In This Tax Newsletter Issue:

- COVID Tax Relief

- Patiently Wailing for the New Circular 230 Update – Potential Changes

- Reminder: Fingerprint Card Cut-off Date for the e-file Application

- Summary of Tax Provisions in the Inflation Reduction Act (IRA)

- Tax Tip 2022-122, Tips on Closing a Business

- Court Authorizes Service of John Doe Summons Seeking the Identities of U.S. Taxpayers Who Have Used Cryptocurrency

- The Plug-In Vehicle Credit Basics

- A Form 990-N Filer will be Required to Use a New Sign-in Process

- IRS Extends the Deadline for Retirement Plan Amendments Under the SECURE and CARES Act

- Understanding A Client/Taxpayer Rights

- The Security Summit releases New Data Security Plan to Assist Tax Professionals with New WISP

- The Biden-Harris Administration’s Student Debt Relief Plan Explained

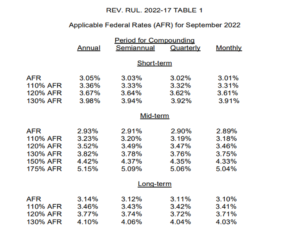

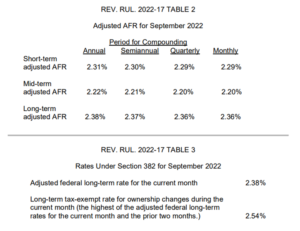

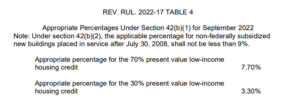

- Applicable Federal Rates for September 2022, Rev. Rul. 2022-17

Issue 1: COVID tax relief: IRS provides broad-based penalty relief for certain 2019 and 2020 returns due to the pandemic; $1.2 billion in penalties being refunded to 1.6 million taxpayers

To help struggling taxpayers affected by the COVID-19 pandemic, the Internal Revenue Service issued Notice 2022-36,which provides penalty relief to most people and businesses who file certain 2019 or 2020 returns late.

The IRS is also taking an additional step to help those who paid these penalties already. Nearly 1.6 million taxpayers will automatically receive more than $1.2 billion in refunds or credits. Many of these payments will be completed by the end of September.

Besides providing relief to both individuals and businesses impacted by the pandemic, this step is designed to allow the IRS to focus its resources on processing backlogged tax returns and taxpayer correspondence to help return to normal operations for the 2023 filing season.

The relief applies to the failure to file penalty. The penalty is typically assessed at a rate of 5% per month and up to 25% of the unpaid tax when a federal income tax return is filed late. This relief applies to forms in both the Form 1040 and 1120 series, as well as others listed in Notice 2022-36.

To qualify for this relief, any eligible income tax return must be filed on or before Sept. 30, 2022.

In addition, the IRS is providing penalty relief to banks, employers and other businesses required to file various information returns, such as those in the 1099 series. To qualify for relief, the notice states that eligible 2019 returns must have been filed by Aug. 1, 2020, and eligible 2020 returns must have been filed by Aug. 1, 2021.

Because both of these deadlines fell on a weekend, a 2019 return will still be considered timely for purposes of relief provided under the notice if it was filed by Aug. 3, 2020, and a 2020 return will be considered timely for purposes of relief provided under the notice if it was filed by Aug. 2, 2021. The notice provides details on the information returns that are eligible for relief.

The notice also provides details on relief for filers of various international information returns, such as those reporting transactions with foreign trusts, receipt of foreign gifts, and ownership interests in foreign corporations. To qualify for this relief, any eligible tax return must be filed on or before Sept. 30, 2022.

Relief is automatic; most of $1.2 billion in refunds delivered to eligible taxpayers by next month

Penalty relief is automatic. This means that eligible taxpayers need not apply for it. If already assessed, penalties will be abated. If already paid, the taxpayer will receive a credit or refund.

As a result, nearly 1.6 million taxpayers who already paid the penalty are receiving refunds totaling more than $1.2 billion. Most eligible taxpayers will receive their refunds by the end of September.

Penalty relief is not available in some situations, such as where a fraudulent return was filed, where the penalties are part of an accepted offer in compromise or a closing agreement, or where the penalties were finally determined by a court. For details, see Notice 2022-36, available on IRS.gov.

This relief is limited to the penalties that the notice specifically states are eligible for relief. Other penalties, such as the failure to pay penalty, are not eligible. But for these ineligible penalties, taxpayers may use existing penalty relief procedures, such as applying for relief under the reasonable cause criteria or the First Time Abate program.

Issue 2: Patiently Wailing for the New Circular 230 Update – Potential Changes

Treasury Circular 230, Regulations Governing Practice Before the Internal Revenue Service, has its origin in what was known as the Horse Act of 1884.

- Individuals were claiming losses from the Civil War.

- Representatives were inflating claims, to more than the total value of horses lost in the war.

- Congress authorized Treasury to regulate those representatives.

- Treasury agents were given guidance in this new role in the form of circulars, which in 1921 were consolidated into one document, Circular 230.

The document includes the rules, regulations, provisions, and procedures governing the ethical conduct and discipline of those who practice before the IRS.

Circular 230 was last revised in 2014, and during the past eight years many changes in tax law and the tax profession has occurred.

The IRS Office of Professional Responsibility (OPR) is charged with overseeing and enforcing the elements of Circular 230. OPR is responsible for interpreting and applying the regulations in Circular 230 governing practice before the IRS. OPR is solely responsible for overseeing practitioner conduct and discipline and is independent from other IRS functions.

In November 2020, Treasury’s 2020-2021 priority guidance plan included updating Circular 230. The director of OPR, Sharyn Fisk, asked for comments from the professional community regarding suggested changes to Circular 230. This was an opportunity for practitioners and the organizations they are involved with to participate in facilitating the ongoing applicability and effectiveness of Circular 230.

Some of the suggestions provided by the AICPA and others included:

- Scope of OPR’s authority: In 2014, the rulings in Loving, 742 F.3d 1013 (D.C. Cir. 2014), and Ridgely v. Lew, 55 F. Supp. 3d 89 (D.D.C. 2014), determined that Treasury did not have the authority to apply Circular 230 to tax return preparation. The result is that several sections need to be updated or modified to be consistent with this finding. In addition, Treasury should continue to evaluate federally authorized tax practitioners’ tax preparation and planning when determining their suitability to practice before the IRS.

- Section 10.20, Information to Be Furnished: The digital age has increased the volume of scanned and electronic documents. This section should be updated to address practitioners’ conduct regarding documents they receive that are the property of their client. While documents received in tax compliance and tax consulting engagements are generally not subject to privilege from disclosure, the comment recommends considering that practitioners would not have the authority to provide those documents to the IRS without the taxpayer’s permission unless they are legally compelled to do so.

- Section 10.21, Knowledge of Client’s Omission: The AICPA recommends Circular 230 clarify a practitioner’s duty to a former client regarding subsequent events or changes in laws after termination of the client engagement.

- Section 10.22, Diligence as to Accuracy:The recommendation is to make Sections 10.22, Diligence as to Accuracy; 10.34, Standards with Respect to Tax Returns and Documents, Affidavits and Other Papers; and 10.37, Requirements for Written Advice, mutually consistent regarding reliance on third parties. In many situations, the third party is independent and therefore beyond the reach of the practitioner’s supervision and training.

- Section 10.28, Return of Client’s Records: The letter recommends updating this section to reflect electronic filing, versus paper filing, of tax documents. Additionally, the circular should better define client records and distinguish them from practitioner workpapers and specify a time limit to comply after receiving a request to return client records.

- Section 10.29, Conflicting Interests: The letter recommends providing a de minimisexemption for owners of less than 5% or 10% of a passthrough entity from being considered an adverse party in a conflict of interest. The increasing popularity of using tiered passthrough entities as investment structures makes identification and resolution of conflicts too difficult in such instances.in addition, a recommendation is to limit the lookback period used to determine who is a client affected by a conflict.

- Sections 10.50, Sanctions, and 10.51, Incompetence and Disreputable Conduct: The recommendation is to evaluate Sections 10.50 and 10.51 for consistency of terminology and application and to clarify when a monetary penalty applies.

- Additionally, the AICPA recommends addressing how the decision in Sexton v. Hawkins, 2:13-cv-00893-RFB-VCF (D. Nev. 3/17/17), affects practitioner sanctions.

- Section 10.64, Answer; Default:The recommendation is to update this section to include electronic signatures.

- Circular 230 does not currently directly address confidentiality, privacy, data protection, or record retention. It should include broad general requirements for ethical conduct in these areas.

- Another recommendation is to include frequently asked questions to broadly address ethical conduct.

Issue 3: Reminder: Fingerprint Card Cut-off Date for the e-file Application

Beginning September 25, the IRS will implement a new electronic fingerprinting process for e-file applicants. Individuals will be required to use the IRS authorized vendor for fingerprinting. Each new Principal and Responsible Official listed on a new e-file application or added to an existing application needing fingerprints, must schedule an appointment with the IRS authorized vendor.

As a reminder, the IRS will not process paper fingerprint cards (Form FD-258) postmarked after August 15.

Fingerprint cards postmarked after August 15 will be returned and customers will need to wait until September 25 to schedule an electronic fingerprinting appointment through the e-file Application.

Instructions for scheduling an appointment will be provided upon submitting an e-file application and on IRS.gov.

Issue 4: Summary of Tax Provisions in the Inflation Reduction Act (IRA)

The Inflation Reduction Act includes a number of tax provisions as well as a record investment into the IRS.

Corporate Minimum Tax: The Inflation Reduction Act imposes a 15% minimum corporate tax on “book income” for companies averaging more than $1 billion in revenue a year and traditionally paying a low corporate rate due to their eligibility for credits and deductions. The tax was scaled back by creating an exemption for accelerated depreciation. The domestic minimum tax was further pared back when a compromise was reached to exempt subsidiaries of private equity firms impacted by the tax. Under the minimum tax, as much as 80% of losses can be carried over to offset financial income in future years. Corporations can also claim certain domestic and foreign tax credits to offset the minimum tax.

Stock Repurchases: The Inflation Reduction Act includes a 1% excise tax on the fair market value of any stock repurchase in a tax year by a publicly traded U.S. corporation, including any subsidiary that has 50% or more of its stock owned by a corporation. The tax also applies to stock repurchases of certain foreign corporations by subsidiaries and “expatriated entities.” The tax takes effect in 2023. It exempts stock repurchases that are:

- Less than $1 million

- Contributed to an employer-sponsored retirement plan, stock ownership plan, or similar plan

- Part of a reorganization with no gain or loss recognized

- Made by a regulated investment company or a real estate investment trust

- Treated as a dividend

Issue 5: Tax Tip 2022-122, Tips on Closing a Business

There are a few things business owners need to do before they close their business. Of course, they need to fulfill their federal tax responsibilities. It’s also important to notify the IRS of their plans.

- File a final tax return and related forms. The type of return to file and related forms depends on the type of business.

- Take care of employees. Business owners with one or more employees must pay any final wages or compensation, make final federal tax deposits and report employment taxes.

- Pay taxes owed. Even if the business closes now, tax payments may be due next filing season.

- Report payments to contract workers. Businesses that pay contractors at least $600 for services including parts and materials during the calendar year in which they go out of business, must report those payments.

- Cancel EIN and close IRS business account. Business owners should notify the IRS so they can close the IRS business account.

- Keep business records. How long a business needs to keep records depends on what’s recorded in each document.

Issue 6: Court Authorizes Service of John Doe Summons Seeking the Identities of U.S. Taxpayers Who Have Used Cryptocurrency

On Aug. 15, 2022, a federal court in the Central District of California entered an order authorizing the IRS to serve a John Doe summons on SFOX, a cryptocurrency prime dealer headquartered in Los Angeles, California, seeking information about U.S. taxpayers who conducted at least the equivalent of $20,000 in transactions in cryptocurrency between 2016 and 2021 with or through SFOX.

Because transactions in cryptocurrencies can be difficult to trace and have an inherently pseudo-anonymous aspect, taxpayers may be using them to hide taxable income from the IRS. In the court’s order, United States District Court Judge Otis D. Wright found that there is a reasonable basis for believing that individuals conducting at least $20,000 in cryptocurrency transactions may have failed to comply with federal tax laws.

The court’s order grants the IRS permission to serve what is known as a “John Doe” summons on SFOX. There is no allegation in this suit that SFOX has engaged in any wrongdoing in connection with its digital currency business. Rather, the IRS uses John Doe summonses to obtain information about possible violations of internal revenue laws by individuals whose identities are unknown. This John Doe summons directs SFOX to produce records identifying U.S. taxpayers who have used its services, along with other documents relating to their cryptocurrency transactions.

The IRS has issued guidance regarding the tax consequences on the use of virtual currencies in IRS Notice 2014-21, which provides that virtual currencies that can be converted into traditional currency are property for tax purposes, and a taxpayer can have a gain or loss on the sale or exchange of a virtual currency, depending on the taxpayer’s cost to purchase the virtual currency (that is, the taxpayer’s tax basis).

Issue 7: The Plug-In Vehicle Credit Basics

New Final Assembly Requirement

If your client is interested in claiming the tax credit available under § 30D (EV credit) for purchasing a new electric vehicle after August 16, 2022 (which is the date that the Inflation Reduction Act of 2022 was enacted), a tax credit is generally available only for qualifying electric vehicles for which final assembly occurred in North America (final assembly requirement).

The Department of Energy has provided that an individual may meet the final assembly requirement. Because some models are built in multiple locations, there may be vehicles on the Department of Energy list that do not meet the final assembly requirement in all circumstances.

To identify the manufacture location for a specific vehicle, please search the vehicle identification number (VIN) of the vehicle on the VIN Decoder website for the National Highway Traffic Safety Administration (NHTSA).

Transition Rule for Vehicles Purchased before August 16, 2022

If the client entered into a written binding contract to purchase a new qualifying electric vehicle before August 16, 2022, but did not take possession of the vehicle until on or after August 16, 2022 (for example, because the vehicle has not been delivered), the client may claim the EV credit based on the rules that were in effect before August 16, 2022. The final assembly requirement does not apply before August 16, 2022.

Vehicles Purchased and Delivered between August 16, 2022 and December 31, 2022

If the client purchased and took possession of a qualifying electric vehicle after August 16, 2022 and before January 1, 2023, aside from the final assembly requirement, the rules in effect before the enactment of the Inflation Reduction Act for the EV credit apply (including those involving the manufacturing caps on vehicles sold). If you entered into a written binding contract to purchase a new qualifying vehicle before August 16, 2022, see the rule above.

What Is a Written Binding Contract?

In general, a written contract is binding if it is enforceable under State law and does not limit damages to a specified amount (for example, by use of a liquidated damages provision or the forfeiture of a deposit). While the enforceability of a contract under State law is a facts-and-circumstances determination to be made under relevant State law, if a customer has made a significant nonrefundable deposit or down payment, it is an indication of a binding contract. For tax purposes in general, a contract provision that limits damages to an amount equal to at least 5% of the total contract price is not treated as limiting damages to a specified amount. For example, if a customer has made a nonrefundable deposit or down payment of 5 % of the total contract price, it is an indication of a binding contract.

A contract is binding even if subject to a condition, as long as the condition is not within the control of either party. A contract will continue to be binding if the parties make insubstantial changes in its terms and conditions.

Future Guidance

To reduce carbon emissions and invest in the energy security of the United States, the Inflation Reduction Act of 2022 significantly changes the eligibility rules for tax credits available for clean vehicles beginning in 2023. The Internal Revenue Service and the Department of the Treasury will post information and request comments from the public on various existing and new tax credit incentives in the coming weeks and months.

Administration – Pre-Inflation Reduction Act of 2022 Information

The information below pre-dates the enactment of the Inflation Reduction Act of 2022 but, subject to the final assembly rule described above, remains relevant for qualifying vehicles purchased and delivered prior to January 1, 2023. A client may be eligible for a credit under § 30D(a), if they purchased a car or truck with at least four wheels and a gross vehicle weight of less than 14,000 pounds that draws energy from a battery with at least 4 kilowatt hours and that may be recharged from an external source. They must have purchased it in or after 2010 and begun driving it in the year in which they claim the credit.

The credit ranges between $2,500 and $7,500, depending on the capacity of the battery. The credit begins to phase out for a manufacturer, when that manufacturer sells 200,000 qualified vehicles.

They may be eligible for a credit under § 30D(g) if they purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 2.5 kilowatt hours and may be recharged from an external source. They must have purchased the vehicle in 2012 or 2013 and begun using it in the year in which they claim the credit. The credit is 10% of the purchase price of the vehicle with a maximum credit of $2,500.

Issue 8: A Form 990-N Filer will be Required to Use a New Sign-in Process

Beginning August 2022, smaller charities that are eligible and choose to file Form 990-N, Electronic Notice for Tax-Exempt Organizations (e-Postcard), must sign into the IRS modernized authentication platform using either their active IRS username or create an account with ID.me, the current IRS credential service provider.

When accessing the Form 990-N submission page, Form 990-N filers have three options:

· Sign in with their active IRS username: Users with an active IRS username have the option to access the Form 990-N submission page using their existing IRS credentials or they can choose to create a new account with ID.me.

· Sign in with their existing ID.me account: Users that have an ID.me account to access other IRS online services or from a state or federal agency can sign in using their existing ID.me account.

· Create a new ID.me account: Users that don’t have an active IRS username credential must register and sign in with ID.me.

ID.me account creation requires an email address and multifactor authentication. Form 990-N filers who have an existing IRS username and register for an ID.me account must use the same email address.

Issue 9: IRS Extends the Deadline for Retirement Plan Amendments Under the SECURE and CARES Act

The IRS has issued a notice that extends until Dec. 31, 2025, the deadline for qualified retirement plans, qualified §403(b) plans or individual retirement arrangements (IRAs) to make certain plan amendments that are required under recently enacted legislation. Notice 2022-33 was issued Aug. 3 and extends the upcoming deadlines for amendments required under:

· Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act)

· Coronavirus Aid, Relief, and Economic Security Act (CARES Act)

· Bipartisan American Miners Act of 2019 (Miners Act)

The extended amendment deadline for §403(b) plans includes those plans that were collectively bargained. Later deadlines will apply to government retirement plans, including plans under §457(b).

Issue 10: Understanding A Client/Taxpayer Rights

The privacy of America’s taxpayers is paramount at the IRS. The right to privacy is one of ten rights the Taxpayer Bill of Rights gives all taxpayers.

Taxpayers have the right to expect that any IRS inquiry, examination, or enforcement action will comply with the law and be no more intrusive than necessary. Taxpayers can also expect that the IRS will respect all due process rights, including search and seizure protections and will provide, where applicable, a collection due process hearing.

Here are a few more details about what a taxpayer’s right to privacy means:

· The IRS cannot seize certain personal items, such as schoolbooks, clothing and undelivered mail.

· The IRS cannot seize a personal residence without first getting court approval, and the agency must show there is no reasonable alternative for collecting the tax debt.

· Sometimes, taxpayers submit offers to settle their tax debt that relate only to how much they owe. This is formally known as a Doubt as to Liability Offer in Compromise. Taxpayers who make this offer do not need to submit any financial documentation.

· During an audit, if the IRS finds no reasonable indication that a taxpayer has no unreported income, the agency will not seek intrusive and extraneous information about the taxpayer’s lifestyle.

· A taxpayer can expect that the IRS’s collection actions are no more intrusive than necessary. During a collection due process hearing, the Office of Appeals must balance that expectation with the IRS’s proposed collection action and the overall need for efficient tax collection.

Issue 11: The Security Summit releases New Data Security Plan to Assist Tax Professionals with New WISP

The Security Summit partners unveiled a special new sample security plan designed to help tax professionals, especially those with smaller practices, protect their data and information.

The special plan, called a Written Information Security Plan or WISP, is outlined in a 29-page document that’s been worked on by members of the Security Summit, including tax professionals, software and industry partners, representatives from state tax groups and the IRS.

Federal law requires all professional tax preparers to create and implement a data security plan. The Security Summit group – a public-private partnership between the IRS, states and the nation’s tax industry – has noticed that some tax professionals continue to struggle with developing a written security plan.

In response to this need, the Summit – led by the Tax Professionals Working Group – has spent months developing a special sample document that allows tax professionals to quickly set their focus in developing their own written security plans.

There are many aspects to running a successful business in the tax preparation industry, including reviewing tax law changes, learning software updates and managing and training staff. One often overlooked but critical component is creating a WISP.

Security issues for a tax professional can be daunting. The Summit team worked to make this document as easy to use as possible, including special sections to help tax professionals get to the information they need.

A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer data it handles. There is no one-size-fits-all WISP. For example, a sole practitioner can use a more abbreviated and simplified plan than a 10-partner accounting firm, which is reflected in the new sample WISP from the Security Summit group.

Once completed, tax professionals should keep their WISP in a format that others can easily read, such as PDF or Word. Making the WISP available to employees for training purposes is encouraged. Storing a copy offsite or in the cloud is a recommended best practice in the event of a natural disaster.

Issue 12: The Biden-Harris Administration’s Student Debt Relief Plan Explained

President Biden, Vice President Harris, and the U.S. Department of Education have announced a three-part plan to help working and middle-class federal student loan borrowers’ transition back to regular payment as pandemic-related support expires. This plan includes loan forgiveness of up to $20,000. To be notified when the process has officially opened, sign up at the Department of Education subscription page. You’ll have until Dec. 31, 2023 to apply.

Part 1. Final extension of the student loan repayment pauses

Due to the economic challenges created by the pandemic, the Biden-Harris Administration has extended the student loan repayment pause a number of times. Because of this, no one with a federally held loan has had to pay a single dollar in loan payments since President Biden took office.

To ensure a smooth transition to repayment and prevent unnecessary defaults, the Biden-Harris Administration will extend the pause a final time through December 31, 2022, with payments resuming in January 2023.

Frequently Asked Questions:

Do I need to do anything to extend my student loan pause through the end of the year?

- No. The extended pause will occur automatically.

Part 2. Providing targeted debt relief to low- and middle-income families

To smooth the transition back to repayment and help borrowers at highest risk of delinquencies or default once payments resume, the U.S. Department of Education will provide up to $20,000 in debt cancellation to Pell Grant recipients with loans held by the Department of Education and up to $10,000 in debt cancellation to non-Pell Grant recipients. Borrowers are eligible for this relief if their individual income is less than $125,000 or $250,000 for households.

In addition, borrowers who are employed by non-profits, the military, or federal, state, Tribal, or local government may be eligible to have all of their student loans forgiven through the Public Service Loan Forgiveness (PSLF) program. This is because of time-limited changes that waive certain eligibility criteria in the PSLF program. These temporary changes expire on October 31, 2022. For more information on eligibility and requirements, go to PSLF.gov.

Frequently Asked Questions:

How do I know if I am eligible for debt cancellation?

- To be eligible, your annual income must have fallen below $125,000 (for individuals) or $250,000 (for married couples or heads of households)

- If you received a Pell Grant in college and meet the income threshold, you will be eligible for up to $20,000 in debt cancellation.

- If you did not receive a Pell Grant in college and meet the income threshold, you will be eligible for up to $10,000 in debt cancellation.

What does the “up to” in “up to $20,000” or “up to $10,000” mean?

- Your relief is capped at the amount of your outstanding debt.

- For example: If you are eligible for $20,000 in debt relief, but have a balance of $15,000 remaining, you will only receive $15,000 in relief.

What do I need to do in order to receive loan forgiveness?

- Nearly 8 million borrowers may be eligible to receive relief automatically because relevant income data is already available to the U.S. Department of Education.

- If the U.S. Department of Education doesn’t have your income data, the Administration will launch a simple application which will be available by early October.

- If you would like to be notified when the application is open, please sign up at the Department of Education subscription page.

- Once a borrower completes the application, they can expect relief within 4-6 weeks.

- We encourage everyone who is eligible to file the application, but there are 8 million people for whom we have data and who will get the relief automatically.

- Borrowers are advised to apply before November 15th in order to receive relief before the payment pause expires on December 31, 2022.

- The Department of Education will continue to process applications as they are received, even after the pause expires on December 31, 2022.

What is the Public Service Loan Forgiveness Program?

- The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your federal student loans after 120 payments working full-time for federal, state, Tribal, or local government; military; or a qualifying non-profit.

- Temporary changes, ending on Oct. 31, 2022, provide flexibility that makes it easier than ever to receive forgiveness by allowing borrowers to receive credit for past periods of repayment that would otherwise not qualify for PSLF.

- Enrollments on or after Nov. 1, 2022 will not be eligible for this treatment. We encourage borrowers to sign up today. Visit PSLF.gov to learn more and apply.

Part 3. Make the student loan system more manageable for current and future borrowers

Income-based repayment plans have long existed within the U.S. Department of Education. However, the Biden-Harris Administration is proposing a rule to create a new income-driven repayment plan that will substantially reduce future monthly payments for lower- and middle-income borrowers.

The rule would:

- Require borrowers to pay no more than 5% of their discretionary income monthly on undergraduate loans. This is down from the 10% available under the most recent income-driven repayment plan.

- Raise the amount of income that is considered non-discretionary income and therefore is protected from repayment, guaranteeing that no borrower earning under 225% of the federal poverty level—about the annual equivalent of a $15 minimum wage for a single borrower—will have to make a monthly payment.

- Forgive loan balances after 10 years of payments, instead of 20 years, for borrowers with loan balances of $12,000 or less.

- Cover the borrower’s unpaid monthly interest, so that unlike other existing income-driven repayment plans, no borrower’s loan balance will grow as long as they make their monthly payments—even when that monthly payment is $0 because their income is low.

The Biden-Harris Administration is working to quickly implement improvements to student loans. Check back to this page for updates on progress. If you’d like to be the first to know, sign up for email updates from the U.S. Department of Education.

Issue 13: Applicable Federal Rates for September 2022, Rev. Rul. 2022-17

REV. RUL. 2022-17 TABLE 5

Rate Under Section 7520 for September 2022 Applicable federal rate for determining the present value of an annuity, an interest for life or a term of years, or a remainder or reversionary interest 3.60%