Reminder: Early Registration Discount for the Virtual Tax Seminars ends August 14th. Save $139

Virtual Tax Seminar Information is available here: Fall & Year-End Tax Seminars

Check out our webinar schedule here: Webinar Schedule

Purchase the Unlimited Webinar Package for $199

In This Issue

- Do You Need to Trace Your Clients Stimulus Payment that they Never Received?

- Economic Stimulus Payment Debit Cards (EIP)

- Update on the Advanced Child Tax Credit Payments

- Claims for Refunds for 2019 and 2020 – Tax Trap

- Legislation Introduced.

- Interim Guidance on Taxpayer Advocate Case Criteria

- Chief Counsel Advice Bank Surrender of Levy Deposits – CCA Number: 202118010

- Changes to Form 4797 Instruction- Correction of Intangible Asset Disposition Election

- Comments/Excerpts from Testimony of Charles P. Rettig before the Senate Appropriations Committee

- Biden’s Proposal on the Capital Gains Rate

- Child and Dependent Care Tax Credit FAQs

- Proc 2021-29: Partnership Amended Return Procedure

- Electronic Tax Administration Advisory Committee June 2021 ANNUAL REPORT TO CONGRESS. June 2021

- Issue 15: Applicable Federal Rates for July 2021, Rev. Rul. 2021-12

Issue 1: Do You Need to Trace Your Clients Stimulus Payment that they Never Received?

If the Notice 1444 or 1444-B shows the stimulus payment was issued as a direct deposit more than 5 days after the payment date or the online account shows the payment amounts, the first step is to check with the bank and make sure the client did not receive a deposit. Do not check with the bank prior to 5 days because they may not have any information.

A client should only request a payment trace to track the payment if they received Notice 1444 or Notice 1444-B showing the payments were issued or the online account shows the payment amounts and they have not received it within the timeframes below. IRS assistors cannot initiate a payment trace unless it has been:

- 5 days since the deposit date and the bank says it hasn’t received the payment

- 4 weeks since the payment was mailed by check to a standard address for the first EIP.

- 6 weeks since the payment was mailed, and you have a forwarding address on file with the local post office.

- 9 weeks since the payment was mailed, and the client has a foreign address for the first EIP; March 31, 2021 for the second EIP.

If the client has a foreign address, there may be international service disruptions at the United States Postal Service (USPS) or the foreign country they are located in due to the COVID-19 pandemic.

The issue you will face is clients who state they did not get EIP1 or EIP 2 and they do not have the Notice 1444 or Notice 1444B. Preparer Form 3911 as instructed below.

- Do not request a payment trace to determine if you were eligible for a payment or to confirm the amount of payment the client should have received.

- Have clients check both checking and savings accounts or other accounts where the stimulus may have been deposited.

- Most banks will identify the deposit as from Treasury.

- Has the clients return been processed for 2019 or 2020?

How IRS Will Process the Claim to Trace the EIP

They will process the claim for a missing payment in one of two ways:

- If the check was not cashed, IRS will reverse the payment and notify the client. If the client finds the original check, they must return it as soon as possible. The client should claim the 2020 Recovery Rebate Credit on the 2020 tax return to receive credit, if eligible.

- If the check was cashed, the Treasury Department’s Bureau of the Fiscal Service will send the client a claim package that includes a copy of the cashed check. Follow the instructions in any packet provided. The Treasury Department’s Bureau of the Fiscal Service will review the claim and the signature on the canceled check before determining whether the payment can be reversed. If reversed, the client will need to claim the Recovery Rebate Credit on the 2020 return, if eligible.

Note: If the client is filing the 2020 tax return before the trace is complete, do not include the payment amount on line 16 or 19 of the Recovery Rebate Credit Worksheet. The client may receive a notice saying the Recovery Rebate Credit was changed, but an adjustment will be made after the trace is complete and it is determined the payment has not been cashed. The client will not need to take any additional action to receive the credit.

To start a payment trace:

- Call IRS at 800-919-9835.

- Mail or fax a completed Form 3911, Taxpayer Statement Regarding Refund.

Reminder: DO NOT request a trace prior to the timeframes above. IRS assistors cannot start a trace prior to those timeframes.

To complete the Form 3911:

- Write “EIP1” or “EIP2” on the top of the form to identify which payment the client needs to trace.

- Complete the form answering all refund questions as they relate to the EIP.

- When completing item 7 under Section 1:

- Check the box for “Individual” as the Type of return

- Enter “2020” as the Tax Period

- Do not write anything for the Date Filed

- Sign the form. If you file married filing joint, both spouses must sign the form.

The client will generally receive a response 6 weeks after IRS receives the request for a payment trace, but there may be delays due to limited staffing. Do not mail Form 3911 if you have already requested a trace by phone.

If the trace is mailed or faxed prior to the timeframes above, the request will not be processed until those timeframes are met.

Mail or fax the form to:

Note: Do not send anything other than a Form 3911 to the fax numbers below.

| If you live in… | then mail to this address… | or fax to… |

| Maine, Maryland, Massachusetts, New Hampshire, Vermont | Andover Internal Revenue Service 310 Lowell St. Andover, MA 01810 |

855-253-3175 |

| Georgia, Iowa, Kansas, Kentucky, Virginia | Atlanta Internal Revenue Service 4800 Buford Hwy Chamblee, GA 30341 |

855-275-8620 |

| Florida, Louisiana, Mississippi, Oklahoma, Texas | Austin Internal Revenue Service 3651 S Interregional Hwy 35 Austin, TX 78741 |

855-203-7538 |

| New York | Brookhaven Internal Revenue Service 1040 Waverly Ave. Holtsville, NY 11742 |

855-297-7736 |

| Alaska, Arizona, California, Colorado, Hawaii, Nevada, New Mexico, Oregon, Utah, Washington, Wisconsin, Wyoming | Fresno Internal Revenue Service 5045 E Butler Avenue Fresno, CA 93888 |

855-332-3068 |

| Arkansas, Connecticut, Delaware, Indiana, Michigan, Minnesota, Missouri, Montana, Nebraska, New Jersey, Ohio, West Virginia | Kansas City Internal Revenue Service 333 W Pershing Rd. Kansas City, MO 64108 |

855-344-9993 |

| Alabama, North Carolina, North Dakota, South Carolina, South Dakota, Tennessee | Memphis Internal Revenue Service 5333 Getwell Rd. Memphis, TN 38118 |

855-580-4749 |

| District of Columbia, Idaho, Illinois, Pennsylvania, Rhode Island | Philadelphia Internal Revenue Service 2970 Market St. Philadelphia, PA 19104 |

855-404-9091 |

| A foreign country, U.S. possession or territory*, or use an APO or FPO address, or file Form 2555 or 4563, or are a dual-status alien. | Austin Internal Revenue Service 3651 S Interregional Hwy 35 Austin, TX 78741 |

855-203-7538 |

Issue 2: Economic Impact Payments – Debit Cards

EIP Cards

Those who have still not activated their card are being sent letters reminding them to activate their card or to request a replacement if they accidently threw it away.

The EIP cards were originally mailed in early January 2021 to about 1.4 million people who were eligible for a second Economic Impact Payment and would have otherwise received a check. The EIP cards were issued by MetaBank®, N.A. and came in a plain envelope from Money Network Cardholder Services.

For this reminder mailing, the Treasury Department logo will be visible on the envelope and letter. The left front of the envelope will clearly include this notation:

“Not a bill or an advertisement. Important information about your Economic Impact Payment.”

The inside of the letter will include instructions for people who have not activated their card yet and includes a picture of what the debit card looks like.

Once the card is activated, people can transfer the funds to a bank account, get cash surcharge-free at an In-Network ATM or request a Money Network® Balance Refund Check. This is a check from MetaBank® for the amount on your card.

For more information, visit EIPcard.com or call MetaBank Customer Service at 800-240-8100 (24 hours a day, 7 days a week).

Issue 3: Update on Advance Child Tax Credit Payments (CTC)

IRS announced that it started sending letters to more than 36 million families, who based on their 2019 or 2020 filed returns or who used the non-Filers tool to register for economic impact payment, may be able to receive expanded and newly-advanceable monthly CTC payments starting 7/15/21.

Eligible families will receive second personalized letter listing estimate of their monthly payment. Eligible families will receive payment of up to $300 per month for each child under age 6 and up to $250 per month for each child age 6 and above.

Advance CTC payments will be issued on 7/15/21, 8/13/21, 9/15/21, 10/15/21, 11/15/21 and 12/15/21.

Most families do not need to take any action to get their payment. Normally, the IRS will calculate the payment amount based on the 2020 tax return. If that return is not available, either because it has not yet been filed or it has not yet been processed, the IRS will instead determine the payment amount using the 2019 return.

The IRS urges individuals and families who have not yet filed their 2020 return – or 2019 return – to do so as soon as possible so they can receive any advance payment they are eligible for.

The “Opt-out” tool is currently available.

Additional Tools – Later this Summer

Throughout the summer, the IRS will be adding additional tools and online resources to help with the advance Child Tax Credit. One of these tools will enable families to unenroll from receiving these advance payments and instead receive the full amount of the credit when they file their 2021 return next year.

In addition, individuals and families will also be able to go to IRS.gov and use a Child Tax Credit Update Portal to notify IRS of changes in their:

- Income

- Filing status

- Number of qualifying children

- Update their direct deposit information and

- Make other changes to ensure they are receiving the right amount as quickly as possible.

- An interactive Child Tax Credit eligibility tool to help families determine whether they qualify for the Advance Child Tax Credit payments.

- Another tool, the Child Tax Credit Update Portal, will initially enable anyone who has been determined to be eligible for advance payments unenroll/ to opt out of the advance payment program.

- Later this year, it will allow people to check on the status of their payments.

- Make updates to their information and

- Be available in Spanish.

If you do not have an account with IRS.gov you will have to initiate an account with ID.me. What is ID.me?

The website provides the following information:

ID.me is committed to a mission of “No Identity Left Behind.” The approach involves two simple steps.

- First, expand access to identity verification so communities that lack online access (i.e., international users, recent immigrants, people who have changed their name) can verify online through a video chat process.

- Second, make the verified login portable so people can seamlessly prove who they are at different websites with a single credential; the same way a Visa card streamlines.

In the ID.me model, individuals only need to verify their identity once. After an identity is verified — whether online (or soon in-person) — each user simply needs to log in to prove their identity to a second, third, fourth, etc., site. The goal is to maximize first-time identity verification rates and then make the login as widely accepted as possible, so it is “everywhere you want to be” to borrow a line from Visa.

About 90% of people never have to use live video chat. They verify their identity through an automated process in about five minutes. That process requires a photo government ID, a phone, and a selfie. It can be completed with a smartphone or a webcam. The 1:1 Face Match step is similar to how Apple uses FaceID to unlock phones or how a TSA agent would compare your face to your photo ID at an airport.

Child Tax Credit Changes

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to $3,600 for qualifying children under the age of 6 and to $3,000 per child for qualifying children between ages 6 and 17.

Before 2021, the credit was worth up to $2,000 per eligible child, and 17-year-olds were not considered as qualifying children for the credit.

The new maximum credit is available to taxpayers with a modified adjusted gross income (AGI) of:

- $75,000 or less for singles,

- $112,500 or less for heads of household, and

- $150,000 or less for married couples filing a joint return and qualified widows and widowers.

For most people, modified AGI is the amount shown on Line 11 of their 2020 Form 1040 or 1040-SR. Above these income thresholds, the extra amount above the original $2,000 credit — either $1,000 or $1,600 per child — is reduced by $50 for every extra $1,000 in modified AGI.

In addition, the entire credit is fully refundable for 2021. This means that eligible families can get it, even if they owe no federal income tax. Before this year, the refundable portion was limited to $1,400 per child.

To qualify for advance Child Tax Credit payments, the client — and the spouse, if they filed a joint return — must have:

- Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return: or

- Given IRS information in 2020 to receive the Economic Impact Payment using the Non-Filers: Enter Payment Info Here tool; and

- A main home in the United States for more than half the year (the 50 states and the District of Columbia) or file a joint return with a spouse who has a main home in the United States for more than half the year; and

- A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number; and

- Made less than certain income limits.

Other Changes

- Removes the minimum income requirement ($2,500), a client can have zero income and still claim the CTC.

The child tax credit for 2021 introduces a new feature: advance payments.

- Taxpayers can receive direct advance payments of their child tax credits, in amounts of $250 or $300 per qualifying child depending on age.

- The advance payment program will enable taxpayers to use their benefits during the year.

- When a taxpayer files their 2021 return (in 2022), they will generally first calculate the total amount of the 2021 child credit they are eligible for (based on the number of qualifying children, income, and marital status for 2021).

- Then, the taxpayer will subtract from their total 2021 credit the sum of advanced child credit payments they received during calendar year 2021.

- The last tax return generally determines where the payment will be sent.

- If a change of address is needed use Form 8822 as soon as possible to get the new address changed with the IRS.

- However, in cases where a taxpayer receives more in advanced payments than the total 2021 credit, they are eligible for, they will generally need to repay any excess credit.

- A taxpayer may have excess credit due to changes in income, marital status, or number of qualifying children between the year used to estimate the advance (2020 or 2019) and their actual circumstances in 2021.

- If a taxpayer’s estimated advance payments totaled $5,400 (based on an estimate of three qualifying young children) but the total 2021 credit they are actually eligible for is $3,600 (because they only had one qualifying young child), they would need to repay up to $1,800 (the difference between $5,400 and $3,600).

- Excess payments caused by changes in the number of qualifying children generally will not need to be repaid for lower and moderate-income taxpayers who are protected by a safe harbor (this safe harbor decreases as income rises).

- Repayment may either reduce a taxpayer’s 2021 tax refund or result in the taxpayer being required to remit payment to the IRS (or be subject to offset of a future tax refund).

- There is a safe harbor for individuals making less than $40,000, or $60,000 for couples filing jointly.

- If the client makes less than this and receives an overpayment of the child tax credit this year, they will not need to repay the amount.

- If income is below the following thresholds, they are not required to repay up to $2,000 per qualifying child (i.e. the “safe harbor” amount)

- Single: $40,000

- Head of Household (HOH): $50,000

- Married Filing Jointly (MFJ): $60,000

- The safe harbor is reduced for filers with income between:

- Single: $40,000 and $80,000

- HOH: $50,000 and $100,000

- MFJ: $60,000 and $120,000

- If income exceeds these thresholds, the client will be responsible for repaying the full amount of any overpayment on the tax return.

- Watch out for divorced couples who alternate years of claiming the dependent child.

- In the coming months, the client will also be able to use the online portal to update their:

- Income

- Mailing address

- Bank account information

- Qualifying children and

- Marital status

- Visit the IRS’ website at http://www.irs.gov/childtaxcredit2021

- The client can opt out of payments, if they prefer, by using the IRS portal

- The client can opt out at any time before Dec. 15 — even if they have already received earlier payments

- There are two reasons they may wish to opt out:

- They prefer to receive the full CTC when they file the 2021 tax return, or

- The income or family situation has changed since last year, and they may be liable for repaying some or all of the advanced payments

- Advance payments made under these new rules are not subject to offset for past due child support, federal tax debts, state tax debts, and collection of unemployment compensation debts

- However, the amount claimed on the client’s 2021 return as a refund would generally be subject to offset

Issue 3: NTA Blog: Claims for Refunds: 2019 and 2020 Tax Year Trap for the Unwary

As most of you recall, to assist taxpayers during the COVID19 pandemic, the IRS postponed the 2019 tax return filing deadline from April 15 to July 15, 2020 and postponed the 2020 tax return filing deadline for individuals from April 15 to May 17, 2021.

Taxpayers who file a claim for refund after April 15 for tax years 2019 or 2020 may have a timely filed claim, but the amount may be unexpectedly rejected in 2023 or 2024 because the IRS postponed the filing deadlines in 2020 and 2021 rather than extended them.

Spoiler Alert: The IRS has the ability to fix and prevent this unintended disastrous trap for the unwary. Before exploring how this seemingly harmless distinction may cause serious headaches for taxpayers by causing denial of refunds, let’s first revisit the laws governing claims for refund.

When to claim a refund, and are there limits on how much a client can claim?

It’s important to note that the claim for refund rules is extensive and complex with many exceptions, but for this discussion, we will primarily focus on the general rule of § 6511(a). Specifically, a claim for refund must be filed:

- Three years from the date the return was filed; or

- Two years from the date the tax was paid, whichever of such periods expires the later.

Filing a timely claim for refund under the general three-year/two-year rule is not the only requirement. § 6511(b) then places limits on the amount of the refund by using two look-back periods. Clients who file a claim within three years of the original return being filed will have their refund limited to the amounts paid within the period prior to the filing of the claim, equal to three years plus the period of any extension of time for filing the original return.

For our discussion, let’s refer to this as the “three-year look-back period.” Clients who do not file a claim for refund within three years of the original return will have their refund limited to the amounts paid within the two years prior to the filing of the claim.

Applying to the 2019 and 2020 Filing Season

Although these limitations may appear straightforward at a glance, a closer look reveals several complexities, particularly when applied to the unusual circumstances of the 2020 and 2021 filing seasons.

Let begin by applying the rule for when a claim for a 2019 tax refund needs to be filed for a 2020 filing season return. As in other years, clients who filed a return on or before April 15 will have three full years from the April 15 due date to file their claim for refund and obtain a refund of any amount paid. Early returns are treated as filed on the April 15 due date.

As we know, the 2020 filing season deadline was automatically postponed for all taxpayers until July 15, 2020. So, for those clients whose 2019 tax returns were filed with the IRS after April 15, 2020, but before July 15, 2020, a timely claim for refund will need to be filed three years from the date of filing. The 2021 filing season deadline was automatically postponed for individual taxpayers until May 17, 2021. So, for individual clients whose 2020 tax returns were filed with the IRS after April 15, 2021, but before May 17, 2021, a claim for refund will need to be filed within three years from the date of filing to be timely under §6511(a).

Example 1:

Mark filed his 2019 return on March 2, 2020. An individual return filed before the April 15 due date is deemed filed on April 15. Three years from the date of filing would be April 15, 2023. However, April 15, 2023, is a Saturday, and Monday, April 17, 2023, is when Emancipation Day is observed, so this taxpayer will have until Tuesday, April 18, 2023, to file a claim for refund.

Example 2: Madison files her 2019 return on June 10, 2020. This client would have three years from June 10, 2020, to file a claim for refund. However, June 10, 2023, is a Saturday, so the taxpayer will have until Monday, June 12, 2023, to file a claim for refund. Note: if the taxpayer e-files her return, it will be received the same day it is submitted.)

But wait – even if a taxpayer has filed a timely claim for refund under §6511(a), now we need to consider the three-year look-back period of §6511(b) – what amount was paid within the three years preceding filing the claim for refund plus any extension of time to file?

Let us expand on our examples from above.

Example 3: In 2019, William was a W-2 employee and had income tax withheld from his paycheck every two weeks. In 2020, the taxpayer filed his 2019 return on June 25. Fast-forward three years. The taxpayer files a claim for refund on June 26, 2023, June 25 is a Sunday, so as we noted above, the claim for refund is timely under § 6511(a)). But now let’s apply the look-back rule of § 6511(b).

Because payments remitted by the client’s employer are deemed paid on April 15, 2020, these amounts are only available for refund until April 18, 2023 (April 15, 2023, is a Saturday, and April 17, 2023, is when Emancipation Day is observed).

Therefore, back to our example: although the claim for refund filed on June 26, 2023, was timely filed, the IRS is precluded from issuing a refund on the withholdings remitted to the IRS because they were deemed paid on April 15, 2020, falling outside the three-year look-back period by about two months.

The postponement period provided by Notice 2020-23 does not act as an extension of time for filing the three-year look-back rule.

As this example illustrates, the important takeaway is that postponing the tax return filing deadline is not the same as extending the tax return filing deadline.

You may find that even though the client took advantage of the 2020 or 2021 postponed filing deadline, it is possible, depending on their individual circumstances, that the date for filing a claim for refund to claim payments made or deemed made on April 15, 2020, will be April 18, 2023, which is less than three years from the date they filed their return if they took advantage of the postponement for filing their 2019 tax return in Notice 2020-23.

Similarly, if a client filed a 2020 return on May 17, 2021, pursuant to Notice 2021-21, the taxpayer could file a timely claim for refund by May 17, 2024, but not get a refund of the withholding deemed paid on April 15, 2021, as the withholding would be outside the three-year look-back period.

Issue 4: Legislation Introduced

Below is a list tax bills introduced in Congress. The bill text for each bill can be accessed by clicking on the bill number.

H.R.1953 – No Taxpayer-Funded Checks for Prisoners Act. To prohibit incarcerated individuals from receiving 2021 recovery rebates.

H.R.1977 – ECORA Act of 2021. To exclude from gross income interest received on certain loans secured by agricultural real property.

H.R.1979 – Tax Excessive CEO Pay Act of 2021. To impose a corporate tax rate increase on companies whose ratio of compensation of the CEO or other highest paid employee to median worker compensation is more than 50 to 1, and for other purposes.

H.R.2077 – Taxi Medallion Loan Forgiveness Debt Relief Act of 2021. To exclude discharges of indebtedness on taxi medallions from gross income.

H.R.2079 – Eliminating the Provider Relief Fund Tax Penalties Act of 2021. To provide that CARES Act Provider Relief Fund payments are not includible in gross income, and for other purposes.

S.1178 – RECRUIT Act of 2021. To allow for a credit against tax for employers of reservists.

S.1274 – Remote and Mobile Worker Relief Act of 2021. To limit the authority of States or other taxing jurisdictions to tax certain income of employees for employment duties performed in other States or taxing jurisdictions, and for other purposes.

H.R.2121 – Improving Child Care for Working Families Act of 2021. To increase the limitation of the exclusion for dependent care assistance programs.

H.R.2143 – Neighborhood Homes Investment Act. To allow a credit against tax for neighborhood revitalization, and for other purposes.

H.R.2165 – Exit Tax Prevention Act of 2021. To limit the authority of a State or other related taxing jurisdiction to impose a tax on a resident who has relocated permanent residence to another State or its related taxing jurisdiction.

H.R.2171 – Freedom to Invest in Tomorrow’s Workforce Act. To permit certain expenses associated with obtaining or maintaining recognized postsecondary credentials to be treated as qualified higher education expenses for purposes of 529 accounts.

H.R.2191 – Protecting Homeowners from Disaster Act of 2021. To repeal the limitation on deductions for personal casualty losses.

H.R.2275 – Mortgage Debt Tax Forgiveness Act of 2021. To make permanent the exclusion from gross income of discharge of qualified principal residence indebtedness.

H.R.2276 – Mortgage Insurance Tax Deduction Act of 2021. To make permanent the deduction for mortgage insurance premiums.

H.R.2284 – Monetary Metals Tax Neutrality Act of 2021. To clarify that gain or loss on the sale or exchange of certain coins or bullion is exempt from recognition.

H.R.2286 – To treat property transferred by gift or at death as sold for fair market value, and for other purposes.

H.R.2304 – Save Social Security Act of 2021. To amend title II of the Social Security Act and the Internal Revenue Code of 1986 to modify the portion of wages and self-employment income subject to payroll taxes.

H.R.2305 – Senior Accessible Housing Act. To provide a refundable tax credit to seniors who install modifications on their residences that would enable them to age in place.

H.R.2439 – SALT Fairness for Working Families Act. To increase the limitation on the amount individuals can deduct for certain State and local taxes.

H.R.2447 – Veterinary Medicine Loan Repayment Program Enhancement Act. To provide for an exclusion for assistance provided to participants in certain veterinary student loan repayment or forgiveness programs.

S.1399 – Homecare for Seniors Act. To allow qualified distributions from health savings accounts for certain home care expenses.

H.R.2370 – Preserving Family Farms Act of 2021. To increase the limitation on the estate tax valuation of certain real property used in farming or other trades or businesses.

S.1233 – Small Business Tax Fairness and Compliance Simplification Act. To simplify reporting requirements, promote tax compliance, and reduce tip reporting compliance burdens in the beauty service industry.

S.1256 – Providing Real Opportunities for Growth to Rising Entrepreneurs for Sustained Success (PROGRESS) Act. To provide a tax credit for investors in start-up businesses, to provide a credit for wages paid by start-up businesses to their first employees, and for other purposes.

S.1274 – Remote and Mobile Worker Relief Act of 2021. To limit the authority of States or other taxing jurisdictions to tax certain income of employees for employment duties performed in other States or taxing jurisdictions, and for other purposes.

S.1300 – Promotion and Expansion of Private Employee Ownership Act of 2021. To amend the Internal Revenue Code of 1986 and the Small Business Act to expand the availability of employee stock ownership plans in S corporations, and for other purposes.

H.R.2346 – E–QUIP Act. To allow 10-year straight line depreciation for energy efficient qualified improvement property.

S.1298 – Clean Energy for America Act. To provide tax incentives for increased investment in clean energy.

H.R.2411 – Broadband for All Act of 2021. To provide a tax credit to consumers to reimburse a portion of the cost of broadband infrastructure serving limited broadband districts.

S.1272 – SIMPLE Plan Modernization Act. To promote retirement savings on behalf of small business employees by making improvements to SIMPLE retirement accounts and easing the transition from a SIMPLE plan to a 401(k) plan.

S.1273 – Military Spouses Retirement Security Act. To provide a credit to small employers for covering military spouses under retirement plans.

H.R.2422 – To move the April 15, 2021 estimated tax payment deadline to May 17, 2021 for individuals and corporations.

H.R.2437 – To extend to May 17 the first scheduled individual estimated tax payment for 2021.

H.R.2450 – To amend the Internal Revenue Code of 1986 to except certain individuals from the 80% taxable income limitation on net operating loss carryovers.

H.R.2549 – Tax Fairness for Workers Act. To allow workers an above-the-line deduction for union dues and expenses and to allow a miscellaneous itemized deduction for workers for all unreimbursed expenses incurred in the trade or business of being an employee.

H.R.2558 – ALIGN Act. To permanently allow a tax deduction at the time an investment in qualified property is made, and for other purposes.

H.R.2563 – Essential Worker Tax Parity Act of 2021. To exclude from gross income $10,200 in wages or net earnings of certain taxpayers for taxable year 2020.

H.R.2576 – For the 99.5% Act. To reinstate estate and generation-skipping taxes, and for other purposes.

H.R.2714 – Working Families Childcare Access Act of 2021. To allow for the inclusion of additional expenses in dependent care FSAs, and for other purposes.

S.1422 – Investing in American Workers Act. To provide a credit for employer-provided worker training.

S.1426 – Parent Tax Credit Act. To establish a refundable tax credit for parents.

S.1443 – Retirement Parity for Student Loans Act. To permit treatment of student loan payments as elective deferrals for purposes of employer matching contributions, and for other purposes.

S.1560 – Helping to Encourage Real Opportunities (HERO) for Youth Act of 2021. To modify the work opportunity credit for certain youth employees.

S.1598 – Carried Interest Fairness Act of 2021. To provide for the proper tax treatment of personal service income earned in pass-thru entities.

S.1627 – Estate Tax Rate Reduction Act. To reduce the rate of tax on estates, gifts, and generation-skipping transfers.

Issue 5: Interim Guidance on Cases the Taxpayer Advocate Will Currently Accept – Control No: TAS-13-0521-0005 – 13.1.7.2.4, TAS Case Criteria 9, TAS Public Policy.

Under § 7803(c)(2)(C)(ii), the Taxpayer Advocate has the sole authority to determine case acceptance criteria. As established in IRM 13.1.7.2.4, if they determine that a compelling public policy warrants assistance to an individual or group of taxpayers, they can designate the issue as meeting case Criteria 9.

At the current time, TAS is authorizing the following four issues for acceptance under Criteria 9 when the case does not meet TAS Criteria 1 through 8:

1) Cases involving the tax-exempt status of organizations subject to an IRS automatic revocation of the organization’s tax-exempt status for failure to file an annual return or notice for three consecutive years.

2) Cases involving any tax account-related issue referred to TAS from a Congressional office, except for Economic Impact Payment (EIP) issues, and issues involving the exclusion of unemployment compensation received during taxable year 2020 from adjusted gross income pursuant to § 9042 of the American Rescue Plan Act of 2021 (ARPA) by taxpayers who filed their tax year 2020 return prior to implementation of the bill.

3) Cases involving revocation, limitation, or denial of a passport under § 7345.

4) Cases that have been referred to a Private Collection Agency for collection of a federal tax debt under § 6306.2

Reminder: If a case involves an issue designated for acceptance under criteria 9, you should first determine if the taxpayer’s circumstances meet TAS case criteria 1 through 8. The case should only be accepted under Criteria 9 if it does not meet any other TAS case criteria.

Issue 6: Chief Counsel Advice Bank Surrender of Levy Deposits – CCA Number: 202118010

Bank Levy Inquiry

In response to an inquiry, you have asked whether it is the date or the specific time that matters when determining whether a person has failed to honor a levy. Specifically, the question is whether a bank must surrender amounts in a taxpayer’s account that the taxpayer deposited on the same day on which the levy was made, but at a time that was after the levy was made.

- 6332(c) provides that a bank must surrender taxpayer property only after 21 days after service of the levy. Accordingly, the concern is that a bank might look retrospectively to the closing balance of a particular account as of the date of service, but not at a particular time on such date.

However, pursuant to the statute, a bank is only required to surrender taxpayer property that was in its possession at the specific time when the levy was made. §6331(b) explicitly provides “except as otherwise provided in subsection (e), a levy shall extend only to property possessed and obligations existing at the time thereof”.

Accordingly, a bank would not be required to surrender amounts that were deposited after a levy was made. And the bank may contrast bank levies with continuing levies on taxpayers’ wages or salaries, which would attach to future earnings.

Conversely, a bank would incur personal liability under § 6332(d)(1) to the extent that it allows a taxpayer to withdraw money from an account on the same day but after a levy is made. And there would also be the potential for imposition of the 50% penalty under paragraph (d)(2).

In practice, the specific time at which a particular levy was made or that an amount was withdrawn may not easily be determined. However, if the time of levy is determinable, for example if the levy is made by fax, and if the specific time of withdrawal occurs several hours later, then the bank would incur personal liability pursuant to §6332(d)(1) to the extent that the amount withdrawn was needed to satisfy the amount of the levy.

Therefore, the answer to the specific question is that a bank would not be required to surrender amounts in a taxpayer’s account that the taxpayer deposited on the same day on which the levy was made, but at a time that was after the levy was made.

Rather, such amounts would represent taxpayer property that was not in the bank’s possession for purposes of that particular levy. And this is important both because a bank would want to avoid §6332(d) liability, but also because a bank would want the protection afforded by § 6331(e), which might indemnify the bank vis-a-vis the taxpayer, and which would not be afforded to the bank to the extent that it remitted taxpayer property that was not subject to the levy.

Issue 7: Update on IRS Processing and Critical Functions

The IRS is opening mail within normal timeframes. The IRS has also continued to make significant progress in processing prior year returns.

As of May 28, 2021, they had 19,000 individual tax returns received prior to 2021 in the processing pipeline. Including current year returns, as of May 28, 2021, IRS had 18.1 million unprocessed individual returns in the pipeline. Unprocessed returns include those requiring correction to the Recovery Rebate Credit (RRC) amount or validation of 2019 income used to figure the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC).

This work does not require IRS to correspond with taxpayers but does require special handling by an IRS employee so, in these instances, it is taking the IRS more than 21 days to issue any related refund. If, as a result, a correction is made to any RRC, EITC or ACTC claimed on the return, the IRS will send taxpayers an explanation.

How long May the client have to wait:

IRS is processing returns received over the summer and fall in 2020 due to the extended July 15, 2020, tax filing due date. While the majority of 2019 refund returns have been processed, in some cases, IRS is processing tax returns that were mailed with a payment even though payment associated with these returns have been processed by the IRS.

However, IRS is rerouting tax returns and taxpayer correspondence from locations that are behind to locations where more staff is available, and they are taking other actions to minimize any delays.

Tax returns are opened in the order received. As the return is processed, it may be delayed because it has a mistake including errors concerning the Recovery Rebate Credit, is missing information, or there is suspected identity theft or fraud. If the IRS can fix the return without contacting the client, they will. If they need more information or need the client to verify that it was actually the client who sent the tax return, IRS will write a letter. The resolution of these issues depends on how quickly and accurately the client responds, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of the return.

What should the client do?

If the client filed electronically and received an acknowledgement, they do not need to take any further action other than promptly responding to any requests for information. If they filed on paper, check Where’s my refund? If it tells them the IRS has received the return or are processing or reviewing it, IRS is processing the return, but it may be under review. Please don’t file a second tax return or contact the IRS about the status of the return.

Status of Processing Form 941, Employer’s Quarterly Federal Tax Return and Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund

The IRS is now opening mail within normal timeframes. The IRS has also made significant progress in processing Forms 941. As of May 6, 2021, we had about 200,000 Forms 941 received prior to 2021 in the processing pipeline. Including current year returns, as of May 6, 2021, IRS had 1.9 million unprocessed 941s in the pipeline.

They are rerouting tax returns and taxpayer correspondence from locations that are behind to locations where more staff is available and are taking other actions to minimize any delays.

Tax returns are opened in the order received. If the client filed electronically and received an acknowledgement, they do not need to take any further action other than promptly responding to any requests for information. Please don’t file a second tax return or contact the IRS about the status of your return. As of May 7, 2021, the inventory of unprocessed Forms 941-X was approximately 100,000 which cannot be processed until the related 941s are processed. While not all of these returns involve a COVID credit, the inventory is being worked at two sites (Cincinnati and Ogden) that have trained staff to work possible COVID credits.

Payment Processing Issue

IRS has identified a delay in processing Form 1040 balance due, Form 1040-X amended, and Form 1040-ES estimated tax payment requests submitted via Modernized e-File. The issue has been resolved, and pending payments are being processed. The client’s account will be credited with the original requested payment date(s). Clients should not re-resubmit these payments.

If a taxpayer re-submitted any of these payment requests due to the delay in processing, they may cancel them by calling 888-353-4537. Cancellation requests must be received no later than 11:59 p.m., Eastern Time, at least two business days prior to a scheduled payment date.

Issue 8: Changes to Form 4797 Instruction- Correction of Intangible Asset Disposition Election

Page 3 of the 2020 Instructions for Form 4797, Sales of Business Property, includes an incorrect reference to a line on Form 1040. On page 3, in the third column, under “Section 197(f)(9)(B)(ii) Election,” the instructions state to report the additional tax on Form 1040, line 12a.

For 2020, the additional tax should be reported on Form 1040, line 16.

Issue 9: Comments/Excerpts from Testimony of Charles P. Rettig before the Senate Appropriations Committee

I am pleased to report the 2021 filing season has gone smoothly in terms of tax return processing and the operation of our information technology (IT) systems. Through May 7, the IRS received more than 126.7 million individual federal tax returns and issued more than 84.8 million refunds totaling more than $242.8 billion.

At the same time, the IRS is working closely with the Treasury Department to implement the American Rescue Plan Act of 2021 (ARP Act) as quickly as possible. As part of these efforts, we took immediate steps to begin delivery of the third round of Economic Impact Payments (EIP) to millions of Americans within days of the legislation being signed on March 11. Through May 12, we have disbursed about 165 million payments totaling approximately $388 billion.

The IRS is also coordinating with Treasury on another important provision, which provides periodic advance payments of the Child Tax Credit (CTC) to eligible Americans.

In Fiscal Year (FY) 2019, the IRS collected $3.56 trillion in taxes and generated almost 96% of the funding that supports the Federal Government’s operations.

Given the events of the past year, we appreciate the $3.1 billion in additional funding we received from Congress to respond to the COVID-19 pandemic and implement the EIPs and other tax changes. In addition, our base FY 2021 funding level (excluding these additional resources) represents a 3.6% increase over FY 2020.

The President’s FY 2022 Discretionary Request advances key Treasury Department priorities, including ensuring that all Americans are treated fairly by our tax system. The request provides increased funding for the IRS to provide additional oversight of high-income and corporate tax returns, ensuring that the wealthy and well-connected pay what they owe and play by the same rules as everybody else. To ensure that all Americans are treated fairly by the nation’s tax system, including that the wealthy and corporations comply with existing laws, the discretionary request provides $13.2 billion for the IRS, an increase of $1.2 billion or 10.4% above the 2021 enacted level.

With this funding, the IRS would:

- Increase oversight of high-income and corporate tax returns to ensure compliance.

- Provide new and improved online tools for taxpayers to communicate with the IRS easily and quickly and

- Improve telephone and in-person taxpayer customer service, including outreach and assistance to underserved communities.

Proposed American Family Plan – NOT Law Currently

In the American Families Plan, the President has included a series of proposals in that overhaul tax administration and provide the IRS the resources and information it needs to address tax evasion. Specifically, the tax administration reforms will:

- Provide the IRS the resources it needs to stop sophisticated tax evasion. The President’s proposal directs that additional resources go toward enforcement against those with the highest incomes, rather than Americans with actual income of less than $400,000.

- Provide the IRS with more complete information. When the IRS has information from third parties, income is accurately reported, and taxes are fully paid. However, high-income taxpayers disproportionately accrue income in opaque sources—like partnership and proprietorship income— where the IRS struggles to verify tax filings. This reform aims to provide the IRS information on account flows so that it has a lens into investment and business activity—similar to the information provided on income streams such as wage, pension, and unemployment income. Importantly, this proposal provides additional information to the IRS without any increased burden for taxpayers. Instead, it leverages the information that financial institutions already know about account holders, simply requiring that they add to their regular, annual reports information about aggregate account outflows and inflows. Providing the IRS this information will help improve audit selection so it can better target its enforcement activity on the most suspect evaders, avoiding unnecessary (and costly) audits of ordinary taxpayers.

- Overhaul outdated technology to help the IRS identify tax evasion. Elements of IRS IT systems are antiquated and make it difficult for the IRS to identify those who are not paying what they owe and to help those who want to comply. The President’s proposal provides the IRS much-needed resources to modernize its technological infrastructure. Leveraging 21st century data analytic tools will enable the IRS make use of new information about income that accrues to high-earners and will help revenue agents unpack complex structures, like partnerships, where income is not easily traced.

- Improve taxpayer service and deliver tax credits. A well-functioning tax system requires that taxpayers be able to interact with the IRS in an efficient and meaningful manner. Inadequate resources often mean that IRS employees are unable to provide taxpayers timely answers to their tax questions. Service enhancement will improve the ability of the IRS to communicate with taxpayers securely and promptly. Importantly, the proposal also includes the necessary resources to ensure that the IRS effectively and efficiently delivers tax credits to families and workers, including newly expanded Child Tax Credits and Child and Dependent Care Tax Credits.

- Regulate paid tax preparers. Taxpayers often make use of unregulated tax preparers who lack the ability to provide accurate tax assistance. These preparers submit more tax returns than all other preparers combined, and they make costly mistakes that subject their customers to painful audits, sometimes even intentionally defrauding taxpayers for their own benefit. The President’s plan calls for giving the IRS the legal authority to implement safeguards in the tax preparation industry. It also includes stiffer penalties for unscrupulous preparers who fail to identify themselves on tax returns and defraud taxpayers (so called “ghost preparers”).

Issue: 10: Biden’s Proposal on the Capital Gains Rate

The rate increase would take effect for sales of stock and businesses after the April 28 announcement of the plan – making it a retroactive tax hike. The proposed increase would tax long-term gains over $1 million as ordinary income, which means that these high-income investors would have to pay a top rate of 39.6%.

Issue 11: Child and Dependent Care Tax Credit FAQs

The child and dependent care tax credit is a credit allowed for a percentage of work-related expenses that a taxpayer incurs for the care of qualifying persons to enable the taxpayer to work or look for work. §9631(a) of the American Rescue Plan Act of 2021, enacted March 11, 2021, amended §21 to expand the credit in 2021 by increasing:

- the amount of work-related expenses taken into account.

- the percentage of allowed work-related expenses, and

- the income limitations.

- 9631(a) also amended §21 to make the credit refundable for a taxpayer (or in the case of a joint return, either spouse) who lives in one of the 50 states or the District of Columbia for more than half the year in 2021.

Claiming the Credit

Q1: Am I eligible to claim the credit?

- A1: You are eligible to claim this credit if you (or your spouse in the case of a joint return) pay someone to care for one or more qualifying persons in order for you to work or look for work, and the income level is within the income limits set for the credit.

- If you are married, you must file a joint return to claim the credit. However, if you are legally separated or living apart from your spouse, you may be able to file a separate return and still claim the credit.

- Earned Income Requirement: You (and your spouse in the case of a joint return) must have earned income during the year to claim the credit.

Q2: Who is a qualifying person?

- A2: A qualifying person is:

- Your dependent who is under age 13 when the care is provided.

- Your spouse, if your spouse isn’t mentally or physically able to care for himself or herself and lives with you for more than half the year; and

- A person who isn’t mentally or physically able to care for himself or herself, lives with you for more than half the year, and either:

- Is your dependent, OR

- Would have been your dependent except that.

- he or she receives more than a certain gross income amount ($4,300 in 2021).

- he or she files a joint return, or

- you (or your spouse in the case of a joint return) can be claimed as a dependent on someone else’s return.

Q3: What does “physically or mentally not able to care for oneself” mean?

- A3: Persons who cannot dress, clean, or feed themselves because of physical or mental problems are considered not able to care for themselves. Persons who must have constant attention to prevent them from injuring themselves or others also are considered not able to care for themselves.

Q4: For 2021, what percentage of my work-related expenses are allowed as a credit?

- A4: The percentage of your work-related expenses allowed as a credit depends on your income (and your spouse’s income in the case of a joint return). The maximum percentage of your work-related expenses allowed as a credit is 50%.

Q5: Can this 50-percent amount of work-related expenses be reduced?

- A5: Yes. The amount of your adjusted gross income determines the percentage of your workrelated expenses that you are allowed as a credit. For this purpose, your income is your “adjusted gross income” shown on your Form 1040, 1040-SR, or 1040-NR.

- For 2021, the 50% amount begins to phase out if the adjusted gross income is more than $125,000, and completely phases out if the adjusted gross income is more than $438,000.

Q6: For 2021, is there a limit on the amount of work-related expenses I can take into account in calculating the credit?

- A6: Yes. The maximum amount of work-related expenses you can take into account for purposes of the credit is $8,000 if you have one qualifying person, and $16,000 if you have two or more qualifying persons. This means that the maximum total amount of the credit is $4,000 (50% of $8,000) if you have one qualifying person, and $8,000 (50 percent of $16,000) if you have two or more qualifying persons.

- Earned Income Limitation: The amount of work-related expenses that can be taken into account in calculating the credit cannot exceed your earned income. If you are married and filing a joint return, the work-related expenses you can take into account are limited to the lesser of your or your spouse’s earned income.

Q7: For 2021, can I take the full credit even if my credit exceeds the amount of taxes I owe?

- A7: Yes. For 2021, the credit is refundable for eligible taxpayers. This means that even if your credit exceeds the amount of Federal income tax that you owe, you can still claim the full amount of your credit, and the amount of the credit in excess of your tax liability can be refunded to you.

Q8: Are there special residency requirements for the refundable portion of the credit?

- A8: Yes. To be eligible for the refundable portion of the credit for 2021, you must have your main home in one of the 50 states or the District of Columbia for more than half of the tax year. Your main home can be any location where you regularly live. Your main home may be your house, apartment, mobile home, shelter, temporary lodging, or other location and doesn’t need to be the same physical location throughout the taxable year. If you are temporarily away from your main home because of illness, education, business, vacation, or military service, you are generally treated as living in your main home during that time. Special Exception for Military Personnel.

Q9: My spouse was out of work during the year. Can we still claim this credit?

- A9: Maybe. You (and your spouse in the case of a joint return) must have earned income to claim the credit. Earned income includes wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment. A net loss from self-employment reduces earned income. Earned income also includes any strike benefits and disability pay you report as wages. Unemployment compensation is not included in earned income. The amount of work-related expenses that can be taken into account in calculating the credit cannot exceed your earned income. If you are married and filing a joint return, your work related expenses on your joint return are limited to the lesser of your or your spouse’s earned income.

Q10: My spouse was a student or unable to care for herself during the year and did not work. Can we still claim this credit?

- A10: Maybe. There are special earned income rules for students and those mentally or physically incapable of caring for themselves. If you (or your spouse in the case of a joint return) are a full-time student or are mentally or physically incapable of caring for yourself, you will be treated as having earned income of $250 if you have one qualifying person (or $500 for two or more qualifying persons) for any month you are a full-time student or not able to care for yourself. Important: If in the same month you and your spouse both did not work and were either full time students or not physically or mentally capable of caring for yourselves, only one of you can be treated as having earned income in that month.

Q11: How do I claim the credit for 2021?

- A11: To claim the credit for 2021, you will need to complete Form 2441, Child and Dependent Care Expenses, and include the form when you file your tax return. In completing the form to claim the 2021 credit, you will need to provide a valid taxpayer identification number (TIN) for each qualifying person. Generally, this is the social security number for the qualifying person.

Q12: What information do I need from my care provider to claim the credit?

- A12: You must identify all persons or organizations that provided care for your child, dependent, or spouse. To identify the care provider, you must give the provider’s name, address, and taxpayer identification number (TIN). You can use Form W-10, Dependent Care Provider’s Identification and Certification, to request this information. If the care provider information you give is incorrect or incomplete, your credit may not be allowed. However, if you can show that you used due diligence in trying to supply the information, you can still claim the credit.

Q13: If I live in American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, Puerto Rico, or the U.S. Virgin Islands, can I claim the credit if I’m otherwise eligible?

- A13: In many cases, the answer is yes. However, the credit must be claimed from your local territory tax agency and not from the IRS. Furthermore, special rules apply to these five U.S. territories.

Q14: For more than half of 2021, I will live overseas, but not in one of the five U.S. territories. Can I claim the refundable credit on my 2021 tax return?

- A14: Generally, no. While you can claim the credit to offset your tax liability , the credit is refundable only if you have your main home in one of the 50 states or the District of Columbia for more than half of the tax year. Your main home can be any location where you regularly live. Your main home may be your house, apartment, mobile home, shelter, temporary lodging, or other location and doesn’t need to be the same physical location or in the same state throughout the taxable year. If you are temporarily away from your main home because of illness, education, business, vacation, or military service, you are generally treated as living in your main home. Special Exception for Military Personnel.

Q15: My main home is in one of the 50 states or the District of Columbia, and I am in the U.S. military and stationed outside the United States for an extended period of time. Am I treated as living in my main home during that time for purposes of the credit?

- A15: Yes. U.S. military personnel who are stationed outside the United States on extended active duty are considered to have their main home in one of the 50 states or the District of Columbia for purposes of qualifying for the refundable portion of the credit. For this purpose, “extended active duty” means any period of active duty pursuant to a call or order to active duty for a period in excess of 90 days or for an indefinite period.

Q16: What qualifies as a work-related expense?

- A16: A work-related expense is an amount you (or your spouse in the case of a joint return) pay for the care of a qualifying person, or for household services if at least part of the services is for the care of a qualifying person, in order for you to work or look for work. Your work can be for others or in your own business or partnership. It can be full or part-time. It also includes actively looking for work. However, if you don’t find a job and have no earned income for the year, you cannot take this credit.

Q17: I pay my mother to watch my children during the day. Does this count as a work-related expense?

- A17: Yes, unless you can claim your mother as a dependent. You can also count some work-related payments you make to other relatives, even if they live in your house. However, do not count any amounts you pay to:

- A person you (or your spouse in the case of a joint return) can claim as a dependent.

- Your child who was under age 19 at the end of the year, even if the child isn’t your dependent.

- A person who was your spouse at any time during the year; or

- The parent of your qualifying person if your qualifying person also is your child and under age 13.

Q18: My child receives care outside my home so that I can work. Does this count as a work related expense?

- A18: Maybe. To count as a work-related expense, the care must be for your dependent under the age of 13 or any other qualifying person who regularly spends at least 8 hours each day in your home. If the care is provided by a dependent care center, the center must comply with all state and local regulations that apply to centers. A dependent care center is a place that provides care for more than 6 persons (other than persons who live there) and receives a fee, payment, or grant for providing services for any of those persons, even if the center is not run for profit.

Q19: My child will be attending a week of overnight camp. Does that camp count as a work related expense?

- A19: No. The cost of overnight camp does not count as a work-related expense.

Q20: My child is enrolled in private kindergarten. Are the expenses to attend the private kindergarten work-related expenses?

- A20: No. Expenses to attend kindergarten or a higher-grade level are not expenses for care, and therefore are not work-related expenses.

Q21: I send my child to after-school care. Are these expenses work-related expenses?

- A21: Maybe. Expenses paid for before- or after-school care of a child in kindergarten or in a higher-grade level are expenses for care, and therefore are work-related expenses, provided all other conditions are satisfied (for example, the expenses allow you to work or to look for work).

Issue 12: Rev. Proc 2021-29: Partnership Amended Return Procedure

This revenue procedure allows eligible partnerships to file amended partnership returns for taxable years beginning in 2018, 2019, and 2020 using a Form 1065, U.S. Return of Partnership Income (Form 1065), with the “Amended Return” box checked, and issue an amended Schedule K-1, Partner’s Share of Income, Deductions, Credits, etc. (Schedule K-1), to each of its partners. The option to file amended returns only applies to partnerships satisfying the requirements of § 3 of this revenue procedure.

Background

Prior to the enactment of the BBA, subchapter C of chapter 63 2 contained the unified partnership audit and litigation rules enacted by the Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA), that were commonly referred to as the TEFRA partnership procedures.

- 1101(c) of the BBA replaced the TEFRA partnership procedures with a centralized partnership audit regime that, in general, determines, assesses, and collects tax at the partnership level. The centralized partnership audit procedures enacted by the BBA are found at §§6221 through 6241 of the Code.

The centralized partnership audit procedures apply to all partnerships, unless the partnership makes a valid election under §6221(b) not to have those procedures apply. Partnerships subject to the centralized partnership audit regime are referred to as BBA partnerships.

This revenue procedure exercises allowed authority to authorize a BBA partnerships to file an amended partnership return and furnish amended Schedules K-1 under the circumstances described in this revenue procedure.

- 6222(a) requires partners in a BBA partnership to treat partnership-related items, as defined in §6241 and the corresponding regulations, consistently on the partner’s return with how the BBA partnership treated such items on its return. This consistency requirement generally applies to all partners. Consistent treatment with the partnership generally requires that partners in a BBA partnership file their returns consistent with the information reported to them on the Schedule K-1.

- 202 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (TCDTRA) retroactively allows a recovery period of 30 years under the alternative depreciation system (ADS) in §168(g) for certain residential rental property, placed in service before January 1, 2018, held by an electing real property trade or business as defined in §163(j)(7)(B), and not previously subject to the ADS.

This revenue procedure explains how a BBA partnership that wishes to change its recovery period under §168(g) for such property in accordance with §202 of the TCDTRA may do so without filing an administrative adjustment request (AAR) under §6227.

This revenue procedure is intended to be implemented in tandem with Revenue Procedure 2021-28.

This revenue procedure allows BBA partnerships the option to file an amended return instead of an AAR, though it does not prevent a partnership from filing an AAR to obtain the benefits of the TCDTRA or any other tax benefits to which the partnership is entitled. A BBA partnership that files an amended return pursuant to this revenue procedure is still subject to the centralized partnership audit procedures enacted by the BBA.

Amended Return Option Provided to Eligible BBA Partnerships for 2018, 2019 and 2020 Taxable Years.

BBA partnerships that filed a Form 1065 and furnished all required Schedules K-1 for the taxable years beginning in 2018, 2019, or 2020 and did so prior to the issuance of this revenue procedure may file amended partnership returns and furnish corresponding Schedules K-1 on or before October 15, 2021.

The amended returns must take into account tax changes under §202 of the TCDTRA, but eligible BBA partnerships.

Eligible BBA Partnerships

(1) The filing and furnishing option provided in this revenue procedure is available only to BBA partnerships that filed Forms 1065 and furnished Schedules K-1 for the partnership taxable years beginning in 2018, 2019, or 2020 and did so prior to the issuance of this revenue procedure. The filing and furnishing option in §3.02 of the revenue procedure is only available to:

(a) BBA partnerships within the scope of §3 of Rev. Proc. 2021-28 that have residential rental property within the scope of §3 of Rev. Proc. 2021-28 and that choose to change either or both of their method of depreciation or general asset account treatment for such property by filing an amended Form 1065 in accordance with procedures or

(b) BBA partnerships within the scope of §3.01(1) of Revenue Procedure 2020-22, that choose to make a late §163(j)(7) election by filing an amended Form 1065.

(2) For purposes of § 6222, the amended return replaces any prior return (including any AAR filed by the partnership) for the taxable year for purposes of determining the partnership’s treatment of partnership-related items.

Eligible Taxable Years.

The filing and furnishing option provided in this revenue procedure applies only to partnership taxable years that began in 2018, 2019, or 2020.

Filing Requirements

To take advantage of the option to file an amended return provided by § 3 of this revenue procedure, a BBA partnership must file a Form 1065 (with the “Amended Return” box checked) and furnish corresponding amended Schedules K-1. The BBA partnership must clearly indicate the application of this revenue procedure on the amended return and write “FILED PURSUANT TO REV PROC 2021-29” at the top of the amended return and attach a statement with each Schedule K-1 furnished to its partners with the same notation.

The BBA partnership may file electronically or by mail but filing electronically may allow for faster processing of the amended return.

Special Rule for BBA Partnerships Whose Returns are Under Examination.

If a BBA partnership is currently under examination for a taxable year beginning in 2018, 2019, or 2020 and wishes to take advantage of the option to file an amended return, the partnership may only do so if the partnership sends notice in writing to the revenue agent coordinating the partnership’s examination that the partnership seeks to use the amended return option prior to or contemporaneously with filing the amended return.

The partnership must also provide the revenue agent with a copy of the amended return upon filing.

Special rule for BBA partnerships who have previously filed an AAR.

If a BBA partnership has previously filed an AAR and wishes to file an amended return pursuant to this revenue procedure for the same taxable year, the partnership should use the items as adjusted in the AAR, where applicable, in lieu of any reporting from the originally filed partnership return.

Issue 13: Electronic Tax Administration Advisory Committee June 2021 ANNUAL REPORT TO CONGRESS. June 2021

ETAAC organized this report to provide brief critical insights through a high-level overview and deeper context in our full-length analysis. ETAAC organized this report into three sections that are consistent with our charter.

- Recommendations for Congressional consideration.

- Recommendations for the IRS focused on electronic filing.

- Recommendations for the IRS focused on Security.

Recommendations:

Recommendation #1: Provide the IRS with flexible, predictable multi-year funding.

Recommendation #2: Accelerate the filing deadline for certain informational returns.

Recommendation #3: Modernize the data-sharing statutes among federal agencies.

Recommendation #4: The Form 1099 Portal should have functionality that integrates with key stakeholders at the time of rollout.

Recommendation #5: Increase the electronic filing goals.

Recommendation #6: Enhance the taxpayer experience in the IRS Identity Theft Tax Refund Fraud (IDTTRF) resolution process.

Recommendation #7: Allow for greater transparency into return processing status.

Recommendation #8: Expand the taxpayer protection tools in the EFIN Toolset.

Recommendation #9: Enhance security plan guidance for tax practitioners.

Recommendation #10: Accelerate the investment in and timing of digital initiatives

Identity Theft – Identity Theft Tax Refund Fraud (IDTTRF)

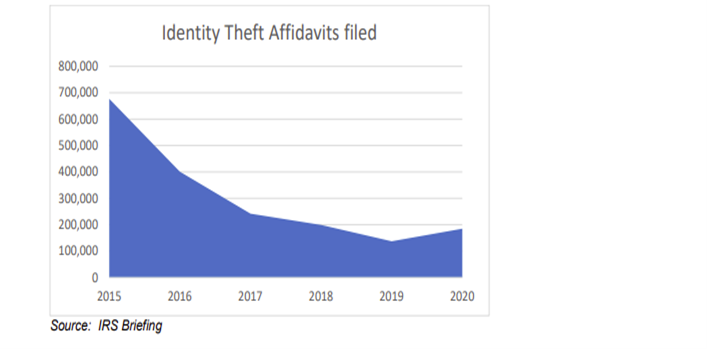

The IDTTRF threat has evolved. Despite the Security Summit’s success, the fight is not over. As the IRS has successfully evolved its efforts against IDTTRF, the criminal element has refined its techniques. The threat remains real and is still substantial. In 2015, there were approximately $15 billion in fraudulent refund attempts. In 2019, that number dropped to roughly $4.8 billion.

The latest schemes are of a higher sophistication. It is more challenging than ever to distinguish a fraudulent return from a legitimate taxpayer’s return. The fraud, though, has started to move to other forms.

One area of increased concern is programs administered across multiple federal or state agencies. For example, IRS saw this migration recently in the evolving scams related to unemployment compensation. Recommendation #3 discusses legislation needed from Congress to address these evolving threats to taxpayer dollars.

Professional Preparers are Under Attack

Criminals need a lot of accurate data about real taxpayers to complete their sophisticated return schemes. Professional preparers have that data and are constantly under attack. Unfortunately, due to the diverse professional preparer market, sections of the market are not prepared to adequately secure taxpayer data. Many smaller offices or single preparers do not know or understand security procedures to protect the data. The IRS does an excellent job of making the preparers aware of threats and schemes, but awareness does not equate to voluntary tax professional action.

The complete report with more detail can be found here. Many actions recommended by the Electronic Tax Administration Advisory Committee have resulted in positive outcomes when enacted by law. It is also good to know what has transpired in the past and the gains or losses IRS has achieved. Good Read.

https://www.irs.gov/pub/irs-pdf/p3415.pdf

Issue 14: Rev. Proc. 2021-25 Inflation Adjusted Amounts for 2022

For calendar year 2022, the annual limitation on deductions under § 223(b)(2)(A) for an individual with self-only coverage under a high deductible health plan is $3,650.

For calendar year 2022, the annual limitation on deductions under § 223(b)(2)(B) for an individual with family coverage under a high deductible health plan is $7,300.

High Deductible Health Plan

For calendar year 2022, a “high deductible health plan” is defined under § 223(c)(2)(A) as a health plan with an annual deductible that is not less than $1,400 for self-only coverage or $2,800 for family coverage, and the annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) do not exceed $7,050 for self-only coverage or $14,100 for family coverage.

For plan years beginning in 2022, the maximum amount that may be made newly available for the plan year for an excepted benefit HRA under § 54.9831-1(c)(3)(viii) is $1,800.

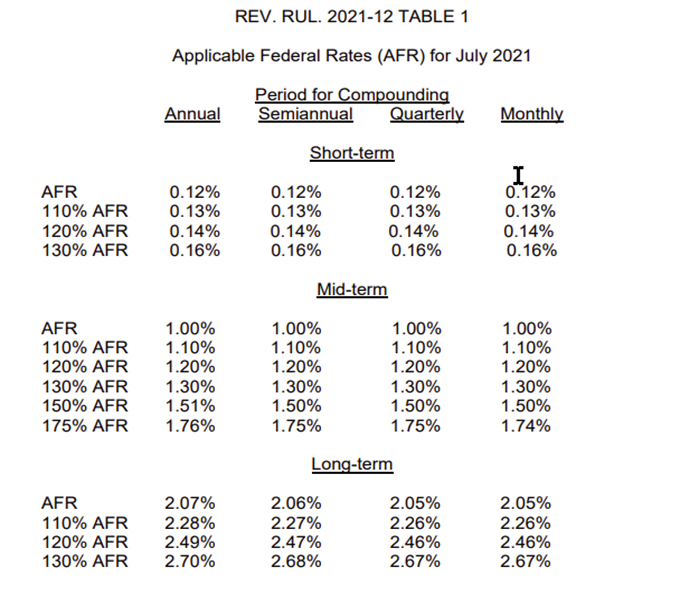

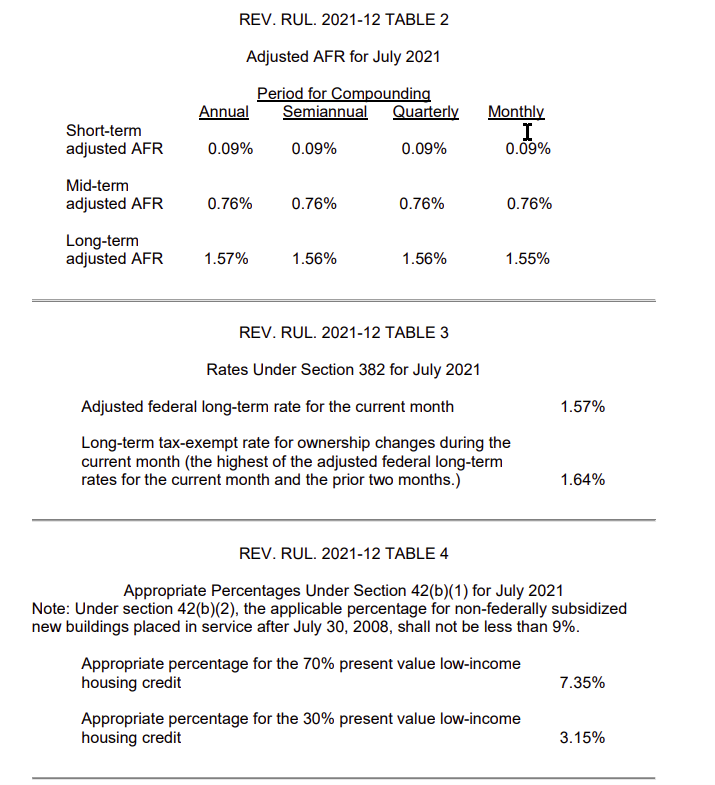

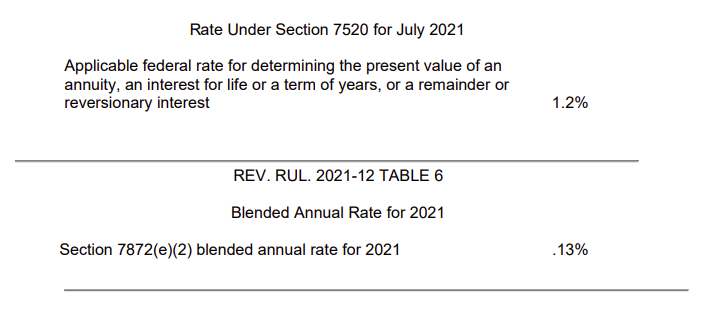

Issue 15: Applicable Federal Rates for July 2021, Rev. Rul. 2021-12