to use against the victim. These cons may send emails impersonating the victim’s family, friends, or co-workers.

Social media scams have also led to tax-related identity theft. The basic element of social media scams is convincing a potential victim that he or she is dealing with a person close to them that they trust via email, text, or social media messaging.

Using personal information, a scammer may email a potential victim and include a link to something of interest to the recipient, but which contains malware intended to commit more crimes. Scammers also infiltrate their victim’s emails and cell phones to go after their friends and family with fake emails that appear to be real, and text messages soliciting, for example, small donations to fake charities that are appealing to the victims.

Individuals should know that any of their information that is publicly shared on social media platforms can be collected and used against them. One way to circumvent these scams is to review privacy settings and limit data that is publicly shared.

Ransomware on the Rise

Financial institutions should be aware of trends and indicators of ransomware, which is a form of malicious software (“malware”) designed to block access to a computer system or data. Access is often blocked by encrypting data or programs on information technology (IT) systems to extort ransom payments from victims in exchange for decrypting the information and restoring victims’ access to their systems or data. In some cases, in addition to the attack, the perpetrators threaten to publish sensitive files belonging to the victims, which can be individuals or business entities.

The U.S. Treasury Financial Crimes Enforcement Network (FINCEN) has noted that ransomware attacks continue to rise across various sectors, particularly across governmental entities as well as financial, educational, and healthcare institutions. Ransomware attacks on small municipalities and healthcare organizations have increased, likely due to the victims’ weaker cybersecurity controls, such as inadequate system backups and ineffective incident response capabilities.

Fake Charities

The IRS advises taxpayers to be on the lookout for scammers who set up fake organizations to take advantage of the public’s generosity. They especially take advantage of tragedies and disasters, such as the COVID-19 pandemic.

Scams requesting donations for disaster relief efforts are especially common on the phone. Taxpayers should always check out a charity before they donate, and they should not feel pressured to give immediately.

Taxpayers who give money or goods to a charity may be able to claim a deduction on their federal tax return by reducing the amount of their taxable income. But taxpayers should remember that to receive a deduction, taxpayers must donate to a qualified charity.

Here are some tips to remember about fake charity scams:

- Individuals should never let any caller pressure them. A legitimate charity will be happy to get a donation at any time, so there’s no rush. Donors are encouraged to take time to do the research.

- Potential donors should ask the fundraiser for the charity’s exact name, web address and mailing address, so it can be confirmed later. Some dishonest telemarketers use names that sound like large well-known charities to confuse people.

- Be careful how a donation is paid. Donors should not work with charities that ask them to pay by giving numbers from a gift card or by wiring money. That’s how scammers ask people to pay. It’s safest to pay by credit card or check — and only after having done some research on the charity.

Immigrant/Senior Fraud

IRS impersonators and other scammers are known to target groups with limited English proficiency as well as senior citizens. These scams are often threatening in nature.

While it has diminished some recently, the IRS impersonation scam remains a common scam. This is where a taxpayer receives a telephone call threatening jail time, deportation, or revocation of a driver’s license from someone claiming to be with the IRS. Taxpayers who are recent immigrants often are the most vulnerable and should ignore these threats and not engage the scammers.

The IRS reminds taxpayers that the first contact with the IRS will usually be through mail, not over the phone. Legitimate IRS employees will not threaten to revoke licenses or have a person deported. These are scare tactics.

As phone scams pose a major threat to people with limited access to information, including individuals not entirely comfortable with the English language, the IRS has added new features to help those who are more comfortable in a language other than English. The Schedule LEP allows a taxpayer to select in which language they wish to communicate. Once they complete and submit the schedule, they will receive future communications in that selected language preference.

Offer in Compromise “Mills”

Offer in Compromise mills contort the IRS program into something it’s not – misleading people with no chance of meeting the requirements while charging excessive fees, often thousands of dollars.

The IRS urges people to take a few minutes to review information on IRS.gov to see if they might be a good candidate for the program – and avoiding costly promoters who advertise on radio and television.”

The IRS reminds taxpayers to beware of promoters claiming their services are needed to settle with the IRS, that their tax debts can be settled for “pennies on the dollar” or that there is a limited window of time to resolve tax debts through the Offer in Compromise (OIC) program.

An “offer,” or OIC, is an agreement between a taxpayer and the IRS that resolves the taxpayer’s tax debt. The IRS has the authority to settle, or “compromise,” federal tax liabilities by accepting less than full payment under certain circumstances. However, some promoters are inappropriately advising indebted taxpayers to file an OIC application with the IRS, even though the promoters know the person won’t qualify. This costs honest taxpayers money and time.

Taxpayers should be especially wary of promoters who claim they can obtain larger offer settlements than others or who make misleading promises that the IRS will accept an offer for a small percentage. Companies advertising on TV or radio frequently cannot do anything for taxpayers that they cannot do for themselves by contacting the IRS directly.

Unscrupulous Tax Return Preparers

Although most tax preparers are ethical and trustworthy, taxpayers should be wary of preparers who will not sign the tax returns they prepare, often referred to as “ghost” preparers. For e-filed returns, the “ghost” will prepare the return, but refuse to digitally sign as the paid preparer.

By law, anyone who is paid to prepare, or assists in preparing federal tax returns, must have a valid Preparer Tax Identification Number (PTIN). Paid preparers must sign and include their PTIN on the return. Not signing a return is a red flag that the paid preparer may be looking to make a quick profit by promising a big refund or charging fees based on the size of the refund.

Unscrupulous tax return preparers may also:

- Require payment in cash only and will not provide a receipt.

- Invent income to qualify their clients for tax credits.

- Claim fake deductions to boost the size of the refund.

- Direct refunds into their bank account, not the taxpayer’s account.

Taxpayers should also remember that they are legally responsible for what is on their tax return even if it is prepared by someone else.

Unemployment Insurance Fraud

Unemployment fraud often involves individuals acting in coordination with or against employers and financial institutions to get state and local assistance to which they are not entitled. These scams can pose problems that can adversely affect taxpayers in the long run.

States, employers, and financial institutions need to be aware of the following scams related to unemployment insurance:

- Identity-related fraud: Filers submit applications for unemployment payments using stolen or fake identification information to perpetrate an account takeover.

- Employer-employee collusion fraud: The employee receives unemployment insurance payments while the employer continues to pay the employee reduced, unreported wages.

- Misrepresentation of income fraud: An individual returns to work and fails to report the income to continue receiving unemployment insurance payments, or in an effort to receive higher unemployment payments, applicants claim higher wages than they actually earned.

- Fictitious employer-employee fraud: Filers falsely claim they work for a legitimate company, or create a fictitious company, and supply fictitious employee and wage records to apply for unemployment insurance payments.

- Insider fraud: State employees use credentials to inappropriately access or change unemployment claims, resulting in the approval of unqualified applications, improper payment amounts, or movement of unemployment funds to accounts that are not on the application.

Below is a short list of financial red flag indicators of unemployment fraud:

- Unemployment payments are coming from a state other than the state in which the customer reportedly resides or has previously worked.

- Multiple state unemployment payments are made within the same disbursement timeframe.

- Unemployment payments are made in the name of a person other than the account holder or in the names of multiple unemployment payment recipients.

- Numerous deposits or electronic funds transfers (EFTs) are made that indicate they are unemployment payments from one or more states to people other than the account holder(s).

- A higher amount of unemployment payments is seen in the same timeframe compared to similar customers and the amount they received.

Syndicated Conservation Easements

- In syndicated conservation easements promoters take a provision of tax law for conservation easements and twist it through using inflated appraisals of undeveloped land and partnerships. These abusive arrangements are designed to game the system and generate inflated and unwarranted tax deductions, often by using inflated appraisals of undeveloped land and partnerships devoid of a legitimate business purpose.

Abusive Micro-captive Arrangements

- In abusive “micro-captive” structures, promoters, accountants or wealth planners persuade owners of closely held entities to participate in schemes that lack many of the attributes of insurance. For example, coverages may “insure” implausible risks, fail to match genuine business needs or duplicate the taxpayer’s commercial coverages. But the “premiums” paid under these arrangements are often excessive and used to skirt tax law. Recently, the IRS has stepped up enforcement against a variation using potentially abusive offshore captive insurance companies domiciled in Puerto Rico and elsewhere.

Potentially Abusive Use of the US-Malta Tax Treaty

- Some U.S. citizens and residents are relying on an interpretation of the U.S.-Malta Income Tax Treaty to take the position that they may contribute appreciated property tax free to certain Maltese pension plans and that there are also no tax consequences when the plan sells the assets and distributes proceeds to the U.S. taxpayer. Ordinarily gain would be recognized upon disposition of the plan’s assets and distributions of the proceeds. The IRS is evaluating the issue to determine the validity of these arrangements and whether Treaty benefits should be available in such instances and may challenge the associated tax treatment.

Improper Claims of Business Credits

Improper claims for the research and experimentation credit generally involve failures to participate in, or substantiate, qualified research activities and/or satisfy the requirements related to qualified research expenses. To claim a research credit, taxpayers must evaluate and appropriately document their research activities over a period of time to establish the amount of qualified research expenses paid for each qualified research activity.

Improper Monetized Installment Sales

- Promoters find taxpayers seeking to defer the recognition of gain upon the sale of appreciated property and organize an abusive shelter through selling them monetized installment sales. These transactions occur when an intermediary purchases appreciated property from a seller in exchange for an installment note, which typically provides for payments of interest only, with principal being paid at the end of the term. In these arrangements, the seller gets the lion’s share of the proceeds but improperly delays the gain recognition on the appreciated property until the final payment on the installment note, often slated for many years later.

Issue 6: Penalties

Clients who do not meet their tax obligations may owe a penalty.

The IRS charges a penalty for various reasons, including if the client does not:

- File their tax return on time.

- Pay any tax owed on time and in the right way.

- Prepare an accurate return.

- Provide accurate information returns.

IRS may charge interest on a penalty if the client does not pay in full and charge some penalties every month until the taxpayer pays the full amount owed.

IRS will send the client a notice or letter by mail. The notice or letter will tell them about the penalty, the reason for the charge and what to do next. These notices and letters include an identification number.

Verify the information in the notice or letter is correct. If they can resolve the issue in the notice or letter, a penalty may not apply.

Types of Penalties

These are some penalties IRS sends notices and letters about:

- Information Return applies to clients who do not file or furnish their required information return or payee statement correctly by the due date.

- Failure to File applies when the client does not file their tax return by the due date.

- Failure to Pay applies when the client does not pay the tax they owe by the due date.

- Accuracy-Related applies when the client does not claim all their income or when they claim deductions or credits for which they do not qualify.

- Failure to Deposit applies when the client does not pay employment taxes accurately or on time.

- Tax Return Preparer Misconduct applies to tax return preparers who engage in misconduct.

- Dishonored Checks applies when the bank does not honor the check or other form of payment.

- Underpayment of Estimated Tax by Corporations applies when the client does not pay estimated tax accurately or on time for a corporation.

- Underpayment of Estimated Tax by Individuals applies when the client does not pay estimated tax accurately or on time as an individual.

Interest on a Penalty

IRS charges interest on penalties.

The date from which IRS begins to charge interest varies by the type of penalty. Interest increases the amount the client owes until the pay the balance in full.

Remove or Reduce a Penalty

IRS may be able to remove or reduce some penalties if the client acted in good faith and can show reasonable cause for why they were not able to meet their tax obligations. By law the IRS cannot remove or reduce interest unless the penalty is removed or reduced.

Dispute a Penalty

If the client disagrees with the amount they owe, they may dispute the penalty.

Call IRS at the toll-free number at the top right corner of the notice or letter or write IRS a letter stating why they should reconsider the penalty. Sign and send the letter along with any supporting documents to the address on the notice.

Have this information when calling or sending a letter:

- The notice or letter IRS sent.

- The penalty the client wants IRS to reconsider (for example, a 2020 late filing penalty).

- For each penalty, an explanation of why the client thinks IRS should remove it.

Avoid a Penalty

The client can avoid a penalty by filing accurate returns, paying the tax by the due date, and furnishing any information returns timely. If the client cannot do so, they can apply for an extension of time to file or a payment plan.

This does not grant the client an extension of time to pay. A payment plan can help them pay over-time.

Issue 7: IRS Adds Ford, Hyundai, and Porsche Models to Plug-in Vehicle Credit List

IRS has added Ford, Hyundai, and Porsche models to the list of vehicles that are eligible for the plug-in electric drive motor vehicle credit.

This credit phases out over 6 quarters (“phase-out period”) beginning when a manufacturer has sold at least 200,000 qualifying vehicles for use in the U.S. (determined on a cumulative basis for sales after December 31, 2009).

| Ford | ||

| Model Year | Vehicle Description | Credit Amount |

| 2021 | Mustang Mach-E GT | $7,500 |

| Hyundai | ||

| Model Year | Vehicle Description | Credit Amount |

| 2021 | Ioniq Plug-In Hybrid Electric Vehicle | $4,543 |

| 2021 | Ioniq Electric Battery Vehicle | $7,500 |

| Porsche | ||

| Model Year | Vehicle Description | Credit Amount |

| 2021 | Cayenne E-Hybrid | $7,500 |

| 2021 | Cayenne E-Hybrid Coupe | $7,500 |

| 2021 | Cayenne Turbo S E-Hybrid Coupe | $7,500 |

| 2021 | Cayenne Turbo S E-Hybrid | $7,500 |

| 2021 | Panamera 4 PHEV: which includes the 4 E-Hybrid, 4 E-Hybrid Sport Turismo, 4 S E-Hybrid, 4 S E-Hybrid Executive, 4 S E-Hybrid Sport Turismo, 4 E-Hybrid Executive, Turbo S E-Hybrid, Turbo S E-Hybrid Executive, Turbo S E-Hybrid Sport Turismo | $7,500 |

Issue 8: H.R. 4184 — 117th Congress (2021-2022) – Regulation of Tax Return Preparers

Legislation was introduced in 2019, that would give the IRS the authority to set minimum standards for all tax practitioners, as well as add new competency requirements. “The Taxpayer Protection and Preparer Proficiency Act,” would give the IRS the explicit legal authority to regulate the practice of tax return preparers, including the ability to sanction them, up to possibly revoking their Preparer Tax Identification Number (PTIN).

All return preparers, under this legislation, would be required to have a PTIN, so revoking one would effectively bar the person from filing returns on behalf of clients.

Preparers would also be required to “satisfy any examination and annual continuing education requirements as prescribed by the Secretary” and complete a background check administered by the Treasury Department.

Those who are already subject to continuing professional education and had to take a comparable exam to practice (so, basically, CPAs, attorneys, and enrolled agents) would be exempt.

As part of Biden’s American Families Plan, the President is calling on Congress to pass legislation to give the IRS that authority.

- Gives Treasury authority to regulate paid tax return preparers.

- Clarifies that the authority being provided is to reinstitute the IRS’s 2011 paid preparer regulatory program.

- Gives the IRS authority to revoke an incompetent or fraudulent preparer’s Preparer Tax Identification Number (PTIN).

- Clarifies that certain non-signing preparers – those persons who prepare returns under the supervision of an attorney, CPA, or enrolled agent– are not required to obtain a PTIN.

- Requires a GAO study on the sharing of information between the Treasury Department and State authorities regarding PTINs issued to paid return preparers and preparer minimum standards.

There is strong support for the legislation.

Check out our webinar schedule here: Webinar Schedule

Purchase the Unlimited Webinar Package for $199

Issue 9: How Clients with 2018-2020 Farming Losses Make/Revoke Certain Elections – Rev. Proc. 2021-14

The IRS has set out how taxpayers that have a net operating loss (NOL) for any tax year that begins in 2018, 2019, or 2020, all or a portion of which consists of a farming loss, can elect to:

- Not apply certain NOL rules contained in the Coronavirus Aid, Relief and Economic Security Act (CARES Act).

- How they can revoke a related election and

- How the consolidated group rules affect those actions.

History

The Tax Cuts and Jobs Act made modifications to the NOL Deduction and NOL Carryback Rules

Enactment of 80% limitation.

The act amended § 172(a)(2) to provide that, with regard to NOLs arising in a taxable year beginning after December 31, 2017, the amount allowed as a “net operating loss deduction,” cannot exceed 80% of the taxable income of the taxpayer computed without regard to any NOL deduction – (the 80% limitation).

The 80% limitation does not apply in the case of:

- An insurance company, as defined in § 816(a), other than a life insurance company.

Two-year carryback period for farming losses.

- The TCJA amended § 172(b)(1) to generally eliminate NOL carrybacks. However, § 13302(c)(1) amended § 172(b)(1) to provide a two-year carryback period for the portion of an NOL that is a farming loss.

- The TCJA further amended § 172(b)(1) to provide that taxpayers entitled to this two-year carryback period may make an irrevocable election to waive it. (§ 172(b)(1)(B)(iv))

- In addition, § 172(b)(3), which predates the TCJA amendments, separately provides that any taxpayer entitled to an NOL carryback period under § 172(b)(1) may irrevocably elect to relinquish the entire carryback period with respect to that NOL for any taxable year.

- The TCJA changes relating to loss carrybacks apply to NOLs arising in taxable years beginning after December 31, 2017.

CARES Act Amendments to TCJA 80% Limitation and NOL Carryback Rules

- The CARES Act provided a temporary suspension of the 80% limitation.

- The CARES Act amended § 172(a) to provide that the 80% limitation applies only to NOLs arising in taxable years beginning after December 31, 2017, that are deducted in taxable years beginning after December 31, 2020.

- The CARES Act amended § 172(b)(1) of the Code to provide a five-year carryback period for any NOL arising in a taxable year beginning after December 31, 2017, and before January 1, 2021.

- 172(b)(1)(D)(i)(II), of the CARES Act, provides, in part, that the two-year carryback period provided by § 172(b)(1)(B) for farming losses does not apply to any such NOL.

COVID-19 Tenant Relief Act (CTRA 2020) – Amendments to CARES Act.

- 281(a) of the CTRA 2020 amended § 2303 of the CARES Act by adding a new subsection (e), which took effect as if originally included in that CARES Act.

New § 2303(e) of the CARES Act contains the following provisions:

(1) Election to disregard the CARES Act amendments. § 2303(e)(1) of the CARES Act provides that a taxpayer with a Farming Loss NOL for any taxable year beginning in 2018, 2019, or 2020, may make an election to disregard the amendments made by section 2303(a) and (b) of the CARES Act (that is, the CARES Act Amendments).

Consequences of Election

If a taxpayer makes the election under § 2303(e)(1), the following consequences will result:

(a) Application of 80% limitation. The 80-percent limitation will apply to determine the NOL deduction for each taxable year beginning in 2018, 2019, or 2020 to the extent the deduction is attributable to NOLs arising in taxable years beginning after December 31, 2017. The 80-percent limitation will not apply to determine the NOL deduction for any taxable year beginning before 2018.

(b) Application of modified taxable income rules.

- 172(b)(2)(C) of the Code, as added by the TCJA and effective prior to enactment of the CARES Act, provides a modified taxable income rule to account for the 80% limitation.

- This rule will apply with regard to each taxable year beginning in 2018, 2019, or 2020.

(c) NOL carryback period.

The NOL carryback period will be determined under § 172(b) as amended by the TCJA and effective prior to enactment of the CARES Act, for any NOL arising in any taxable year beginning in 2018, 2019, or 2020.

For example, if a taxpayer with a Farming Loss NOL in 2018 makes the election under § 2303(e)(1), only the portion of the Farming Loss NOL that consists of a farming loss can be carried back two taxable years.

In addition, for taxpayers other than insurance companies, as defined in § 816(a), that are not life insurance companies, no portion of any NOL that does not constitute a farming loss can be carried back to any taxable year beginning before January 1, 2018.

Making the Election

- 2303(e)(1)(B)(i) of the CARES Act provides that, except in the case of a deemed election of the revenue procedure, an election to disregard the CARES Act amendments (Affirmative Election) under § 2303(e)(1) must be made in the manner prescribed by the Secretary.

Once made, an election under § 2303(e)(1) is irrevocable.

- 2303(e)(1)(B)(ii)(I) of the CARES Act generally provides that an Affirmative Election must be made by the due date, including extensions of time, for filing the taxpayer’s Federal income tax return for the taxpayer’s first taxable year ending after December 27, 2020.

Deemed election

In the case of any taxpayer with a Farming Loss NOL that files a federal income tax return before December 27, 2020, that disregards the CARES Act Amendments, the taxpayer is treated as having made a deemed election (Deemed Election) under § 2303(e)(1) unless the taxpayer amends such return to reflect such amendments by the due date (including extensions of time) for filing the taxpayer’s Federal income tax return for the first taxable year ending after December 27, 2020.

Revocation of election to waive two-year carryback period.

- 2303(e)(2) of the CARES Act provides taxpayers with the ability to revoke an election to waive the two-year carryback period if the election:

- was made by the taxpayer before December 27, 2020; and

- (ii) relates to the two-year carryback period for the portion of any Farming Loss NOL that is a farming loss arising in taxable years beginning in 2018 or 2019.

Election to Disregard CARES Act Amendments

A taxpayer with a Farming Loss NOL, other than a taxpayer making a Deemed Election may make an Affirmative Election under § 2303(e)(1) of the CARES Act if:

- The Farming Loss NOL arose in any taxable year of the taxpayer beginning in 2018, 2019, or 2020; and

- The taxpayer satisfies all of the conditions described in § 3.01(2) of this revenue procedure.

- 3.01(2)

To make a valid Affirmative Election a taxpayer must satisfy the following conditions:

- Election deadline.

The taxpayer must make the Affirmative Election on a statement described in § 3.01(2)(b) of this revenue procedure by the due date, including extensions of time, for filing the taxpayer’s Federal income tax return for the taxpayer’s first taxable year ending after December 27, 2020.

(b) Required statement.

The taxpayer must attach a statement to the taxpayer’s Federal income tax return for the taxpayer’s first taxable year ending after December 27, 2020. The statement must provide in type or legible writing at the top of the statement the following:

“The taxpayer elects under § 2303(e)(1) of the CARES Act and Revenue Procedure 2021-14 to disregard the amendments made by § 2303(a) of the CARES Act for taxable years beginning in 2018, 2019, and 2020, and the amendments made by § 2303(b) of the CARES Act that would otherwise apply to any net operating loss arising in any taxable year beginning in 2018, 2019, or 2020. The taxpayer incurred a Farming Loss NOL, as defined in section 1.01 of Revenue Procedure 2021- 14, in [list each applicable taxable year beginning in 2018, 2019, or 2020].”

The taxpayer should also attach a copy of the statement to any original or amended Federal income tax return or application for tentative refund on which the taxpayer claims a deduction attributable to a two-year NOL carryback pursuant to the

Affirmative Election – Deemed Election

Except as provided in § 3.02(3) of this revenue procedure, a taxpayer is treated as having made a Deemed Election under § 2303(e)(1) of the CARES Act if the taxpayer, before December 27, 2020, filed one or more original or amended Federal income tax returns, or applications for tentative refund, that disregard the CARES Act Amendments with regard to a Farming Loss NOL.

Special procedure for certain taxpayers whose two-year carryback claims filed before December 27, 2020, were rejected.

Some taxpayers may have had their two-year carryback claims, as reflected on their applications for tentative refund or claims for refund that were filed before December 27, 2020, rejected by the Internal Revenue Service (IRS).

If such a taxpayer wants to continue to pursue those claims, the taxpayer should submit complete copies of their rejected applications or claims, including the original or amended Federal income tax returns for the taxable years in which the NOLs arose, in the manner set forth in this section 3.02(2), which will enable the IRS to review their cases as expeditiously as possible.

(a) The taxpayer should submit a complete copy of each rejected application for tentative refund or claim for refund based on a two-year carryback period, including the original or amended Federal income tax return for the taxable year in which the NOL arose, to the IRS Service Center at which the taxpayer previously filed the application or claim and return. (b) The taxpayer should provide in type or legible writing at the top of the first page of a complete copy of each application or claim the following:

“Deemed Election under § 3.02(2) of Revenue Procedure 2021-14.”

(c) The complete copy of each application or claim and return should be submitted on or before the due date, including extensions of time, for filing the taxpayer’s Federal income tax return for the taxpayer’s first taxable year ending after December 27, 2020.

(3) Exception to Deemed Election.

A taxpayer will not be treated as having made a Deemed Election if, for each taxable year for which the taxpayer filed an original or amended Federal income tax return or an application for tentative refund that treated a Farming Loss NOL in a manner that disregards the CARES Act Amendments, the taxpayer subsequently files either an amended return by the due date, including extensions of time, for filing the taxpayer’s Federal income tax return for the taxpayer’s first taxable year ending after December 27, 2020, or an application for tentative refund within the required time for filing such an application and also by the due date, including extensions of time, for filing the taxpayer’s Federal income tax return for the taxpayer’s first taxable year ending after December 27, 2020, that properly reflects the treatment of each Farming Loss NOL under the CARES Act Amendments.

For example, a taxpayer who disregarded the CARES Act Amendments by using a 2-year carryback for the farming loss portion of the taxpayer’s only Farming Loss NOL and filed Forms 1120X for the two carryback years, and who subsequently timely files a Form 1139 with a 5-year carryback that accounts for that Farming Loss NOL in a manner consistent with the CARES Act Amendments for each of the five carryback years, will not be treated as having made a Deemed Election.

Similarly, a taxpayer who filed a Form 1139 prior to December 27, 2020, and disregarded the CARES Act Amendments by using a 2-year carryback for the farming loss portion of the taxpayer’s only Farming Loss NOL and subsequently timely files a Form 1139 with a 5-year carryback that accounts for that Farming Loss NOL in a manner consistent with the CARES Act for each of the five carryback years, will not be treated as having made a Deemed Election.

- 4. Revocations Regarding Waivers of Carryback Periods

Revocation of election not to apply the two-year carryback period for farming losses

A taxpayer that, pursuant to § 172(b)(1)(B)(iv) or § 172(b)(3), elected not to have the two-year carryback period apply to the farming loss portion of a Farming Loss NOL incurred in a taxable year beginning in 2018 or 2019 may revoke that election if the taxpayer:

(a) made that election before December 27, 2020; and

(b) satisfies all of the conditions described in § 4.01(2) of this revenue procedure.

Time and Manner for Filing a Revocation.

To make a valid revocation under § 4.01(1) of this revenue procedure, a taxpayer must satisfy the following conditions:

(a) Revocation deadline.

A taxpayer must make the revocation described in section 4.01(1) of this revenue procedure by the date that is 3 years after the due date, including extensions of time, for filing the return for the taxable year the Farming Loss NOL was incurred.

(b) Required Statement.

The taxpayer must attach a statement to an amended return for the loss year. The statement must provide in type or legible writing at the top of the statement the following:

“Pursuant to § 4.01 of Rev. Proc. 2021-14 the taxpayer is revoking a prior §172(b)(1)(B)(iv) or § 172(b)(3) election not to have the two-year carryback period provided by § 172(b)(1)(B)(i) apply to the Farming Loss NOL, as defined in § 1.01 of Rev. Proc. 2021-14, incurred in the taxable year.”

Consolidated Groups

For purposes of this revenue procedure, with regard to an affiliated group of corporations, as defined in § 1504, filing, or required to file, a consolidated return for the taxable year (consolidated group)—

- The term “taxpayer” includes a consolidated group.

- The term “NOL” includes, with regard to a consolidated taxable year, the excess of deductions over gross income, as determined under § 1.1502-11(a) of the Income Tax Regulations without regard to any consolidated net operating loss (CNOL) deduction.

Manner of Making Elections

An Affirmative Election under § 3.01 of this revenue procedure and a revocation described in § 4.01 of this revenue procedure are made by the agent for the consolidated group.

An amended return described in § 3.02(3) of this revenue procedure is filed, and a Deemed Election under § 3.02 of this revenue procedure is deemed made, by the agent for the consolidated group.

Consequences of Affirmative and Deemed Elections

If the agent for the consolidated group makes an Affirmative Election or a Deemed Election, the consequences described in § 2.03(2) of this revenue procedure apply to the consolidated group.

Therefore, for example, if a consolidated group has a CNOL a portion of which is a farming loss, and if the agent for the consolidated group makes an Affirmative Election or a Deemed Election, then the portion of the CNOL that is a farming loss can be carried back two taxable years, and the 80% limitation will apply to determine the deduction for the entire CNOL for each taxable year beginning in 2018, 2019, or 2020.

Reliance on Rules in § 1.1502-21 Regarding Application of the 80% limitation.

If a consolidated group makes an Affirmative Election or a Deemed Election, the consolidated group may choose to apply § 1.1502-21(a), (b)(1), (b)(2)(iv), and (c)(1)(i)(E), as revised by TD 9927 (85 FR 67966, Oct. 27, 2020), for its taxable years beginning in 2018, 2019, or 2020.

A “farming loss” is the lesser of:

- the amount that would be the NOL for the tax year if only income and deductions attributable to farming businesses are taken into account, or

- the amount of the NOL for that tax year.

Issue 10: IRS Hiring

IRS plans to hire 1300 field revenue officers, 400 tax compliance officers who will be available for “in person audits” (formerly called “office audits”), and 518 automated collection (ACS) phone representatives.

SB/SE expects to use new personnel to increase compliance in the following areas: fuel tax, syndicated conservation easements, and employment taxes.

IRS expects that their largest ACS call center will be in Puerto Rico by the end of 2021 due to the value of employees with bilingual abilities.

IRS expects to increase collection personnel in Puerto Rico from 57 to as many as 400 by the end of 2021.

In addition, Criminal Division expects to add more than 500 people this year, with about half of those being special agents.

Issue 11: Chief Counsel Addresses Concerns Regarding IRS-Issued FAQs

There is an IRS working group that has been considering various aspects of FAQs, including the extent to which practitioners and taxpayers may rely on them. IRS won’t assert FAQs in support of its positions on audit or in litigation.

IRS hopes to soon unveil a system that will archive FAQ guidance. Users of the new system will be able to search for FAQs and see the ways in which they may have been edited by IRS.

Issue 12: Accounting Method Change Adjustment Affects Business Interest Deduction Calculation

Chief Counsel Advice 202123007

In Chief Counsel Advice, IRS has held that a taxpayer’s net negative § 481(a) adjustment resulting from a change in its method of accounting for depreciation must be added back in the calculation of the taxpayer’s §163(J) business interest deduction limitation. It has also provided its opinion on this calculation where somewhat different facts apply.

ISSUE:

To determine the amount allowed as a deduction under § 163(j) for a taxable year, does the adjusted taxable income under §163(j)(8) for such taxable year include those adjustments that are required under § 481(a) by a change in method of accounting for depreciation?

CONCLUSION:

Yes, to determine the amount allowed as a deduction under § 163(j) for a taxable year, the adjusted taxable income under § 163(j)(8) for such taxable year includes those adjustments that are required under § 481(a) by a change in method of accounting for depreciation.

A full discussion can be found at: https://www.irs.gov/pub/irs-wd/202123007.pdf

Issue 15: Applicable Federal Rates for August 2021, Rev. Rul. 2021-14

REV. RUL. 2021-14 TABLE 5 Rate Under § 7520 for August 2021 4 Applicable federal rate for determining the present value of an annuity, an interest for life or a term of years, or a remainder or reversionary interest 1.2%

![]() Basics & Beyond Resources

Basics & Beyond Resources

- Blog Page

- Resource List

- Webinar & Seminar Schedules

- Get Registered!

- Note: Paid attendees can request a link to the replay of any previously recorded webinar presentations by emailing us at [email protected]