In this Issue:

- More Q & A from the Fall Virtual Series

- IRS Opens Annual Self-Certification and E-file Application URL Registration

- IRS Reduces Fees to Obtain or Renew a PTIN

- 1040 MeF Production Shutdown Schedule

- Employee Retention Credit Eligibility Checklist: Publication5887

- Educational Assistance Programs Can Help Pay Workers’ Student Loans

- Reminder: Payers Filing Erroneous Information Returns Will Receive a CP2100 or 2100A Notice.

- IRS Opens Free Energy Credit Online Tool for Sellers of Clean Vehicles to Register for Time-of-sale Reporting and Dealer Advance Payments for the Clean Vehicle Credit – IR-2023-202

- 401(k) Limit Increases to $23,000 for 2024, IRA Limit Rises to $7,000

- IRS Extends Use of Electronic Signatures, Encrypted Email

- Enrolled Agent Renew Time for Some

- IRS Achieves Key Paperless Processing Initiative Goal, Outlines Improvements for Filing Season 2024

- Reminder: Beneficial Ownership Reporting Kicks on January 1, 2024

- FinCEN Warns of BOI Reporting Scams

- FinCEN Finalizes Rule on Use of FinCEN Identifiers in Beneficial Ownership Information Reporting – November 07, 2023

- Ongoing Discussion on Who Can Assist in Preparing and Filing Under the Corporate Transparency Act

- IRS reminds Eligible 2020 and 2021 Non-filers to Claim Recovery Rebate Credit Before Time Runs Out

- Applicable Federal Rates for December 2023, Rev. Rul. 2023- 2021

IRS Delays Form 1099-K Threshold Change – Thanksgiving Gift from IRS

The IRS has delayed implementation of the $600 Form 1099-K reporting threshold required under the American Rescue Plan Act (ARPA). For 2023, the $20,000/200 transactions limit will still apply. Then in 2024 the IRS is suggesting a $5,000 filing threshold, with an ultimate goal of eventually lowering it to the $600 threshold at some point in the future.

ARPA reduced the Form 1099-K filing threshold from $20,000 in payments and 200 transactions to $600 in payments for the 2022 calendar year. However, citing taxpayer confusion and other issues, the IRS declared 2022 a transition year where the previous thresholds would apply.

On Nov. 21 the IRS issued Notice 2023-74, which said the thresholds of $20,000 in payments and 200 transactions would remain in place for the 2023 calendar year. The notice did not address the $5,000 reporting threshold for 2024, which was announced in an accompanying IRS news release. The agency said the extended transition period is intended to minimize the burden and provide easier reporting requirements for taxpayers. The IRS continues to work closely with third-party groups, tax professionals and others to ensure compliance with the law.

Note: Many third-party providers have spent the last 2 years gearing up for the new reporting requirements as defined in the America Rescue Plan Act of 2021. They may be reporting transactions based on that law change. We have discussed in depth the reporting requirements on personal sales and potential capital gain sales in many webinars, our virtual seminars, and our newsletters. Be prepared to report as we have described, if needed.

Issue 1: Additional Q & A from the Fall Virtual Sessions

Retirement

Question #6 – I’m referring to a beneficiary who is an individual that inherits an IRA and must withdraw from the account within 10 years under the newer rules. Do they have to take RMD’s each year? Or can they wait until year 10 to withdraw the entire account balance?

If the owner reached their “Required Beginning Date” (RBD) at the time of their death, then RMDs must continue (waived for 2021, 2022, and 2023). Distribute using Table I –

- Use younger of

- Beneficiary’s age or

- Owner’s age at birthday in year of death

- Determine beneficiary’s age at year end following year of owner’s death.

- Reduce beginning life expectancy by 1 for each subsequent year.

- Can take owner’s RMD for year of death.

If the owner did not reach the “Required Beginning Date” –

- Take entire balance by end of 5th year following year of death, or

- Distribute based on Table 1 –

- Use beneficiary’s age at year-end following year of owner’s death.

- Reduce beginning life expectancy by 1 for each subsequent year.

Question #7 – Are the distributions from a 10-yr. inherited IRA part of the RMD calculation?

Yes. I’m assuming that during a particular calendar year a distribution from an inherited IRA is received by the beneficiary. These distributions may be considered as part of the RMD obligation for a particular calendar year.

Questions #8 – In the Secure Act 2.0 the IRS supposedly included a new provision that if the original Trad IRA account owner has started RMDs, then the beneficiary (in addition to the 10-yr depletion rule) would also need to take RMDs each year during those 10-years. The IRS has waived this requirement for 2022 and 2023 because the details on how that RMD is calculated has not been defined properly. But the IRS is suppose[d] define the calculation by Jan 1 so that this will be enforceable for 2024. Is this correct?

Not exactly. First, the Secure Act 2.0 did not address the issues that you have outlined in your question. The Proposed Regulation released on February 23, 2022, did address the need to take RMDs during the 10-year period if an owner of the IRA account reached their Required Beginning Date (and therefore were taking RMDs). It is true that in Notices issue in 2022 (October) and 2023 (July) that no RMDs for 2021, 2022, and 2023 are required and the excise tax associated with the failure to distribute and RMD will not apply. In Notice 2023-54 (7/17/2023) Section III is states … “Final regulations regarding RMDs under IRC §401(a)(9) and related provisions will apply for calendar years beginning no earlier than 2024.” Obviously, until the final regulations are released, there will not RMDs required for Inherited IRAs with non-eligible designated beneficiaries.

Question #9 – Can I take $35,000 at one time to the Roth or am I limited to $6,500 per year? Are you asking if you can contribute $35,000?

The $35,000 is a lifetime maximum amount that an individual may rollover to a ROTH IRA from an IRC §529 account. However, upon satisfaction of certain ground rules for the IRC §529 arrangement, an individual may contribute each year up to the maximum IRA contribution limit ($7,000 in 2024) for a particular calendar year. This limit will be reduced by any other deducted IRA contribution or Roth IRA contribution made during the same calendar year. Once an individual has rollover $35,000 from an IRC §529 arrangement, the ability to future rollovers is prohibited.

Question #10 – From the 529 to the Roth in one year?

See my discussion in Question #9. I believe we have cover most of the rules on this issue. You may want to note wages or earnings will be necessary the ROTH IRA holder in other to make an IRC §529 rollover.

Question #11 – Wife (54) inherited traditional IRA from 55 yr. old husband in 2022. Is there any possible requirement for an RMD until wife reaches under the 10-year rule she reaches 73?

Assuming that the wife is the sole beneficiary of the husband’s IRA, the wife is an “Eligible Designated Beneficiary” and all of the stretch IRA rules still apply. There is a special election that the spouse may want to make in 2024 under SECURE 2.0 that would permit the wife to use the Uniform Life Time distribution table and any beneficiaries that she would name would be treated as “eligible designated beneficiaries” and allow the beneficiaries of the surviving spouse’s IRA to continue the “stretch IRA” distribution methodology. Also, the wife would not have to begin RMDs from this until age 75 under the SECURE Act 2.0 changes to RMD age.

Question #12 – If the sole beneficiary of the IRA was the spouse and she transferred it to a new beneficiary IRA, does she need to take RMD’s and wipe it out over 10 years? I know the spouse isn’t normally required to follow that rule but does it at all depend how she moved the IRA into her name to determine whether the “spouse exception” applies? (New IRA in her name/beneficiary IRA)

The action “she transferred it to a new beneficiary IRA” is not quite accurate. A beneficiary of an IRA would leave the owner’s account in the same solution but just maintain the account as a beneficiary. Then we follow the rules for RMD distribution based on the deceased spouse. For example, husband is age 63 (and died) and wife is 67. Husband dies. The wife maintains the IRA as a beneficiary IRA. She may take distributions from the IRA after the spouse’s death. However, it she does not, then the first distribution (assuming we are in calendar year 2023), would not apply until the calendar year in which the deceased spouse would have reached age 75 (under SECURE Act 2.0). That would be the calendar year 2035. Hopefully this helps you with this question. If not, just re-question and I’ll answer.

Questions #13 – I thought that an inherited IRA is not subject to the 10% penalty even if under 59-1/2? Is that not the case?

ABSOLUTE NOT TRUE! Once she transfers the inherited IRA, she is now the owner of the IRA and unless there is an exception to an IRA distribution prior to age 59 1/2, she would be subject to the IRC §72(t) additional tax. That’s why you maintain the “beneficiary status” because the deceased spouse is still treated as the owner of that account for purposes of these rules.

Question #14 – I turn 73 on 10/13/2025. What tax year do I start RMD?

Your required beginning date will be April 1, 2026 (the date you must take out the 2025 RMD). However, you will also have a 2026 RMD based on the calendar year account balance @ 12/31/2025) in calendar year 2026. You may distribute the first RMD in calendar year 2025 and satisfy the RMD requirements for the year in which you turned aged 73 (calendar year 2025).

Question #15 – If you have a trust [named as a beneficiary of an IRA] bene IRA after 2020, can they be paid out over 10 years vs the previous rule of 5 years?

No, the five year applies because the beneficiary is a “NON-DESIGNATED” Beneficiary (i.e., an estate or a trust). However, if RMDs have commenced prior to the death of the IRA holder and estate or trust is the named beneficiary (without any provisions that would make the beneficiary designated qualify as a “Designated Beneficiary”), then the distributions will follow the rule – the period (which ever longer), (a) the life expectancy of the deceased owner, or (b) the five-year period. If the Required Beginning Date was in play (i.e., death of the IRA owner prior this April 1st date), then the 5-year rule applies (no RMDs required during the 5-year period).

Sole Proprietorship/Schedule C/ 1099 Questions

If your gross receipts on Schedule C (for example) include sales tax, then your state sales tax filings will not necessarily match the reported figure on Schedule C?

If sales tax is included in income, then you would be taking a deduction for sales tax and the two should match. There may be a small difference with rounding and such, whereas exact amounts need to be shown.

If a client is filing late, a couple years, should he still file the 1099s for sub-contractors on Schedule C?

Yes, always try to stay current with filings even late. This impacts chances of getting penalty abatements and such. Remember to take the expense on Schedule C.

Do you see any risk in issuing a person a 1099 and W-2 within a given year. For example, someone was a contractor for a few months early in the year and then came in as an employee later in the year.

As long as the type of work is different, you’re allowed to do that.

What did you say about a professional gambler? If he plays online poker and reports income – can he also deduct expenses on Schedule C?

If it is an active and a true trade and business, I do not have an issue with Schedule C. Regular ongoing continuous rather sporadic activities must be substantial and there must be a profit motive.

In the case of a retail store, would “COGS” purchase PRIOR to opening day (to stock the store) be “start-up” costs on the Sch C? Or normal COGS expense?

Normal Cost of Goods Sold

I do lots of daycares that receive block grant and food program income on 1099-misc’s. I usually put these amounts on other income line. what do you think?

Either the gross receipts or the other income. The key is reconcile all of the Form 1099-XXX income on the Schedule C.

S Corporation

Amy, any way to get another CP 261, if the original has been lost? This is the S Corporation election approval from IRS.

If you’ve lost your S-Corporation Approval Letter, known as the CP261 Notice, you cannot request another copy of it. However, you can request an S-Corp Verification Letter, or 385C, by calling the IRS at 1-800-829-4933.

On § 351 transfer to new S Corp, how do the liabilities that transfer in affect basis. In year one they have an S operating loss. If they did not transfer in much in asset value and little for capital stock, does the basis limit prevent deduction of the loss on the personal 1040?

Correct; but note that in order to have a loss, either the shareholder transferred in money (in which case they have basis) or they took out a loan (in which case this does not create basis.)

I have a new client and the prior tax/attorney preparer took all his home office expenses directly on Schedule C, when I take his home office expenses on 8829 this year, can I say this is the first year for depreciation for the home? No depreciation for the house was ever taken.

“From IRS FAQs – Can depreciation for the portion of the home used in a qualified business use be deducted for a taxable year in which the simplified method is used?

No. You cannot use the simplified method and deduct any depreciation (including any additional first-year depreciation) or IRC § 179 expense for the portion of the home used in a qualified business use for the same taxable year. However, you can deduct depreciation for depreciable business assets (for example, furniture and equipment) other than the portion of the home used in the qualified business. Follow up item – FAQ #20 – Question asks recapture of depreciation when you used the simplified method – For taxable years in which the simplified method is used, the depreciation deduction allowable for the portion of the home used in a qualified business use is deemed to be zero. Accordingly, you do not have to recapture any depreciation for taxable years in which you used the simplified method. However, you may have to recapture depreciation for taxable years in which you used the standard method.

Issue 2: IRS Opens Annual Self-Certification and E-file Application URL Registration

This is a reminder that all Online Providers must complete the annual self-certification questions beginning October 1, 2023, to ensure they comply with Publication 1345 IRS e-file security, privacy, and business standards.

If you are an Authorized IRS e-file Provider who owns or operates a website(s) that collects, transmits, stores or processes taxpayer information, the IRS also requires you to register those URL(s) on your e-file Application. The annual certification process includes the registration of these Websites.

If you have not previously registered your URL(s), select the URL collection link on the e-file Application information page menu to register.

Providers must submit to the IRS the following information about their websites:

- An EFIN for the online provider,

- The name of a principal or responsible officer listed on the provider’s EFIN application, and

- The Uniform Resource Locators (URLs) for all websites the provider uses to collect information from taxpayers for e-filing federal returns.

Once the website is in use, any changes to the initial information provided to the IRS must be reflected on the provider’s e-file application within three business days.

Issue 3: IRS Reduces Fees to Obtain or Renew a PTIN

On September 30, the IRS released regs that reduce the user fees paid by tax preparers to obtain a preparer tax identification number (PTIN). Under these new regs the cost for obtaining or renewing a PTIN will fall to $11 (plus $8.75 for a third-party contractor). The fee to obtain or renew a PTIN was $30.75 in 2022.

The IRS requires certain tax preparers to include a PTIN on a return, statement or other document required to be filed with the IRS.

Treasury regs require that certain return preparers include their PTIN on any returns, claims for refund or other documents they prepare that are filed with the IRS. A PTIN is used instead of the preparer’s social security number to identify the preparer. The IRS charges practitioners a fee to obtain or renew a PTIN to cover its direct and indirect administrative costs for providing the PTIN.

Issue 4: 1040 MeF Production Shutdown Schedule

Shutdown begins on Saturday, November 18, 2023, at 11:59 p.m. Eastern time, to prepare the system for the upcoming Tax Year 2023 Filing Season.

Important Note: Only “Send Submissions” for 1040 (both State and Federal) will be affected by this shutdown, all other services such as “Get Acks” and all state services will not be affected by the shutdown and users should be able to continue to use those services.

Transmitters:

Transmitting 1040 Submissions (State & Federal) 11:59 p.m. Eastern time.

Important Note: Business (BMF) returns are not impacted by this IMF Production Shutdown schedule.

The BMF Production Shutdown schedule will be communicated in a QuickAlerts bulletin, outlining the exact timeframes, in early December and the times will be posted on the MeF Operational Status page.

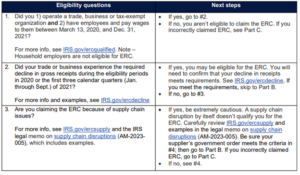

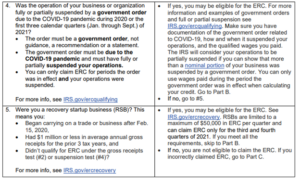

Issue 5: Employee Retention Credit Eligibility Checklist: Publication5887

The Employee Retention Credit (ERC or ERTC) is a complex tax credit for businesses and tax-exempt organizations that kept paying employees during the COVID-19 pandemic either when they were shut down due to a government order or when they had the required decline in gross receipts during certain eligibility periods in 2020 and 2021.

The IRS continues to see aggressive marketing that lures ineligible taxpayers to claim the ERC. While the credit is real, many promoters are aggressively misrepresenting who can qualify for the credit. In many instances, the IRS is seeing businesses and tax-exempt organizations being misled by promoters into thinking they’re eligible when they are not.

IRS wants to help taxpayers avoid this situation, so they prepared this question-and-answer chart to help employers figure out if they may be eligible for the credit. You can use this chart with someone who is considering claiming credit or with someone who has already submitted a claim to the IRS.

The IRS is committed to helping taxpayers while preventing incorrect ERC claims and fraud.

Part A: Checking your eligibility This chart can help a business or other organization quickly decide if they may qualify for the Employee Retention Credit. This is a very technical area of the law, but this chart includes the main eligibility factors. Answer these questions in numerical order to see if you may be eligible to claim the ERC.

Part B: Claiming the ERC if you’re eligible If the previous questions directed you to Part B, you may qualify for the ERC based on the information you provided. Be sure you have thorough records that show wages paid, gross receipts, government orders and other required documents. If you need help, you should work with a trusted tax professional.

You can find more information at IRS.gov/erc such as frequently asked questions, examples, guidance, warning signs of scams and more.

Part C: Resolving an incorrect ERC claim If you incorrectly claimed the Employee Retention Credit, you can use the ERC claim withdrawal process outlined at IRS.gov/withdrawmyerc if all of the following apply:

- You made the claim on an adjusted employment tax return (Forms 941-X, 943-X, 944-X, CT-1X).

- You filed your adjusted return only to claim the ERC, and you made no other adjustments.

- You want to withdraw the entire amount of your ERC claim.

- The IRS has not paid your claim, or the IRS has paid your claim, but you haven’t cashed or deposited the refund check.

Requesting a withdrawal means you’re asking the IRS not to process your entire adjusted return that included your ERC claim. If the IRS accepts your request, the claim will be treated as if it was never filed. If you’re not able to use the withdrawal process, you can still file another adjusted return if you need to reduce the amount of your ERC claim or make other changes to your adjusted return. If you incorrectly claimed the credit and cashed or deposited your refund check, watch IRS.gov/erc for updates. You can’t use the withdrawal process. However, the IRS is working on guidance to help employers that were misled into incorrectly claiming the ERC and receiving the credit.

Issue 6: Educational Assistance Programs Can Help Pay Workers’ Student Loans

Educational assistance programs offered by employers can now be used to pay principal and interest on an employee’s qualified education loans. Traditionally, these programs have been used to pay for books, equipment, supplies, fees, tuition, and other education expenses for the employee. Payments made directly to the lender, as well as those made to the employee, qualify.

By law, tax-free benefits under an educational assistance program are limited to $5,250 per employee per year. Normally, assistance provided above that level is taxable as wages.

Though educational assistance programs have been available for many years, the option to use them to pay student loans is available only for payments made after March 27, 2020. Under current law, this option will be available until Dec. 31, 2025.

For more information on other requirements, refer to:

Publication 15-B, Employer’s Tax Guide to Fringe Benefits

Publication 970, Tax Benefits for Education – Chapter 10, it provides details on what qualifies as a student loan.

Issue 7: Reminder: Payers Filing Erroneous Information Returns Will Receive a CP2100 or 2100A Notice.

Payers who file information returns with data that does not match IRS records will get a CP2100 or CP2100A notice. These notices tell payers that the information returns they submitted have a missing or incorrect Taxpayer Identification Number, name, or both.

Each notice includes a list of payees with the issues found. Payers need to compare the names on the notice with their account information and correct or update their records, as necessary. Payers may also need to correct their backup withholding on payments made to payees.

Tax Tip 2023-75 provides a list of the most common information returns with errors, as well as additional links to further guidance on backup withholding.

Issue 8: IRS Opens Free Energy Credit Online Tool for Sellers of Clean Vehicles to Register for Time-of-sale Reporting and Dealer Advance Payments for the Clean Vehicle Credit – IR-2023-202

The Internal Revenue Service announced today that sellers of clean vehicles can now register using the new IRS Energy Credits Online tool, available free from the IRS.

Known as IRS Energy Credits Online or IRS ECO, this free electronic service is secure, accurate and requires no special software. Though available to any business of any size, IRS Energy Credit Online may be especially helpful to any small business that currently sells clean vehicles.

The IRS’s new Energy Credits Online tool will allow dealers and sellers of clean vehicles to complete the entire process online and receive advance payments within 72 hours. The tool will generate a Time of Sale report that the taxpayer will use when filing their federal tax return to claim or report the credit.

Beginning in 2024, clean vehicle sellers and licensed dealers must use the tool for their customers to successfully claim or transfer the new or previously owned clean vehicle credit for vehicles placed in service Jan.1, 2024 or later.

The IRS issued proposed regulations, Revenue Procedure 2023-33 and frequently asked questions on Oct. 6, 2023, that provide details to sellers to register with the IRS to be eligible to receive the credit transfers from taxpayers, and details that to participate, a dealer must verify their identity using the IRS identity verification system and register through IRS Energy Credits Online tool.

The IRS encourages any dealer or seller to register using Energy Credits Online to share in its benefits. These benefits include:

- Advance payments to dealers will typically occur within 72 hours of an accepted clean vehicle credit transfer Time of Sale report.

- The IRS acknowledges receipt and confirmation in real time that a qualified manufacturer has provided the VIN being sold as eligible when a Time of Sale report is submitted.

- Users can make corrections to information submitted through the tool.

- The tool keeps issuer information from year to year.

Enrollment in the IRS Energy Credit Online tool is now open. Clean vehicle sellers should begin the online enrollment process immediately.

Initially, only one individual representative of the dealer or seller who is currently authorized to legally bind the dealer or seller can complete the initial registration through IRS Energy Credits Online. Starting December 2023, dealers and sellers will be able to authorize more than one employee to submit Time of Sale reports and advance payment requests.

Additional resources

- Publication 5862, Energy Credits Online: Register for Energy Credits Online

- Publication 5867, Clean Vehicle Dealer and Seller Energy Credits Online Registration User Guide

- Publication 5863, A Step-By-Step Guide for New and Used Clean Vehicle Dealers and Sellers for the Energy Credits Online

- Publication 5864, New and Previously Owned Clean Vehicle Credit Time of Sale Reporting with Energy Credits Online

- Publication 5865, Clean Vehicle Credit Transfer

- Publication 5866, New Clean Vehicle Tax Credit Checklist

- Publication 5866-A, Used Vehicle Tax Credit Checklist

- Dealer Registration Frequently Asked Questions

- Video: How Dealers and Sellers Register for Energy Credits Online

- Fact Sheet 2023-22, Frequently Asked Questions About the New, Previously Owned and Qualified Commercial Clean Vehicles Credit

Issue 9: 401(k) Limit Increases to $23,000 for 2024, IRA Limit Fises to $7,000

The Internal Revenue Service announced that the amount individuals can contribute to their 401(k) plans in 2024 has increased to $23,000, up from $22,500 for 2023. The IRS also issued technical guidance regarding all of the cost of living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2024 in Notice 2023-75.

Highlights of changes for 2024

The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government’s Thrift Savings Plan is increased to $23,000, up from $22,500.

The limit on annual contributions to an IRA increased to $7,000, up from $6,500. The IRA catch up contribution limit for individuals aged 50 and over was amended under the SECURE 2.0 Act of 2022 (SECURE 2.0) to include an annual cost of living adjustment but remains $1,000 for 2024.

The catch-up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), and most 457 plans, as well as the federal government’s Thrift Savings Plan remains $7,500 for 2024. Therefore, participants in 401(k), 403(b), and most 457 plans, as well as the federal government’s Thrift Savings Plan who are 50 and older can contribute up to $30,500, starting in 2024. The catch-up contribution limit for employees 50 and over who participate in SIMPLE plans remains $3,500 for 2024.

The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements (IRAs), to contribute to Roth IRAs, and to claim the Saver’s Credit all increased for 2024.

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or the taxpayer’s spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. (If neither the taxpayer nor the spouse is covered by a retirement plan at work, the phase-outs of the deduction do not apply.) Here are the phase out ranges for 2024:

- For single taxpayers covered by a workplace retirement plan, the phase-out range is increased to between $77,000 and $87,000, up from between $73,000 and $83,000.

- For married couples filing jointly, if the spouse making the IRA contribution is covered by a workplace retirement plan, the phase-out range is increased to between $123,000 and $143,000, up from between $116,000 and $136,000.

- For an IRA contributor who is not covered by a workplace retirement plan and is married to someone who is covered, the phase-out range is increased to between $230,000 and $240,000, up from between $218,000 and $228,000.

- For a married individual filing a separate return who is covered by a workplace retirement plan, the phase-out range is not subject to an annual cost-of-living adjustment and remains between $0 and $10,000.

The income phase-out range for taxpayers making contributions to a Roth IRA is increased to between $146,000 and $161,000 for singles and heads of household, up from between $138,000 and $153,000. For married couples filing jointly, the income phase-out range is increased to between $230,000 and $240,000, up from between $218,000 and $228,000. The phase-out range for a married individual filing a separate return who makes contributions to a Roth IRA is not subject to an annual cost-of-living adjustment and remains between $0 and $10,000.

The income limit for the Saver’s Credit (also known as the Retirement Savings Contributions Credit) for low- and moderate-income workers is $76,500 for married couples filing jointly, up from $73,000; $57,375 for heads of household, up from $54,750; and $38,250 for singles and married individuals filing separately, up from $36,500.

The amount individuals can contribute to their SIMPLE retirement accounts is increased to $16,000, up from $15,500.

Additional changes made under SECURE 2.0 are as follows:

- The limitation on premiums paid with respect to a qualifying longevity annuity contract to $200,000. For 2024, this limitation remains $200,000.

- Added an adjustment to the deductible limit on charitable distributions. For 2024, this limitation is increased to $105,000, up from $100,000.

- Added a deductible limit for a one-time election to treat a distribution from an individual retirement account made directly by the trustee to a split-interest entity. For 2024, this limitation is increased to $53,000, up from $50,000.

Details on these and other retirement-related cost-of-living adjustments for 2024 are in Notice 2023-75, available on IRS.gov.

Issue 10: IRS Extends Use of Electronic Signatures, Encrypted Email

The IRS this week announced it is extending the ability of tax professionals to use digital signatures and encrypted email. The IRS will accept digital signatures on certain documents indefinitely, while it will permit use of encrypted email – when a tax professional is working directly with IRS personnel – through Oct. 31, 2025.

Issue 11: Enrolled Agent Renew Time for Some

Enrolled agents: If your Social Security number (SSN) ends in a in 7, 8, 9 or no SSN, you must renew your status as an enrolled agent by Jan. 31, 2024. You must renew your status every three years to remain eligible to practice before the IRS. Failure to renew your status by the Jan. 31, 2024, deadline will result in your enrolled agent status becoming “inactive.” To renew:

- Complete Form 8554, Application for Renewal of Enrollment to Practice Before the IRS, online at Pay.gov.

- Pay the $140 renewal fee.

All enrolled agents must also have an active Preparer Tax Identification Number (PTIN) and you must enter it on Form 8554. Renewals may take up to 90 days to process. Failure to accurately report your continuing education (CE) may delay the processing of your application. If you have questions about the renewal process, call toll-free 855-472-5540 (hours: 6:30 a.m. – 5 p.m. CT). Visit IRS.gov/ea for more information about the enrolled agents program.

Issue 12: IRS Achieves Key Paperless Processing Initiative Goal, Outlines Improvements for Filing Season 2024

Taxpayers are now able to digitally submit all correspondence and responses to notices three months ahead of schedule; New and improved “Where’s My Refund?” tool will launch in filing season 2024.

Following a dramatically improved 2023 filing season thanks to Inflation Reduction Act (IRA) investments, the U.S. Department of the Treasury (Treasury) and Internal Revenue Service (IRS) announced additional improvements taxpayers will experience next filing season. The Treasury and IRS also announced meeting the first goal of the Paperless Processing Initiative announced in August by Secretary of the Treasury Janet L. Yellen and Commissioner of the IRS Danny Werfel. Taxpayers are now able to digitally submit all correspondence and responses to notices.

Paperless Processing Initiative: Taxpayers are now able to digitally respond to all correspondence.

- The IRS met the first goal of the Paperless Processing Initiative three months ahead of schedule. Taxpayers are now able to digitally submit all correspondence and responses to notices. The IRS in February 2023 launched the ability to submit nine notices through the Document Upload Tool. Prior to filing season 2023, taxpayers could only submit these documents through the mail. The IRS has now achieved the ability to digitally respond to all notices in eight months. As of Oct. 27, the IRS has received more than 35,000 responses to notices via the online tool.

- As a result of achieving this goal, the IRS estimates more than 94% of individual taxpayers will no longer have to send mail to the IRS. Taxpayers use these non-tax forms to request or submit information on a range of topics, including identity theft and proof of eligibility for key credits and deductions to help working Americans. Reaching this milestone will enable up to 125 million paper documents per year to be submitted digitally. Taxpayers who want to submit paper returns and correspondence may continue to do so.

- The IRS will meet the second goal of the Paperless Processing Initiative by the start of filing season 2024 by providing the option for taxpayers to e-file 20 additional tax forms, enabling up to 4 million additional tax documents to be digitally filed every year. This includes amendments to Forms 940, 941, 941-SS and 941(PR), which are some of the most common forms businesses file when amending returns.

Improved digital service through “Where’s My Refund?” Tool.

- In filing season 2024, taxpayers will benefit from important new updates to the “Where’s My Refund?” tool, which is the IRS’ most popular customer service tool. In 2022, “Where’s My Refund?” was used by 54 million taxpayers and generated 550 million hits. However, the tool provides limited information, often leading taxpayers to call the IRS to inquire about their refund status.

- The updates to “Where’s My Refund?” will allow taxpayers to see more detailed refund status messages in plain language. These updates will also ensure “Where’s My Refund?” works seamlessly on mobile devices. Taxpayers often see a generic message stating that their returns are still being processed and to check back later. With the new and improved “Where’s My Refund?”, taxpayers will see clearer and more detailed updates, including whether the IRS needs them to respond to a letter requesting additional information. The new updates will reduce the need for taxpayers to call the IRS for answers to basic questions.

- Example of current message: “Your tax return is still being processed. A refund date will be provided when available. For more information about processing delays, please see our Refund Frequently Asked Questions.”

- Example of new and improved messages: “To protect you from identity theft, your tax return is currently being reviewed. To help us process your return more quickly, verify your identity and tax return information. If you recently received a letter from us, follow the instructions on the letter. Please have your tax return (Form 1040 series) available and read the website or letter before starting the verification process. If you already reviewed your identity and tax return information you may check the status of your refund in 2-3 weeks.”

- “We received your return and sent you a letter requesting more information. Please respond by following the instructions in the letter. If you don’t respond, your refund amount could be changed. It may take 2-3 weeks for you to receive the letter.”

- “We have reviewed your return and any information we may have requested from you and are now processing your return. Any changes to the status of your refund, including any new refund date, will be reflected here when any new update is available.”

- The IRS wanted to make these updates for years and is now able to thanks to Inflation Reduction Act resources. It’s estimated that taxpayers will view the new and improved status updates 70 million times next filing season. Further upgrades are planned for future filing seasons.

IRS to provide better phone service.

- 85% Level of Service: The IRS is committed to maintaining the significantly improved phone service achieved in filing season 2023 and will again reach 85% Level of Service on the agency’s main taxpayer helpline during filing season 2024.

- 5-minute call wait time: The IRS will achieve an average call wait time of 5 minutes or less on the agency’s main taxpayer helpline during filing season.

- 95% call back availability: The IRS will offer a call back option available to 95% of eligible taxpayers seeking telephone assistance at the beginning of the call if the projected wait time is longer than 15 minutes.

- Build taxpayer trust: The IRS is continuing to promote trust and satisfaction when taxpayers call the agency. During filing season 2024, the IRS will exceed the Office of Management and Budget’s Trust Goal of 75% for taxpayers receiving assistance from the IRS’ main helpline. Taxpayers are offered the opportunity to respond to brief surveys following their calls to the IRS.

IRS to provide better in-person service.

- In-person support at Taxpayer Assistance Centers: The IRS has currently opened or reopened 50 Taxpayer Assistance Centers using Inflation Reduction Act funding. For filing season 2024, the IRS will increase the hours available at Taxpayer Assistance Centers by more than 8,500 hours.

- Waco, Texas; Oct. 10, 2023

- Missoula, Montana; Oct. 2, 2023

- Martinsburg, West Virginia; Oct. 2, 2023

- Monroe, Louisiana; Sept. 25, 2023

- York, Pennsylvania; Sept. 18, 2023

- Topeka, Kansas; Sept. 5, 2023

- Utica, New York; Aug. 28, 2023

- Fayetteville, Arkansas; Aug. 14, 2023

- Hickory, North Carolina; Aug. 7, 2023

- Rome, Georgia; Aug. 7, 2023

- Plantation, Florida; Aug. 3, 2023

- Panama City, Florida; July 31, 2023

- Cranberry Township, Pennsylvania; July 31, 2023

- Peoria, Illinois; July 24, 2023

- Huntington, West Virginia; July 5, 2023

- Lincoln, Nebraska; May 23, 2023

- La Vale, Maryland; May 15, 2023

- Altoona, Pennsylvania; May 8, 2023

- Fredericksburg, Virginia; May 1, 2023

- Parkersburg, West Virginia; May 1, 2023

- Bend, Oregon; April 17, 2023

- Greenville, Mississippi; April 10, 2023

- Trenton, New Jersey; April 10, 2023

- Bellingham, Washington; April 3, 2023

- Augusta, Maine; March 30, 2023

- Jackson, Tennessee; March 28, 2023

- Joplin, Missouri; March 28, 2023

- Colorado Springs, Colorado; March 27, 2023

- Glendale, Arizona; March 27, 2023

- Cranberry Township, Pennsylvania; March 22, 2023

- La Crosse, Wisconsin; March 20, 2023

- Charlottesville, Virginia; March 17, 2023

- Queensbury, New York; March 9, 2023

- Santa Fe, New Mexico; Feb. 27, 2023

- Longview, Texas; Jan. 17, 2023

- Overland Park, Kansas; Jan. 17, 2023

- West Nyack, New York; Jan. 5, 2023

- Binghamton, New York; Jan. 3, 2023

- Casper, Wyoming; Jan. 3, 2023

- Fort Myers, Florida; Dec. 19, 2022

- Grand Junction, Colorado; Dec. 19, 2022

- Rockford, Illinois; Dec. 12, 2022

- Hagerstown, Maryland; Dec. 1, 2022

- DASE (Guaynabo), Puerto Rico; Nov. 28, 2022

- Johnson City, Tennessee; Nov. 28, 2022

- Prestonsburg, Kentucky; Nov. 28, 2022

- Vienna, Virginia; Nov. 28, 2022

- Greensboro, North Carolina; Nov. 22, 2022

- Bloomington, Illinois; Nov. 21, 2022

- Ponce, Puerto Rico; Nov. 14, 2022

IRS to launch Direct File pilot in filing season 2024.

- Direct File is a new tool that will provide taxpayers with the choice to e-file their federal tax return for free, directly with the IRS. It will be an interview-based service that will work as well on a mobile phone as it does on a laptop, tablet, or desktop computer. Direct File will be available in English and Spanish in 2024 and is designed to meet taxpayers where they are and accommodate their needs. If taxpayers have questions during the pilot, they will be able to get help from dedicated IRS Direct File customer support representatives.

- While the scope is still being finalized, IRS expects the taxpayers who will be eligible to participate in the pilot to be low- to moderate-income working individuals, couples and families who take the standard deduction. The tool supports W-2 wages, Social Security/Railroad Retirement benefits, unemployment compensation and interest income of $1,500 or less. Eligible taxpayers participating in the pilot may claim the Earned Income Tax Credit, Child Tax Credit and Credit for Other Dependents. The Direct File tool will also support deductions for educator expenses and student loan interest. All other types of income, credits and deductions are out of scope for the 2024 pilot.

- While Direct File will not file state tax returns for taxpayers who reside in a pilot state with a state income tax, once they have submitted their federal return, Direct File will direct taxpayers to the appropriate state filing system where they will be able to complete their state return. States with income tax that are partnering with the IRS on the Direct File pilot include Arizona, California, Massachusetts, and New York. In addition, taxpayers from states with no income tax will be eligible to participate (Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming). Washington has also chosen to join the integration effort as a partner for the state’s application of the Working Families Tax Credit following completion of their federal return.

- The IRS will introduce Direct File to the public in a phased manner, starting small and expanding the user base over time. An early phase of the pilot will be invitation-only, including during Presidents’ Day weekend, an early peak in filing volume. The goal is to ensure that these invitations are extended to a wide range of eligible taxpayers from all pilot supported states. A phased rollout allows the IRS to open the pilot to more eligible participants (beyond the invite-only phase) once these initial phases are successful. First, volume would be limited to ensure Direct File is able to successfully meet taxpayer needs related to customer support and state integration, as well as prevent fraud. Based on current projections, the IRS anticipates that at least several hundred thousand taxpayers across the country will decide to participate in the pilot.

IRS launches IRS Energy Credits Online to expand access to Inflation Reduction Act clean energy credits.

The IRS has launched the Energy Credits Online (IRS ECO) portal, a modern online tool that supports successful implementation of several of the clean energy provisions of the Inflation Reduction Act that have a pre-file registration component. IRS ECO shows how modernizing IRS service and technology are key to meeting the Inflation Reduction Act’s economic and climate goals.

- Clean Vehicles: Beginning on Jan. 1, 2024, buyers of qualifying new and previously owned clean vehicles can transfer their expected tax credit to a dealer who has registered with the IRS. The dealer can then provide the full amount of the expected credit to the buyer in the form of a downpayment for the vehicle purchase or cash, allowing the buyer to receive their full credit at the time of the sale. To participate in the Clean Vehicle Credit transfer, a dealer must be licensed to sell vehicles and register through IRS ECO. IRS ECO will provide dealers real-time confirmation of whether submission is accepted based on information in the Time of Sale report and Vehicle Identification Number (VIN) information provided by manufacturers to the IRS. After successfully submitting the Time of Sale report online, dealers will receive payment of the amount they provided to the buyer, usually within 72 hours.

- Direct Pay and Transfer Elections: IRS ECO will enable state and local governments, Tribal organizations, tax-exempt organizations, and some taxable businesses to register for the new monetization features created by the Inflation Reduction Act and will also enable access to monetization of the Creating Helpful Incentives to Produce Semiconductors (CHIPS) credit. Eligible organizations can register using IRS ECO to take advantage of 12 IRA clean energy credits and the CHIPS credit. Registering in IRS ECO enables applicable entities to choose direct payment for credits or elect to transfer certain credits to third parties. Final guidance on direct payment and transfer election is forthcoming prior to filing season.

- IRS launches the first phase of the business tax account.

- The IRS has launched the first phase of the business tax account, enabling unincorporated sole proprietors who have an active Employer Identification Number to set up an account, view their business profile and manage authorized users. Over time, the business tax account will allow business taxpayers to check their tax payment history, make payments, view notices, authorize powers of attorney and conduct other business with the IRS.

- Future improvements will allow taxpayers to use their business tax accounts to view letters or notices, request tax transcripts, add third parties for power of attorney or tax information authorizations, schedule or cancel tax payments and store bank account information.

Issue 13: Reminder: Beneficial Ownership Reporting Kicks on January 1, 2024

Beginning January 1, 2024, corporations, limited liability companies and certain other entities must report information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN).

The Corporate Transparency Act (CTA) establishes uniform beneficial ownership information reporting requirements for certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the U.S. The CTA authorizes FinCEN to collect that information and disclose it to authorized government authorities and financial institutions, subject to certain safeguards and controls.

A final rule implementing the beneficial ownership information reporting requirements of the Corporate Transparency Act (CTA) was issued in September 2022. These regulations go into effect on January 1, 2024.

Under the final rules, entities created or registered before January 1, 2024, have one year to file their initial disclosure reports. Entities created or registered after January 1, 2024, will have 30 days after formation or registration to submit their initial disclosure reports. Once an initial report has been filed, both existing and new reporting companies will have to submit updates within 30 days of a change in their beneficial ownership information.

Note. The final rules carve out 23 exemptions from the reporting requirement. One such exemption is for large operating companies with 20 or more full-time U.S. employees, more than $5 million in sales, and a physical operating presence in this country.

Beneficial ownership information that must be reported by an entity includes: the full legal names, dates of birth, and addresses for all individuals who have “substantial control” over the entity or who own at least 25% of it. The rules require FinCEN to establish a database to hold all this beneficial ownership information.

FinCEN has provided more information about the beneficial ownership information reporting requirements, including: Answers to Frequently Asked Questions, infographics about key filing dates and key questions, and an introductory video and a more detailed informational video.

Issue 14: FinCEN Warns of BOI Reporting Scams

The Financial Crimes Enforcement Network (FinCEN) has been notified of recent attempts to solicit information from individuals and entities that may be subject to beneficial ownership information (BOI) reporting requirements under the Corporate Transparency Act of 2021.

The fraudulent correspondence may be an e-mail or letter titled “Important Compliance Notice” that asks the recipient to click on a website address or scan a quick-response (QR) code. FinCEN is warning recipients not to respond to the fraudulent messages, click on any links or scan any QR codes within them. FinCEN can’t accept BOI reports before Jan. 1, 2024.

Issue 15: FinCEN Finalizes Rule on Use of FinCEN Identifiers in Beneficial Ownership Information Reporting – November 07, 2023

The Financial Crimes Enforcement Network (FinCEN) is issuing a final rule that specifies the circumstances in which a reporting company may report an entity’s FinCEN identifier in lieu of information about an individual beneficial owner.

- A FinCEN identifier is a unique number that FinCEN will issue upon request after receiving required information. Although there is no requirement to obtain a FinCEN identifier, doing so can simplify the reporting process and allows entities or individuals to provide the required identifying information directly to FinCEN.

- The final rule, which amends FinCEN’s final Beneficial Ownership Information (BOI) Reporting Rule, specifically responds to commenter concerns that the reporting of entity FinCEN identifiers could obscure the identities of beneficial owners in a manner that might result in greater secrecy or incomplete or misleading disclosures. The final rule provides clear criteria that must be met in order for a reporting company to report an intermediate entity’s FinCEN identifier in lieu of information about the individual beneficial owner.

- The final rule will be effective January 1, 2024, to align with the effective date of the BOI Reporting Rule.

- To learn more about FinCEN identifiers, see Chapter 4.3 of FinCEN’s Small Entity Compliance Guide available at https://fincen.gov/boi/small-entity-compliance-guide.

- Beginning on January 1, 2024, many companies in the United States will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the company, to FinCEN. FinCEN is a bureau of the U.S. Department of the Treasury. Learn more at fincen.gov/boi.

Issue 16: Ongoing Discussion on Who Can Assist in Preparing and Filing Under the Corporate Transparency Act

Some discussion here in Iowa and possibly other states concerning who can assist a reporting company with the Corporate Transparency Act (CTA) reporting. Based on the just released updated FAQ’s – two sections are noted below that basically states an attorney, a CPA or an accountant can assist. In addition, third-party service providers can submit reports.

The issue is still being discussed in Iowa as: the only person who should be allowed to assist any reporting company in preparing and filing the reports should be lawyers. The newly released FAQ’s have addressed this issue. FAQ’s are not considered substantial authority but can be used when determining positions to take. I would make a copy of the FAQ’s and file away in case needed. Beneficial Ownership Information Reporting | FinCEN.gov

Excerpts from the FAQ’s:

7. Is a reporting company required to use an attorney or a certified public accountant (CPA) to submit beneficial ownership information to FinCEN?

No. FinCEN expects that many, if not most, reporting companies will be able to submit their beneficial ownership information to FinCEN on their own using the guidance FinCEN has issued. Reporting companies that need help meeting their reporting obligations can consult with professional service providers such as lawyers or accountants. [Issued November 16, 2023]

1. Can a third-party service provider assist reporting companies by submitting required information to FinCEN on their behalf?

Yes. Reporting companies may use third-party service providers to submit beneficial ownership information reports. Third-party service providers will have the ability to submit the reports via FinCEN’s E-Filing system and/or an Application Programming Interface (API). Technical specifications for the API will be made available at a later date. [Issued September 29, 2023]

Issue: 17: IRS reminds Eligible 2020 and 2021 Non-filers to Claim Recovery Rebate Credit Before Time Runs Out

The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it’s too late.

The vast majority of those eligible for Economic Impact Payments related to Coronavirus tax relief have already received them or claimed them through the Recovery Rebate Credit. The deadlines to file a return and claim the 2020 and 2021 credits are May 17, 2024, and April 15, 2025, respectively.

The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments. Economic Impact Payments, also referred to as stimulus payments, were issued in 2020 and 2021. The IRS estimates that some individuals and families are still eligible for the payment(s). However, taxpayers must first file a tax return to make their claim even if they had little or no income from a job, business or other source.

Who is eligible?

Generally, to claim the 2020 Recovery Rebate Credit, a person must:

- Have been a U.S. citizen or U.S. resident alien in 2020.

- Not have been a dependent of another taxpayer for 2020.

- Have a Social Security number issued before the due date of the tax return that is valid for employment in the United States.

Generally, to claim the 2021 Recovery Rebate Credit, a person must:

- Have been a U.S. citizen or U.S. resident alien in 2021.

- Not have been a dependent of another taxpayer for 2021.

- Have a Social Security number issued by the due date of the tax return, claim a dependent who has a Social Security number issued by the due date of the tax return, or claim a dependent with an Adoption Taxpayer Identification Number.

The 2020 RRC can be claimed for someone who died in 2020. The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later.

Filing deadlines if you haven’t yet filed a tax return

To claim the:

- 2020 Recovery Rebate Credit, file a tax return by May 17, 2024.

- 2021 Recovery Rebate Credit, file a tax return by April 15, 2025.

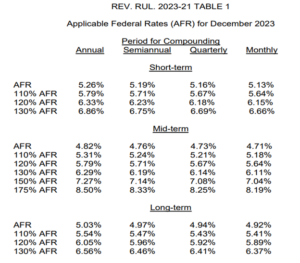

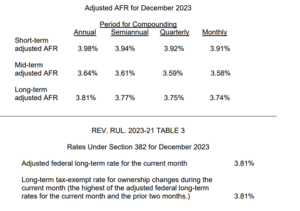

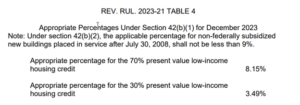

Issue 18: Applicable Federal Rates for December 2023, Rev. Rul. 2023- 2021

Rev. Rul 2023-21 Table 2

Rev. Rul. 2023-21 Table 5

Rate Under Section 7520 for December 2023 4 Applicable federal rate for determining the present value of an annuity, an interest in life or a term of years, or a remainder or reversionary interest 5.80%