I hope you are resting after tax season. TAKE A BREAK!

And read this newsletter..

In This Issue:

- Werfel Settles into Role as New IRS Commissioner

- Where Are We with the Federal Debt a Report Identifies Tax Cuts as Primarily Responsible

- Basis Adjustment Does Not Apply to Assets of Irrevocable Grantor Trust

- Retirement Plan and IRA Required Minimum Distributions FAQs – An Overview to Help Address your Clients Questions

- IRS Finds Water Rights Are 1031 Property

- IRS Issues Guidance and updates Frequently Asked Questions Related to the New Vehicle Critical Mineral and Battery Components

- IRS Issues Renewed Warning on Employee Retention Credit Claims

- Attempting this W-2 Scam Can Lead to Penalties for Taxpayers

- Understand Digital Asset Reporting and Tax Requirements

- IRS Revises Form 8940, Request for Miscellaneous Determination, to Allow Electronic Filing

- IRS Working on E-Signature Extension

- FinCEN Issues Proposed Beneficial Ownership Information Reporting FAQs

- Form 3115, Application for Change in Accounting Method has Been Updated

- Taxpayer Protection Program Redesigned 5071C Letter Pilot

- DOJ Touts Efforts to Crack Down on Fraudulent Tax Preparers

- Taxpayers Who Reported Certain State Relief Payments Should File Amended Returns IR 2023-77

- Applicable Federal Rates for May 2023, Rev. Rul. 2023-9

- Here’s What Your Clients Need to know About How to Claim the Clean Vehicle Tax Credits – Join us on May 17th for our Quarterly Update as we further explain the Credit. https://www.cpehours.com/webinar-schedule/

Issue 1: Werfel Settles into Role as New IRS Commissioner

On March 9, the Senate confirmed Daniel Werfel as IRS commissioner by a bipartisan vote of 54-42, and Werfel was sworn in March 13. The current status of IRS which includes the backlog of unprocessed paper income tax returns; implementing the proposed Service Industry Tip Compliance Agreement and preparing for reporting requirements attributable to Form 1099-K and cryptocurrency transactions are just a few issues his leadership will face during his term.

In addition, IRS unveiled its Strategic Operating Plan, an ambitious effort which details a decade of change including 42 key initiatives and 190 key projects designed to help taxpayers, the tax community and the nation.

The plan makes clear that the resources to be deployed over the short and long term will be used to:

- Rebuild and strengthen IRS customer service activities, putting an end to long wait times on the phone, adding capacity to the in-person taxpayer assistance centers around the country, and providing new online tools for those who want to engage with the IRS digitally.

- Add capacity to unpack the complex filings of high-income taxpayers, large corporations and complex partnerships, addressing a growing chasm between the number of experienced compliance personnel at the IRS who audit high-income, high-wealth tax filings for compliance (about 2,600 employees) and the roughly 30,000 individuals making more than $10 million a year, 60,000 large corporations and 300,000 large partnerships and S corps.

- Update various outdated systems in IRS core operations to help ensure the agency has the most modern and robust security technology to protect taxpayer data.

In IRS customer service initiatives, taxpayers can already see important changes this tax season, and the plan provides a foundation for future efforts. In compliance initiatives, the IRS will ensure that the agency follows Treasury Secretary Yellen’s directive not to raise audit rates above historical levels for small businesses and households making less than $400,000.

What this means is that over the next number of years, as the IRS moves to implement the Strategic Operating Plan, the agency is focused on pursuing high-income and high-wealth individuals, complex partnerships and large corporations that are not paying the taxes they owe. As a result, the IRS has no plans to increase the audit rate for small businesses and households making less than $400,000.

This plan charts the course forward for the IRS and tax administration.

The plan is organized around five objectives:

- Dramatically improve services to help taxpayers meet their obligations and receive the tax incentives for which they are eligible.

- Quickly resolve taxpayer issues when they arise.

- Focus expanded enforcement on taxpayers with complex tax filings and high-dollar noncompliance to address the tax gap.

- Deliver cutting-edge technology, data and analytics to operate more effectively.

- Attract, retain and empower a highly skilled, diverse workforce and develop a culture that is better equipped to deliver results for taxpayers.

Each objective will be accomplished through specific initiatives outlined in the plan. The plan contains 42 initiatives designed to achieve IRS goals, each of which includes multiple key projects and milestones to measure progress. The plan covers more than 190 key projects and more than 200 specific milestones. The IRS will identify additional projects and milestones as work continues. The number of projects and milestones will grow significantly over time as the plan evolves to meet the needs of the nation and tax administration.

The future will bring more improvements, with taxpayers able to get more online access to their tax accounts – simplifying their interactions with the IRS. Detailed information about refunds will be easier to track through improvements to the “Where’s My Refund?” tool. Many more service improvements are detailed in the plan.

The plan also highlights how the IRS will be working to ensure fair enforcement of the nation’s tax laws and compliance with existing laws while respecting taxpayer rights. The IRS will be solely focused on increased efforts on identified compliance issues involving large corporations, larger partnerships and high-wealth individuals.

As the IRS begins implementation of this plan, the agency will work with the public, partners and oversight groups to ensure the transformation work meets the needs of taxpayers and the nation.

Issue 2: Where Are We with the Federal Debt a Report Identifies Tax Cuts as Primarily Responsible

A series of large, permanent tax cuts over the past 25 years have created substantial federal budget shortfalls and continue to exert upward pressure on the debt ratio.

Tax cuts under President Bush, their bipartisan extensions, and tax cuts under President Trump slashed taxes disproportionately for the wealthy and profitable corporations. Since these enhancements the cost of $10 trillion has substantially contributed to more than 90% of the increase in the national debt as a percentage of the economy. This excludes the debt attributable to the one-time costs of responding to the COVID-19 pandemic and the Great Recession.

Over time, these tax cuts will grow to be responsible for the entire increase in the debt ratio since their enactment.

The Bush administration enacted sweeping tax cuts that will have cost more than $8 trillion by the end of fiscal year 2023. The tax cuts lowered personal income tax rates across the board, both for labor income and for capital gains, and they significantly increased the untaxed portion of estates and lowered the estate tax rate.

Trump’s signature tax bill, The Tax Cuts and Jobs Act of 2017 enacted when Republicans gained control of the White House and both houses of Congress in 2017, will have cost roughly $1.7 trillion by the end of fiscal year 2023. These tax cuts reduced personal income tax rates and permanently lowered the corporate tax rate, among other changes.

Representative Vern Buchanan, a Florida Republican, has also introduced legislation to make permanent President Trump’s 2017 tax cuts, at a cost of roughly $2.6 trillion over the next decade.

Issue 3: Basis Adjustment Does Not Apply to Assets of Irrevocable Grantor Trust

Revenue Ruling 2023-02 confirms that the basis adjustment under § 1014 generally does not apply to the assets of an irrevocable grantor trust not included in the deceased grantor’s gross estate for Federal estate tax purposes.

- 1014 of the Internal Revenue Code does not apply to “step-up” the basis of assets gifted to an irrevocable grantor trust by completed gift in cases in which such assets are not included in the gross estate of the owner of the trust for Federal estate tax purposes. In such cases, even though the grantor trust’s owner is liable for Federal income tax on the trust’s income, the assets of the grantor trust are not considered as acquired or passed from a decedent by bequest, devise, inheritance, or otherwise within the meaning of § 1014(b), and therefore § 1014(a) does not apply.

Example:

Facts. Andrew, an individual, established irrevocable trust and funded the trust with an Asset in a transfer that was a completed gift for gift tax purposes. Andrew retained power over the trust that caused him to be treated as the owner of the trust for income tax purposes. Andrew did not hold a power over the trust that would result in the inclusion of the trust’s assets in Andrew’s gross estate.

- 1014(a)(1) generally provides that the basis of property in the hands of a person acquiring the property from a decedent or to whom the property passed from a decedent, if not sold, exchanged, or otherwise disposed of before the decedent’s death by that person, is the FMV of the property at the date of the decedent’s death.

- 1014(b)lists the seven types of property that are considered to have been acquired from or to have passed from the decedent for purposes of § 1014(a). The revenue ruling points out that this list is exclusive, citing Collins, (DC CA 1970) 26 AFTR 2d 70-5577.

The IRS said that Asset is not described in §§ 1014(b)(2), 1014(b)(3) or § 1014(b)(4) because Andrew did not retain a power to revoke or amend the trust or hold a power to appoint Asset. And Asset is not described by §§ 1014(b)(9) or 1014(b)(10) because it is not included in Andrew’s gross estate under the provisions of the estate tax rules.

Holding. Andrew creates the trust, an irrevocable trust, retaining a power that causes Andrew to be the owner of the entire trust for income tax purposes but does not cause the trust assets to be included in Andrew’s gross estate for purposes of the estate tax rules. If Andrew funds the trust with an Asset in a transaction that is a completed gift for gift tax purposes, the basis of Asset is not adjusted to its fair market value on the date of Andrew’s death under §1041 because the Asset was not acquired or passed from a decedent as defined in §1014(b). Accordingly, the basis of Asset immediately after Andrew’s death is the same as the basis of Asset immediately prior to Andrew’s death.

Issue 4: Retirement Plan and IRA Required Minimum Distributions FAQs – An Overview to Help Address your Clients Questions

Required minimum distributions (RMDs) are the minimum amounts a client must withdraw from retirement accounts each year. They generally must start taking withdrawals from a traditional IRA, SEP IRA, SIMPLE IRA, and retirement plan accounts when reaching age 72 (73 if you reach age 72 after Dec. 31, 2022).

Account owners in a workplace retirement plan (for example, 401(k) or profit-sharing plan) can delay taking their RMDs until the year they retire, unless they’re a 5% owner of the business sponsoring the plan.

Roth IRAs do not require withdrawals until after the death of the owner. Designated Roth accounts in a 401(k) or 403(b) plan are subject to the RMD rules for 2022 and 2023. However, for 2024 and later years, RMDs are no longer required from designated Roth accounts. You must still take RMDs from designated Roth accounts for 2023, including those with a required beginning date of April 1, 2024.

- Your client can withdraw more than the minimum required amount.

- The withdrawals are included in taxable income except for any part that was already taxed (basis) or that can be received tax-free (such as qualified distributions from designated Roth accounts).

Beginning in 2023, the SECURE 2.0 Act raised the age that your client must begin taking RMDs to age 73. If they reach age 72 in 2023, the required beginning date for their first RMD is April 1, 2025, for 2024. Notice 2023-23 permits financial institutions to notify IRA owners no later than April 28, 2023, that no RMD is required for 2023.

If they reach age 73 in 2023, they were 72 in 2022 and subject to the age 72 RMD rule in effect for 2022. If they reach age 72 in 2022,

- The first RMD is due by April 1, 2023, based on the account balance on December 31, 2021, and

- The second RMD is due by December 31, 2023, based on the account balance on December 31, 2022.

For defined contribution plan participants or IRA owners who die after December 31, 2019, (with a delayed effective date for certain collectively bargained plans), the entire balance of the deceased participant’s account must be distributed within ten years.

There’s an exception for a surviving spouse, a child who has not reached the age of majority, a disabled or chronically ill person, or a person not more than ten years younger than the employee or IRA account owner.

The new 10-year rule applies regardless of whether the participant dies before, on, or after the required beginning date. The required beginning date is the date an account owner must take their first RMD.

The following frequently asked questions and answers provide general information and should not be cited as legal authority.

Q1. What are Required Minimum Distributions? (Updated March 14, 2023)

Required Minimum Distributions (RMDs) are minimum amounts that IRA and retirement plan account owners generally must withdraw annually starting with the year they reach age 72 (73 if you reach age 72 after Dec. 31, 2022). Retirement plan account owners can delay taking their RMDs until the year in which they retire unless they’re a 5% owner of the business sponsoring the plan. Owners of traditional IRA, and SEP and SIMPLE IRA accounts must begin taking RMDs once the account holder is age 72 (73 if you reach age 72 after Dec. 31, 2022), even if they’re retired.

Retirement plan participants and IRA owners, including owners of SEP IRAs and SIMPLE IRAs, are responsible for taking the correct amount of RMDs on time, every year from their accounts, and they may face stiff penalties for failure to take RMDs.

When a retirement plan account owner or IRA owner dies before January 1, 2020, before their RMDs are required to begin, the entire amount of the owner’s benefit generally must be distributed to the beneficiary who is an individual.

- within 5 years of the end of the year following the year of the owner’s death, or

- over the life of the beneficiary starting by the end of the year following the year of the owner’s death.

For defined contribution plan participants, or IRA owners, who die after December 31, 2019, (with a delayed effective date for certain collectively bargained plans), the SECURE Act requires the entire balance of the participant’s account be distributed within ten years. This 10-year rule has an exception for a surviving spouse, a child who has not reached the age of majority, a disabled or chronically ill person or a person not more than ten years younger than the employee or IRA account owner. The new 10-year rule applies regardless of whether the participant dies before, on, or after, the required beginning date. The required beginning date is the date an account owner must take their first RMD.

Q2. What types of retirement plans require minimum distributions? (Updated March 14, 2023)

The RMD rules apply to all employer sponsored retirement plans, including profit-sharing plans, 401(k) plans, 403(b) plans, and 457(b) plans. The RMD rules also apply to traditional IRAs and IRA-based plans such as SEPs, SARSEPs, and SIMPLE IRAs.

The RMD rules do not apply to Roth IRAs while the owner is alive. However, RMD rules do apply to the beneficiaries of Roth 401(k) accounts.

Q3. When must I receive my required minimum distribution from my IRA? (Updated March 14, 2023)

You must take your first required minimum distribution for the year in which you reach age 72 (73 if you reach age 72 after Dec. 31, 2022). However, you can delay taking the first RMD until April 1 of the following year. If you reach age 72 in 2022, you must take your first RMD by April 1, 2023, and the second RMD by Dec. 31, 2023.

If you reach age 72 in 2023, your first RMD for 2024 (the year you reach 73) is due by April 1, 2025.

A different deadline may apply to RMDs from pre-1987 contributions to a 403(b) plan (see FAQ 5 below).

Q4. How is the amount of the required minimum distribution calculated?

Generally, a RMD is calculated for each account by dividing the prior December 31 balance of that IRA or retirement plan account by a life expectancy factor that the IRS publishes in Tables in Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs). Choose the life expectancy table to use based on your situation.

Joint and Last Survivor Table II – use this table if the sole beneficiary of the account is your spouse and your spouse is more than 10 years younger than you.

Uniform Lifetime Table III – use this if your spouse is not your sole beneficiary or your spouse is not more than 10 years younger.

Single Life Expectancy Table I – use this if you are a beneficiary of an account (an inherited IRA).

Q5. Can an account owner just take a RMD from one account instead of separately from each account?

An IRA owner must calculate the RMD separately for each IRA they own but can withdraw the total amount from one or more of the IRAs. Similarly, a 403(b)-contract owner must calculate the RMD separately for each 403(b) contract they own but can take the total amount from one or more of the 403(b) contracts.

However, RMDs required from other types of retirement plans, such as 401(k) and 457(b) plans, must be taken separately from each of those plan accounts.

Q6. Who calculates the amount of RMD? (Updated March 14, 2023)

Although the IRA custodian or retirement plan administrator may calculate the RMD, the account owner is ultimately responsible for taking the correct RMD amount.

Q7. Can an account owner withdraw more than the RMD?

Yes.

Q8. What happens if a person does not take an RMD by the required deadline? (Updated March 14, 2023)

If an account owner fails to withdraw the full amount of the RMD by the due date, the amount not withdrawn is subject to a 50% excise tax. SECURE 2.0 Act drops the excise tax rate to 25%; possibly 10% if the RMD is timely corrected within two years. The account owner should file Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, with their federal tax return for the year in which the full amount of the RMD was required, but not taken.

Q9. Can the penalty for not taking the full RMD be waived?

Yes, the penalty may be waived if the account owner establishes that the shortfall in distributions was due to a reasonable error and that reasonable steps are being taken to remedy the shortfall. In order to qualify for this relief, you must file Form 5329 and attach a letter of explanation.

Q10. Can a distribution in excess of the RMD for one year be applied to the RMD for a future year?

No.

Q11. How are RMDs taxed?

The account owner is taxed at their income tax rate on the amount of the withdrawn RMD. However, to the extent the RMD is a return of basis or is a qualified distribution from a Roth IRA, it is tax free.

Q12. Can RMD amounts be rolled over into another tax-deferred account?

No.

Q13. Is an employer required to make plan contributions for an employee who has reached age 72 (73 if you reach age 72 after Dec. 31, 2022) and is receiving required minimum distributions? (Updated March 14, 2023)

Yes, you must continue contributions for an employee, even if they are receiving RMDs. You must also give the employee the option to continue making salary deferrals in a plan that permits them. Otherwise, you will fail to follow the plan’s terms which may cause your plan to lose its qualified status. You may correct this failure through the Employee Plans Compliance Resolution System (EPCRS).

Q15. How are RMDs determined in a Defined Benefit Plan? (Updated March 14, 2023)

A defined benefit plan generally must make RMDs by distributing the participant’s entire interest in periodic annuity payments as calculated by the plan’s formula for:

- the participant’s life,

- the joint lives of the participant and beneficiary, or

- a “period certain” (see Treas. Reg. 1.401(a)(9)-6, A-3).

Q16. What are the required minimum distribution requirements for pre-1987 contributions to a 403(b) plan? (Updated March 14, 2023)

If the 403(b) plan (including any 403(b) plan that received pre-1987 amounts in a direct transfer that complies with Treas. Reg. Section 1.403(b)-10(b)):

- has separately accounted and kept records for pre-1987 amounts, and

- is for the primary purpose of providing retirement benefits (see the incidental benefit rules in Treas. Reg. Section 1.401-1(b)(1)(I)),

then the pre-1987 amounts (excluding any earnings or gains on such amounts):

- are not subject to the age 72 (73 if you reach age 72 after Dec. 31, 2022) RMD rules of IRC Section 401(a)(9),

- are not used in calculating age 70½ (or age 72 or 73) RMDs from the 403(b) plan, and

- don’t need to be distributed from the plan until December 31 of the year in which a participant turns age 75 or, if later, April 1 of the calendar year immediately following the calendar year in which the participant retires.

If the plan includes both pre-1987 and post 1987 amounts, for distributions of any amounts in excess of the age 70½ RMDs, the excess is considered to be from the pre-1987 amounts.

If records are not kept for pre-1987 amounts, the entire account balance is subject to the age 70½ (or age 72 or 73) RMD rules of IRC section 401(a)(9).

Issue 5: IRS Finds Water Rights Are 1031 Property

Some water rights are considered real property for §1031 exchange purposes if the properties involved are held for productive use in a trade or business or held as an investment, according to a recent IRS private letter ruling (PLR 202309007). The agency found the water rights and the rights to the land involved were sufficiently similar to constitute property of a “like kind” for the purposes of §1031 because the water rights were granted in perpetuity.

The ruling was requested by a taxpayer who held a license for the unrestricted use of water in perpetuity with the owners of other ranches who were successors in interest to the same water rights. The ranch owner planned to sell a portion of the water rights and reinvest the proceeds in real property and take advantage of §1031 to avoid recognizing any gain.

Issue 6: IRS Issues Guidance and updates Frequently Asked Questions Related to the New Vehicle Critical Mineral and Battery Components

The Internal Revenue Service issued proposed regulation related to certain requirements that must be met for critical minerals and battery components for the new clean vehicle credit.

The Inflation Reduction Act (IRA) allows a maximum credit of $7,500 per vehicle, consisting of $3,750 in the case of a vehicle that meets certain requirements relating to critical minerals and $3,750 in the case of a vehicle that meets certain requirements relating to battery components.

The critical mineral and battery component requirements will apply to vehicles placed in service on or after April 18, 2023, the day after the Notice of Proposed Rulemaking is issued in the Federal Register.

New clean vehicles placed in service on or after April 18, 2023, are subject to the critical mineral and battery component requirements even if the vehicle was ordered or purchased before April 18, 2023. A vehicle’s eligibility for the new clean vehicle credit is generally based on the rules that apply as of the date a vehicle is placed in service, meaning the date the taxpayer takes delivery of the vehicle.

This means that the vehicle may or may not be eligible depending on whether it meets the critical mineral and battery component requirements.

As a result of this guidance, the IRS updated the frequently-asked-questions (FAQs) for the clean vehicle credits.

Fact Sheet 2023-08 updates FAQs related to new, previously owned and qualified commercial clean vehicles.

The FAQs revisions are as follows:

- Topic A: Eligibility Rules for the New Clean Vehicle Credit: Questions 2, 3, 4, 5, 6, and 7, added question 11.

- Topic B: Income and Price Limitations for the New Clean Vehicle Credit: added question 2, renumbering questions 2 through 10 to 3 through 11, respectively, updated questions 1, 3, 7, 8, and 9.

- Topic C: When the New Requirements Apply to the New Clean Vehicle Credit: Questions 2, 4, 5, and 6, added question 8, renumbered prior question 8 to question 9.

- Topic F: Claiming the Previously Owned Clean Vehicles Credit: Question 2.

- Topic G: Qualified Commercial Clean Vehicles Credit: Added question 10.

These FAQs are being issued to provide general information to taxpayers and tax professionals as expeditiously as possible.

Just place “IRS Fact Sheet 2023-08 in your search engine to access the fact sheet.

Issue 7: IRS Issues Renewed Warning on Employee Retention Credit Claims

The Internal Revenue Service issued a renewed warning urging people to carefully review the Employee Retention Credit (ERC) guidelines before trying to claim the credit as promoters continue pushing ineligible people to file.

The IRS and tax professionals continue to see third parties aggressively promoting these ERC schemes on radio and online. These promoters charge large upfront fees or a fee that is contingent on the amount of the refund. And the promoters may not inform taxpayers that wage deductions claimed on the business’ federal income tax return must be reduced by the amount of the credit.

The IRS has been warning about this scheme since last fall, but there continue to be attempts to claim the ERC during the 2023 tax filing season. Tax professionals note they continue to be pressured by people wanting to claim credits improperly. The IRS Office of Professional Responsibility is working on additional guidance for the tax professional community that will be available in the near future.

People and businesses can avoid this scheme, and by not filing improper claims in the first place. If the business filed an income tax return deducting qualified wages before it filed an employment tax return claiming the credit, the business should file an amended income tax return to correct any overstated wage deduction.

Businesses should be cautious of advertised schemes and direct solicitations promising tax savings that are too good to be true. Taxpayers are always responsible for the information reported on their tax returns. Improperly claiming the ERC could result in taxpayers being required to repay the credit along with penalties and interest.

What is the ERC?

The ERC is a refundable tax credit designed for businesses who continued paying employees while shut down due to the COVID-19 pandemic or who had significant declines in gross receipts from March 13, 2020, to Dec. 31, 2021. Eligible taxpayers can claim the ERC on an original or amended employment tax return for a period within those dates.

To be eligible for the ERC, employers must have:

- sustained a full or partial suspension of operations due to orders from an appropriate governmental authority limiting commerce, travel or group meetings due to COVID-19 during 2020 or the first three quarters of 2021,

- experienced a significant decline in gross receipts during 2020, or a decline in gross receipts during the first three quarters of 2021, or

- qualified as a recovery startup business for the third or fourth quarters of 2021.

As a reminder, only recovery startup businesses are eligible for the ERC in the fourth quarter of 2021. Additionally, for any quarter, eligible employers cannot claim the ERC on wages that were reported as payroll costs in obtaining PPP loan forgiveness or that were used to claim certain other tax credits.

To report tax-related illegal activities relating to ERC claims, submit by fax or mail a completed Form 14242, Report Suspected Abusive Tax Promotions or Preparers and any supporting materials to the IRS Lead Development Center in the Office of Promoter Investigations.

Mail: Internal Revenue Service

Lead Development Center Stop MS5040

24000 Avila Road

Laguna Niguel, California 92677-3405

Fax: 877-477-9135

Employers should also report instances of fraud and IRS-related phishing attempts to the IRS at [email protected] and Treasury Inspector General for Tax Administration C at 800-366-4484.

Issue 8: Attempting this W-2 Scam Can Lead to Penalties for Taxpayers

A new scam circulating on social media urges people to use wage information on a tax return to claim false credits in hopes of getting a big refund.

How the W-2 scam works

The scheme encourages people to use tax software to manually fill out Form W-2, Wage and Tax Statement, and include false income information. Scam artists suggest people make up large income, withholding figures and employer. Scam artists then instruct people to file the bogus tax return electronically in hopes of getting a substantial refund – sometimes as much as five figures – due to the large amount of withholding.

There are two other variations of this scheme going around. Both involve misusing Form W-2 wage information in hopes of generating a larger refund:

- One variation involves people using Form 7202, Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals, to claim a credit based on income earned as an employee and not as a self-employed individual. These credits were available for self-employed individuals for 2020 and 2021 during the pandemic; they are not available for 2022 tax returns.

- A similar variation involves people making up fictional employees employed in their household and using Schedule H (Form 1040), Household Employment Taxes, to try claiming a refund based on false sick and family medical leave wages they never paid. Taxpayers use the form to report household employment taxes if they hired someone to do household work and those wages were subject to Social Security, Medicare or federal unemployment (FUTA) taxes, or if the employer withheld federal income tax from those wages.

The IRS verifies W-2s and is watching for these scams.

People who try this scam face a wide range of penalties, including a frivolous return penalty of $5,000. They also run the risk of criminal prosecution for filing a false tax return.

For anyone who has taken part in one of these schemes, there are several options that the IRS recommends. People can amend a previous tax return or consult with a trusted tax professional.

Issue 9: Understand Digital Asset Reporting and Tax Requirements

All taxpayers filing 2022 tax year Forms 1040 and 1040-SR must check a box indicating whether they received digital assets as a reward, award or payment for property or services or disposed of any digital asset that was held as a capital asset through a sale, exchange or transfer.

Examples of digital assets transactions include:

- A sale of digital assets.

- The receipt of digital assets as payment for goods or services provided.

- The receipt or transfer of digital assets for free, without providing any consideration, does not qualify as a bona fide gift.

- The receipt of new digital assets as a result of mining and staking activities.

- The receipt of new digital assets as a result of a hard fork.

- An exchange of digital assets for property, goods or services.

- An exchange or trade of digital assets for another digital asset(s).

- Any other disposition of a financial interest in digital assets.

Reporting digital assets transactions

- If the “yes” box is checked, taxpayers must report all income related to their digital asset transactions.

- Taxpayers should use Form 8949, Sales and other Dispositions of Capital Assets, to figure their capital gain or loss and report it on Schedule D (Form 1040), Capital Gains and Losses.

- If the transaction was a gift, they must file Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return.

- If individuals received any digital assets as compensation for services or disposed of any digital assets they held for sale to customers in a trade or business, they must report the income as they would report other income of the same type. For example, they would report W-2 wages on Form 1040 or 1040-SR, line 1a, or inventory or services on Schedule C.

The Instructions for Form 1040 and 1040-SR and the IRS Digital Assets page have more information.

Issue 10: IRS Revises Form 8940, Request for Miscellaneous Determination, to Allow Electronic Filing

As part of ongoing efforts to improve service for the tax-exempt community, the Internal Revenue Service issued the revised Form 8940, Request for Miscellaneous Determination, and its instructions to allow electronic filing.

Beginning April 3, 2023, IRS will make available the electronic version of the Form 8940 that exempt organizations use to make miscellaneous determination requests online at Pay.gov. The IRS will provide a 90-day grace period during which it will continue to accept paper versions of Form 8940 (Rev. 6-2011); however, after this grace period the Form 8940 must be submitted electronically.

In addition to the miscellaneous requests that were previously made using Form 8940, the following miscellaneous requests are now also made on Form 8940:

- Government entities requesting voluntary termination of exempt status under § 501(c)(3) (previously a letter request).

- Canadian registered charities requesting inclusion in Tax Exempt Organization Search database (TEOS) of organizations eligible to receive tax-deductible charitable contributions (Pub. 78 data) or a determination on public charity classification (previously a letter request).

- Private foundations giving notice only of intent to terminate private foundation status under section 507(b)(1)(B) (previously provided on Form 8940 or by general correspondence).

Issue 11: IRS Working on E-Signature Extension

The IRS announced it is working to extend its policy allowing taxpayers facing audits or collections to electronically sign and email certain documents beyond October 2023 while the agency develops a long-term solution. The temporary policy, in place since 2021, is set to expire after Oct. 31.

Under the extended policy, the IRS accepts electronic signatures on the following documents:

- Extensions of the statute of limitations on assessment or collection

- Waivers of statutory notice of deficiency and consents to an assessment

- Closing agreements

Other statements or forms collected outside the standard filing procedures.

Issue 12: FinCEN Issues Proposed Beneficial Ownership Information Reporting FAQs

The Financial Crimes Enforcement Network (FinCEN) has issued FAQs on the beneficial ownership information (BOI) reporting requirements that will take effect on January 1, 2024.

Required beneficial ownership information reporting. In September 2022, FinCEN issued final regs (RIN 1506-AB49) implementing the Corporate Transparency Act (CTA). The CTA requires certain business entities created or registered to do business in the U.S. to report identifying information about their beneficial owners to FinCEN.

FAQs. To supplement the guidance provided in the final regs, FinCEN recently issued a series of frequently asked questions (FAQs). The FAQs provide the following information:

- Unless exempt, entities would need to report their beneficial ownership information (BOI) to FinCEN if they had to file a document with their state, territory, or Tribal government to create or register the entity to do business in that jurisdiction (reporting entity).

Note: Sole proprietors using a fictitious or doing business as (DBA) name may also need to file DOI information if they had to register their DBA with a state agency.

- A reporting entity will need to provide FinCEN with its legal name and any trade name or DBA, its address, the jurisdiction in which it was formed or first registered, and its taxpayer identification number.

- For each beneficial owner, the reporting company will need to provide the individual’s legal name, birthdate, address and identifying number and copy of a driver’s license, passport, or other approved document.

Per the FAQs, a “beneficial owner” of a reporting entity is any individual who exercises substantial control over the entity or who owns or controls at least 25% of the entity.

Initial reports. For entities created or registered to do business in the U.S. before January 1, 2024, their initial BOI reports are due by January 1, 2025. For entities created or registered to do business in the U.S. on or after January 1, 2024, their BOI reports are due within 30 calendar days of receiving notice that their entity’s creation or registration is effective.

Updated reports. Updated reports will be required when there is a change to previously reported information about the reporting entity or its beneficial owners. These reports will be due within 30 calendar days after a change occurs.

Corrected reports. Corrected reports will be required when previously reported information was inaccurate when filed. Corrected reports will be due within 30 calendar days of the error’s discovery.

The FAQs also note that FinCEN will not charge a fee for filing these reports.

Issue 13: Form 3115, Application for Change in Accounting Method has Been Updated

Announcement 2023-12 informs taxpayers and practitioners that the Internal Revenue Service has revised Form 3115, Application for Change in Accounting Method, and its instructions. The Form 3115 (Rev. December 2022) is the current Form 3115 (December 2022 Form 3115) and replaces the December 2018 version of the Form 3115. Announcement 2023-12 also provides guidance to allow for a reasonable period for taxpayers to transition to the December 2022 Form 3115.

Issue 14: Taxpayer Protection Program Redesigned 5071C Letter Pilot

Beginning this month, the IRS is phasing in a redesigned 5071C letter, which is sent to taxpayers who require identity and tax return verification. The letter will include an embedded QR code and updated format. The QR code will link to IRS.gov/Verify Return. No changes were made to the IRS Taxpayer Protection Program Hotline number provided on the letter. Please encourage taxpayers to complete the online identity and tax return verification to minimize processing delays no matter which version of the 5071C letter they receive.

Issue 15: DOJ Touts Efforts to Crack Down on Fraudulent Tax Preparers

The Department of Justice, ahead of Tax Day, advised taxpayers to exercise extreme caution in selecting tax preparers and touted recent successes in catching and stopping fraudulent tax service providers.

The DOJ warned of too-good-too-be-true offers from “shady” return preppers who over-promise or exaggerate credit and deduction claims on clients’ returns in efforts to rake in fees. Oftentimes, the DOJ said, these bad actors try to collect from customers without attaching identifying preparer information.

If your preparer asks you to sign a blank return, refuses to sign your return as your return preparer, or is charging you a fee based on the size of your refund, consult the IRS’s website and tips to make sure you are not exposing yourself to trouble.

The DOJ Tax Division coordinates with the U.S. Attorney’s Offices nationwide to convict fraudulent preparers and leverage the court system to recoup “ill-gotten gains.”

Taxpayers concerned about a suspicious tax preparer can submit to the IRS a completed Form 14242, Report Suspected Abusive Tax Promotions or Preparers, and supporting evidence. Also, the IRS Whistleblower Office pays out monetary awards to individuals who provide tips that lead to collections that may have otherwise been missed. Individuals submitting a whistleblower claim should use Form 211, Application for Award for Original Information.

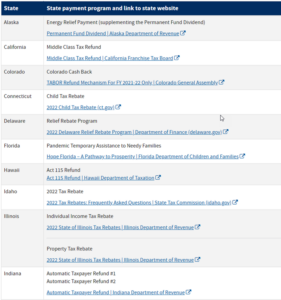

Issue 16: Taxpayers Who Reported Certain State Relief Payments Should File Amended Returns IR 2023-77

Taxpayers who filed their federal income taxes early this year and included certain state relief payments in their taxable income should consider filing an amended return, according to the IRS.

On February 10, 2023, the IRS issued guidance for taxpayers in 21 states who received special relief payments in 2022 from their state governments. The IRS determined that these payments related to general welfare and disaster relief and, therefore, weren’t taxable income. This meant that taxpayers in California, Colorado, Connecticut, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Maine, New Jersey, New Mexico, New York, Oregon, Pennsylvania, and Rhode Island.

Note: The IRS’ guidance also applies to the special supplemental Energy Relief Payment made by Alaska.

In addition, many people in Georgia, Massachusetts, South Carolina, and Virginia may exclude their special 2022 state tax refunds from income if the payment is a refund of state taxes paid and the recipient either claimed the standard deduction for tax year 2022 or itemized their tax year 2022 deductions but did not receive a tax benefit.

Amended returns. The IRS recommends that taxpayers who filed their returns before February 10, 2023, should check their tax return to see if they paid tax on a state relief payment to determine if an amended return is necessary. If an amended return is needed, taxpayers should file their amended return electronically and direct deposit any resulting refund.

Taxpayers have the option of submitting their amended return on paper using Form 1040-X, Amended U.S. Individual Income Tax Return.

Note: It will take much longer to process a paper return and these taxpayers are not eligible for direct deposit. They will receive a paper check for any resulting refund.

These taxpayers should follow the form’s instructions to complete the paper form but should mail their amended return to:

- Department of the Treasury

- Internal Revenue Service

- Austin, TX 73301-0052

Issue 17: Here’s What Your Clients Need to know About How to Claim the Clean Vehicle Tax Credits – Join us on May 17th for our Quarterly Update as we further explain the Credit.

https://www.cpehours.com/webinar-schedule/

The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug-in electric drive motor vehicles, including adding fuel cell vehicles to the tax credit.

Beginning January 1, 2023, eligible vehicles may qualify for a tax credit of up to $7,500. The amount of the credit depends on when the eligible new clean vehicle is placed in service and whether the vehicle meets certain requirements for a full or partial credit.

- The buyer must meet certain income limitations.

- The final assembly of a new clean vehicle must occur within North America.

- The vehicle can’t exceed a manufacturer suggested retail price of:

- $80,000 for vans, sport utility vehicles and pickup trucks

- $55,000 for other vehicles

The purchase of a new clean vehicle between 2009 and 2022 may also qualify for a tax credit.

The IRA also added a credit for used clean vehicles, which can equal 30% percent of the sale price up to a maximum credit of $4,000. However, this recent credit does not apply to used clean vehicles purchased before 2023.

Here’s an updated list of frequently asked questions about new and used clean vehicle credits that covers:

- eligibility rules,

- income and price limitations,

- when the new requirements apply, and

- claiming the credit.

These credits are nonrefundable, so taxpayers can’t get back more on the credit than what they owe in taxes. Plus, the taxpayer cannot apply any excess credit to future tax years.

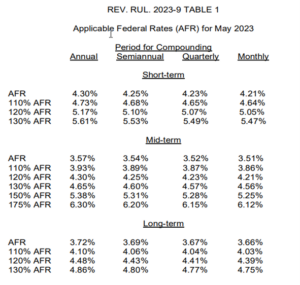

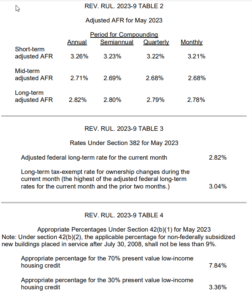

Issue 18: Applicable Federal Rates for May 2023, Rev. Rul. 2023-9

REV. RUL. 2023-9 TABLE 5

Rate Under Section 7520 for May 2023 Applicable federal rate for determining the present value of an annuity, an interest in life or a term of years, or a remainder or reversionary interest 4.40%