In this Issue:

- When is the Form 990 series filing deadline?

- IRS Reminds U.S. Taxpayers Living, Working Abroad to File Tax Return

- ERC Claim Withdrawal Program Still Open; Recheck Claims

- Fiscal Year 2024 Mandatory Review of Compliance with the Freedom of Information Act

- IRS Delivers Strong 2024 Tax Filing Season; Expands Services for Millions of People on Phones, In-Person, and Online with Expanded Funding

- Treasury, IRS Issue New Rules on Corporate Stock Repurchase Excise Tax

- IRS Changes TDS Authorization Process

- Energy-Efficient Property Guidance Released

- IRS Provides Updates on COVID Fraud Cases

- TIGTA: IRS Reducing Processing Backlog

- Social Security Eliminates Overpayment Burden for Social Security Beneficiaries – Automatic Overpayment Recovery Rate Reduced to 10%

- How to Correct an Electronically Filed Return Rejected for a Missing Form 8962

- IRS Launches New Effort Aimed at High-Income Non-filers; 125,000 Cases Focused on High Earners, Including Millionaires, Who Failed to File Tax Returns with Financial Activity Topping $100 Billion

- Operation Fraud Street Mafia: Nine Arrested for Tax Fraud and More

- IRS Alert: Beware of Companies Misrepresenting Nutrition, Wellness and General Health Expenses as Medical Care for FSAs, HSAs, HRAs and MSAs

- 2024 RMDs Waived for 10-year IRA Payouts

- Applicable Federal Rates for May 2024, Rev. Rul. 2024-09

Don’t forget to register for the Unlimited Webinar Package: https://www.cpehours.com/webinar-schedule/

Issue 1: When is the Form 990 series filing deadline?

The Form 990 series filing deadline this year is Wednesday, May 15, 2024.

Form 990, 990-EZ, Form 990-N, or 990-PF must be filed by the 15th day of the 5th month after the end of your organization’s accounting period. For a calendar year taxpayer, Form 990, 990-EZ, Form 990-N, or 990-PF is due May 15 of the following year.

Which Form 990-series return should be filed?

Most tax-exempt organizations are required to file an annual return. Which form an organization must file generally depends on its financial activity, as indicated in the chart below.

| Status | Form to file: |

| Gross receipts normally

< $50,000 |

Form 990-N |

| Gross receipts < $200,000 and

Total assets < $500,000 |

Form 990-EZ or |

| Gross receipt > $200,000 or

Total assets > $500,000 |

Form 990 |

| Private foundation – regardless of status | Form 990-PF |

What if an organization needs more time to file?

Tax-exempt organizations that need additional time to file beyond the May 15 deadline can request a 6-month automatic extension by filing Form 8868, Application for Extension of Time To File an Exempt Organization Return. In situations where tax is due, extending the time for filing a return does not extend the time for paying tax. The IRS encourages organizations requesting an extension to electronically file Form 8868.

Are there consequences for filing late?

An organization that does not meet its Form 990 or Form 990-EZ filing requirement may have to pay a penalty for each day the return is late. The amount of the penalty depends on the size of the organization.

What happens if an organization does not file?

Under § 6033(j), the tax-exempt status of an organization that does not file a required return or notice for three consecutive years will be automatically revoked as of the due date of the third unfiled return. Revoked organizations must file Form 1120, U.S. Corporation Income Tax Return, or a Form 1041, U.S. Income Tax Return for Estates and Trusts, and may need to pay income taxes.

Issue 2: IRS Reminds U.S. Taxpayers Living, Working Abroad to File Tax Return

The IRS reminds taxpayers living and working outside the U.S. to file their 2023 federal income tax return by Monday, June 17, 2024. Taxpayers who live or have a business in Israel, Gaza or the West Bank, and certain other taxpayers affected by the terrorist attacks in the State of Israel, have until Oct. 7, 2024, to both file and pay most taxes due. Review Notice 2023-71 for more information.

Issue 3: ERC Claim Withdrawal Program Still Open; Recheck Claims

The ERC Voluntary Disclosure Program expired, but the IRS encourages businesses to recheck claims and pursue the claim withdrawal process if they need to ask the IRS not to process an ERC claim for any tax period that has not been paid yet.

Issue 4: Fiscal Year 2024 Mandatory Review of Compliance with the Freedom of Information Act

Taxpayers may request information from the Internal Revenue Service through the Freedom of Information Act (FOIA) and § 6103.1 If the IRS does not process requests under these statues correctly, taxpayers do not receive the information to which they are entitled.

The FOIA requires Federal agencies to make records of the Federal Government available to the public upon request, unless specifically exempted. Although the statute was intended to allow access to documents concerning policy and procedures, it is also used for requesting tax records. Federal agencies are required to make records promptly available to any person upon request as long as they meet the request criteria.

- The request reasonably describes such records.

- The request is made in accordance with published rules and procedures.

- There are no legal requirements to deny the request.

Why TIGTA Did This Audit

The overall objective of this audit was to determine whether the IRS improperly withheld information requested by taxpayers in writing based on Freedom of Information Act (FOIA) exemption 5 United States Code (U.S.C.) § (§) 552(b)(7) or Internal Revenue Code (I.R.C.) § 6103.

TIGTA is required to conduct periodic audits to determine whether the IRS properly denied written requests for taxpayer information and report the results to Congress. Impact on Tax Administration Taxpayers may request information from the IRS through the FOIA. However, FOIA exemption (b)(7) allows certain records or information compiled for law enforcement purposes to be withheld.

While § 6103(c) and (e) protects the confidentiality of taxpayer returns and return information, it does allow the taxpayer, or a person designated by the taxpayer, to request and receive tax return and return information. If the IRS does not process requests under these statutes correctly, taxpayers do not receive the information to which they are entitled.

The Disclosure Office processes all written FOIA requests, and it closed 3,533 FOIA requests between October 1, 2022, and March 31, 2023. The Disclosure Office denied the requested information either partially or fully based on FOIA exemption (b)(7) for 516 of these 3,533 requests.

TIGTA reviewed a statistically valid stratified sample of 99 of the 516 fully or partially denied FOIA requests and determined that the IRS correctly withheld information using FOIA exemption (b)(7) for 98 of the 99 FOIA information requests TIGTA sampled.

This was an improvement when compared to our last report, in which TIGTA reported that the Disclosure Office did not follow FOIA redaction requirements for 11 of the 83 requests reviewed. Although the IRS Disclosure Office is tasked with responding to written requests for IRS information, other IRS offices having custody of taxpayer records may also process written requests for information made under § 6103.

The Disclosure Office does not track § 6103(c) and (e) information requests received and processed by other offices. The Disclosure Office closed 162§ 6103(c) or (e) requests between October 1, 2022, and March 31, 2023, and withheld information from the requestor in 10 requests. TIGTA reviewed all 10 § 6103(c) and (e) requests and did not identify any disclosure errors.

Issue 5: IRS Delivers Strong 2024 Tax Filing Season; Expands Services for Millions of People on Phones, In-Person, and Online with Expanded Funding

The Internal Revenue Service highlighted a variety of improvements that dramatically expanded service for millions of taxpayers during the 2024 filing season.

Through Inflation Reduction Act funding, the IRS continued to expand taxpayer service levels not seen in more than a decade with double-digit gains occurring in critical areas. Compared to a year ago, the IRS answered over 1 million more taxpayer phone calls this tax season, helped over 170,000 more people in-person, and saw 75 million more IRS.gov visits fueled by a new and expanded “Where’s My Refund?” tool.

Through April 6, the IRS processed more than 100 million individual tax returns. Tens of millions more will come in advance of the April deadline, the busiest time of the year for tax returns. The IRS also projects about 19 million taxpayers will file extensions, which will be due Oct. 15.

Since the start of the January tax season, the IRS has delivered more than $200 billion in refunds through early April. The average refund was $3,011, a 4.6% increase from last April’s average of $2,878.

Here are major filing season numbers in 10 key areas. These numbers, generally from late March and early April, reflect the historic 2024 tax season taking place at the IRS:

- Improved phone service. Continuing a trend seen last year following the addition of 5,000 new telephone assistors, the IRS level of service on its main phone lines reached more than 88%. That’s above the 84% level seen last year and more than a five-fold increase from the phone service levels seen during the pandemic era period, when the level of service was at just 15% in 2022.

- More calls answered. The IRS answered more taxpayer calls on its live assistor lines this year, a 16.8% increase from 2023. IRS assistors handled 7,608,000 calls, up from 6,513,000 the year before. IRS automated lines handled approximately another 7 million calls, 280,000 more than the previous year.

- More callback options. The IRS offered callback options on 97% of the phone lines this filing season. The agency offered call back for over 4 million taxpayers this tax season, more than double the 1.8 million calls in 2023. This option, offered when phone lines were busy, saved taxpayers nearly 1.4 million hours of wait time on the phones.

- More in-person help. The IRS helped 170,000 more taxpayers in-person this filing season than in 2023. IRS employees at Taxpayer Assistance Centers (TACs) served 648,000 taxpayers this year, up from 474,000 in 2023, a 37% increase.

- Expanded in-person hours. The IRS added extended hours at 242 TAC locations across the nation, generating more than 11,000 extra service hours for taxpayers during the 2024 filing season. In addition to extended service hours, IRS also offered taxpayer assistance on Saturdays in more than 70 locations. These evening and Saturday hours made it more convenient for thousands of hard-working taxpayers to get help.

- Higher usage of IRS.gov. Driven by increased use of the expanded information on the “Where’s My Refund?” for the 2024 filing season, IRS.gov saw large increases in traffic. The website had nearly 500 million visits, an 18% increase. And “Where’s My Refund?” accounted for more than 275 million of those visits, up 62 million from 2023 representing a 29% increase.

- More chatbot use. The IRS saw more use of its virtual assistant tool on key IRS.gov pages. There were 832,000 uses this filing season, up nearly 150% from 330,000 uses in 2023.

“Taxpayers continued to see major improvements from the IRS during the 2024 tax season,” said IRS Commissioner Danny Werfel. “A well-funded IRS is like night and day for taxpayers. With the help of more funding and added resources, service for taxpayers this filing season eclipsed levels seen during the past decade. This tax season meant real-world improvements for people looking for help, whether calling, visiting in-person or using IRS.gov.”

“We still have much more work to do, both to finish the 2024 tax season as well as put in place continued improvements made possible by Inflation Reduction Act funding,” Werfel said. “But this filing season marks another important chapter where we’ve improved service for taxpayers, continuing an accelerating trend in the story of transforming the IRS.”

Don’t forget to register for the Unlimited Webinar Package: https://www.cpehours.com/webinar-schedule/

Issue 6: Treasury, IRS Issue New Rules on Corporate Stock Repurchase Excise Tax

The Department of Treasury and the IRS announced proposed regulations that would offer taxpayers and tax professionals new guidance concerning the one percent excise tax owed on corporate stock repurchases. The proposed regulations would impact publicly traded domestic corporations that repurchase their stock or whose stock is acquired by certain affiliates. The regulations also would impact certain publicly traded foreign corporations that repurchase their stock or whose stock is acquired by certain affiliates. These regulations follow Notice 2023-2, which provided initial guidance on the application of the stock repurchase excise tax.

Issue 7: IRS Changes TDS Authorization Process

As part of the agency’s continuing efforts to combat identity theft and protect taxpayer information, the IRS has made changes to the Transcript Delivery System (TDS). Beginning April 8, tax preparers must call the Practitioner Priority Service (PPS) to request transcripts to be deposited into their secure object repository (SOR). While PPS has been the primary avenue for these requests, other IRS toll-free lines will no longer offer the SOR as a delivery method.

Tax preparers must also pass the current required authentication and verify their short identification. If the identity cannot be verified, transcripts will only be mailed to the address of record. The IRS’s PPS assistors cannot resolve issues with ID.Me identity proofing or the status of an ID.Me account.

Issue 8: Energy-Efficient Property Guidance Released

New IRS guidance says that rebates paid for the purchase of energy-efficient property and improvements are not income. The guidance (IR 2024-19) provides that taxpayers who receive rebates for the purchase of energy-efficient homes should not include the value of those rebates as income on their tax returns. However, they must reduce the property’s basis by the rebate amount when they sell it.

The language of the Inflation Reduction Act (IRA) of 2022 describes performance-based incentives and electrification product subsidies as “rebates.” According to the guidance, amounts received through the Department of Energy (DOE) home energy rebate programs funded under the IRA will be treated as a reduction in the purchase price or cost of the property for eligible upgrades and projects.

Issue 9: IRS Provides Updates on COVID Fraud Cases

The IRS marked the four-year anniversary of Congress passing the Coronavirus Aid, Relief and Economic Security (CARES) Act by announcing that Criminal Investigation has investigated 1,644 tax and money laundering cases related to COVID fraud, involving a total of $8.9 billion. It added that more than half of that amount comes from cases opened in the past year.

The cases being investigated by Criminal Investigation include a range of criminal activity, including fraudulently obtained loans, credits, and payments the CARES Act provided for workers, families and small businesses. As of Feb. 29, 2024, 795 people have been indicted for alleged COVID-related crimes and 373 individuals have been sentenced to an average of 34 months in prison. Criminal Investigation has a 98.5% conviction rate on COVID fraud cases it has prosecuted.

“The work by IRS Criminal Investigation provides a vital role in protecting against fraud and serves a key part in the agency’s wider efforts to ensure fairness in the nation’s tax system,” said IRS Commissioner Danny Werfel. “Protecting taxpayers against fraud in pandemic-era programs is just one example of the important role that CI plays in the law enforcement community. A healthy budget for the IRS helps us get the job done, and the work of CI provides a critical safety net to protect the nation against fraud.”

Recent sentencings include:

Long Island man sentenced to 10 years in prison for sprawling COVID-19 loan fraud:

In March 2024, Rami Saab, also known as “Rami Hasan,” was sentenced to 10 years in prison and required to pay $9.6 million in restitution for his role as the mastermind behind a sprawling conspiracy to fraudulently obtain loans amid the COVID-19 pandemic. Saab and a network of co-conspirators fraudulently applied for more than $32 million in loans from the Paycheck Protection Program (PPP) and Economic Injury Disaster Loan Program (EIDL) on behalf of shell corporations they controlled. Relying on false information and fabricated documentation supplied by Saab and his conspirators, the Small Business Administration (SBA) and private banks administrating the PPP and EIDL programs granted at least 20 such applications, resulting in Saab and his fellow conspirators receiving $9.6 million in emergency-relief funds intended for distressed small businesses. Using a web of more than 50 otherwise dormant bank accounts, Saab and others laundered the proceeds before using the funds for their own self-enrichment.

Toledo area man sentenced to 94 months in prison for COVID fraud:

Terrence L. Pounds was sentenced in March 2024 to 94 months in prison and ordered to pay more than $4.2 million dollars to the SBA after being convicted of conspiracy to commit wire fraud, wire fraud and money laundering. Pounds and his co-defendants devised a scheme to obtain SBA-financed loans from the EIDL Program and the PPP under false pretenses, often claiming the loans were for nonprofit, faith-based organizations with over $1 million in revenue and 15 employees. He successfully obtained millions of dollars in loans and then used the money to purchase several new vehicles, which were later forfeited to the U.S. government.

CI is the law enforcement arm of the IRS, responsible for conducting financial crime investigations, including tax fraud, narcotics trafficking, money-laundering, public corruption, healthcare fraud, identity theft and more. CI special agents are the only federal law enforcement agents with investigative jurisdiction over violations of the Internal Revenue Code, obtaining a nearly 90% federal conviction rate. The agency has 20 field offices located across the U.S. and 12 attaché posts abroad.

Issue 10: TIGTA: IRS Reducing Processing Backlog

The IRS significantly reduced its inventories of tax returns and other types of tax account work during 2023, and many functions at its tax-processing centers have returned to pre-pandemic levels, the Treasury Inspector General for Tax Administration (TIGTA) found in a recent report. However, TIGTA still has concerns about the inventories of amended tax returns remaining to be worked, which are significantly above pre-pandemic levels. IRS inventories of suspended returns also remain substantially higher than pre-pandemic levels.

Delays in processing backlogged tax returns and other types of tax account work burden taxpayers, including delaying the receipt of their refunds, TIGTA found. Additionally, significant inventories of tax account work continue to delay the resolution of taxpayer account issues.

Issue 11: Social Security Eliminates Overpayment Burden for Social Security Beneficiaries – Automatic Overpayment Recovery Rate Reduced to 10%

The Social Security Administration announced it will decrease the default overpayment withholding rate for Social Security beneficiaries to ten percent (or $10, whichever is greater) from 100%, significantly reducing financial hardship on people with overpayments.

“Social Security is taking a critically important step towards our goal of ensuring our overpayment policies are fair, equitable, and do not unduly harm anyone,” said Martin O’Malley, Commissioner of Social Security. “It’s unconscionable that someone would find themselves facing homelessness or unable to pay bills, because Social Security withheld their entire payment for recovery of an overpayment.”

The agency works to pay the right people the right amounts at the right time, and Social Security issues correct payments in most cases. However, there is room to improve, as people count on the agency to prevent overpayments from happening and make it easier to navigate the recovery and waiver processes when they occur.

When a person has been overpaid, the law requires the agency to seek repayment, which can create financial difficulties for beneficiaries. As of March 25, 2024, the agency will collect ten percent (or $10, whichever is greater) of the total monthly Social Security benefit to recover an overpayment, rather than collecting 100 percent as was previous procedure. There will be limited exceptions to this change, such as when an overpayment resulted from fraud.

There will be a short transition period where people will continue to experience the older policy. People placed in 100% withholding during this transition period should call Social Security’s National 800 Number at 1-800-772-1213 to lower their withholding rate.

The change applies to new overpayments. If beneficiaries already have an overpayment with a withholding rate greater than ten percent and would like a lower recovery rate, they too should call Social Security at 1-800-772-1213 or their local Social Security office to speak with a representative. If a beneficiary requests a rate lower than ten percent, a representative will approve the request if it allows recovery of the overpayment within 60 months – a recent increase to improve how the agency serves its customers from the previous policy of only 36 months. If the beneficiary’s proposed rate would extend recovery of the overpayment beyond 60 months, the Social Security representative will gather income, resource, and expense information from the beneficiary to make a determination.

Additionally, people have the right to appeal the overpayment decision or the amount. They can ask Social Security to waive collection of the overpayment, if they believe it was not their fault and cannot afford to pay it back. The agency does not pursue recoveries while an initial appeal or waiver is pending. Even if people do not want to appeal or request a waiver, they should contact the agency if the planned withholding would cause hardship. Social Security has flexible repayment options, including repayment of as low as $10 per month. Each person’s situation is unique, and the agency handles overpayments on a case-by-case basis.

Issue 12: How to Correct an Electronically Filed Return Rejected for a Missing Form 8962

The Internal Revenue Service reminds taxpayers that an electronically filed tax return will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (APTC) on Form 8962, Premium Tax Credit (PTC), but does not complete the form in the software and submit it with their tax return.

Taxpayers must file Form 8962 if any family member was enrolled in Marketplace health insurance and IRS records show that APTC was paid to their Marketplace insurance company. Taxpayers use Form 8962 to reconcile their APTC with the PTC they are allowed. This reconciliation is required even when APTC fully subsidizes the cost of Marketplace insurance, and no premiums are paid by the taxpayer.

The IRS has been seeing an increase in the number of taxpayers who are not including the required Form 8962 when using tax software to file their returns.

FAQs on correcting an electronically filed return rejected for a missing Form 8962

Q1. Why was my electronic return rejected? (added Feb. 23, 2024)

A1. The electronic return was rejected because IRS records show that APTC was paid to the Marketplace health insurance company on behalf of a member of the family, and they are required to complete Form 8962 and attach it to the return to reconcile the APTC with the PTC they were allowed. For purposes of the PTC, the “family” consists of yourself, your spouse if filing jointly, and all other individuals who are claimed as dependents on the return. If someone else enrolled a member of the family in Marketplace health insurance with APTC and the client claimed the family member on their tax return, the client is required to complete Form 8962 and attach it to the return. If another taxpayer has agreed that they will reconcile on their return all or a portion of the APTC paid on behalf of a member of your family, complete Part IV of Form 8962 and attach it to the return.

Q2. How do I know if I was enrolled in Marketplace health insurance with APTC? (added Feb. 23, 2024)

A2. You or the person who enrolled a family member in Marketplace health insurance should have received Form 1095-A, Health Insurance Marketplace Statement, from your Marketplace. Form 1095-A shows the months of coverage and any APTC paid to the Marketplace health insurance company for the coverage.

Q3. What if I was enrolled in Marketplace health insurance but did not receive Form 1095-A? (added Feb. 23, 2024)

A3. If the client purchased insurance through the Federally facilitated Marketplace and set up a HealthCare.gov account, they can get a copy of Form 1095-A online from the account. If the client purchased insurance through a State-based Marketplace, they may be able to get an electronic copy of Form 1095-A from the State-based Marketplace account. Visit the Marketplace’s website to find out the steps needed to follow to get a copy of Form 1095-A online.

Q4. What if my Form 1095-A is incorrect? (added Feb. 23, 2024)

A4. If the client purchased insurance through the Federally-facilitated Marketplace , and they think the information on the Form 1095-A is incorrect, or if they think they should not have received a Form 1095-A because they were not enrolled in Marketplace health insurance, they should contact the Federally-facilitated Marketplace Call Center. If they purchased insurance through a State-based Marketplace, please contact the Marketplace Call Center, which information can be found at your State-based Marketplace website.

Q5. What if they think they are not required to file Form 8962? (added Feb. 23, 2024)

A5. If they think they are not required to complete Form 8962 and attach it to the return, confirm that APTC was not paid to the Marketplace health insurance company for any member of the family. To confirm that APTC was not paid, they should attach to the return a pdf attachment titled “ACA Explanation” with a written explanation of the reason why they believe Form 8962 should not be required. They may also upload any copies of a corrected or voided Form 1095-A from the Marketplace or any notice issued by the Marketplace indicating proof of no enrollment.

Issue 13: IRS Launches New Effort Aimed at High-Income Non-filers; 125,000 Cases Focused on High Earners, Including Millionaires, Who Failed to File Tax Returns with Financial Activity Topping $100 Billion

In the continuing effort to improve tax compliance and ensure fairness, the Internal Revenue Service announced a new effort focusing on high-income taxpayers who have failed to file federal income tax returns in more than 125,000 instances since 2017.

The new initiative, made possible by Inflation Reduction Act funding, begins with IRS compliance letters going out this week on more than 125,000 cases where tax returns have not been filed since 2017. The mailings include more than 25,000 to those with more than $1 million in income, and over 100,000 to people with incomes between $400,000 and $1 million between tax years 2017 and 2021.

These are all cases where the IRS has received third-party information – such as through Forms W-2 and 1099s – indicating these people received income in these ranges but failed to file a tax return. Without adequate resources, the IRS non-filer program has only run sporadically since 2016 due to severe budget and staff limitations that did not allow these cases to be worked. With new Inflation Reduction Act funding available, the IRS now has the capacity to do this core tax administration work.

The IRS will begin mailing these compliance alerts for failure to file a tax return, formally known as the CP-59 Notice. About 20,000 to 40,000 letters will go out each week, beginning with the filers in the highest-income categories. The IRS noted that some of these non-filers have multiple years included in the case count so the number of taxpayers receiving letters will be smaller than the actual number of notices going out.

People receiving these letters should take immediate action to avoid additional follow-up notices, higher penalties as well as increasingly stronger enforcement measures. People in this category should also consult with a trusted tax professional so they can quickly file their late tax returns and pay delinquent tax, interest and penalties. The failure-to-file penalty amounts to 5% of the amount owed every month – up to 25% of the tax bill.

Since the IRS is not aware of the potential credits and deductions these people may have, the amount of potential revenue to be gained from this effort is uncertain. The third-party information on these taxpayers indicates financial activity of more than $100 billion. Even with a conservative estimate, the IRS believes hundreds of millions of dollars of unpaid taxes are involved in these cases. At the same time, some non-filers may actually be owed a refund.

The new non-filer initiative is part of a larger effort underway with the IRS working to ensure large corporate, large partnership and high-income individual filers pay the taxes they owe. Prior to the Inflation Reduction Act, more than a decade of budget cuts prevented the IRS from keeping pace with the increasingly complicated set of tools that the wealthiest taxpayers use to shelter or manipulate their income to avoid taxes. The IRS is now taking swift and aggressive action to close this gap.

The IRS has a variety of efforts underway to improve tax compliance in overlooked areas where the agency did not have adequate resources prior to Inflation Reduction Act funding.

For example, the IRS is continuing to pursue millionaires that have not paid hundreds of millions of dollars in tax debt. The IRS has collected nearly $500 million in ongoing efforts to recoup taxes owed by 1,600 millionaires with work continuing in this area. In other areas, the IRS is pursuing multi-million-dollar partnership balance sheet discrepancies, ramping up audits of more than 75 of the largest partnerships using artificial intelligence (AI) as well as other areas.

Issue 14: Operation Fraud Street Mafia: Nine Arrested for Tax Fraud and More

The IRS Criminal Investigation Division partnered with the FBI and DEA in a recent investigation that found more than $550 million in fraudulent claims for the Employee Retention Credit (ERC). The so-called Operation Fraud Street Mafia investigation found that Kristopher Thomas, a prison inmate, led a multi-million-dollar ERC scheme whereby Thomas and his co-conspirators filed payroll tax returns with the IRS that claimed the ERC for businesses that were not entitled to receive the credits. Thomas has been charged in two separate federal complaints with drug trafficking and ERC-related tax fraud. Defendants in California and Maryland are also charged in the two schemes. IRS records show Thomas and his co-conspirators filed hundreds of payroll tax returns that claimed over $550 million in tax refunds.

Issue 15: IRS Alert: Beware of Companies Misrepresenting Nutrition, Wellness and General Health Expenses as Medical Care for FSAs, HSAs, HRAs and MSAs

Amid concerns about people being misled, the Internal Revenue Service reminded taxpayers and heath spending plan administrators that personal expenses for general health and wellness are not considered medical expenses under the tax law.

This means personal expenses are not deductible or reimbursable under health flexible spending arrangements, health savings accounts, health reimbursement arrangements or medical savings accounts (FSAs, HSAs, HRAs and MSAs).

This reminder is important because some companies are misrepresenting the circumstances under which food and wellness expenses can be paid or reimbursed under FSAs and other health spending plans.

Some companies mistakenly claim that notes from doctors based merely on self-reported health information can convert non-medical food, wellness and exercise expenses into medical expenses, but this documentation actually does not. Such a note would not establish that an otherwise personal expense satisfies the requirement that it be related to a targeted diagnosis-specific activity or treatment; these types of personal expenses do not qualify as medical expenses.

For example: A diabetic, in his attempts to control his blood sugar, decides to eat foods that are lower in carbohydrates. He sees an advertisement from a company stating that he can use pre-tax dollars from his FSA to purchase healthy food if he contacts that company. He contacts the company, who tells him that for a fee, the company will provide him with a ‘doctor’s note’ that he can submit to his FSA to be reimbursed for the cost of food purchased in his attempt to eat healthier. However, when he submits the expense with the ‘doctor’s note’, the claim is denied because food is not a medical expense and plan administrators are wary of claims that could invalidate their plans.

FSAs and other health spending plans that pay for, or reimburse, non-medical expenses are not qualified plans. If the plan is not qualified, all payments made to taxpayers under the plan, even reimbursements for actual medical expenses, are includible in income.

Issue 16: 2024 RMDs Waived for 10-year IRA Payouts

IRA beneficiaries subject to the 10-year payout period are not required to take required minimum distributions in 2024, according to IRS Notice 2024-35. The SECURE Act of 2019 provides that most non-spouse beneficiaries of IRA owners who die after 2019 are subject to a 10-year payment rule with a required beginning date (RBD) that is usually April 1 of the year after the owner turns 73. The IRS required that the annual RMDs be paid in years 1-9 of the 10-year period if the IRA owner died on or after the date the RMDs were required to begin.

The IRS had previously excused annual RMDs for non-spouse beneficiaries of IRA owners who died in 2020 or later for 2021-2023. The agency also excused annual RMDs for 2022 and 2023 for beneficiaries who inherited in 2021 after the owner’s RBD and 2023 RMDs for those who inherited in 2022 after the owner’s RBD. Notice 2024-35 adds an additional year of relief so taxpayers who inherited after 2019 and subject to the 10-year payout rule won’t be required to receive annual RMDs before 2025 but will be required to do so beginning that year.

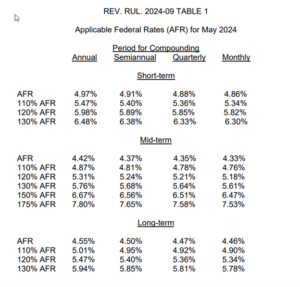

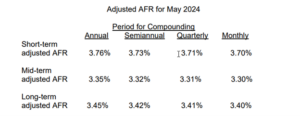

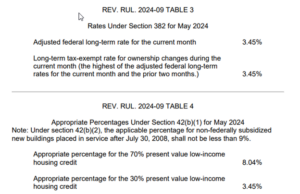

Issue 17: Applicable Federal Rates for May 2024, Rev. Rul. 2024-09

REV. RUL. 2024-09 TABLE 5 Rate Under Section 7520 for May 2024

Applicable federal rate for determining the present value of an annuity, an interest for life or a term of years, or a remainder or reversionary interest 5.40%

REV. RUL. 2024-09 TABLE 2

![]() Basics & Beyond Resources

Basics & Beyond Resources

- Blog Page

- Resource List

- Webinar & Seminar Schedules

- Get Registered!

- Note: Paid attendees can request a link to the replay of any previously recorded webinar presentations by emailing us at [email protected]