IRS has issued new FAQ’s on a few topics, and we have included a few reminders on some issues. TIGTA reports are always interesting as well as for nothing else then clarification on what IRS is doing right or wrong.

With 2024 being an election year – most legislation is stalled – so now is the time to prepare for any end of year changes that may arise after the 2024 elections and before new members are sworn into Congress.

In this Issue:

- The Newlyweds Checklist

- A Comprehensive Strategy Is Needed to Address the Significant Backlog of Adjustment Source Documentation Inventory

- Builders of Energy Efficient Homes May Qualify for a Valuable Tax Credit

- FinCEN Reminds Financial Institutions to Remain Vigilant to Elder Financial Exploitation

- IRS Addresses 2023 Balance Due Notices

- Prepared Remarks of FinCEN Director Andrea Gacki During Beneficial Ownership Information Reporting Event in Tucson, Arizona – A Good Explanation of Why the Law Was Passed

- Businesses: The Employer-Provided Childcare Tax Credit is worth up to $150,000

- Hobby or Business: What People Need to Know if They Have a Side Business

- Justice Department News

- CFPB Sues Student Loan Servicer PHEAA for Pursuing Borrowers for Loans Discharged in Bankruptcy

- New Fact Sheet: Disaster Relief Impacts to Retirement Plans and IRAs

- The IRS Ceased Compliance With the $10 Million Taxpayer Treasury Directive in Favor of an Overall Focus on High-Income Taxpayer Noncompliance

- Next Phase of Employee Retention Credit Work Begins; Review Shows Vast Majority Pose Risk of Being Incorrect

- ID Theft Victims Face Long Refund Delays

- Educational assistance programs: Treasury, IRS issue FAQs

- New TEOS Improvements Webpage – Form 990

- Russian Tax Treaty Suspension

- CBO: End of TCJA Would Increase Tax Revenue

Issue 1: Newlyweds Tax Checklist

Summer wedding season has arrived, and newlyweds can make their tax filing easier by doing a few things now. A taxpayer’s marital status as of December 31 determines their tax filing options for the entire year, but that’s not all newlyweds need to know.

Report a name change

Report any name changes to the Social Security Administration. The name on a person’s tax return must match what’s on file at the SSA. If it does not, it could delay any tax refund. To update information, taxpayers should file Form SS-5, Application for a Social Security Card. It’s available on SSA.gov, by phone at 800-772-1213 or at a local SSA office.

Update address

Notify the United States Postal Service, employers and the IRS of any address change. To officially change their mailing address with the IRS, taxpayers must compete and submit Form 8822, Change of Address.

Check withholding

Newly married couples must give their employers a new Form W-4, Employee’s Withholding Certificate, within 10 days. If both spouses work, they may move into a higher tax bracket or be affected by the additional Medicare tax. They can use the Tax Withholding Estimator on IRS.gov to check their withholding and for help completing a new Form W-4.

Review filing status

Married people can choose to file their federal income taxes jointly or separately each year. While filing jointly is usually more beneficial, it’s best to figure the tax both ways to find out which makes the most sense. Taxpayers should remember that if a couple is married as of December 31, the law says they’re married for the whole year for tax purposes.

Beware of scams

All taxpayers should be aware of and avoid tax scams. The IRS will never contact a taxpayer using email, phone calls, social media or text messages. First contact generally comes in the mail.

Issue 2: A Comprehensive Strategy Is Needed to Address the Significant Backlog of Adjustment Source Documentation Inventory

Business and individual taxpayers at times require the Internal Revenue Service (IRS) to adjust their tax accounts. The tax account adjustments are often in response to the IRS’s identification of errors on a tax return during processing, taxpayer inquiries, or when the IRS processes claims from taxpayers such as an amended tax return.

When a tax adjustment is made on a business or individual tax account, the IRS office that makes the adjustment is required to send all documentation supporting the adjustment to one of the IRS’s Tax Processing Centers located in Austin, Texas; Kansas City, Missouri; or Ogden, Utah.

The information required to be sent includes documentation that the IRS received from the taxpayer as well as documentation generated by the IRS in support of the tax account adjustment, i.e., adjustment source documentation. The IRS office initiating the tax account adjustment sends the adjustment source documentation to the same Tax Processing Center where the IRS’s tax system prints a Form 5147, Integrated Data Retrieval System Transactions Record.

Form 5147 includes a Document Locator Number (DLN),2 which is assigned to the adjustment file. The DLN enables the IRS’s Files Management function to identify and retrieve the adjustment source documentation from storage should a functional area require the information to address a subsequent tax issue involving the taxpayer.

The specific Tax Processing Center that receives the supporting documents and prints the Form 5147 is usually based on the geographic location where the taxpayer resides. Once the adjustment source documentation is received and the Form 5147 is printed, representatives in the IRS’s Files Management function associate the adjustment source documentation with the corresponding Forms 5147 to create the adjustment case file. The adjustment case file is stored locally in the IRS’s Files Management function for one year, and then ultimately the adjustment case file is sent to a Federal Records Center as required by record retention guidelines.

The IRS’s record retention policies, as well as the potential need to support tax adjustments, such as in Tax Court, require the IRS to retain the source documentation. On a weekly basis, the Submission Processing Files Management function updates the Miscellaneous Inventory Report at each site that feeds into the Miscellaneous Monitoring Report which is used to track the adjustment source documentation inventory at each of the three Tax Processing Centers.

The Miscellaneous Monitoring Report identifies the beginning balances, receipts, closures, and ending balances of the IRS’s adjustment source documentation inventory. Submission Processing management officials use this report to monitor its closure of adjustment source document inventory.

The IRS faces challenges in its ability to eliminate the backlog of adjustment source documents to be associated with a corresponding Form 5147. As of November 2023, the IRS reports having over 2.6 million source documents that need to be associated with the corresponding Form 5147.

TIGTA also found that the IRS has not developed a comprehensive strategy that outlines actions the IRS plans to take, the resources needed, and the time frame to resolve this backlog.

Our review of IRS adjustment source document inventory reports identified significant inaccuracies in the reporting of these inventories. For example, for the week ending October 27, 2023, the IRS inaccurately reported the closure of over 600,000 adjustment source documents at the Ogden Tax Processing Center. After TIGTA brought this to their attention, IRS management confirmed that the report was inaccurate, noting that the true number of closures was around 96,000.

In addition, the inventory reports were not being timely updated to accurately reflect transshipment closures on a weekly basis. In September 2023, the Ogden Tax Processing Center sent three shipments of adjustment source documentation totaling 341,773 to the Federal Records Center out of numerical order.

The IRS’s contract with the National Archives and Records Administration requires processed adjustment source documents be placed in numerical order before they are sent to the Federal Records Center. In addition, the Kansas City Tax Processing Center included various items that did not belong in the adjustment source documentation transshipments to the Ogden Tax Processing Center on four shipping pallets.

Issue 3: Builders of Energy Efficient Homes May Qualify for a Valuable Tax Credit

Eligible contractors who build new energy efficient homes or substantially reconstruct existing homes into qualified energy efficient homes may be eligible for a tax credit up to $5,000 per home. The exact amount of the credit depends on eligibility requirements such as the type of home, the home’s energy efficiency and the date when someone buys or leases the home.

Contractor eligibility

To claim the credit, contractors have to:

- Construct or substantially reconstruct and rehabilitate a qualified home.

- Own the home and have a basis in it during construction.

- Sell or rent it to a person for use as a residence.

Home requirements

For a home to qualify, it must be:

- A single-family home, including manufactured or multifamily homes, as defined under certain Energy Star program requirements.

- Located in the United States.

- Purchased or rented for use as a residence.

- Certified to meet applicable energy saving requirements based on home type before the home is sold or leased to someone for use as a home.

Energy efficiency requirements and credit amounts: 2023 and after

For homes acquired through 2032, the credit amount ranges from $500 to $5,000, depending on the certification achieved and standards met, which include:

- Energy Star program requirements.

- Zero Energy Ready Home program requirements.

- Prevailing wage requirements.

Energy efficiency requirements and credit amounts: Before 2023

For homes acquired before 2023, the credit amount is $1,000 or $2,000 depending on the standard met, which include:

- 50% standard for single family, multifamily and manufactured homes: The home must have an annual level of heating and cooling energy consumption that is at least 50% less energy than a comparable home. It must also get at least 1/5 of its energy savings from building envelope components.

- 30% standard for manufactured homes: The manufactured home must have an annual level of heating and cooling energy consumption that is at least 30% less energy than a comparable home. It must also get at least 1/3 of its energy savings from building envelop components.

For both standards, the home must be certified to meet applicable energy savings standards, including the Energy Star program requirements. Manufactured homes must also meet Federal Manufactured Home Construction and Safety Standards.

How to properly claim the credit

Eligible contractors must meet all requirements before claiming the credit. Eligible contractors should review the Instructions for Form 8908, Energy Efficient Home Credit, for full details about these requirements. They must also complete Form 8908, Energy Efficient Home Credit, and submit it with their tax return to claim the credit.

Issue 4: FinCEN Reminds Financial Institutions to Remain Vigilant to Elder Financial Exploitation

EFE is the illegal or improper use of an older adult’s funds, property, or assets, according to FinCEN’s June 2022 EFE Advisory and the U.S. Department of Justice Elder Justice Initiative. Older adults are typically considered individuals aged 60 or older. EFE consists of two primary subcategories: elder theft and elder scams

As the nation recognizes World Elder Abuse Awareness Day, the Financial Crimes Enforcement Network (FinCEN) reminds financial institutions to remain vigilant in identifying and reporting suspicious activity related to elder financial exploitation (EFE). EFE-related losses affect personal savings, checking accounts, retirement savings, and investments, and can severely impact victims’ well-being and financial security as they age. FinCEN has previously published resources to help stakeholders combat EFE.

Earlier this year, FinCEN issued an analysis focusing on patterns and trends identified in Bank Secrecy Act (BSA) data linked to EFE, which indicated roughly $27 billion in EFE-related suspicious activity.

FinCEN examined BSA reports filed by financial institutions between June 15, 2022 and June 15, 2023 where filers either used the key term referenced in FinCEN’s June 2022 EFE Advisory or checked “Elder Financial Exploitation” as a suspicious activity type. This amounted to 155,415 filings from financial institutions.

In addition to filing a Suspicious Activity Report, FinCEN recommends that financial institutions refer customers who may be victims of EFE to the Department of Justice’s National Elder Fraud Hotline at 833-FRAUD-11 or 833-372-8311 for assistance with reporting suspected fraud to the appropriate government agencies.

EFE victims can file incident reports to the Federal Bureau of Investigation’s Internet Crime Complaint Center (IC3) and the Federal Trade Commission.

Overview of Key Findings:

Consistent with the June 2022 EFE Advisory, FinCEN identified two predominant categories of victimization across EFE-related BSA filings:

(1) elder scams, where the victim does not know the perpetrator; and

(2) elder theft, where the victim knows the perpetrator.

- Banks Filed 72 % of All EFE-Related BSA filings: Two banks reported 33 %, or 50,670 BSA filings, of the filings in the dataset. These bank filings mostly reported their customers as victims or perpetrators, but also included reports where the filer acted as a correspondent bank.

- Financial Institutions Filed More Elder Scam-Related BSA Filings than Elder Theft-Related BSA Filings: BSA filings relating to elder scams accounted for approximately 80 % of reported EFE-related activity. This does not necessarily indicate that scams occur more often than theft, but filers are reporting on it more frequently.

- Account Takeover is the Most Frequently Cited EFE Typology: The majority of elder scam-related filings also referenced account takeover activity.

- Adult Children are the Most Frequent Elder Theft-Related Perpetrators: BSA filers reported adult children as the perpetrators of elder theft in nearly 40 percent of cases, based on a manual review of EFE-related filings.

- Reliance on Unsophisticated Methodologies and Avoiding Human Contact: Perpetrators mostly rely on unsophisticated means to steal funds that minimize direct contact with financial institution employees. These include using previously compromised identifying information and/or passwords, guessing passwords, or mass spam emails that elicit replies containing sensitive information

FinCEN Resources on Elder Financial Exploitation

Issue 5: IRS Addresses 2023 Balance Due Notices

The IRS says it is aware that some taxpayers are receiving CP14 (Balance Due, No Math Error) notices showing they have a 2023 balance despite having made payments with their returns. Taxpayers who receive the notice but paid their tax bill in full and on time electronically or by check should not respond to the notice at this time, the IRS says. The agency apologized for any inconvenience the notices may have caused, is researching the matter and will provide an update as soon as possible.

According to the IRS, taxpayers who paid electronically or by check with their 2023 return may show their accounts as pending, even though the IRS received and processed the payment through their bank. The IRS says the notice may have been initiated before the payment was processed, or the payment may have been processed, but contained errors requiring additional handling before the account could be updated.

Any assessed penalties and interest will be adjusted automatically when the taxpayer’s payment is applied correctly by the IRS. However, taxpayers who paid only part of their 2023 tax due should pay the remaining balance or follow the instructions on the notice to enter into an installment agreement or request additional collection alternatives.

Issue 6: Prepared Remarks of FinCEN Director Andrea Gacki During Beneficial Ownership Information Reporting Event in Tucson, Arizona – A Good Explanation of Why the Law Was Passed

June 11, 2024

ANDREA GACKI

DIRECTOR, FINCEN

OPENING REMARKS

BENEFICIAL OWNERSHIP INFORMATION REPORTING EVENT

TUCSON, ARIZONA

Good morning. I want to thank you all for coming out today, and I especially want to thank Senator Sinema’s office for their partnership in pulling this together. I’m honored to be with you to discuss the work of the Financial Crimes Enforcement Network—or FinCEN—and more specifically, to answer the question of why implementing the beneficial ownership information reporting requirements of the Corporate Transparency Act is one of our top priorities.

But first, I thought it would be helpful to explain a bit more about what FinCEN does, so you can understand why this initiative is so vital to our broader efforts to strengthen U.S. national security and protect our financial system.

First, FinCEN issues regulations to combat money laundering, terrorist financing, and other forms of illicit finance. Those regulations require that approximately 300,000 financial institutions report timely and accurate information under the Bank Secrecy Act regarding suspicious activity and certain transactions.

We then provide access to this information to law enforcement and other national security agencies. We also have teams of analysts who examine this reporting using advanced analytic tools and techniques to map illicit networks, identify trends and typologies, and isolate targets for investigations and enforcement. This helps law enforcement investigate serious crimes like narcotrafficking, human trafficking, fraud, and identity theft.

We also issue advisories to drive further reporting on priority risks to the U.S. financial system and national security, and we host public-private events to discuss everything from ideas for improving our overall regulatory regime to details on criminal schemes and typologies.

My team and I will participate in a counter-fentanyl information exchange here in Tucson with law enforcement agencies and financial institutions, where we will share typologies and approaches on combatting illicit fentanyl trafficking.

This exchange is part of an ongoing effort by FinCEN to collaborate at the local level in U.S. cities that have been highly impacted by the opioid crisis. In December, the Department of the Treasury launched a Counter-Fentanyl Strike Force to bring together personnel, expertise, intelligence, and resources across key Treasury offices and is jointly led by the Office of Terrorism and Financial Intelligence at Treasury, where FinCEN resides, and IRS Criminal Investigation.

As part of the Strike Force, FinCEN launched a new initiative: The Promoting Regional Outreach to Educate Communities on the Threat of Fentanyl — or PROTECT program — which will be a nationwide series of meetings where local and regional banks and local, regional, and federal law enforcement can share information on illicit financial flows, including typologies and red-flag indicators of fentanyl-related activity, and discuss what types of information are particularly valuable when financial institutions report suspicious activity related to fentanyl.

I’m confident that we will see results from this new chapter of public-private information sharing; to help us all identify related illicit activity and enable the further disruption of fentanyl trafficking.

At FinCEN, we also employ various tools to hold illicit or noncompliant actors accountable. In addition to our rigorous support of civil and criminal investigations by other agencies, FinCEN imposes civil money penalties when U.S. financial institutions fail to comply with the Bank Secrecy Act’s important mandate to protect national security and the integrity of our financial system.

We are also implementing the Anti-Money Laundering Act of 2020, including the Corporate Transparency Act, which is an important piece of the puzzle as we work to stop bad actors from exploiting the U.S. financial system.

With this background in mind, I want to turn back to my original question: Why is it so important for small businesses to report beneficial owners, the real people behind their companies?

Terrorist financiers, drug kingpins, and other criminals use anonymous corporate structures to launder, move, and hide illicit funds into and through the United States. This dirty money undermines legitimate business activity and compromises U.S. economic and national security. Moreover, the effects of financial crime are detrimental to cities, towns, neighborhoods, and families across America.

Human trafficking, fraud schemes, elder abuse, narcotraffickers, ransomware attackers, and other bad actors often rely on anonymous shell companies to facilitate these serious crimes. Examples of this can hit close to home. Just last month, a Mesa, Arizona individual received a prison sentence for his role as a leader in a transnational criminal organization that laundered sixteen-and-a-half million dollars in narcotics proceeds for the Sinaloa Cartel. According to the plea agreement, this person created a network of shell companies used to launder illicit bulk cash.

Corporate anonymity gives criminals a head start over law enforcement. Investigators must devote substantial time and resources to show who the real person is that controls or owns an entity. Criminals know about this advantage and use it to further enrich themselves and exploit the U.S. financial system.

In 2021, Congress enacted the bipartisan Corporate Transparency Act, or CTA, to help law enforcement fight this illicit activity. The CTA peels back the layers of anonymity by requiring many companies doing business in the United States to report information to FinCEN about their beneficial owners—in other words, the real people who own or control them.

The information is housed in a secure, non-public database, and we’ve set rigorous standards around access and data-sharing to ensure that only authorized recipients can obtain beneficial ownership information. We are providing access to law enforcement and other partners in a phased approach to ensure this data is protected and fulfills the law enforcement and national security purposes laid out in the CTA.

I’d like to take a moment to discuss how it might help bring bad actors to account in the real world.

In 2018, the U.S. Department of the Treasury’s Office of Foreign Assets Control, or OFAC—which administers and enforces economic sanctions—took action against a Russian oligarch named Suleiman Abusaidovich Kerimov that should have prevented him from benefitting from his assets in the United States. For approximately four years after this action, however, Kerimov continued to use a complex series of legal structures to continue to retain an interest in, and benefit from, his over $1 billion in assets in the United States. These funds were invested in large public and private U.S. companies and managed by a series of U.S. investment firms and facilitators. Along the way, Kerimov and his proxies used various layers of shell companies, including LLCs, to conceal his interest. In 2022, OFAC publicly identified a Delaware-based trust that Kerimov was leveraging. Untangling this web of corporate structures allowed OFAC to ensure that Kerimov’s assets in the United States remain blocked and inaccessible to him.

Identifying this network required an extensive, multi-year enforcement investigation into Kerimov’s U.S. holdings by OFAC. Beneficial ownership information reporting can make these types of investigations more efficient by providing a direct resource for law enforcement, national security, and intelligence officials. It can give law enforcement an advantage over illicit actors, diminish the head start that corporate anonymity provides, and ultimately level the playing field for legitimate American businesses.

But let me be clear. Small business owners doing their best to comply with the law should not lose sleep over these new reporting requirements. The CTA penalizes willful violations of the law, and this is where we plan to focus our enforcement actions. It’s not a “gotcha” exercise, and we’re not looking to needlessly burden America’s thriving small business community.

On the other hand, the illicit actors that the CTA targets—kleptocrats, criminals, money launderers, terrorist financiers, tax evaders, and others looking to manipulate America’s corporate system to hide their identities—should lose sleep over this law.

As more legitimate and law-abiding businesses comply with the requirements and report beneficial ownership information, bad actors will increasingly be forced into tough choices that jeopardize their ability to perpetuate crime undetected.

If they choose not to file, or if they file falsely, that may trigger an investigation. If they file true beneficial ownership information, they lose the anonymity that protects their criminal enterprise.

In other words, more transparency means fewer opportunities for bad actors to avoid detection, even when they think they’re hiding.

We recognize—and celebrate—that America’s small business community is vital to our economy. With that in mind, some ask why these reporting requirements apply to so many small businesses, but not bigger corporations. Indeed, the CTA exempts certain other types of businesses, including some large businesses, from its beneficial ownership reporting requirements. In part, it’s because many of those big businesses are already disclosing their ownership structure in some way to other federal agencies. If you think of a big company like Amazon or Cox cable here in Arizona, they are already required to disclose information about those who own or control them to other financial regulators that supervise these companies, and indeed, are generally subject to greater regulatory scrutiny.

Nevertheless, we also know that running a small business is not easy. That’s why, in every step of implementing this law, we’ve considered small business owners and the potential burden that any regulation might impose on their day-to-day operations. Filing a report is easy and free of charge, and for companies with simple ownership structures, we estimate that it should take about 20 minutes. The majority of companies that are required to file should be able to complete the process without the help of an attorney or accountant. And it’s not an annual requirement: unless you need to update or correct information, beneficial ownership reporting is a one-time filing.

To successfully support law enforcement and other officials as they work to protect our national security and economy, it’s important for small businesses across the country to do their part. In terms of deadlines, most companies’ reports aren’t due until January 1, 2025. But we encourage you not to wait. The database is live and ready when you are. If you created or registered your business this year, in 2024, you have 90 days to file your initial report. Starting in 2025, every newly created or registered company must file within 30 days.

We have additional information about these deadlines and lots of guidance, FAQs, videos, and other materials to make compliance as easy as possible on our website, fincen.gov/boi—and we thank small businesses in advance for doing their part to help stop illicit finance.

Thanks again for joining me today, and thanks again to Senator Sinema’s office for bringing us together. With that, I’m excited to hear your questions and thoughts, so I’ll open the floor.

###

Updated March 11, 2024

On March 1, 2024, in the case of National Small Business United v. Yellen, No. 5:22-cv-01448 (N.D. Ala.), a federal district court in the Northern District of Alabama, Northeastern Division, entered a final declaratory judgment, concluding that the Corporate Transparency Act exceeds the Constitution’s limits on Congress’s power and enjoining the Department of the Treasury and FinCEN from enforcing the Corporate Transparency Act against the plaintiffs. The Justice Department, on behalf of the Department of the Treasury, filed a Notice of Appeal on March 11, 2024. While this litigation is ongoing, FinCEN will continue to implement the Corporate Transparency Act as required by Congress, while complying with the court’s order. Other than the particular individuals and entities subject to the court’s injunction, as specified below, reporting companies are still required to comply with the law and file beneficial ownership reports as provided in FinCEN’s regulations.

FinCEN is complying with the court’s order and will continue to comply with the court’s order for as long as it remains in effect. As a result, the government is not currently enforcing the Corporate Transparency Act against the plaintiffs in that action: Isaac Winkles, reporting companies for which Isaac Winkles is the beneficial owner or applicant, the National Small Business Association, and members of the National Small Business Association (as of March 1, 2024). Those individuals and entities are not required to report beneficial ownership information to FinCEN at this time.

Update [March 11, 2024]: This notice was updated on March 11, 2024, to reflect that a Notice of Appeal has been filed regarding this case.

Issue 7: Businesses: The Employer-Provided Childcare Tax Credit is worth up to $150,000

The Employer-Provided Childcare Tax Credit is an incentive for businesses to provide childcare services to their employees.

About the tax credit

This tax credit helps employers cover some costs for childcare resource and referral and for a qualified childcare facility. A qualified childcare facility is one that meets the requirements of all laws and regulations of the state or local government in which it’s located.

The credit is worth up to $150,000 per year to offset 10% of qualified childcare resource and referral costs and 25% of qualified childcare facility costs.

Who is eligible?

To be eligible for the credit, an employer must have paid or incurred qualified childcare costs during the tax year to provide childcare services to employees.

Qualified childcare costs are:

- Costs associated with acquiring, constructing, rehabilitating or expanding property used as the taxpayer’s qualified childcare facility.

- Operating expenses paid by the business, including amounts paid to support childcare workers through training, scholarship programs and providing increased compensation to employees with higher levels of childcare training.

- Qualified resource and referral costs which include amounts paid or incurred under a contract with a qualified childcare facility to provide childcare services to employees of the taxpayer.

How to claim the credit

Employers should complete Form 8882, Credit for Employer-Provided Childcare Facilities and Services, to claim the credit. The credit is part of the general business credit subject to the carryback and carryforward rule. This means employers may carry back unused credit one year and then carryforward 20 years after the year of the credit. Taxpayers whose only source for the credit is from pass-through entities can report the credit directly on Form 3800, General Business Credit.

Issue 8: Hobby or Business: What People Need to Know if They Have a Side Business

Hobbies and businesses are treated differently when it comes to filing taxes. The biggest difference between the two is that businesses operate to make a profit while hobbies are for pleasure or recreation.

Whether someone is having fun with a hobby or running a business, if they are paid through payment apps for goods and services during the year, they may receive an IRS Form 1099-K for those transactions. These payments are taxable income and must be reported on federal tax returns.

There are a few other things people should consider when deciding whether their project is a hobby or business. No single thing is the deciding factor. Taxpayers should review all the factors to make a good decision.

How taxpayers can decide if it’s a hobby or business

These questions can help taxpayers decide whether they have a hobby or business:

- Does the time and effort they put into the activity show they intend to make a profit?

- Does the activity make a profit in some years, and if so, how much profit does it make?

- Can they expect to make a future profit from the appreciation of the assets used in the activity?

- Do they depend on income from the activity for their livelihood?

- Are any losses due to circumstances beyond their control or are the losses normal for the startup phase of their type of business?

- Do they change their methods of operation to improve profitability?

- Do they carry out the activity in a businesslike manner and keep complete and accurate books and records?

- Do the taxpayer and their advisors have the knowledge needed to carry out the activity as a successful business?

Whether taxpayers have a hobby or run a business, good recordkeeping throughout the year will help when they file taxes.

Issue 9: Justice Department News

The Justice Department filed a civil injunction suit against Miami tax return preparers, Niclas Pierre and Elius Bessard, and their tax return preparation businesses, seeking to bar them from owning or operating a tax preparation business and preparing tax returns. The complaint alleges that Pierre and Bessard, through their companies, prepared more than 8,000 tax returns for customers. The two hid their fraudulent activity by not identifying themselves as the return preparer, and instead listed another person as the return preparer or listed no one at all. The defendants’ deceitful actions have cost the United States millions of dollars in lost tax revenue. The exact loss is difficult to estimate because of the complexity of their schemes and their failure to consistently identify themselves as the tax return preparers.

Issue 10: CFPB Sues Student Loan Servicer PHEAA for Pursuing Borrowers for Loans Discharged in Bankruptcy

Lawsuit alleges PHEAA illegally collects money that borrowers do not owe, reports false information to credit reporting companies

MAY 31, 2024

The Consumer Financial Protection Bureau (CFPB) sued student loan servicer Pennsylvania Higher Education Assistance Agency (PHEAA), which does business as American Education Services (AES), for illegally collecting on student loans that have been discharged in bankruptcy and sending false information about consumers to credit reporting companies. The CFPB’s lawsuit asks the court to order PHEAA to stop its illegal conduct, provide redress to borrowers it has harmed, and pay a civil penalty.

PHEAA is a student loan servicer with its principal office in Harrisburg, Pennsylvania. It is a public corporation organized under the laws of the Commonwealth of Pennsylvania. As of December 2023, PHEAA serviced a portfolio of student loans worth roughly $17.8 billion.

The United States Bankruptcy Code provides consumers a financial fresh start by discharging debts and prohibiting creditors from collecting on discharged debts. Many student loans, both federal and private, can be discharged in bankruptcy only if a borrower initiates a separate proceeding and meets a more stringent legal standard than is applied to other debts.

However, certain private student loans are discharged in normal bankruptcy proceedings like other unsecured consumer debt. These “non-qualified” private student loans include money borrowed to pay for tuition at schools that do not qualify for federal Title IV funding, such as unaccredited trade or K-12 schools, loans for medical and dental residency, loans to students attending school less than half-time, or loans where the loan amount was higher than the cost of attendance (which can occur when a loan is disbursed directly to a consumer).

AES services a range of private student loans, including those that have strict discharge requirements in bankruptcy and non-qualified loans that are routinely discharged. Nevertheless, when a consumer with private student loans serviced by AES receives a bankruptcy discharge, the company’s practice is to treat all of that consumer’s education-related loans as not discharged, unless it receives an explicit court order or other express direction from the loan owner.

The CFPB alleges that PHEAA’s practices violate the Consumer Financial Protection Act and the Fair Credit Reporting Act’s implementing regulation. As a result of PHEAA’s practices, borrowers are forced to either pay debt they do not owe, or risk being hit with negative information on their credit reports and default due to the purported non-payment.

Specifically, the CFPB alleges PHEAA harms consumers by:

- Failing to maintain policies and procedures to identify when loans are discharged by bankruptcy: AES fails to recognize that some private student loans are discharged in bankruptcy and instead treats nearly all private student loans as though the consumer still owes those debts.

- Illegally collecting and furnishing inaccurate information about discharged loans: Between 2017 and 2021, AES collected or attempted to collect approximately 7,934 private student loans after a bankruptcy proceeding. Although discovery in litigation will reveal the total scope of PHEAA’s unlawful collection activity, at least 177 were loans eligible for discharge in bankruptcy. Borrowers were thus subjected to illegal collections on loans they did not owe. AES also furnishes inaccurate information to credit reporting companies regarding borrowers’ outstanding debt, which causes financial harm to consumers and may make it harder to qualify for other credit in the future.

- Falsely telling borrowers they still owe payments on discharged loans: AES sends inaccurate and misleading repayment letters and billing statements to borrowers who no longer have any financial obligation to pay the discharged debts.

Enforcement Action

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, the CFPB has the authority to take action against institutions violating consumer financial laws, including the Fair Credit Reporting Act and engaging in unfair, deceptive, or abusive acts or practices. The CFPB’s lawsuit against PHEAA seeks a stop to alleged unlawful conduct, redress for affected consumers, the imposition of a civil money penalty paid into the CFPB’s victims relief fund, and other relief.

Issue 11: New Fact Sheet: Disaster Relief Impacts to Retirement Plans and IRAs

The IRS released a new Fact Sheet on the impact of SECURE 2.0 provision that provides ongoing disaster relief for certain loans and distributions in federally declared major disasters. Before SECURE 2.0, there was no disaster relief that allowed these loans and distributions for all major disasters.

In order to take advantage of the disaster recovery relief, a participant must be a “qualified individual” who has been affected by a “qualified disaster” as described in more detail below:

- Qualified disaster: A qualified disaster is any disaster the US president declares as a major disaster after December 27, 2020. The Federal Emergency Management Agency (FEMA) disaster declaration, as well as the incident period for a qualified disaster and the disaster area, can be found on FEMA’s website.

- Qualified individual: A person whose principal residence is in the qualified disaster area during the incident period and experiences an economic loss because of the qualified disaster is a qualified individual. The FAQs define “economic loss” broadly to include real or personal property damage, displacement from home, or temporary or permanent layoffs.

Absent actual knowledge to the contrary, plans may rely on a participant’s reasonable representation of satisfaction of the eligibility criteria for disaster relief.

DISTRIBUTIONS

Qualified disaster recovery distributions are distributable events for 401(k), money purchase pension, 403(b), or governmental 457(b) plans. Qualified individuals may also take a qualified disaster recovery distribution from an individual retirement account (IRA).

- Maximum Distribution Limit: Qualified disaster recovery distributions are limited to $22,000 per disaster for any qualified individual (across all plans and IRAs).

- Repayments allowed: When the eligible retirement plan terms allow it, a qualified individual may repay all or part of a qualified disaster recovery distribution within three years of the date of receipt. In general, repayments are treated as rollover contributions. Plans that do not accept rollover contributions are not required to accept disaster recovery repayments. It should be noted that in addition to repayment of qualified disaster distributions, a first-time homebuyer who took a distribution to build or buy a residence in a qualified disaster area but did not build or buy due to a qualified disaster may also repay that distribution, even though the original distribution was not a qualified disaster recovery distribution. However, instead of the three-year repayment period above, the repayment must be made within the window to take a disaster recovery distribution ending on the latest of the three dates described below.

- Timing of distributions: The window to take a disaster recovery distribution opens on the first day of the incident period for that qualified disaster and closes 180 days after the latest of (1) the first day of the incident period or (2) the date of the disaster declaration. For a distribution to a first-time homebuyer qualified individual to buy a residence in a qualified disaster area, the window begins 180 days before the first day of the incident period and ends 30 days after the last day of the incident period.

- Tax treatment: Qualified disaster recovery distributions will not be subject to the 10% penalty tax on early distributions. For individuals, federal income taxes will be assessed over a three-year period starting in the year the qualified individual receives the distribution, unless the qualified individual elects to be taxed in full in the year of receipt.

Plan sponsors should note that even if the plan does not offer qualified disaster recovery distributions, qualified individuals who take a distribution from the plan based on another distributable event will still be able to treat these amounts as qualified disaster recovery distributions for their own taxes. This includes claiming the exception to the 10% early distribution tax on their tax returns and paying federal income tax over the three-year period described above.

So, employees may be able to take advantage of certain components of this disaster relief, even if their employer’s plan does not specifically offer it.

LOANS

The FAQs provide the following guidance regarding loans to qualified individuals affected by qualified disasters:

- Increased loan limits: Plan sponsors may increase the dollar limit for plan loans from the lesser of 50% of the vested benefit or $50,000 to the lesser of 100% of the vested benefit or $100,000.

- Additional repayment time: Plan sponsors may suspend loan payments due within 180 days after the last day of the incident period and extend the due dates for these payments up to one year. This suspension applies to any plan loan outstanding on or after the latest of (1) the first day of the incident period or (2) the date of the disaster declaration.

Issue 12: The IRS Ceased Compliance With the $10 Million Taxpayer Treasury Directive in Favor of an Overall Focus on High-Income Taxpayer Noncompliance

The TIFTA audit was initiated to determine whether the IRS is meeting the former Secretary of the Treasury’s established goal requiring the IRS to audit a minimum of 8 % of all high-income individual returns, with incomes more than $10 million, filed each year.

On February 10, 2020, the then Secretary of the Treasury directed the IRS, pursuant to 26 United States Code §§ 7801 and 7803(a)(2), to audit a minimum of 8 % of all high-income individual returns filed each year. On March 13, 2020, the IRS Commissioner responded that accomplishing the goal would require significant opportunity costs but agreed to comply using total positive income of $10 million or more to select returns (2020 Treasury Directive).

In August of 2022, the Inflation Reduction Act was enacted with the purpose in part to fund the IRS so that it could examine more high-income taxpayers. In an August 2022 directive to the IRS, the Secretary of the Treasury directed that no Inflation Reduction Act funding should be used to increase the audit rate of taxpayers with incomes below $400,000 (2022 Treasury Directive).

An analysis of the 2020 Treasury Directive assists in understanding the impact on audit productivity that comes from focusing audit resources on taxpayers above certain high-income thresholds.

What TIGTA Found

The IRS complied with the 2020 Treasury Directive for three tax years but ceased monitoring it at the end of Fiscal Year 2023. At the start of this audit, an IRS executive informed TIGTA in December of 2022 that the 2020 Treasury Directive would no longer be followed because these audits were unproductive having high no-change rates.

The IRS also stated it was embarking on a different approach focusing on complying with the 2022 Treasury Directive. TIGTA found that many of the examined returns pursuant to the 2020 Treasury Directive were productive depending on which IRS function conducted the examinations and which case selection methods were used.

The Small Business/Self Employed Division’s closed examinations of individual taxpayer returns with income of $10 million or more, in Tax Years 2016 through 2021, were generally more productive than income ranges below $10 million, yielding four times more dollars assessed per return and two times more dollars assessed per hour when compared to examinations of returns with income of $400,000 to under $10 million.

On the other hand, Large Business and International Division case selection methods in place prior to the 2020 Treasury Directive resulted in better productivity metrics when compared to post-Treasury Directive results. For example, the no-change rate has increased when comparing pre-directive tax years (Tax Years 2016 through 2017) to post-directive tax years (Tax Years 2018 through 2020).

TIGTA also found that some of the opportunity costs the IRS identified in response to the Department of the Treasury at the outset of the 2020 Treasury Directive were overstated by 190 examinations of large and mid-sized businesses.

What TIGTA Recommended

TIGTA made two recommendations to the IRS:

- include a separate category for taxpayers with TPI of $10 million or more when evaluating the compliance of high-income individual taxpayers for Initiative 3.4 of the IRS Strategic Operating Plan to ensure the productivity of examinations on these high-income individual returns are tracked and analyzed in comparison to examinations of taxpayers at other income levels

- Identify the potential causes for the Large Business and International Division’s low productivity examination results and monitor measures to ensure that the most productive returns are selected for examination.

The IRS partially agreed with both recommendations stating that it already categorizes and monitors productivity measures for high-income high-wealth taxpayers, including those with TPI of $10 million or more, and that it will identify the potential causes for the low productivity examination results and will use enhanced data and analytics to select cases based on the highest risk of noncompliance.

Issue 13: Next Phase of Employee Retention Credit Work Begins; Review Shows Vast Majority Pose Risk of Being Incorrect

The IRS this week announced plans to reject thousands of improper high-risk Employee Retention Credit claims while starting a new round of processing lower-risk claims to help qualified taxpayers.

The IRS recognized between 10% and 20% of claims fall into what the agency has determined to be the highest-risk group, which show clear signs of being erroneous claims for the pandemic-era credit. Tens of thousands of these will be denied in the weeks ahead. This high-risk group includes filings with warning indications that clearly fall outside the guidelines established by Congress.

Taxpayers with ERC claims that are still being processed are being urged not to take any further action or contact the IRS. The agency said it is taking longer to process claims that it did last summer and that taxpayers should await notification from the IRS. The moratorium on new ERC claims continues.

Issue 14: ID Theft Victims Face Long Refund Delays

National Taxpayer Advocate Erin Collins (TAS) calls for increased IRS focus on identity theft victims after finding they are waiting nearly two years to receive their tax refunds. According to a recent post on her blog, taxpayers should brace themselves for long delays for their case to be resolved after submitting a Form 14039, Identity Theft Affidavit, to the IRS. Collins called on the agency to prioritize assistance to taxpayers who have been the victim of identity theft, paying out their refunds and preventing future harm.

While the IRS has taken steps to reduce processing times and appears to have increased the number of closed cases, processing times increased from 556 days at the end of the 2023 fiscal year to 675 days as of April 2024. Collins said the IRS should prioritize improved response for identity theft claims using the same all-hands-on-deck approach it used to address its processing of paper returns during the pandemic.

Issue 15: Educational assistance programs: Treasury, IRS issue FAQs

The Department of Treasury and the IRS published frequently asked questions (FAQs) in Fact Sheet 2024-22, about questions pertaining to educational assistance programs under § 127 of the Internal Revenue Code (Code) (a § 127 educational assistance program). Certain educational assistance benefits that are given under an educational assistance program may be excluded by taxpayers from their gross income. Payments for tuition fees, and costs associated with books and supplies are among the benefits of the program. They also cover principal and interest payments for qualifying loans that an employer makes between March 27, 2020, and Jan. 1, 2026.

Issue 16: New TEOS Improvements Webpage – Form 990

As part of an ongoing effort to improve service for the tax-exempt community, the TEOS Modernization Team is focused on improving usability based on stakeholder feedback. The team recently enhanced public access to Form 990 series data by providing a range of descriptive information (metadata) on the new TEOS Improvements page. This new page features:

- A comprehensive list of TE/GE public disclosure datasets that offers an overview of the available datasets on IRS.gov.

- Dataset guides that outline the type of data available, usage, data format and update schedules to aid users in understanding and utilizing the data effectively.

- Data dictionaries and indices that identify column headers and data elements in each dataset that provide clarity on the content and structure of the data.

- Annotated forms that illustrate the relationships between form field names and datasets.

- Redacted schemas tailored for non-software developers that simplify the understanding of the raw XML data files.

- A compiled FAQ document that addresses common inquiries and concerns regarding disclosure, datasets, and related topics.

Resources on the new webpage aim to improve accessibility and facilitate the public’s use of Form 990 series data, in addition to enhancing transparency and understanding within the tax-exempt community.

Issue 17: Russian Tax Treaty Suspension

Announcement 2024-26 The United States provided formal notice to the Russian Federation on June 17, 2024, to confirm the suspension of the operation of paragraph 4 of Article 1 and Articles 5-21 and 23 of the Convention between the United States of America and the Russian Federation for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income and Capital, signed at Washington on June 17, 1992 (Convention), as well as the operation of its accompanying Protocol, by mutual agreement.

Issue 18: CBO: End of TCJA Would Increase Tax Revenue

Recent budget projections from by the Congressional Budget Office (CBO) say the expiration of the Tax Cuts and Jobs Act (TCJA) could increase federal tax collections from individuals by 10% in 2025 and 11% in 2026.

The increased revenue would stem from the reductions in the standard deduction and estate and gift tax thresholds that result from the TCJA expiring at the end of 2025. Even if the TCJA were to be extended, tax collection from individuals would increase by 4% annually.

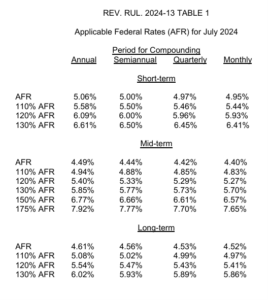

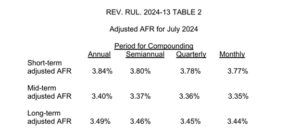

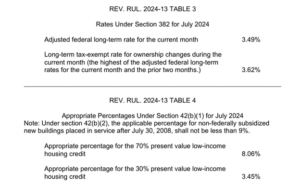

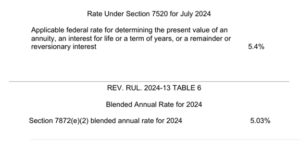

Issue 13: Applicable Federal Rates for July 2024, Rev. Rul. 2024-13

REV. RUL. 2024-13 TABLE 5

![]() Basics & Beyond Resources

Basics & Beyond Resources

- Blog Page

- Resource List

- Webinar & Seminar Schedules

- Get Registered!

- Note: Paid attendees can request a link to the replay of any previously recorded webinar presentations by emailing us at [email protected]