Will we see a Secure Act Part 2?

As we approach the end of– an unexpected, unbelievable 2020 year – many will remember this year for the virus and the extended tax season. Others may remember the transition into online CPE and learning.

Unfortunately, the virus will follow us in 2021, but it has been amazing how most of us have adapted and all have come together to accomplish the 2020 tax season.

As we await Congress and its decision on a fourth Coronavirus legislation, our instructors will have up to date information at our year-end sessions. We will be monitors “just released” information to share as it becomes available.

As we come together for our Thanksgiving Celebration, which in many cases, will be somewhat different. Regardless of what life handed you this year – remember – we as individuals and a nation have much to be thankful for.

Important Update

You may not run across this issue but Heads UP.

Scenario

Client was covered by the Marketplace (Health Care Insurance) in 2019 and 2020 and received a subsidy.

The 2019 tax return was filed and accepted on the 26th of June 2020. The client received a letter from the Marketplace that the return has not been received by IRS and therefore they have to pay back their subsidy for 2019 and CANNOT apply for a subsidy for 2021. (We assume they can still get coverage based on the letter received, but the letter is confusing.)

The Process:

The Marketplace gets a tape from the IRS and the tape is filtered for returns processed, if return has not processed, the Marketplace assumes the client did not file. The Marketplace states they cannot get coverage for 2021 until the return processes. The letter is somewhat confusing – as we think they may be able to get coverage but not subsidies. Keep that thought for now as we work to get clarification.

Some of these late returns may not be processed until early January or possibly later.

A copy of the return with the electronic filing history and the Form 9325 was offered to prove filing but the Marketplace will not accept.

This may prevent clients from getting Marketplace subsidies or possibly coverage if the return has not been processes by IRS. The 45-day window ends on December 15, 2020 – if the return is not processed by that date can they get insurance???? We are not sure based on the way the letter from the Marketplace is structured.

One of our team has three clients that this appears to be a problem. They are working with the Taxpayer Advocate. We will keep you informed.

The Marketplace open season begins November 1, 2020 – December 15, 2020. Since that is a weekend – open season began October 30, 2020.

2020 Year-End Seminars

https://www.cpehours.com/income-tax-seminar-information/

2020 Year-end Income Tax Update (see details below):

- 2020 Tax Legislation–New Developments, Review of Cases, Rulings & IRS Pronouncements

- QBI, CARES and Secure Act Unique Year End Issues

- Meals & Entertainment under the TCJA

- IRC 121 and the Primary Residence

- Ethics – The Creative Tax Professional

- S-Corporation Basis Issues

- Centralized Partnership Audit Regime

- Preparing for the 2021 Tax Season and the Coronavirus Impact

We are also here to assist with other CPE you may need to completed your annual requirements. Check the Webinar Schedule below to complete your required CPE for 2020.

| Date | Topic | CPE Hours | Time | Instructor |

| Tuesday November 10, 2020

|

“Do the Right Thing” Part 2: Ethics Due Diligence Responsibilities

|

1 Credit Hour

|

2:00-3:00

Eastern Time |

Kristy Maitre |

| Tuesday November 10, 2020

|

“Do the Right Thing” Part 3: Frivolous Returns

|

1 Credit Hour | 3:30-4:30

Eastern Time |

Kristy Maitre |

| Tuesday November 17, 2020

|

What’s New in Retirement Planning

|

1 Credit Hour | 2:00-3:00

Eastern Time |

Michael Miranda

|

| Wednesday November 18, 2020

|

Quarterly Tax Update: Part 3

|

1 Credit Hour | 2:00-3:00

Eastern Time |

Kristy Maitre, AJ Reynolds & Michael Miranda

|

| Tuesday December 15, 2020

|

Schedule K-1 Reporting – Notice 2019-66 (Fall/Winter)

|

1 Credit Hour

|

2:00-3:00

Eastern Time |

Michael Miranda

|

| Wednesday December 16, 2020

|

Penalty Abatement & Reasonable Cause

|

1 Credit Hour

|

2:00-3:00

Eastern Time |

AJ Reynolds |

| Thursday December 17, 2020

Date |

“Do the Right Thing” Part 4: Hot Button Issues of the OPR

|

1 Credit Hour | 2:00-3:00

Eastern Time |

Kristy Maitre |

| Friday December 18, 2020

|

“Do the Right Thing” Part 3: Frivolous Returns

|

1 Credit Hour

|

2:00-3:00

Eastern Time |

Kristy Maitre |

In This Issue

Issue 1: When Does a Business Need to Apply for Forgiveness of the PPP Loan?

Issue 2: Renew Your PTIN by December 31, 2020

Issue 3: IRS Resumes Balance Due Notices

Issue 4: An Early Draft of Form 1065 Instructions 2020 – Detail Partner Tax Basis Reporting

Issue 5: US Tax Court NEW Case Management System – DAWSON- will be Active December 28, 2020

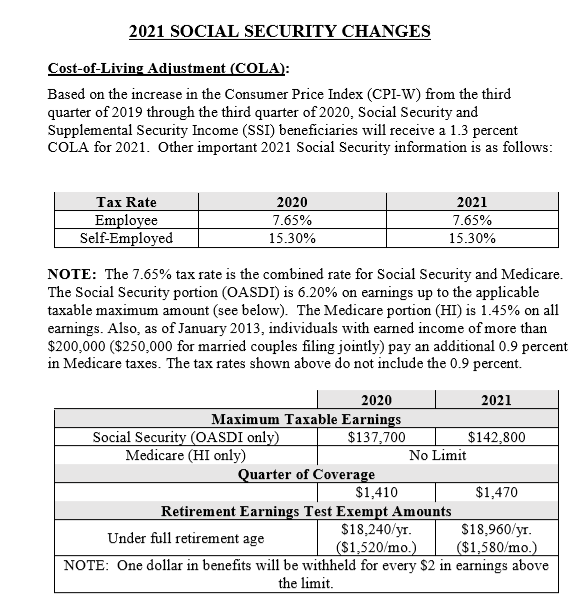

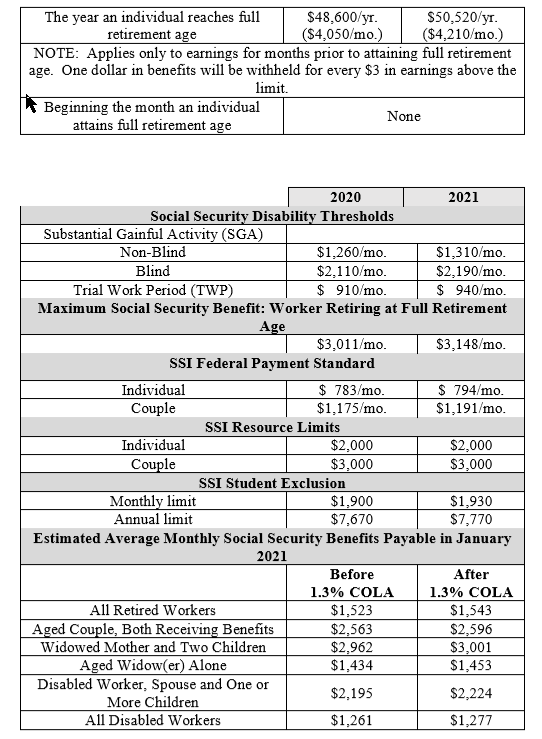

Issue 6: Social Security Wage Base Increases to $142,800 for 2021 – Other Social Changes

Issue 7: Alabama – Notice of Annual Renewal of Alabama Tax Licenses

Issue 8: IRS Extends Economic Impact Payment Deadline to November 21, 2020 to Help Non-Filers

Issue 9: Deferral of Employment Tax Deposits and Payments Through December 31, 2020 – Self-Employed

Issue 10: Update – Temporary Procedures to Fax Certain Forms 1139 and 1045 Due to COVID-19

Issue 11: Your Client’s Account Has Been Detailed to a Private Collection Group, What Are the Options if the Client ants Only IRS to Deals with the Balance Due?

Issue 12: Final Regulation TD 9899 Qualified Business Income – §461 Excess Business Losses are Part of QBI

Issue 13: Final Regulation TD 9899 Qualified Business Income – Special Rules for Trusts and Estates

Issue 14: Maybe a SECURE Act #2 – Don’t Hold Breath Though

Issue 15: 2020 Instructions for Schedule K-1 Form 1041 – New Issues

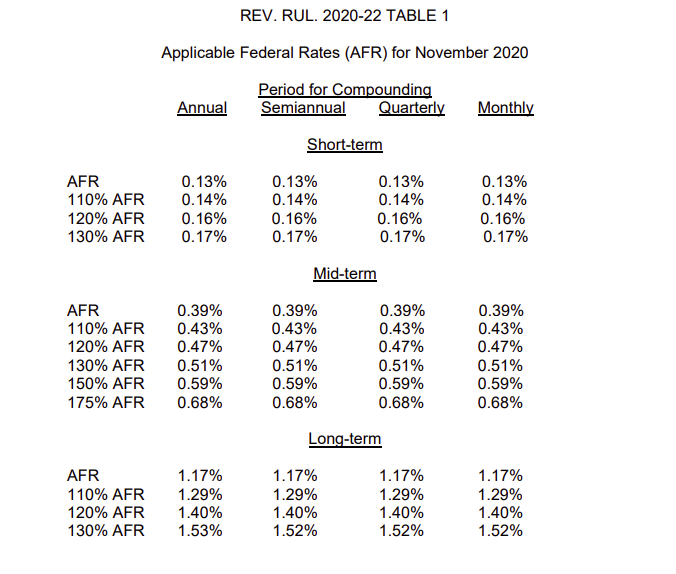

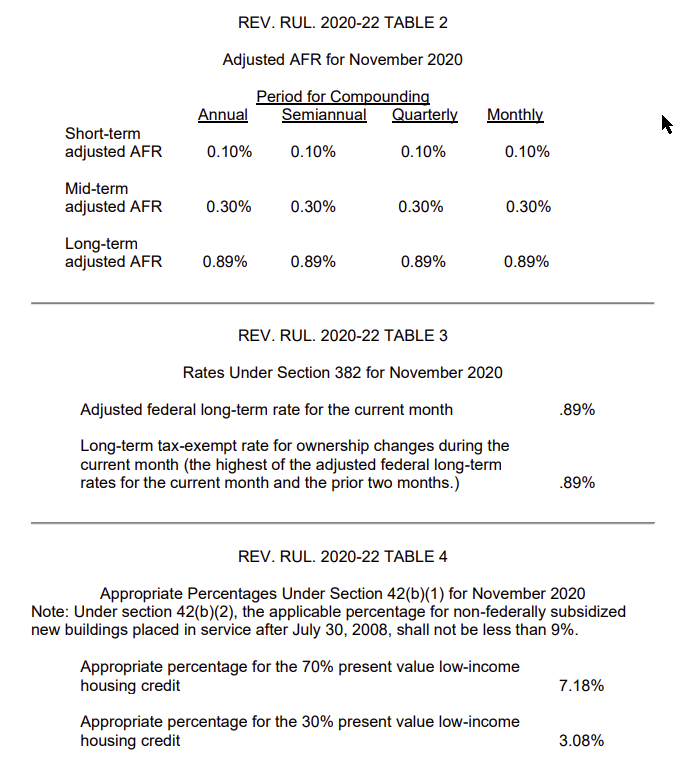

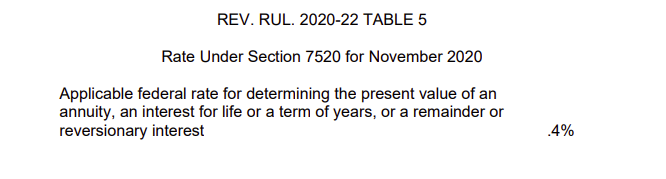

Issue 16: Applicable Federal Rates (AFR) for November 2020 – Rev. Rul. 2020-22

TAX NEWS

Issue 1: When Does a Business Need to Apply for Forgiveness of the PPP Loan?

First a bit about what Congress is looking at in the form of forgiveness.

- Under Senate Bill 4321,the “Continuing Small Business Recovery and Paycheck Protection Program Act, all PPP borrowers receiving $150,000 or less shall automatically have their loan forgiven if the debtee “signs and submits to the lender an attestation that the eligible recipient made a good faith effort to comply with the requirements under §7(a)(36) of the Small Business Act (15 U.S.C. 636(a)(36)).”

- Under Senate Bill 4117, borrowers of those smaller amounts would merely need to submit a “one-page online or paper form, to be established by the Administrator not later than 7 days after the date of enactment of this subsection, that attests that the eligible recipient complied with the requirements under §7(a)(36) of the Small Business Act (15 U.S.C. 636(a)(36)).”

- Four addition Senate or House bills are similar in nature and all are part of the negotiations currently being held to consider Coronavirus #4.

Most Recent Guidance:

The U.S. Small Business Administration (SBA) released guidance confirming that Paycheck Protection Program (PPP) loan forgiveness applications are not due on Oct. 31.

Question: The PPP loan forgiveness application forms (3508, 3508EZ, and 3508S) display an expiration date of 10/31/2020 in the upper-right corner. Is October 31, 2020 the deadline for borrowers to apply for forgiveness?

Answer: No. Borrowers may submit a loan forgiveness application any time before the maturity date of the loan, which is either two or five years from loan origination. However, if a borrower does not apply for loan forgiveness within 10 months after the last day of the borrower’s loan forgiveness covered period, loan payments are no longer deferred, and the borrower must begin making payments on the loan.

For example, a borrower whose covered period ends on October 30, 2020 has until August 30, 2021 to apply for forgiveness before loan repayment begins. The expiration date in the upper-right corner of the posted PPP loan forgiveness application forms is displayed for purposes of SBA’s compliance with the Paperwork Reduction Act and reflects the temporary expiration date for approved use of the forms. This date will be extended, and when approved, the same forms with the new expiration date will be posted.

Issue 2: Renew Your PTIN by December 31, 2020

Preparer Tax Identification Number (PTIN) renewal for 2021 is underway, as is participation in the Annual Filing Season Program for 2021. The IRS Return Preparer’s Office (RPO) will be sending letters reminding tax professionals to renew the PTIN and the AFSP participants to take annual test. More than 780,000 active tax return preparers are starting to prepare for the upcoming 2021 filing season by renewing their Preparer Tax Identification Numbers (PTINs) now. All current PTINs will expire December 31, 2020.

Anyone who prepares or assists in preparing federal tax returns for compensation must have a valid 2021 PTIN before preparing returns. All enrolled agents must also have a valid PTIN.

Tax preparers must pay a fee of $35.95 to renew or obtain a PTIN for 2021. The PTIN fee is non-refundable.

In case you forgot – we must confirm we are aware of our data security responsibilities.

Issue 3: IRS Resumes Balance Due Notices

The IRS will resume issuing the 500 series balance due notices to taxpayers in late October. These notices were paused on May 9 due to COVID-19.

Although the IRS continued to issue most agency notices, the 500 series were suspended temporarily because of a backlog of mail at the IRS due to COVID-19. The mail backlog is now caught up enough to account for the timely mailed payments. In late October or early November some taxpayers will begin seeing the updated 500 series notices with current issuance and payment dates.

Issue 4: An Early Draft of Form 1065 Instructions 2020 – Detail Partner Tax Basis Reporting

The IRS released revised instructions for partnerships required to report capital accounts to partners on Schedule K-1 (Form 1065).

The revised instructions indicate that partnerships filing Form 1065 for tax year 2020 are to calculate partner capital accounts using the transactional approach for the tax basis method. Under the tax basis method outlined in the instructions, partnerships report partner contributions, the partner’s share of partnership net income or loss, withdrawals and distributions, and other increases or decreases using tax basis principles as opposed to reporting using other methods such as GAAP.

According to IRS data, most partnerships already use the tax basis method although partnerships previously could report capital accounts determined under multiple methods. Partnerships that did not prepare Schedules K-1 under the tax capital method for 2019 or otherwise maintain tax basis capital accounts in their books and records (for example, for purposes of reporting negative capital accounts) may determine each partner’s beginning tax basis capital account balance for 2020 using one of the following methods: the Modified Outside Basis Method, the Modified Previously Taxed Capital Method, or the §704(b) Method, as described in the instructions, including special rules for publicly traded partnerships.

To promote compliance with using the tax basis method described in the revised instructions, the Treasury Department and the IRS intend to issue a notice providing additional penalty relief for the transition in tax year 2020. The notice will provide that solely for tax year 2020 (for partnership returns due in 2021), the IRS will not assess a partnership a penalty for any errors in reporting its partners’ beginning capital account balances on Schedules K-1 if the partnership takes ordinary and prudent business care in following the form instructions to calculate and report the beginning capital account balances. This penalty relief will be in addition to the reasonable cause exception to penalties for any incorrect reporting of a beginning capital account balance.

The IRS plans similar revisions, as applicable, to Form 8865, Return of U.S. Persons with Respect to Certain Foreign Partnerships.

Issue 5: US Tax Court NEW Case Management System – DAWSON- will be Active December 28, 2020

In late 2020, the United States Tax Court will be launching DAWSON (Docket Access Within a Secure Online Network), the Court’s new case management system. The Court expects DAWSON to be active by December 28, 2020.

To facilitate the transition to DAWSON, beginning at 5:00 PM Eastern Time on November 20, 2020, the current e-filing system will become inaccessible and all electronic files will become read-only. Consistent with current practices, cases will remain electronically viewable. No documents may be e-filed in the current system after that time. The Court does not anticipate issuing any orders or opinions during the time e-filing is inaccessible.

The Chief Judge has issued a blanket extension of time in which to file Answers to petitions filed between September 21, 2020 and October 28, 2020. See Administrative Order 2020-04. All other documents required to be filed after 5:00 PM Eastern Time on November 20, 2020 and before DAWSON is active must be filed in paper with the Court. To make a paper filing during this period, no motion for leave will be required, but the filing party must include a certificate demonstrating service on the other party.

Taxpayers can comply with statutory deadlines for filing petitions, notices of appeal, or other documents by timely mailing them to the Court. Timeliness of mailing is determined by the postmark of the United States Postal Service or the delivery certificate of a designated private delivery service.

For concerns about premature assessments, please email the Internal Revenue Service at [email protected].

Further updates, including notice as to when DAWSON will be active for eFiling, will be made on the Tax Court website, www.ustaxcourt.gov. If you have any questions, contact the Public Affairs Office at (202) 521-3355.

Administrative Order No. 2020-04

Subject: Answer Filing Deadline During the Transition to a New Case Management System In late 2020, the United States Tax Court will be launching DAWSON (Docket Access Within a Secure Online Network), the Court’s new case management system. The Court expects DAWSON to be active by December 28, 2020.

To facilitate the transition to DAWSON, beginning at 5:00 PM Eastern Time on November 20, 2020, the current e-filing system will become inaccessible and all electronic files will become read-only. No documents may be e-filed in the current system after that time. The Court does not anticipate issuing any orders or opinions during the time e-filing is inaccessible.

It is hereby ORDERED that the due dates for Answers to petitions filed between September 21 and October 28, 2020, are extended by 60 days. All other documents required to be filed after 5:00 PM Eastern Time on November 20, 2020, and before DAWSON is active must be filed in paper with the Court. To make a paper filing during this period, no motion for leave will be required, but the filing party must include a certificate demonstrating service on the other party.

Maurice B. Foley Chief Judge

Issue 6: Social Security Wage Base Increases to $142,800 for 2021 – Other Social Changes

Issue 7: Alabama – Notice of Annual Renewal of Alabama Tax Licenses

Beginning November 1, 2020, taxpayers will be required to renew the State of Alabama Tax License annually.

The My Alabama Taxes (MAT) website will provide the ability for the business information to be verified and/or updated in order to generate a new license for the upcoming year. The following tax types will be required to renew the State of Alabama Tax License each year:

- Sales Tax

- Rental Tax

- Sellers Use Tax

- Lodgings Tax

- Utility Gross Receipts Tax

- Simplified Sellers Use Tax

The following information will be required to be reviewed and/or updated:

- Current Legal Name – must be reviewed

- Owner/Officer/Member Information – must be reviewed and/or updated

- Phone number(s) – must be reviewed and/or updated

- Social security numbers/FEIN’s – must be reviewed

- Location address(es) including d/b/as for each location – must be reviewed and/or updated

- Main address must be reviewed

- Location address(es) must be reviewed and/or updated

Each year, verification that the business is continuing to operate in the same business entity type for which the existing license was issued will need to be completed. You will need to apply for a new license if the entity type changed (e.g. original entity type of Sole Proprietorship changes to Corporation or Multi-member LLC).

The renewal process will be completed on an annual basis in order to generate a new license for each calendar year. Therefore, if the license is not renewed pursuant to Section 40-23-6.1, Code of Alabama 1975, as amended, the State of Alabama Tax License previously issued to your business will be cancelled and you will no longer be allowed to use the Tax License in order to make tax-exempt purchases for resale or rental purposes.

Please be advised that your Alabama Tax License shall not be renewed until the required information has been provided to the Department.

Issue 8: IRS Extends Economic Impact Payment Deadline to November 21, 2020 to Help Non-Filers

The deadline to register for an Economic Impact Payment (EIP) is now November 21, 2020. This new date will provide an additional five weeks beyond the original deadline.

The IRS urges people who don’t typically file a tax return – and haven’t received an Economic Impact Payment – to register as quickly as possible using the Non-Filers: Enter Info Here tool on IRS.gov. The tool will not be available after November 21.

This additional time into November is solely for those who have not received their EIP and don’t normally file a tax return. The deadline for taxpayers who requested an extension of time to file their 2019 tax return remains October 15, 2020.

Issue 9: Deferral of Employment Tax Deposits and Payments Through December 31, 2020 – Self-Employed

Will the IRS issue reminder notices to taxpayers reflecting the total amount of deferred taxes and the payment due dates?

The IRS intends to issue a reminder notice to employers before each applicable due date. Because each return period is treated separately for purposes of determining the amount of tax due for the period, Form 941 filers that deferred in all four quarters of 2020 may receive four reminder notices stating the deferred amounts that are due on the applicable dates in 2021 and 2022, even though the amounts for all four quarters will have the same due dates of December 31, 2021 and December 31, 2022.

Are self-employed individuals eligible to defer payment of self-employment tax imposed on net earnings from self-employment income?

Yes. Self-employed individuals may defer the payment of 50 % of the Social Security tax imposed under §1401(a) of the Internal Revenue Code on net earnings from self-employment income for the period beginning on March 27, 2020 and ending December 31, 2020. (§2302 of the CARES Act calls this period the “payroll tax deferral period.”)

Is there a penalty for failure to make estimated tax payments for 50 % of Social Security tax on net earnings from self-employment for the payroll tax deferral period?

No. For any taxable year that includes any part of the payroll tax deferral period, 50 percent of the Social Security tax imposed on net earnings from self-employment attributable to the payroll tax deferral is not used to calculate the installments of estimated tax due under §6654 of the Internal Revenue Code. This means that self-employed individuals that defer payment of 50% of Social Security tax on their net earnings from self-employment attributable to the period beginning on March 27, 2020, and ending on December 31, 2020, may reduce their estimated tax payments by 50% of the Social Security tax due for that period.

How can a self-employed individual determine 50% of the Social Security portion of self-employment tax attributable to net earnings from self-employment earned during March 27, 2020 through December 31, 2020?

Self-employed individuals may use any reasonable method to allocate 50% of the Social Security portion of self-employment tax attributable to net earnings from self-employment earned during March 27, 2020, through December 31, 2020.

For example, an individual may allocate 22.5% of the individual’s annual earnings from self-employment to the period from January 1, 2020, through March 26, 2020, and 77.5% of the individual’s annual earnings to the period from March 27, 2020, through December 31, 2020. Similarly, an individual may use any reasonable method in applying the Social Security wage base or taking into account partnership income in determining the portion of 50% of the Social Security portion of self-employment tax attributable to net earnings from self-employment for the period from March 27, 2020, through December 31, 2020.

Issue 10: Update – Temporary Procedures to Fax Certain Forms 1139 and 1045 Due to COVID-19

Fax Form 1139 and Form 1045 to Claim Quick Refunds of the Credit for Prior Year Minimum Tax Liability of Corporations and Net Operating Loss Deductions In response to the COVID-19 Pandemic and solely to implement the following provisions of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), until further notice, the IRS is implementing the temporary procedures described below for digital transmission of Form 1139 and Form 1045:

Only claims allowed under §§2303 and 2305 of the CARES Act that are made on Form 1139 or Form 1045 are eligible refund claims under temporary procedures described below

Starting on April 17, 2020 and until further notice, the IRS will accept eligible refund claims Form 1139 submitted via fax to 844-249-6236 and eligible refund claims Form 1045 submitted via fax to 844-249-6237.

When does the temporary faxing process described in these FAQs end?

The last day to fax an eligible refund claim under these procedures is December 31, 2020. The fax numbers listed herein will no longer be operational as of midnight EST on December 31, 2020. The instructions to the Form 1139 and Form 1045 provide the applicable requirements for how to submit these forms to IRS. The end of the faxing process is independent of any filing due dates.

For example, the last day to file Form 1139 electing to take the 100% refundable minimum tax credit in 2018, is December 30, 2020. Additionally, if you file one application for a tentative refund and claim both the NOL carryback and the minimum tax credit at the same time, you must file the application by the earliest applicable deadline.

Issue 11: Your Client’s Account Has Been Detailed to a Private Collection Group, What Are the Options if the Client ants Only IRS to Deals with the Balance Due?

Congress passed a law requiring us to use private collection agencies (PCA). These agencies assist IRS in collecting certain overdue tax accounts.

IRS placed the account with a PCA for collection of unpaid tax liability because the individual met one of the following criteria:

- IRS lacked the resources or could not locate the individual.

- A year has passed and the individual or the individual’s representative hasn’t interacted with IRS on the account.

- One-third of the collection statute has lapsed and was not assigned for collection.

IRS would not have assigned the account to a private collection agency if the individual was:

- Under 18 years of age

- In a designated combat zone

- The victim of tax-related identity theft

- Currently under examination, litigation, criminal investigation, or levy

- Subject to pending or active offers in compromise

- Subject to an installment agreement

- Subject to a right of appeal

- Classified as an innocent spouse case

- In a presidentially declared disaster requesting relief from collection

IRS will not assign the accounts of the deceased to private collection agencies.

The IRS has contracted the following private collection agencies (PCAs):

CBE

P.O. Box 2217

Waterloo, IA 50704

800-910-5837

ConServe

P.O. Box 307

Fairport, NY 14450

844-853-4875

Performant

P.O. Box 9045

Pleasanton, CA 94566

844-807-9367

Pioneer

PO Box 500

Horseheads, NY 14845

800-448-3531

The IRS will send the taxpayer a letter before they are contacted by a private collection agency (PCA). This letter is called a Notice CP40 . It verifies that the case was transferred to a PCA.

The taxpayer can also request a copy of your account transcript through our Get Transcript tool to verify that IRS assigned the account to a PCA. The transcript will contain the following:

| CODE | EXPLANATION OF TRANSACTION |

DATE | AMOUNT |

| 971 | Collection referred to a private debt collection agency |

08-07-2017 | $0.00 |

| 971 | Notice issued CP 0040 | 08-07-2017 | $0.00 |

If the client does not wish to work with the assigned private collection agency to settle the overdue tax account, they must submit this request in writing to the PCA.

Issue 12: Final Regulation TD 9899 Qualified Business Income – §461 Excess Business Losses are Part of QBI

Treatment of Previously Suspended Losses Included in QBI § 1.199A-3(b)(1)(iv) of the February 2019 Final Regulations provides that previously disallowed losses or deductions (including under §§465, 469, 704(d), and 1366(d)) allowed in the taxable year are generally taken into account for purposes of computing QBI, except to the extent the losses or deductions were disallowed, suspended, limited, or carried over from taxable years ending before January 1, 2018.

These losses are used, for purposes of §199A, in order from the oldest to the most recent on a first-in, first-out (FIFO) basis. The February 2019 Proposed Regulations expanded this rule to provide that previously disallowed losses or deductions are treated as losses from a separate trade or business in the year they are taken into account in determining taxable income.

Further, the attributes of the previously disallowed losses or deductions, including whether they are attributable to a trade or business and whether they would otherwise be included in QBI, are determined in the year the loss or deduction is incurred.

The Treasury Department and the IRS are aware that taxpayers and practitioners have questioned whether the exclusion of § 461(l) from the list of loss disallowance and suspension provisions in §1.199A-3(b)(1)(iv) means that losses disallowed under §461(l) are not considered QBI in the year the losses are taken into account in determining taxable income.

Generally, for taxable years beginning after December 31, 2020, and before January 1, 2026, §461(l) disallows an excess business loss for taxpayers other than C corporations. Any disallowed excess business loss is treated as a net operating loss carryover for the taxable year for purposes of determining any net operating loss carryover under §172(b) in subsequent taxable years.

If a loss or deduction that would otherwise be included in QBI under the rules of §1.199A-3 is disallowed or suspended under any provision of the Code, such loss or deduction is generally taken into account for purposes of computing QBI in the year it is taken into account in determining taxable income.

These final regulations clarify this point by amending §1.199A-3(b)(1)(iv)(A) to specifically reference excess business losses disallowed by §461(l) and treated as a net operating loss carryover for the taxable year for purposes of determining any net operating loss carryover under §172(b) in subsequent taxable years.

Final Regulations Read as Follows:

Previously disallowed losses or deductions allowed in the taxable year generally are taken into account for purposes of computing QBI to the extent the disallowed loss or deduction is otherwise allowed by §199A.

These previously disallowed losses include but are not limited to losses disallowed under §§461(l), 465, 469, 704(d), and 1366(d). These losses are used for purposes of §199A and this section in order from the oldest to the most recent on a first-in, first-out (FIFO) basis and are treated as losses from a separate trade or business.

Publicly Traded Partnerships

To the extent such losses relate to a PTP, they must be treated as a loss from a separate PTP in the taxable year the losses are taken into account.

However, losses or deductions that were disallowed, suspended, limited, or carried over from taxable years ending before January 1, 2018 (including under §§465, 469, 704(d), and 1366(d)), are not taken into account in a subsequent taxable year for purposes of computing QBI.

Issue 13: Final Regulation TD 9899 Qualified Business Income – Special Rules for Trusts and Estates

- 1.199A-6 provides guidance that certain specified entities (including trusts and estates) might need to compute the §199A deduction of the entity and/or passthrough information to each of its owners or beneficiaries, so they may compute their §199A deduction.

- 1.199A-6(d) contains special rules for applying §199A to trusts and decedents’ estates.

Under §1.199A-6(d)(3)(ii), the QBI, W–2 wages, UBIA of qualified property, qualified REIT dividends, and qualified PTP income of a trust or estate are allocated to each beneficiary and to the trust or estate based on the relative proportion of the trust’s or estate’s distributable net income (DNI) for the taxable year that is distributed or required to be distributed to the beneficiary or is retained by the trust or estate.

Proposed §1.199A-6(d)(3)(iii) further provides that a trust described in §663(c) with substantially separate and independent shares for multiple beneficiaries will be treated as a single trust for purposes of determining whether the taxable income of the trust exceeds the threshold amount.

Clarified Separate Shares Rules in Final Regulations

Treasury and the IRS have clarified the separate share rule in these final regulations to provide that

“in the case of a trust or estate described in §663(c) with substantially separate and independent shares for multiple beneficiaries, the trust or estate will be treated as a single trust or estate not only for purposes of determining whether the taxable income of the trust or estate exceeds the threshold amount but also in determining taxable income, net capital gain, net QBI, W-2 wages, UBIA of qualified property, qualified REIT dividends, and qualified PTP income for each trade or business of the trust or estate, and computing the W-2 wage and UBIA of qualified property limitations.

Further clarification of the separate share rule under §663 is beyond the scope of these final regulations, but Treasury and the IRS intend to continue to study the issues raised by the commenters.

Accordingly, these final regulations provide that the allocation of these items to the separate shares of a trust or estate described in §663(c) will be governed by the rules under s§663(e) and such guidance as may be published in the Internal Revenue Bulletin (see §601.601(d)(2)(ii)(b)).

- 1.199A-6(d)(3)(v) of the February 2019 Proposed Regulations provides rules under which the taxable recipient of a unitrust or annuity amount from a charitable remainder trust described in § 664 can take into account QBI, qualified REIT dividends, or qualified PTP income for purpose of determining the recipient’s §199A deduction.

Issue 14: Maybe a SECURE Act #2 – Don’t Hold Breath Though

When the SECURE Act was enacted last December, it was folded into an end-of-year spending bill. A similar scenario could happen this year, as Congress will need to reconvene in a lame-duck session to expend the government’s funding beyond the current temporary measure that runs only through December 11, 2020.

However, it is not clear whether this bill will have the same level of bipartisan support and what the overall appetite will be after the elections to act on additional legislation beyond funding the government. As it is, Congress and the Trump administration have had a hard-enough time reaching consensus on a follow-up COVID-19 relief bill.

But just in case you get questions from any news source your client may have listen to concerning a possible Secure Act #2, here is a bullet list put together by Michael Miranda – our resident retirement specialist and a member of the Basic and Beyond Team. The two in red may get a higher profile in the news.

According to a summary, the legislation would, among other things:

- expand automatic enrollment in retirement plans by enrolling employees automatically in their company’s 401(k) plan when a new plan is created.

- modify the credit for small employer pension plan startup costs.

- increase and “modernize” the existing Saver’s Credit for contributions to a retirement plan or IRA (the bill would create a single credit rate of 50%, would increase the maximum credit amount from $1,000 per person to $1,500, and would increase the maximum income eligibility amount).

- expand retirement savings options for non-profit employees by allowing 403(b) plans to join together to offer retirement plans to their employees in multiple employer plans (MEPs).

- allow a higher catch-up limit to apply at age 60 (from 2020’s $6,500 to $10,000—SIMPLEs also expanded to $5,000 from $3,000), providing more flexibility for older individuals to set aside savings as they approach retirement. Appears the age 50 catch up is secure, just an additional catch up when turning 60 as individuals who have attained age 60 have a shorter time to save for retirement, making a higher limit appropriate.

- increase the required minimum distribution age to 75.

- allow individuals to receive an employer match in their retirement plans for paying down a student loan.

- provide a safe harbor for corrections of employee elective deferral failures.

- reduce the excise tax on certain accumulations in qualified retirement plans.

- expand the Employee Plans Compliance Resolution System (allowing more types of errors to be corrected internally through self-correction, and exempt certain failures to make required minimum distributions from the otherwise applicable excise tax); and

- make it easier for employees to find lost retirement accounts by creating a national, online, database of lost accounts (to be managed by the Pension Benefit Guaranty Corporation (PBGC)).

CAUTION: Much can happen when the bill hits the floor of the House or Senate, things change as the bill is debated and the final bill may be different or include other issues. This is a heads up if you receive questions – we must establish a wait and see mode. If passed in some form – this could impact year end retirement planning.

Issue 15: 2020 Instructions for Schedule K-1 Form 1041 – New Issues

Excess Deductions on Termination

Under Final Regulations – TD9918, each excess deduction on termination of an estate or trust retains its separate character as an amount allowed in arriving at adjusted gross income; a non-miscellaneous itemized deduction; or a miscellaneous itemized deduction. Box 11, code A, was revised to read Excess deductions—§67(e) expenses and a new Box 11, code B, Excess deductions—Non-miscellaneous itemized deductions was added.

Review Box 11, Code A—Excess Deductions on Termination – §67(e) Expenses and Box 11, Code B—Excess Deductions on Termination Non-Miscellaneous Itemized Deductions, later, for more information.

Business Interest Expense Limitation Change for 2020 and 2019

The business interest expense limitation of §163(j) increases from 30% to 50% of adjustable taxable income for tax year 2020, and retroactively for 2019.

Every taxpayer who deducts business interest is required to file Form 8990, Limitation on Business Interest Expense Under Section 163(j), unless an exception for filing is met. Review Form 8990 and its instructions and Box 14, Other Information, code Z, for details.

Issue 16: Applicable Federal Rates (AFR) for November 2020 – Rev. Rul. 2020-22